Introduction: Understanding Market Downturns

Financial markets are inherently cyclical, and downturns—though often unsettling—are a natural part of that rhythm. Whether you’re an experienced trader or a long-term investor, the ability to navigate periods of decline isn’t just about minimizing losses—it’s about positioning yourself strategically to emerge stronger. This guide explores a range of proven approaches to **trading downturns**, from foundational principles like diversification and risk control to more advanced tactics such as short selling and options trading. By understanding the mechanics behind market corrections and economic contractions, you can transform periods of volatility into opportunities for resilience and growth.

What Exactly Is a Market Downturn? Key Definitions

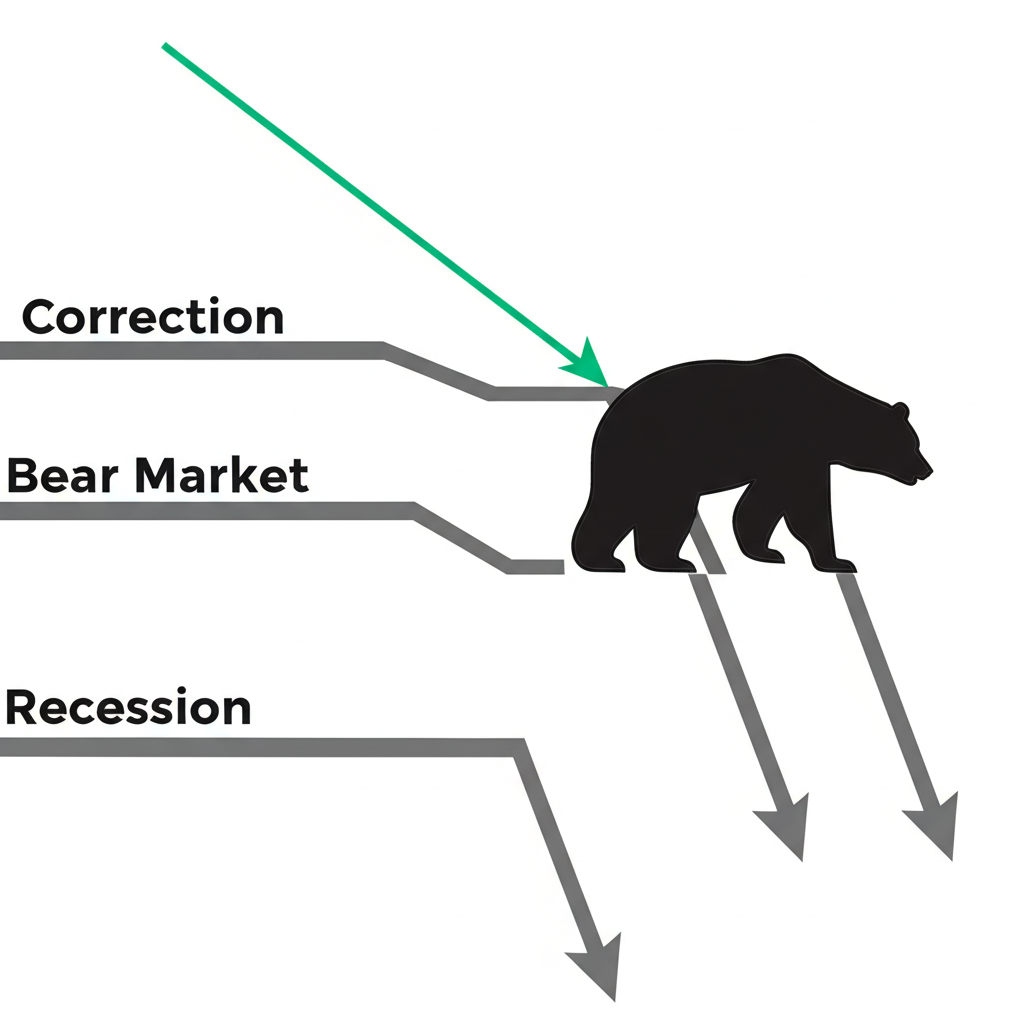

The term “market downturn” covers a spectrum of declining conditions, each with its own implications. Recognizing the differences is essential for making informed decisions and applying the right strategies.

A **market correction** refers to a drop of 10% or more from recent highs in a major index like the S&P 500. These corrections are relatively common—occurring roughly once every year or two—and often resolve within a few months. They can serve as healthy resets after extended rallies, helping to cool overheated valuations.

A **bear market**, in contrast, represents a deeper decline of 20% or more. These episodes tend to last longer, sometimes stretching over a year or more, and are typically accompanied by weakening economic data, declining corporate earnings, and widespread pessimism among investors.

Then there’s the **recession**—a broader economic phenomenon defined by a sustained contraction in economic activity across multiple sectors. While bear markets and recessions often coincide, they’re not the same. A recession reflects real-world conditions like job losses and shrinking GDP, while a bear market reflects falling stock prices, which can sometimes precede or lag economic trends.

Lastly, **volatility**—the rate at which prices fluctuate—tends to spike during downturns. High volatility can be intimidating, but for active traders, it also opens the door to tactical entries, exits, and hedging opportunities. Understanding these market states empowers investors to respond appropriately, whether by protecting capital, adjusting allocations, or seeking selective trades.

A Historical Perspective: Learning from Past Crashes and Bear Markets

History doesn’t repeat itself exactly, but it often rhymes—especially when it comes to market cycles. Looking back at major downturns reveals patterns that can inform today’s decisions. The stock market crash of 1929 plunged the world into the Great Depression, wiping out vast amounts of wealth. Yet, markets eventually rebounded, laying the groundwork for decades of future growth.

The Dot-Com Bubble burst in 2000 followed a period of exuberance around tech startups. When reality set in, valuations collapsed, and many companies vanished. Still, the survivors evolved into the tech giants we know today. The 2008 Global Financial Crisis, triggered by a housing bubble and systemic risk in financial institutions, sent the S&P 500 down more than 50%. But within four years, it had recovered all losses and gone on to reach new all-time highs.

More recently, the market plunge in March 2020—driven by pandemic fears and economic shutdowns—was one of the fastest bear markets in history. Yet, it was also one of the swiftest recoveries, fueled by aggressive monetary and fiscal stimulus. These episodes, detailed in resources like Investopedia’s analysis of bear markets, remind us that downturns, while painful, are typically temporary. The key insight? Markets have always recovered—often dramatically—rewarding those who stayed disciplined.

The Psychology of Downturns: Mastering Your Emotions

One of the greatest challenges in **trading downturns** isn’t analytical—it’s emotional. When markets fall, fear takes over. Headlines scream about losses, social media amplifies panic, and the instinct to sell everything can feel overwhelming. But acting on emotion is often the worst move an investor can make.

Behavioral finance shows that humans are wired to feel the pain of losses more acutely than the pleasure of gains—a tendency known as **loss aversion**. This can lead to panic selling at market lows, just before a recovery begins. Another common trap is **confirmation bias**, where investors seek out information that supports their existing fears or beliefs, ignoring data that suggests stability or opportunity.

Successful investors don’t eliminate emotion—they manage it. They do so by sticking to a well-defined plan, avoiding impulsive trades, and recognizing that short-term noise rarely alters long-term fundamentals. Maintaining emotional discipline means focusing on process over outcome, trusting your strategy even when the market tests your resolve.

Common Mistakes to Avoid During Market Declines

When uncertainty rises, even seasoned investors can fall into familiar traps. Avoiding these pitfalls is critical to preserving capital and positioning for recovery.

**Panic selling** is perhaps the most damaging. Selling during a steep decline locks in losses and removes you from the market just as prices begin to rebound. Many investors who exited in early 2009 missed the historic rally that followed.

**Abandoning your investment plan**—whether it’s a diversified portfolio or a long-term asset allocation—can do more harm than good. Emotional reactions often lead to selling low and buying high, the opposite of sound strategy.

**Trying to time the bottom** is another common error. Markets rarely hit a single, predictable low. Those who wait for the “perfect” moment to re-enter often miss the earliest and most powerful phase of the recovery.

**Overleveraging**—using excessive margin or debt to amplify positions—can turn a temporary dip into a financial crisis. During downturns, margin calls can force investors to liquidate at the worst possible time.

Finally, **ignoring risk management** leaves portfolios exposed. Failing to set stop-loss levels, monitor position sizes, or reassess exposure in changing conditions can lead to outsized losses.

Core Investment Strategies for Weathering Downturns

For long-term investors, the goal during a **market downturn** isn’t to chase quick wins—it’s to protect capital, maintain stability, and stay positioned for recovery. These core strategies focus on discipline, balance, and resilience.

Diversification and Asset Allocation

**Portfolio diversification** remains one of the most effective tools for managing risk. By spreading investments across asset classes—such as equities, fixed income, real estate, and commodities—investors reduce their dependence on any single market segment. When stocks fall, bonds or gold may hold their value or even rise, helping to cushion overall portfolio losses.

**Asset allocation** takes this a step further by tailoring the mix of assets to your risk tolerance, time horizon, and financial goals. A younger investor might tolerate more stock exposure, while someone nearing retirement may favor stability through bonds and dividend-paying stocks.

Regular rebalancing is key. As market movements shift your original allocation, rebalancing involves selling outperforming assets and buying underperforming ones. This enforces a “buy low, sell high” discipline automatically, counteracting emotional impulses.

During downturns, consider increasing exposure to **defensive sectors** like utilities, consumer staples, and healthcare—industries that provide essential goods and services regardless of economic conditions.

Dollar-Cost Averaging: A Disciplined Approach

**Dollar-cost averaging** removes emotion from investing by committing to regular, fixed contributions regardless of market levels. Whether the market is up or down, you invest the same amount each month or quarter.

This strategy works particularly well during downturns. As prices fall, your fixed investment buys more shares, lowering your average cost over time. For example, investing $500 monthly in a volatile market means acquiring more units when prices are low and fewer when they’re high—smoothing out volatility and reducing the risk of buying at a peak.

It’s a powerful antidote to market timing, especially for long-term investors who may not have the time or expertise to predict short-term movements.

Maintaining an Emergency Fund and Managing Debt

Financial stability starts with liquidity. An emergency fund—typically covering three to six months of living expenses—ensures you don’t have to sell investments at a loss during a downturn to cover unexpected costs.

Likewise, high-interest debt can become a burden when income is disrupted. Paying down credit cards or personal loans frees up cash flow and reduces financial pressure, allowing you to stay invested without panic.

Avoid using leverage to invest during uncertain times. The combination of debt and falling markets can lead to devastating outcomes, including margin calls and forced liquidations.

Active Trading Strategies for Profiting in Downturns

While long-term investors focus on endurance, active traders look for ways to profit from the very volatility others fear. These strategies demand experience, discipline, and strong **risk management**, but they can yield returns even in falling markets.

Short Selling and Inverse ETFs

**Short selling** allows traders to profit from declining prices. By borrowing shares and selling them, the trader aims to buy them back later at a lower price, pocketing the difference. However, this strategy carries substantial risk—losses are theoretically unlimited if the stock price rises instead of falls.

For those seeking a simpler approach, **inverse ETFs** offer exposure to falling markets without the complexities of borrowing shares. An inverse S&P 500 ETF, for instance, gains value when the index drops. These funds are rebalanced daily, making them suitable for short-term trades but risky for long-term holding due to compounding effects.

Both tools require careful monitoring and are best suited for experienced traders with clear exit plans.

Utilizing Options and Futures for Hedging or Speculation

Derivatives like **options** and **futures** offer flexibility for both protection and profit during downturns.

With **options**, buying **put contracts** is a common way to hedge a portfolio. A put gives you the right to sell a stock at a set price, limiting downside risk. Alternatively, buying puts on an index can serve as a speculative bet on further declines.

**Selling covered calls**—calls on stocks you already own—can generate income in a flat or slightly declining market. While this caps your upside, it provides a buffer against small drops.

**Futures contracts** allow traders to speculate on the direction of indices, commodities, or currencies. S&P 500 futures, for example, are widely used to gauge market sentiment. Futures involve leverage, meaning small price movements can lead to large gains or losses—making risk controls essential.

Defensive Sector Rotation and Niche Opportunities

Markets rarely fall uniformly. During downturns, certain sectors tend to outperform due to stable demand or perceived safety.

**Utilities**, for instance, provide essential services and often pay steady dividends, making them attractive in uncertain times. **Consumer staples**—companies that sell food, beverages, and household goods—see consistent demand regardless of the economy. **Healthcare** remains relatively resilient, as medical needs don’t disappear during recessions.

Traders can rotate capital into these defensive sectors to reduce exposure to more cyclical areas like technology or industrials.

Additionally, niche assets like **gold** often shine during downturns. Historically viewed as a safe-haven asset, gold tends to rise during periods of inflation, geopolitical tension, or financial instability. Including a small allocation to gold or gold-related ETFs can add a layer of protection.

Technical Analysis for Identifying Trading Opportunities

For active traders, **technical analysis** provides a framework for navigating volatility. By analyzing price patterns and volume, traders can spot potential turning points and momentum shifts.

Key indicators include:

– **Moving Averages (MAs):** Help identify trends. A break below a long-term MA like the 200-day may signal a bearish shift, while a crossover of short and long-term MAs can indicate momentum changes.

– **Relative Strength Index (RSI):** Measures momentum. An RSI below 30 suggests an asset may be oversold, potentially indicating a rebound.

– **MACD (Moving Average Convergence Divergence):** Tracks the relationship between two moving averages. A bearish crossover can signal further downside.

– **Support and Resistance Levels:** These price zones often act as psychological barriers. A breakdown below support may confirm a downtrend, while a bounce could suggest temporary stabilization.

Used together, these tools help traders make informed decisions about entry, exit, and position sizing—even in chaotic markets.

Preparing for the Next Market Cycle: Recovery and Growth

Downturns don’t last forever. History shows that every bear market has eventually given way to recovery—and often, strong bull runs. The challenge lies in recognizing the early signs of a turnaround and positioning accordingly.

Indicators of an impending recovery include improving economic data, such as rising employment or stabilizing manufacturing numbers. Shifts in central bank policy—like interest rate cuts or renewed stimulus—can also signal a bottom. Additionally, changes in investor sentiment, such as a drop in fear metrics like the VIX, may suggest renewed confidence.

As markets stabilize, consider gradually increasing exposure to growth-oriented sectors like technology, consumer discretionary, and small-cap stocks—areas that often lead the next phase of **recovery** and **growth**.

Rebalancing is crucial here. After a downturn, your portfolio may be tilted toward defensive assets. Gradually shifting back toward your target allocation helps capture upside without abandoning risk controls.

According to Russell Investments, recoveries can be swift and powerful, with a significant portion of gains occurring in the early months. Missing this window can dramatically impact long-term returns.

Conclusion: Strategic Resilience in Volatile Markets

**Trading downturns** isn’t about predicting every twist and turn. It’s about preparation, discipline, and perspective. Market corrections, bear markets, and recessions are inevitable—but so is recovery. By combining sound long-term **investment strategies** with tactical **trading strategies**, investors can protect capital, manage risk, and seize opportunities.

Success hinges not just on financial tools, but on mindset. Controlling emotion, avoiding common mistakes, and staying aligned with your goals are just as important as any trading technique. With a balanced approach—rooted in diversification, risk management, and historical awareness—you can navigate volatility with confidence and emerge better positioned for the next phase of **growth**.

Frequently Asked Questions (FAQ)

What is the definition of a market downturn in investing?

A market downturn refers to a period when financial markets, typically stock markets, experience a significant decline in value. This can range from a short-term “market correction” (a 10%+ drop) to a more severe and prolonged “bear market” (a 20%+ decline) or even coincide with a broader “recession” in the economy.

How do market corrections differ from bear markets and recessions?

- Market Correction: A short-term drop of 10% or more from recent highs, usually lasting a few weeks to a few months.

- Bear Market: A more substantial and sustained decline of 20% or more from recent highs, often lasting many months or even years, signaling widespread pessimism.

- Recession: An economic contraction characterized by a significant decline in overall economic activity (GDP, employment, etc.) over several months. While recessions often accompany bear markets, they refer to the broader economy, not just the stock market.

Historically, how often do significant stock market downturns occur?

Significant stock market downturns (corrections or bear markets) are a regular feature of market cycles. Corrections can occur annually or every few years, while bear markets are less frequent, typically happening every 3-5 years on average, though the exact timing and severity are unpredictable. History shows markets consistently recover over time.

What are the most effective long-term investment strategies to employ during a downturn?

Effective long-term strategies include:

- **Diversification and Asset Allocation:** Spreading investments across various asset classes to mitigate risk.

- **Dollar-Cost Averaging:** Consistently investing a fixed amount over time, buying more shares when prices are low.

- **Maintaining an Emergency Fund:** Ensuring liquidity to avoid forced selling of investments.

- **Focusing on Quality:** Investing in financially strong companies with solid fundamentals.

Can active traders profit during a declining market, and what strategies are involved?

Yes, active traders can profit during declining markets by employing bearish strategies such as:

- **Short Selling:** Borrowing and selling stocks with the expectation of buying them back at a lower price.

- **Inverse ETFs:** Funds designed to move inversely to a specific index or sector.

- **Buying Put Options:** Speculating on a price decline or hedging existing long positions.

- **Defensive Sector Rotation:** Shifting capital into sectors that historically perform better during downturns (e.g., utilities, consumer staples).

These strategies carry higher risk and require sophisticated risk management.

What are the biggest mistakes investors make when the stock market goes down?

The biggest mistakes often stem from emotional reactions:

- **Panic Selling:** Liquidating investments at or near market lows.

- **Abandoning Investment Plans:** Deviating from a well-researched strategy.

- **Trying to Time the Bottom:** An often unsuccessful attempt to buy at the absolute lowest point.

- **Overleveraging:** Taking on too much debt, which amplifies losses.

Is there a specific month that is historically worse for stock trading or market performance?

While historical data can show seasonal trends, such as September often being cited as a historically weak month for stock market performance, these are statistical averages and not guarantees. Market performance is influenced by a multitude of complex factors, and past seasonality does not predict future results. Relying solely on such patterns for trading decisions is risky.

How long does the average stock market downturn last, and what signals its end?

The duration of a market downturn varies significantly. Corrections typically last a few weeks to months, while bear markets can last from several months to a couple of years. Signals of an ending downturn often include:

- Stabilization or improvement in economic indicators.

- A shift in central bank policy (e.g., interest rate cuts).

- Increased investor sentiment and confidence.

- A clear break above key technical resistance levels in market indices.

What role does diversification play in protecting a portfolio during market volatility?

Diversification is crucial for protecting a portfolio during market volatility as it spreads risk across various asset classes, sectors, and geographies. When one part of your portfolio is performing poorly, another might be holding steady or even increasing in value, thereby dampening overall portfolio losses. It helps to smooth out returns and reduce the impact of any single negative event.

Should I consider short selling or inverse ETFs to trade market downturns?

Short selling and inverse ETFs are advanced strategies primarily used by experienced traders to profit from declining markets. While they can be effective, they come with significant risks, including potentially unlimited losses for short selling. It’s essential to have a deep understanding of these instruments, rigorous risk management protocols, and sufficient capital before considering them. For most long-term investors, focusing on defensive positioning and dollar-cost averaging is a more appropriate approach during downturns.

留言