Introduction: Understanding U.S. Bank’s Profit Landscape

U.S. Bank stands as a cornerstone of the American financial system, ranking as the fifth-largest commercial bank in the country by assets. With a vast network serving millions of individuals, small businesses, and corporate clients, its financial performance often mirrors the broader health of the U.S. economy and the banking industry at large. As economic tides shift, so too do the dynamics shaping a major institution like U.S. Bank. This analysis provides a thorough examination of the bank’s latest profitability, uncovering the forces behind its earnings momentum, assessing its resilience amid market fluctuations, and placing its results in context within the competitive banking arena. Whether you’re an investor evaluating opportunities, a financial professional tracking sector trends, or a consumer interested in institutional stability, this deep dive offers valuable insights into one of America’s most enduring financial institutions.

U.S. Bank’s Latest Earnings Performance: A Snapshot

In the first quarter of 2024, U.S. Bank delivered a net income of approximately $1.5 billion, resulting in diluted earnings per share of $0.98. These figures reflect the bank’s ability to maintain profitability even as external pressures—such as shifting interest rates and cautious consumer sentiment—reshape the financial landscape. While net income showed a modest dip compared to the previous quarter, the result aligns with expectations given strategic reinvestments and a dynamic macro environment. On a year-over-year basis, the performance remains robust, signaling that the institution’s core operations continue to generate reliable returns. This resilience underscores U.S. Bank’s disciplined approach to managing its balance sheet and adapting to evolving market conditions.

Key Financial Highlights and Metrics

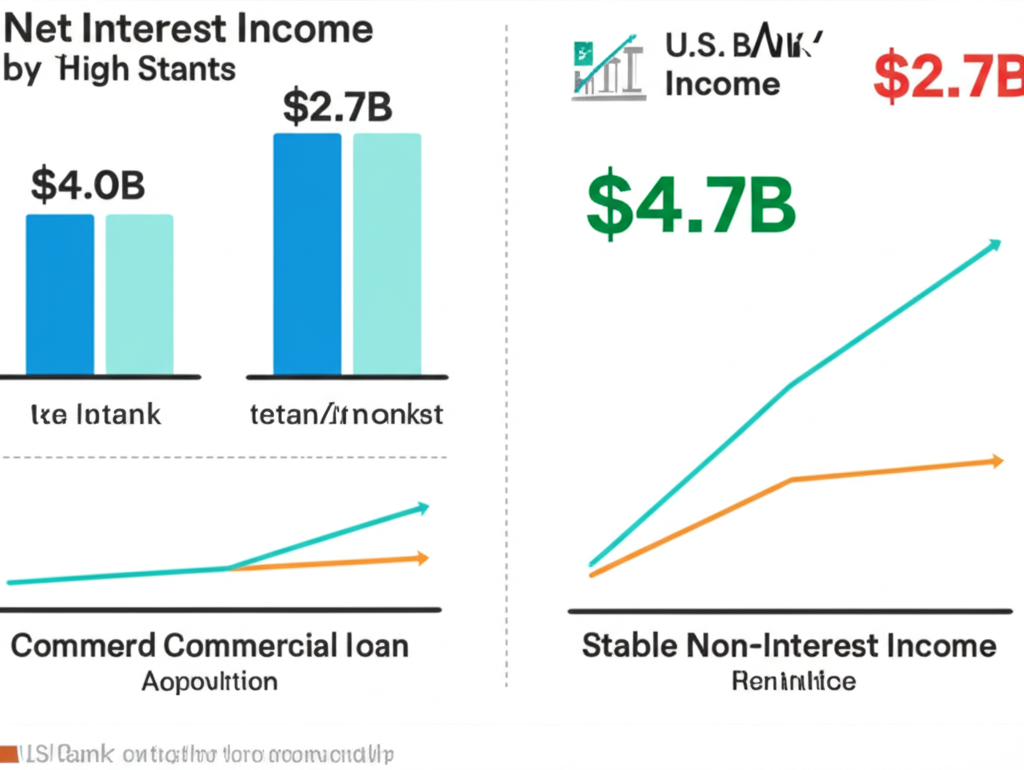

A closer look at U.S. Bank’s financials reveals a balanced and well-structured business model. Net interest income, the primary engine of traditional banking revenue, reached $4.0 billion in Q1 2024. This performance was shaped by the prevailing interest rate environment and the bank’s ability to manage the yield curve effectively. Complementing this core stream, non-interest income contributed $2.7 billion, driven by transaction fees, investment services, and other service-based activities. This diversification helps insulate earnings from volatility in any single revenue category. Meanwhile, commercial and industrial lending continued to expand, supporting asset growth, while deposit balances held steady—a sign of strong customer retention and trust. Together, these metrics illustrate a bank that is not only financially sound but also strategically positioned to adapt as economic conditions evolve.

Diving Deep into Profit Drivers: What’s Fueling U.S. Bank’s Success?

U.S. Bank’s sustained profitability doesn’t stem from a single factor but from a confluence of strategic decisions, market dynamics, and operational discipline. Understanding these elements is key to grasping how the bank continues to deliver value in an unpredictable environment.

The Role of Net Interest Income (NII) and Interest Rate Environment

Net interest income remains the foundation of U.S. Bank’s earnings model. It reflects the spread between what the bank earns on interest-generating assets—such as loans and securities—and what it pays out on interest-bearing liabilities like customer deposits. The Federal Reserve’s monetary policy plays a pivotal role here. In a rising rate environment, U.S. Bank has historically benefited as loan yields increase, often outpacing the cost of funding. However, the bank’s strength lies not just in benefiting from rate hikes but in its disciplined asset-liability management. By carefully structuring its loan and deposit portfolios, U.S. Bank aims to maintain a healthy net interest margin even when rates stabilize or decline. This agility allows it to protect profitability across different phases of the economic cycle.

Non-Interest Income: Fees, Services, and Dealmaking

Beyond interest-driven revenue, U.S. Bank has built a substantial and resilient stream of non-interest income. This includes fees from payment processing, credit and debit card transactions, wealth management advisory services, trust and custody operations, and mortgage banking. The corporate and commercial banking divisions further contribute through capital markets activities and advisory services for mergers and acquisitions. While U.S. Bank isn’t a bulge bracket investment bank, its deal-making capabilities in mid-market transactions add meaningful value. These fee-based revenues are less sensitive to interest rate swings, offering a stabilizing force when NII faces pressure. As digital banking grows, so does the potential for recurring, scalable fee income from value-added services.

Loan Growth and Asset Quality

Expanding the loan portfolio is a direct path to increasing net interest income, but growth must be balanced with prudence. U.S. Bank has maintained steady loan origination across consumer, commercial, and real estate segments, driven by disciplined underwriting and relationship-based banking. More importantly, the bank’s focus on asset quality ensures that growth doesn’t come at the cost of risk. Low levels of non-performing loans and conservative provisioning for credit losses reflect a vigilant risk management culture. When the economy is strong, lower loss provisions boost net income. In downturns, the bank’s strong capital and reserve positions allow it to absorb potential defaults without jeopardizing stability. This balance between growth and risk control is a hallmark of its long-term success.

Economic Headwinds and Tailwinds: Impact on U.S. Bank

The bank’s performance is deeply intertwined with macroeconomic forces. Inflation, employment trends, GDP growth, and consumer confidence all influence lending demand, credit quality, and fee-based activity. Elevated inflation has led to higher interest rates, which can support net interest margins—but if borrowing costs become too steep, they may dampen loan demand, especially in consumer and mortgage markets. Conversely, strong economic growth fuels business investment and consumer spending, increasing the need for credit and financial services. U.S. Bank’s diversified footprint and conservative approach have historically allowed it to navigate both favorable conditions and periods of stress. Its ability to adjust lending standards, pricing, and capital allocation gives it a strategic edge in volatile times.

U.S. Bank’s Financial Strength Beyond Profits

While profitability captures attention, true financial health extends beyond quarterly earnings. U.S. Bank’s stability rests on a foundation of strong capital, prudent risk management, and regulatory compliance.

Credit Ratings and Stability Assessment

Independent credit rating agencies consistently affirm U.S. Bank’s financial strength. Moody’s typically assigns long-term deposit ratings in the A1 to A2 range, while S&P Global maintains an A+ issuer credit rating. Fitch Ratings also places the bank in the A/A+ category. These ratings are not arbitrary—they reflect rigorous evaluations of capital adequacy, asset quality, earnings stability, and risk management effectiveness. High ratings enhance investor and depositor confidence and lower the bank’s cost of borrowing in capital markets. In times of market uncertainty, institutions with strong credit profiles like U.S. Bank are better positioned to maintain operations and support customers.

Capital Ratios and Regulatory Compliance

A well-capitalized balance sheet is essential for absorbing losses and supporting growth. U.S. Bank exceeds the capital requirements set by the Federal Reserve and other regulators. Its Common Equity Tier 1 (CET1) ratio—a key measure of core capital relative to risk-weighted assets—remains comfortably above minimum thresholds. This strong capital position enables the bank to withstand economic shocks, fund strategic initiatives, and return capital to shareholders through dividends and share repurchases. The bank’s consistent adherence to regulatory standards also demonstrates its commitment to transparency and long-term sustainability, reinforcing its reputation as a reliable financial partner.

U.S. Bank in the Competitive Landscape: How It Stacks Up

The U.S. banking sector is marked by intense competition, with a few dominant national players and a wide array of regional and community banks. U.S. Bank occupies a distinctive niche as a “super-regional” institution, combining national scale with deep local relationships. Its acquisition of Union Bank significantly expanded its presence on the West Coast, enhancing its competitive reach and diversifying its customer base.

Top Profitable Banks in America: Where Does U.S. Bank Stand?

While U.S. Bank does not match the sheer scale of JPMorgan Chase or Bank of America in terms of total net income, it consistently ranks among the top 5 to 10 most profitable banks in the nation. More telling than absolute profit figures are efficiency metrics. U.S. Bank often achieves competitive or superior returns on assets (ROA) and returns on equity (ROE), suggesting it uses its resources effectively. For example, a strong ROA indicates that the bank generates solid earnings relative to its asset base. This efficiency stems from its focused strategy, strong regional market penetration, diversified revenue streams, and disciplined approach to credit and cost management. As a result, U.S. Bank holds a respected position in the industry—not just as a major player, but as a model of operational excellence.

Future Outlook and Potential Challenges for U.S. Bank

Looking ahead, U.S. Bank remains optimistic about its ability to generate consistent returns. Management is focused on digital transformation to improve customer engagement and streamline operations, which can reduce costs and open new revenue channels. Growth opportunities include expanding in high-potential markets, deepening cross-selling across product lines, and investing in data analytics to deliver personalized financial solutions. The bank is also positioning itself in emerging areas like ESG (Environmental, Social, and Governance) initiatives and sustainable finance, aligning with evolving customer and investor expectations.

Yet, challenges persist. A potential economic slowdown could lead to higher loan losses and weaker demand for credit. Regulatory scrutiny remains intense, with possible changes to capital rules or consumer protection laws that could increase compliance burdens. Competition is intensifying—not only from traditional banks but also from agile fintech firms that are redefining customer experience. Additionally, the future path of interest rates remains uncertain, requiring careful balance sheet management to protect net interest margins. Cybersecurity also looms as a critical concern, demanding ongoing investment in technology and risk controls.

Implications for Investors and Consumers

For investors, U.S. Bank presents a compelling case for stability and income. Its consistent earnings, strong capital ratios, and high credit ratings make it a relatively low-volatility holding in a diversified portfolio. The bank’s dividend history and share repurchase programs appeal to income-oriented investors. However, investors should monitor key indicators such as net interest margin trends, loan loss provisions, and efficiency ratios to gauge long-term performance.

For consumers, the bank’s financial strength translates into peace of mind. Deposits are protected by FDIC insurance up to $250,000 per depositor, per ownership category, and the bank’s robust capital and risk management practices further reduce the likelihood of disruption. Customers also benefit from a broad range of services—from everyday checking and savings accounts to investment advice and mortgage lending—making U.S. Bank a one-stop financial partner for many households and businesses.

Conclusion: U.S. Bank’s Resilient Profitability

U.S. Bank’s ability to generate consistent profits is rooted in a well-balanced business model, strategic foresight, and a culture of disciplined risk management. Its earnings are powered by a dual engine of net interest income and diversified fee-based revenue, allowing it to thrive across economic cycles. Beyond profitability, the bank’s strong credit ratings, solid capital position, and regulatory compliance underscore its role as a stable and trustworthy institution. As the financial landscape evolves with technological innovation and shifting economic conditions, U.S. Bank’s resilience and adaptability position it well for continued success. For stakeholders across the spectrum—from shareholders to depositors—the bank remains a dependable force in American finance.

1. Is U.S. Bank financially strong, and what are the key indicators of its strength?

Yes, U.S. Bank is considered financially strong. Key indicators include consistently positive profits, strong credit ratings from agencies like Moody’s (A1/A2) and S&P Global (A+), robust capital ratios (such as its CET1 ratio exceeding regulatory minimums), and a diversified revenue stream that reduces reliance on any single income source. Its conservative risk management also contributes significantly to its stability.

2. What were U.S. Bank’s most recent quarterly earnings, and how did they perform against expectations?

In Q1 2024, U.S. Bank reported a net income of approximately $1.5 billion, with diluted earnings per share (EPS) of $0.98. Performance against expectations can vary depending on analyst consensus, but these figures generally reflect a resilient operational performance in a dynamic economic environment, often meeting or slightly exceeding adjusted forecasts.

3. Which factors primarily contribute to U.S. Bank’s profits, such as net interest income or fee-based services?

U.S. Bank’s profits are primarily driven by two main components:

- Net Interest Income (NII): The revenue earned from lending activities (loans, investments) minus the interest paid on deposits and other borrowings. This is heavily influenced by interest rate movements.

- Non-Interest Income: Revenue generated from fee-based services such as payment services (credit card fees), wealth management, mortgage banking, and other advisory services. This provides diversification and stability.

4. How does U.S. Bank’s profitability compare to other leading American banks, and what is its market position?

While U.S. Bank may not have the absolute highest net income compared to the largest banks like JPMorgan Chase or Bank of America due to scale, it consistently ranks among the top 5-10 most profitable U.S. banks. Its efficiency ratios (like Return on Assets and Return on Equity) are often competitive, reflecting strong operational performance. U.S. Bank holds a significant market position as the fifth-largest commercial bank by assets, with a strong presence in various regional markets across the U.S.

5. What is the current outlook for U.S. Bank’s stock and earnings per share for the upcoming year (e.g., 2025)?

The outlook for U.S. Bank’s stock and EPS in 2025 is generally positive, assuming a stable to moderately growing economy. Analysts typically project continued solid earnings, supported by prudent balance sheet management, ongoing digital transformation, and potential benefits from a stable interest rate environment. However, this is subject to macroeconomic shifts, regulatory changes, and competitive pressures. For detailed projections, it’s advisable to consult recent investor presentations and analyst reports.

6. Should consumers be concerned about the stability of their deposits with U.S. Bank in the current economic climate?

Consumers should not be concerned about the stability of their deposits with U.S. Bank. The bank’s strong financial health, high credit ratings, robust capital levels, and strict regulatory compliance (including FDIC insurance for deposits up to the legal limit of $250,000 per depositor, per insured bank, for each account ownership category) provide substantial safeguards for customer funds. The current economic climate, while dynamic, does not pose an existential threat to well-capitalized institutions like U.S. Bank.

7. What are U.S. Bank’s latest credit ratings, and what do they signify for its financial health?

U.S. Bank’s latest credit ratings typically remain strong from major agencies:

- Moody’s: Often in the A1/A2 range for long-term senior unsecured debt and deposits.

- S&P Global: Typically A+ for its issuer credit rating.

- Fitch Ratings: Also generally in the A/A+ range.

These ratings signify excellent financial health, low credit risk, strong capacity to meet financial commitments, and high market confidence, which translates into lower borrowing costs for the bank and greater assurance for investors and depositors.

8. Where can I find detailed U.S. Bank earnings call transcripts and investor presentations?

Detailed U.S. Bank earnings call transcripts, investor presentations, and financial reports are readily available on the bank’s official Investor Relations website. You can typically find these under sections like “Events & Presentations” or “Financial Information.” Additionally, the bank files its complete financial statements with the U.S. Securities and Exchange Commission (SEC), which can be accessed through the SEC EDGAR database by searching for “U.S. Bancorp” (its parent company).

9. Has U.S. Bank’s headquarters location (HQ) played any role in its recent financial performance?

U.S. Bank’s headquarters in Minneapolis, Minnesota, while a significant operational hub, typically doesn’t have a direct, unique impact on its *recent national financial performance* in the same way a strong regional economy might affect a purely local bank. As a large, nationally operating financial institution with a diversified geographic footprint and customer base, its overall profitability is driven more by national and global economic trends, interest rate policies, and its strategic acquisitions (like Union Bank) and operational efficiencies rather than specific local market conditions around its HQ.

10. What are the biggest challenges and opportunities U.S. Bank faces in maintaining its profitability?

Challenges:

- Economic downturns leading to higher credit losses and reduced loan demand.

- Intense competition from larger banks and agile fintech companies.

- Regulatory changes imposing additional compliance costs.

- Managing the evolving interest rate environment to optimize Net Interest Income.

- Cybersecurity threats and technological infrastructure investments.

Opportunities:

- Continued digital transformation to enhance customer experience and operational efficiency.

- Strategic acquisitions and organic growth in key markets.

- Expansion of fee-based services, particularly in wealth management and payment solutions.

- Leveraging data analytics for personalized customer offerings and risk management.

- Adapting to and leading in sustainable finance and ESG (Environmental, Social, Governance) initiatives.

留言