Introduction: Understanding Roblox’s Market Position

Roblox isn’t just another gaming platform—it’s a digital universe where imagination becomes experience. As a trailblazer in interactive entertainment, Roblox Corporation (RBLX) has built a sprawling user-generated metaverse that blends gaming, social connection, and creativity into a single ecosystem. Millions of developers use its tools to craft immersive 3D environments, while hundreds of millions of users engage with that content, creating a self-sustaining digital economy powered by Robux, the platform’s virtual currency. This unique structure sets Roblox apart from traditional game studios or social networks. Its valuation isn’t simply about stock prices or quarterly earnings; it reflects investor confidence in a bold vision for the future of digital life. To understand Roblox’s worth, one must examine how its community-driven model fuels engagement, drives revenue, and positions it at the forefront of the evolving metaverse landscape.

Roblox Valuation Today: Key Statistics and Current Market Cap

As a publicly traded company listed on the New York Stock Exchange under the ticker RBLX, Roblox’s market capitalization is constantly shifting based on investor sentiment and broader market trends. As of early May 2024, the company’s market cap sits between $22 billion and $25 billion, with shares trading in the $35 to $40 range. While this represents a significant pullback from its peak valuation during the 2021 metaverse boom, it also signals a period of recalibration and stabilization as the platform demonstrates consistent user growth and improving financial discipline.

Looking at the numbers more closely reveals a company investing heavily in long-term potential rather than short-term profits. Over the trailing twelve months, Roblox has generated approximately $2.8 to $3.0 billion in revenue, driven by strong demand for Robux across its global user base. However, net income remains negative, with losses estimated between $1.0 and $1.2 billion over the same period, largely due to sustained investment in infrastructure, safety, and developer incentives. Despite these accounting losses, Roblox has maintained a healthy free cash flow of around $500 to $600 million, indicating its ability to convert user spending into operational liquidity.

The Price-to-Sales (P/S) ratio, a key metric for high-growth tech firms, currently ranges between 7x and 9x. This positions Roblox above many traditional gaming companies but well below the speculative highs seen in 2021. These figures suggest investors are cautiously optimistic, pricing in continued growth while demanding clearer signs of a path to profitability.

| Metric | Value (Approx. as of Q1 2024) |

| :——————– | :—————————- |

| **Market Capitalization** | ~$22 – $25 billion |

| **Current Stock Price** | ~$35 – $40 per share |

| **Revenue (TTM)** | ~$2.8 – $3.0 billion |

| **Net Income (TTM)** | ~-$1.0 – -$1.2 billion |

| **P/S Ratio (TTM)** | ~7x – 9x |

| **Free Cash Flow (TTM)**| ~$500 – $600 million |

*Note: These figures are approximate and subject to change based on real-time market data and quarterly financial reports. Investors should refer to official Roblox investor relations for the most current information.*

Historical Valuation Trends and Milestones

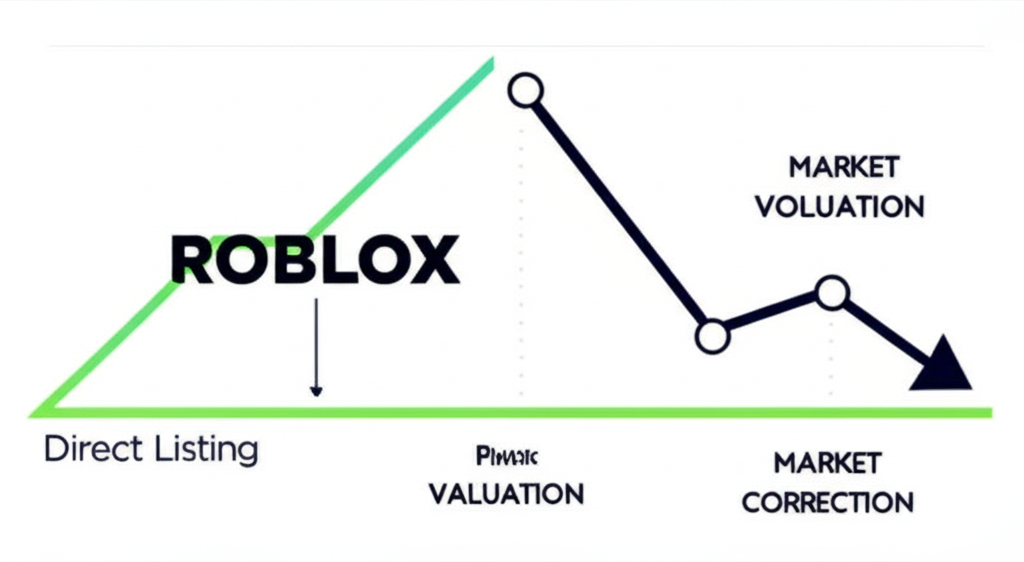

Roblox’s public market journey began on March 10, 2021, with a direct listing that opened at $64.50 per share, valuing the company at roughly $42 billion. This debut reflected immense investor excitement surrounding the metaverse concept, which surged during the pandemic as digital experiences became central to social and recreational life. For a time, that optimism translated into explosive growth—by late 2021, Roblox’s market capitalization soared past $80 billion, making it one of the most valuable player-generated content platforms in the world.

However, the tide turned sharply in 2022. As interest rates climbed and tech stocks faced a broad selloff, Roblox’s valuation contracted significantly. Concerns over user acquisition costs, slowing growth, and persistent losses led to a steep decline, with the stock losing much of its peak value. The correction tested investor patience but also forced the company to focus on efficiency, user retention, and sustainable monetization.

Since 2023, Roblox has shown resilience. While it hasn’t recaptured its all-time highs, its valuation has stabilized, supported by solid gains in daily active users, rising bookings, and improved cash flow management. This trajectory reflects a maturing platform transitioning from speculative growth to measurable performance. The historical arc—from ambitious debut to speculative peak, then correction, and now measured recovery—offers critical context for understanding how market expectations have evolved and what might lie ahead.

How Roblox Makes Money: The Business Model Explained

At the heart of Roblox’s financial engine is a two-sided marketplace powered by virtual currency. Users buy Robux with real money to access premium features, purchase digital items, or enhance their avatars. These transactions aren’t just one-off purchases—they represent the foundation of a complex, platform-wide economy.

What sets Roblox apart is how it handles revenue recognition. The total amount spent on Robux is recorded as “bookings,” but only a portion is recognized as revenue each quarter. This deferred recognition aligns with the estimated average lifespan of Robux usage, which can span several months. This method smooths out revenue fluctuations but can obscure the immediate impact of user spending on financial statements.

The platform’s economics hinge on a revenue-sharing model between Roblox and its developer community. When a user spends Robux in a game, a portion goes to the developer as earnings, which can later be exchanged for real currency. While the exact percentage varies—often ranging from 20% to 50% depending on the developer program and engagement level—Roblox retains a majority share of the initial Robux sale. This retained amount covers operational costs, platform development, customer support, and content moderation, particularly crucial given the platform’s young audience.

It’s important to clarify that Roblox does not take a 30% cut of developer earnings in the way app stores charge developers. Instead, the company captures a large portion of the original purchase before any payout occurs. For example, if a user spends $1 on Robux, only a fraction of that dollar ever reaches the developer. This structure allows Roblox to maintain high gross margins—often cited above 80%—making the business highly scalable despite significant payouts to creators.

Key Drivers of Roblox’s Valuation

User Growth and Engagement Metrics

Roblox’s valuation hinges on its ability to attract and retain users. Daily Active Users (DAU) is the most watched metric, serving as a barometer for platform health and reach. In recent quarters, DAU has continued to climb, with strong growth both in North America and international markets. But it’s not just about numbers—engagement matters just as much. Hours Engaged, which tracks how long users spend in experiences, reveals the depth of connection users have with the platform. Higher engagement correlates with more Robux spending and stronger community loyalty.

Even more telling is Average Bookings Per Daily Active User (ABPDAU), a metric that measures how much each user contributes to the platform’s top line. Growth in ABPDAU signals that Roblox is getting better at monetizing its existing audience, not just expanding it. In Q1 2024, bookings rose 17% year-over-year to $923.7 million, fueled by gains in both DAU and ABPDAU. This dual growth is exactly what investors look for: a platform that’s growing bigger and deeper at the same time.

Financial Performance: Revenue, Profitability, and Cash Flow

While revenue growth is impressive, profitability remains a central debate among investors. Roblox continues to report net losses—$270.6 million in Q1 2024—due to heavy investment in product development, safety systems, and global expansion. However, traditional profitability metrics like GAAP net income don’t tell the whole story.

Gross profit margins remain strong, reflecting the efficiency of selling digital goods with minimal marginal cost. More importantly, Roblox consistently generates positive free cash flow—$500 to $600 million over the trailing twelve months—demonstrating that the core business model converts user spending into real, usable capital. This ability to self-fund growth without relying on constant external financing is a major strength and a key reason investors remain confident despite the red ink on the bottom line.

The Developer Ecosystem and Creator Economy

Roblox’s success isn’t driven by a single studio or a handful of hit games—it’s powered by millions of independent creators. This decentralized model turns the platform into a living, evolving universe where innovation comes from the community itself. Unlike traditional publishers that must fund every game internally, Roblox leverages its developer ecosystem as a distributed R&D engine.

The company supports this community with powerful creation tools, monetization pathways, and promotional resources. When developers succeed, the entire platform benefits: better content attracts more users, who spend more Robux, which in turn funds more developer payouts. This virtuous cycle strengthens network effects—the hallmark of valuable digital platforms.

From a valuation standpoint, this ecosystem represents both a competitive moat and a long-term growth engine. The more developers build on Roblox, the harder it becomes for competitors to replicate its breadth and depth of content. Investors don’t just value Roblox’s current financials—they’re betting on the continued expansion of this creator-driven economy.

Metaverse Potential and Future Growth Avenues

Roblox’s long-term valuation is tied to its ambition of becoming a central hub in the metaverse—not just for gaming, but for education, virtual events, brand experiences, and social interaction. The company is already seeing traction beyond its core youth demographic, with brands like Gucci, Nike, and Warner Music hosting virtual experiences on the platform.

Looking ahead, opportunities abound. Monetization could expand into immersive advertising, premium subscriptions for exclusive content, or even enterprise applications for training and collaboration. International expansion, particularly in regions like Southeast Asia and Latin America, offers massive untapped potential. As the definition of digital interaction evolves, Roblox’s early-mover advantage and scalable infrastructure position it well to capture value across multiple domains.

Valuation Methodologies for Platform Companies Like Roblox

Traditional Multiples Analysis (P/E, P/S, EV/Revenue)

For traditional investors, valuation starts with financial multiples. The Price-to-Earnings (P/E) ratio is less useful for Roblox given its recurring net losses, often rendering the ratio negative or undefined. Instead, analysts turn to the Price-to-Sales (P/S) or Enterprise Value-to-Revenue (EV/Revenue) ratios, which are more applicable to high-growth, pre-profitability companies.

As of early 2024, Roblox trades at a P/S ratio of roughly 7x to 9x. This is higher than legacy gaming firms like Electronic Arts or Take-Two Interactive, reflecting investor belief in its platform potential and faster growth trajectory. However, it’s well below the triple-digit multiples seen during the 2021 frenzy. Comparing Roblox to social platforms like Meta Platforms offers another lens—while Meta benefits from mature advertising revenue, Roblox is valued for its engagement depth and future monetization potential.

User-Based Valuation and Platform Economics

Given its two-sided marketplace, Roblox lends itself to user-centric valuation models. Key metrics include:

– **Lifetime Value (LTV):** Estimating how much revenue a user generates over their time on the platform.

– **Customer Acquisition Cost (CAC):** Measuring how much Roblox spends to bring in a new daily active user.

– **LTV/CAC Ratio:** A ratio above 3:1 is typically seen as healthy, indicating efficient growth.

Roblox doesn’t always disclose CAC publicly, but analysts infer it from marketing spend and user growth. A strong LTV/CAC ratio would suggest the business can scale profitably. Additionally, the strength of network effects—where each new user makes the platform more valuable for others—adds intangible value that traditional models may understate.

Discounted Cash Flow (DCF) Overview

The Discounted Cash Flow (DCF) model remains a cornerstone of intrinsic valuation. For Roblox, this involves projecting future free cash flows, discounting them back to the present using a risk-adjusted rate, and adding a terminal value for long-term growth.

DCF valuations for Roblox vary widely based on assumptions about user growth, monetization efficiency, and the timeline to profitability. Bullish models assume continued DAU expansion, rising ABPDAU, and eventual margin expansion. Bearish models factor in slowing growth, increased competition, or regulatory headwinds. Despite the uncertainty, a well-constructed DCF helps investors move beyond multiples to assess what Roblox might be worth based on its long-term cash-generating potential.

Risks and Challenges Impacting Roblox’s Valuation

Regulatory Scrutiny and Data Privacy Concerns

Roblox’s large youth audience makes it a natural target for regulators. In the U.S., compliance with the Children’s Online Privacy Protection Act (COPPA) is non-negotiable, while in Europe, the General Data Protection Regulation (GDPR) imposes strict rules on data handling. Any misstep in content moderation, data collection, or in-game monetization could trigger investigations, fines, or forced changes to the business model.

Concerns about virtual economies—such as whether certain gameplay mechanics resemble gambling—have also drawn attention. The Federal Trade Commission (FTC) has repeatedly emphasized the need for stronger safeguards for children online. Increased regulation could raise compliance costs, limit advertising options, or restrict features, all of which could dampen growth and investor enthusiasm.

Competition and User Retention

The digital entertainment space is fiercely competitive. Roblox competes not only with gaming giants like Epic Games (Fortnite) and Minecraft but also with social platforms like TikTok and YouTube, which are increasingly incorporating interactive and gamified content. The risk isn’t just losing new users—it’s retaining existing ones as they age out of childhood.

Roblox must continuously evolve its content and social features to stay relevant to teenagers and young adults. If it fails to offer experiences that appeal beyond its core demographic, user engagement could plateau. Moreover, developer retention is equally critical—without a steady stream of high-quality content, the platform risks becoming stale.

Economic Headwinds and Consumer Spending

Robux purchases are discretionary, meaning they’re vulnerable to economic downturns. In times of inflation or job insecurity, families may cut back on virtual spending, directly impacting bookings and revenue. This sensitivity was evident during previous recessions when digital entertainment spending fluctuated with broader consumer confidence.

Global economic uncertainty, as monitored by institutions like the International Monetary Fund (IMF), remains a persistent risk. A prolonged slowdown could pressure Roblox’s top line, especially if user growth slows in key international markets.

Conclusion: The Future Outlook for Roblox’s Valuation

Roblox stands at a pivotal moment. It has proven its ability to build and sustain a global digital ecosystem, driven by user creativity and deep engagement. Its valuation reflects not just current financials, but a bet on the future of digital interaction. While GAAP profitability remains elusive, the platform’s strong free cash flow, growing bookings, and resilient user base suggest a business model with real staying power.

The road ahead will depend on several factors: expanding into older demographics, diversifying revenue beyond Robux sales, navigating regulatory challenges, and continuing to empower its developer community. The metaverse vision remains ambitious, and execution will be key. If Roblox can balance innovation with financial discipline, it has the potential to become one of the defining digital platforms of the 21st century. For now, its valuation reflects cautious optimism—a belief in long-term potential, tempered by the realities of a competitive and unpredictable market.

How much is Roblox (RBLX) worth in terms of market capitalization today?

As of recent financial reports (e.g., Q1 2024), Roblox’s market capitalization typically ranges between $22 billion and $25 billion, though this figure fluctuates daily with its stock price.

Has Roblox Corporation ever achieved consistent profitability, and what are its current earnings trends?

Roblox has generally not achieved consistent GAAP profitability due to significant investments in growth, platform development, and developer incentives. While it generates strong bookings and positive free cash flow, it often reports net losses. For example, in Q1 2024, it reported a net loss of $270.6 million.

Is Roblox stock (RBLX) considered overvalued by financial analysts at its current trading price?

Opinions on whether RBLX is overvalued vary among analysts. While its valuation multiples like Price-to-Sales are often higher than traditional gaming companies, reflecting its growth potential and platform model, the absence of consistent net profit can lead to concerns about its valuation. Analysts often use alternative metrics like bookings growth and free cash flow to assess its value.

What are the primary financial metrics and key performance indicators that drive Roblox’s valuation?

Key drivers include:

- **Daily Active Users (DAU):** User base size and growth.

- **Bookings:** Total Robux purchased, indicating revenue potential.

- **Average Bookings Per Daily Active User (ABPDAU):** Monetization efficiency per user.

- **Free Cash Flow (FCF):** Cash generation from operations.

- **Revenue Growth:** Overall top-line expansion.

How does Roblox’s unique platform business model influence its overall market value and future growth prospects?

Roblox’s platform model, driven by user-generated content and a vibrant developer ecosystem, creates powerful network effects. This model reduces content creation costs, fosters continuous innovation, and enhances user engagement, all of which contribute to its long-term growth potential and therefore its market value. The scalability of the platform is a key advantage.

Can you provide a brief overview of Roblox’s valuation history, including its direct listing and major fluctuations?

Roblox went public via a direct listing in March 2021 with a valuation of around $42 billion. It peaked in late 2021 with a market cap exceeding $80 billion, fueled by metaverse enthusiasm. However, it experienced a significant correction in 2022 amidst broader tech downturns, stabilizing in 2023-2024, generally in the $20-30 billion range, as it focused on consistent user and bookings growth.

What is the significance of “Roblox revenue” and “Roblox market cap” in assessing the company’s financial health?

Roblox revenue indicates the company’s ability to generate income from its platform activities, primarily Robux sales. Roblox market cap, on the other hand, reflects the total value of its outstanding shares, representing the market’s collective assessment of the company’s current worth and future prospects. Both are crucial for understanding its financial scale and investor sentiment.

Does the “Roblox takes 30%” developer fee model impact its valuation, and how is it accounted for in financial statements?

Roblox’s revenue comes from the sale of Robux, and a portion is paid out to developers. While it’s not a direct 30% fee from developers’ earnings, the company retains a significant share of Robux sales to cover costs and generate profit. This model impacts valuation by ensuring high gross margins, which are attractive to investors, despite substantial developer payouts being a key operating expense.

What role do daily active users (DAU) and user engagement play in determining Roblox’s stock valuation?

DAU and user engagement (e.g., hours engaged) are fundamental. A growing and highly engaged user base signifies a healthy and expanding platform, which directly correlates with potential for increased Robux purchases and future monetization. Investors view these metrics as leading indicators of Roblox’s long-term revenue growth and competitive strength.

Where can investors find a comprehensive “Roblox Market summary” and real-time stock data?

Investors can find a comprehensive Roblox market summary and real-time stock data on major financial news websites (e.g., Google Finance, Yahoo Finance, Bloomberg, Reuters) or through their brokerage platforms. For official financial reports and investor presentations, the Roblox Investor Relations website is the primary source.

留言