Introduction: Understanding the Jolt of a Market Crash

Few financial events stir as much anxiety as a market crash. The phrase alone can trigger a sense of dread, evoking visions of plunging stock charts, economic chaos, and panicked investors scrambling to exit positions. Yet despite its frightening reputation, a market crash is not a rare anomaly—it’s a recurring feature of capitalist economies. While unsettling, these episodes are part of the natural ebb and flow of financial markets. This guide breaks down what a market crash truly entails, how it affects your personal finances and broader economic life, and—most importantly—how you can build resilience to withstand the storm. With the right knowledge and strategy, what seems like a financial disaster can become a test of discipline and long-term vision.

What Exactly is a Stock Market Crash? Definition and Characteristics

A stock market crash isn’t just a bad day on Wall Street—it’s a rapid, widespread plunge in equity values across major indices like the S&P 500 or the Dow Jones Industrial Average. Though there’s no strict threshold, a drop of 10% or more in a single session or over a few days is generally considered a crash. What sets it apart from a gradual pullback is its velocity and the atmosphere of panic that fuels it. Investor confidence evaporates almost overnight, triggering a cascade of sell orders that send prices spiraling downward. Historical examples underscore this volatility: Black Monday in 1987 saw the Dow plunge over 22% in just one trading day, while the 2008 financial crisis, though more prolonged, was marked by repeated sharp declines driven by collapsing financial institutions and frozen credit markets.

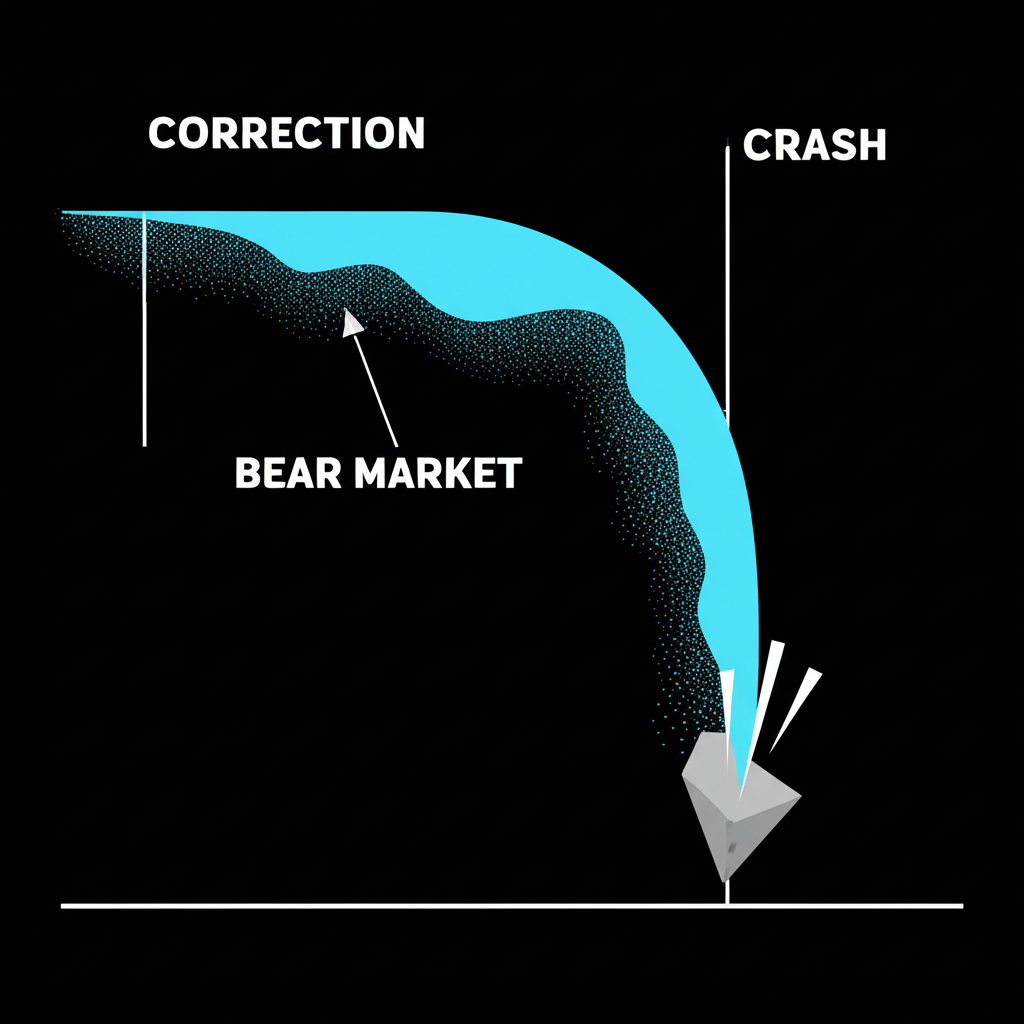

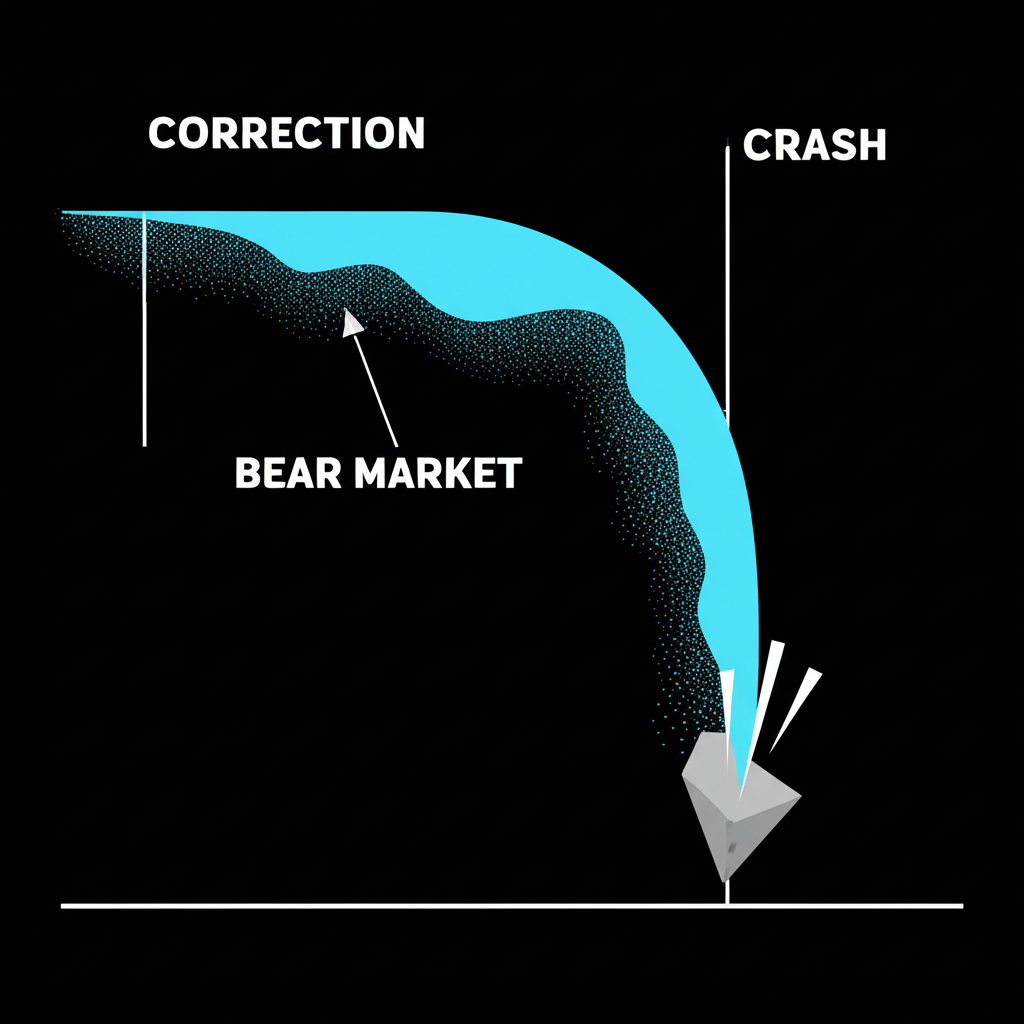

Market Crash vs. Correction vs. Bear Market: Key Distinctions

It’s easy to conflate different types of market declines, but understanding the distinctions is essential for sound financial decision-making. Here’s how these events differ in scope, duration, and psychological impact:

| Feature | Market Correction | Bear Market | Market Crash |

| :—————- | :———————————————- | :———————————————- | :———————————————– |

| **Magnitude** | 10% to 20% decline from recent peak | 20% or more decline from recent peak | Usually 10%+ in a single day or very short period |

| **Duration** | Typically short-lived (weeks to a few months) | Can last for months or even years | Very sudden, often one or few trading days |

| **Frequency** | Relatively common (occurs every 1-2 years on average) | Less common than corrections, more frequent than crashes | Rare, unpredictable, high impact |

| **Investor Mood** | Concern, re-evaluation | Pessimism, sustained fear | Panic, extreme fear |

A correction is a natural market reset, often healthy and necessary after periods of overvaluation. A bear market reflects a deeper, sustained downturn, usually tied to weakening economic fundamentals. A crash, however, is defined by its speed and shock effect—its suddenness often amplifies fear far beyond the immediate financial damage.

The Domino Effect: Immediate Economic Impacts of a Market Crash

A market crash doesn’t exist in a vacuum. Its impact radiates outward, setting off a chain reaction across the economy. The first casualty is confidence—both consumer and corporate. As retirement accounts and investment portfolios shrink, households feel less wealthy, even if their income hasn’t changed. This psychological shift, known as the wealth effect, leads people to delay major purchases, cut back on travel, and reduce spending on luxury items. Businesses, sensing weaker demand and uncertain financing, respond by freezing hiring, halting expansion, and reducing capital expenditures.

This contraction in spending and investment hits the core of economic activity. Consumer spending accounts for nearly 70% of GDP in the U.S., so when households tighten their budgets, companies see declining revenues. Lower profits lead to cost-cutting, including layoffs. As unemployment begins to rise, the cycle reinforces itself: fewer jobs mean less spending, which leads to more business strain. The result is often a contraction in GDP, marking the onset of a recession. The interplay between financial markets and real economic activity becomes starkly visible during these periods.

Impact on Consumer Spending and Business Investment

When markets nosedive, consumer behavior shifts almost immediately. People with exposure to equities—whether through 401(k)s, IRAs, or direct holdings—tend to become more cautious. Even those not directly invested may react to media coverage and the general mood of uncertainty. This ripple in sentiment dampens demand for big-ticket items like cars, home renovations, and vacations.

For businesses, a market crash complicates access to capital. Publicly traded firms may find it harder to issue new stock, and credit markets can tighten, increasing borrowing costs. Startups and growth-stage companies, which rely heavily on investor confidence, may see funding dry up overnight. Even profitable firms may delay projects or cancel plans due to forecasting uncertainty. The combined effect—sluggish consumer demand and restrained corporate investment—can slow economic momentum significantly, sometimes tipping a fragile economy into recession.

Your Money on the Line: What Happens to Personal Investments

When headlines scream about plunging markets, the first question many ask is: what does this mean for *my* money? The short answer: your portfolio may take a hit, but the long-term outcome depends largely on your response.

Stocks and Mutual Funds: The Direct Hit

Equity investors bear the brunt of a market crash. Individual stock prices can collapse across sectors, especially if the sell-off is broad-based. Mutual funds and ETFs, which pool investments in dozens or hundreds of stocks, reflect this decline in their net asset value (NAV). During the 2008 financial crisis, for instance, the S&P 500 lost roughly 57% of its value from peak to trough between October 2007 and March 2009. According to the Council on Foreign Relations, this period erased trillions in household wealth. Yet it’s critical to recognize that these losses are mostly “paper losses” unless you sell. Holding through the downturn preserves the potential for recovery when markets stabilize.

401(k)s and Retirement Accounts: Long-Term Implications

Most retirement accounts are heavily weighted toward equities, making them particularly vulnerable during market crashes. A sudden drop in value can be alarming, especially for those approaching retirement who may have less time to recover. However, for younger investors, a downturn can actually present a strategic opportunity. Continuing regular contributions—especially through dollar-cost averaging—means buying more shares at lower prices. Over time, this can significantly boost long-term returns when the market rebounds. The key is to avoid emotional reactions; panic selling locks in losses and undermines decades of disciplined saving.

Bonds and Other “Safe Haven” Assets: A Relative Perspective

When stocks tumble, investors often pivot to safer assets. Government bonds, particularly U.S. Treasuries, are among the most sought-after. As demand rises, bond prices increase and yields fall—a classic flight to safety. This inverse relationship with equities makes bonds a valuable stabilizing force in a diversified portfolio. Investopedia explains that bonds often hold their value or appreciate during recessions, providing a buffer against stock market volatility. Including bonds, cash equivalents, or even alternative assets can help smooth portfolio performance during turbulent times.

Beyond Stocks: Ripple Effects on Other Asset Classes and Daily Life

The consequences of a market crash extend well beyond investment accounts, influencing housing, commodities, employment, and everyday financial decisions.

Real Estate: Will Houses Be Cheaper If the Market Crashes?

Real estate doesn’t react to stock market crashes as quickly or directly. Home prices are more closely tied to employment, interest rates, and credit availability. However, if a crash triggers a deep or prolonged recession, the housing market often follows. Job losses reduce buyer demand, tighter lending standards make mortgages harder to obtain, and economic uncertainty causes buyers to delay decisions. These factors can lead to price stagnation or declines in certain markets. Still, housing trends vary widely by region—some areas may remain strong due to local economic resilience or demographic shifts. A crash doesn’t guarantee cheaper homes, but it can create buying opportunities in markets hit hardest by economic fallout.

Commodities: The Role of Gold and Other Resources

Commodities respond to crashes in divergent ways. Gold, long viewed as a store of value, typically gains during market turmoil. Investors turn to it as a hedge against inflation, currency devaluation, and systemic risk, pushing prices upward. Silver and other precious metals may follow similar patterns, though with more volatility. On the other hand, industrial commodities like oil, copper, and iron ore are closely linked to economic growth. A crash that signals weakening demand often leads to falling prices for these resources. Energy markets, in particular, can experience sharp corrections if a downturn reduces industrial output and transportation activity.

Jobs and Employment: A Broader Economic Downturn

Perhaps the most personal impact of a market crash is on employment. As companies face shrinking revenues and tighter credit, they often respond by cutting costs. This can mean hiring freezes, reduced hours, salary freezes, or outright layoffs. The unemployment rate typically rises in the months following a major market downturn, affecting not just financial stability but mental health and household well-being. The connection between Wall Street and Main Street becomes undeniable: when confidence falters in financial markets, it often translates into real-world job insecurity for millions.

Preparing for the Unthinkable: Proactive Steps Before a Crash

While no one can predict exactly when the next crash will occur, you can take meaningful steps to reduce your vulnerability and maintain control when volatility strikes.

Build a Strong Emergency Fund

A well-funded emergency reserve is your first line of defense. Aim to save three to six months’ worth of essential living expenses in a liquid, low-risk account like a high-yield savings account. This fund ensures you won’t need to sell investments at a loss to cover unexpected costs—whether it’s a medical bill, car repair, or temporary job loss. Financial security begins with liquidity; without it, even a minor setback can force poor investment decisions during a downturn.

Diversify Your Portfolio

Putting all your money in one asset class is like betting on a single horse. Diversification spreads risk across different types of investments—stocks, bonds, real estate, international markets, and alternative assets. When one sector struggles, others may hold steady or even gain. For example, while equities may fall during a crash, bonds or gold might rise, helping balance overall portfolio performance. A diversified approach won’t prevent losses entirely, but it can reduce their severity and improve long-term outcomes.

Review Your Risk Tolerance and Investment Horizon

Your ability to handle market swings depends on your personal circumstances. A 30-year-old investor has decades to recover from a downturn, making it reasonable to take on more risk in pursuit of higher returns. Someone nearing retirement, however, may prioritize capital preservation over growth. Regularly reassessing your risk tolerance and investment timeline ensures your portfolio aligns with your goals. Life changes—marriage, children, career shifts—can all influence your financial strategy, so periodic reviews are essential.

Minimize Debt

High-interest debt, especially from credit cards, becomes a serious burden during economic downturns. When income is uncertain, large monthly payments can strain your budget and limit flexibility. Prioritize paying down debt before a crisis hits. Reducing liabilities not only frees up cash flow but also reduces financial stress. A low-debt position gives you more room to maneuver—whether you need to cover expenses, invest during a market dip, or weather a job loss.

Navigating the Storm: What to Do During and After a Market Crash

When markets plunge, emotions run high. Fear, anxiety, and the urge to “do something” can lead to costly mistakes. A disciplined approach is your best tool for navigating the turbulence.

Stay Calm and Avoid Panic Selling

The most common error during a crash is selling everything in a moment of fear. This turns temporary paper losses into permanent ones. Markets have historically recovered from every major downturn, often rebounding strongly in the years that follow. Selling at the bottom means missing the recovery. Instead, focus on your long-term plan. Remember why you invested in the first place—and trust that time in the market usually beats timing the market.

Rebalance Your Portfolio (If Appropriate)

A crash can skew your portfolio’s original balance. For example, if stocks fall sharply, they may now represent a smaller portion of your holdings than intended. Rebalancing involves selling assets that have held up well (like bonds) and using the proceeds to buy undervalued stocks, restoring your target allocation. This forces you to “buy low, sell high” systematically. It’s not about market timing—it’s about maintaining discipline and ensuring your risk level stays aligned with your goals.

Continue Investing: Dollar-Cost Averaging

If you’re still earning and contributing to retirement accounts, keep doing so. Dollar-cost averaging—investing a fixed amount regularly—works especially well during downturns. When prices are low, your contributions buy more shares. Over time, this lowers your average cost per share. For instance, investing $500 a month during the 2008 crisis would have allowed you to accumulate shares at rock-bottom prices, positioning you for strong gains during the subsequent bull market.

Seek Professional Financial Advice

In times of extreme volatility, a financial advisor can provide clarity and perspective. A qualified professional can assess your unique situation, review your asset allocation, and help you avoid emotional decisions. They can also identify tax-efficient strategies, adjust withdrawal plans for retirees, or suggest tactical shifts if warranted. An advisor isn’t a crystal ball, but they can be a steady hand on the wheel when the financial seas get rough.

Common Myths About Market Crashes Debunked

Misinformation can lead to fear-driven choices. Let’s clear up some common misconceptions.

“You Lose All Your Money”: The Reality of Market Declines

One of the most persistent fears is total financial ruin. In reality, unless you sell during a crash, you don’t lose money—you experience a decline in value. These are unrealized losses, not actual cash lost. History shows that markets eventually recover. The S&P 500, for example, has reached new all-time highs after every major crash. The key is patience and perspective: short-term pain doesn’t have to mean long-term failure.

“Crashes Are Unpredictable”: Understanding Indicators vs. Guarantees

While no one can pinpoint the exact date of a crash, warning signs do exist. An inverted yield curve, where short-term interest rates exceed long-term rates, has preceded many recessions. Sky-high valuations, excessive leverage, or geopolitical instability can also signal rising risk. These aren’t guarantees of an imminent crash, but they suggest increased vulnerability. Rather than trying to time the market, investors should use these signals as prompts to review their preparedness.

“Only Experts Can Profit”: Opportunities for Average Investors

You don’t need a Wall Street trading desk to benefit from market downturns. Average investors who stick to disciplined strategies—like consistent contributions, rebalancing, and holding diversified portfolios—often outperform those chasing short-term gains. Dollar-cost averaging, for example, is simple, accessible, and highly effective. Success in investing isn’t about being smarter than the market—it’s about being more consistent and emotionally resilient.

Conclusion: Resilience and Long-Term Perspective

Market crashes are inevitable, but they don’t have to be devastating. They test your financial discipline, your emotional fortitude, and your long-term vision. By understanding the mechanics of a crash, preparing in advance, and responding with calm and clarity, you can not only survive the storm but emerge in a stronger position. Building an emergency fund, diversifying your holdings, minimizing debt, and staying invested through volatility are time-tested strategies that have helped generations of investors weather financial crises. Remember: every major crash in history has eventually been followed by a recovery—and often, a new bull market. The best defense isn’t prediction; it’s preparation.

1. What will you do if the market crashes?

If the market crashes, my primary strategy would be to stay calm and avoid panic selling. I would review my diversified portfolio, ensure my emergency fund is intact, and potentially look for opportunities to buy undervalued assets through dollar-cost averaging, aligning with my long-term financial plan.

2. Will houses be cheaper if the market crashes?

A stock market crash doesn’t automatically mean houses will be cheaper immediately. Real estate tends to be a lagging indicator. However, if the crash leads to a prolonged economic recession with job losses and tighter credit, it can reduce housing demand and potentially lead to lower home prices over time, though not always uniformly across all markets.

3. Can I lose my 401k if the market crashes?

You can see a significant decrease in the value of your 401k or other retirement accounts during a market crash. These are typically “paper losses” unless you sell your investments. Historically, markets recover, and those who stay invested and continue contributing often see their 401k values rebound and grow over the long term.

4. How do you survive a stock market crash?

- **Stay calm:** Avoid emotional decisions like panic selling.

- **Maintain your long-term plan:** Stick to your investment strategy.

- **Ensure liquidity:** Have a strong emergency fund.

- **Continue investing:** Utilize dollar-cost averaging.

- **Diversify:** Ensure your portfolio is well-allocated across different asset classes.

5. What happens to the economy if the stock market crashes?

A stock market crash can trigger a broader economic downturn. It often leads to reduced consumer confidence and spending, decreased business investment, potential job losses, and a slowdown in GDP growth, potentially leading to a recession.

6. Do you lose all your money if the stock market crashes?

No, you do not lose all your money. While your portfolio value can decline significantly, these are usually unrealized losses. If you hold onto your investments, they have the opportunity to recover their value when the market rebounds, as it has historically done after every major crash.

7. If stock market crashes what happens to gold?

Gold often acts as a “safe haven” during stock market crashes and economic uncertainty. Its price typically rises as investors flock to it to preserve wealth and hedge against volatility and potential currency devaluation.

8. If stock market crashes what happens to real estate?

The impact on real estate is typically indirect and delayed. A severe market crash leading to a recession can affect real estate by reducing consumer confidence, increasing unemployment, and tightening credit, which can eventually lead to decreased demand and potentially lower home prices, but the effect is not usually immediate or uniform.

9. What are the historical examples of major stock market crashes?

- **1929:** The Wall Street Crash, leading to the Great Depression.

- **1987:** Black Monday, when the Dow Jones Industrial Average fell over 22% in a single day.

- **2000:** The Dot-com Bubble Burst.

- **2008:** The Global Financial Crisis, triggered by the subprime mortgage crisis.

- **2020:** The COVID-19 related market crash.

10. How long does it typically take for the market to recover after a crash?

Recovery times vary significantly depending on the severity and underlying causes of the crash. Some recoveries are relatively swift (e.g., the 2020 COVID-19 crash saw a quick rebound), while others can take several years (e.g., the 2000 Dot-com bust). Historically, however, the market has always recovered and gone on to reach new highs over the long term, as noted by financial institutions like Fidelity.

留言