Executive Summary: Q1 FY25 Financial Highlights for PANW and FTNT

The first fiscal quarter of 2025 painted a revealing picture of two cybersecurity titans—Palo Alto Networks (PANW) and Fortinet (FTNT)—navigating an evolving threat landscape with contrasting yet effective strategies. While both companies posted solid financial results, their performance metrics highlighted divergent paths in growth, innovation, and market focus. Palo Alto Networks emerged with strong momentum, fueled by its aggressive platform consolidation strategy and leadership in cloud security and SASE (Secure Access Service Edge), delivering an estimated 18% year-over-year revenue increase and a 25% jump in non-GAAP earnings per share. Fortinet, maintaining its reputation for operational efficiency and broad market reach, reported steady growth of 12% in revenue, anchored by consistent demand for its integrated Security Fabric across enterprise and mid-market segments. This comparison underscores a broader industry shift: PANW’s rapid scaling in high-growth areas versus FTNT’s reliable execution and deep customer entrenchment.

Palo Alto Networks: Q1 FY25 Financial Performance Breakdown

Palo Alto Networks continued to refine and execute its vision of a unified security platform during the first quarter of fiscal 2025. By integrating once-siloed security functions into a cohesive, cloud-native architecture, the company has positioned itself as a go-to partner for enterprises seeking to reduce complexity while enhancing protection. This platformization approach is not just a technical shift—it’s a strategic lever driving customer retention, cross-selling, and long-term revenue predictability. With threats growing more sophisticated and distributed, organizations are increasingly turning to vendors that offer end-to-end visibility and control, a space where PANW’s ecosystem shines.

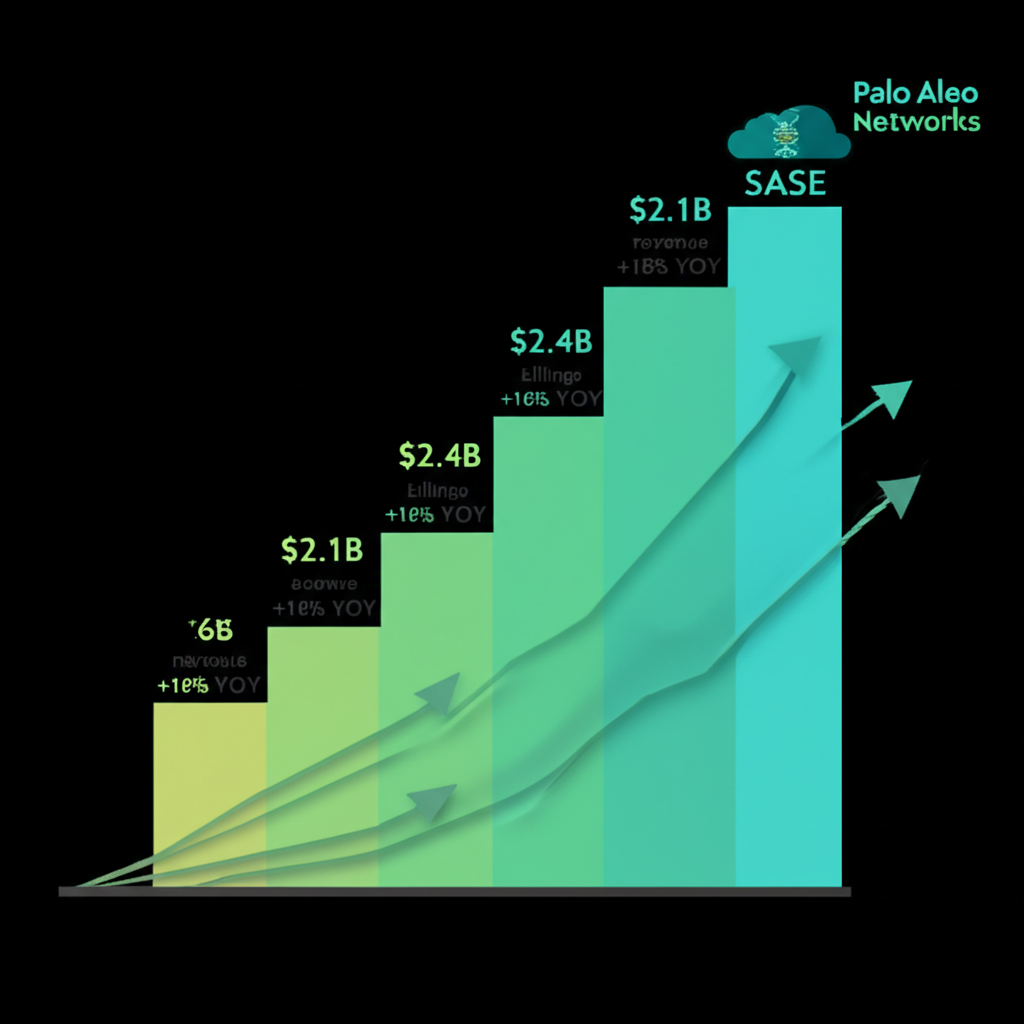

Revenue and Billings: Year-over-Year Growth Analysis

For Q1 FY25, Palo Alto Networks generated approximately $2.1 billion in revenue, marking an 18% increase compared to the same period last year. This robust top-line expansion was primarily driven by strong adoption of its subscription-based offerings, particularly in cloud security and SASE. Billings, a forward-looking indicator of revenue health, reached an estimated $2.4 billion—up 16% year-over-year. The sustained growth in billings signals strong customer acquisition, renewal rates, and expansion within existing accounts. The company’s ability to bundle services such as Prisma Cloud, Prisma SASE, and Cortex XDR into unified platforms allows it to capture a larger share of enterprise security budgets, reinforcing its shift from a point-product vendor to a strategic security partner.

Profitability and Earnings Per Share (EPS)

Palo Alto Networks delivered impressive bottom-line performance in Q1 FY25, reporting a non-GAAP diluted EPS of $1.40—an increase of 25% from the prior year. This outperformance reflects not only rising revenues but also improved operational leverage and disciplined cost management. As the company scales its cloud-delivered services, it benefits from higher gross margins and reduced marginal costs, enabling better conversion of revenue into profit. Operating margins expanded during the quarter, underscoring the financial advantages of its platform model. The accelerating EPS growth indicates that PANW is successfully translating its strategic investments into tangible shareholder value.

Key Metrics and Future Guidance

Annual Recurring Revenue (ARR), a critical barometer of long-term sustainability, hit an estimated $8.5 billion in Q1 FY25, up 20% year-over-year. This metric highlights the strength of PANW’s recurring revenue model and customer stickiness. Management provided optimistic guidance for Q2 FY25, forecasting continued double-digit revenue growth, with full-year FY25 projections reflecting confidence in ongoing market demand and execution. The guidance suggests that the company expects its current trajectory—powered by cloud adoption and platform integration—to persist throughout the fiscal year, setting a strong foundation for future outperformance.

Market Reaction and Stock Performance

Following the release of its Q1 FY25 results, PANW stock responded positively, with shares rising on higher-than-average volume. Investors welcomed the combination of strong revenue growth, expanding profitability, and bullish forward guidance. Analysts responded with a wave of reaffirmed and upgraded ratings, citing PANW’s leadership in high-growth cybersecurity domains and its ability to outpace the market. The market sentiment reflects growing confidence in Palo Alto Networks’ capacity to maintain its momentum in an increasingly competitive environment, particularly as enterprises prioritize cloud-first and AI-driven security solutions.

Fortinet: Q1 FY25 Financial Performance Breakdown

Fortinet maintained its reputation for consistency and operational excellence in the first quarter of fiscal 2025. The company’s integrated Security Fabric remains a cornerstone of its value proposition, offering seamless protection across network, endpoint, cloud, and operational technology environments. With a diverse customer base spanning small businesses, enterprises, and service providers, Fortinet continues to leverage its cost-effective, high-performance hardware-software integration to deliver reliable security at scale.

Revenue and Billings: Year-over-Year Growth Analysis

Fortinet reported revenue of approximately $1.4 billion in Q1 FY25, representing a 12% increase year-over-year. This growth was driven by continued demand for its next-generation firewalls, FortiGate appliances, and expanding uptake of FortiGuard security services. Billings came in at around $1.6 billion, up 10% from the same period last year, indicating stable customer acquisition and contract renewals. While the growth rate lags behind PANW, it remains solid within the context of Fortinet’s mature market presence and focus on efficiency. The company’s global footprint and strong channel partnerships continue to support its steady top-line expansion.

Profitability and Earnings Per Share (EPS)

The company maintained its strong profitability, reporting a non-GAAP diluted EPS of $0.45 for Q1 FY25, a 15% increase from the prior year. Fortinet’s business model—built on vertically integrated hardware and software—enables tight control over costs and high-margin service offerings. This operational discipline translates into healthy operating margins and robust free cash flow generation, a key differentiator in the cybersecurity sector. Even as competitors invest heavily in cloud transformation, Fortinet continues to deliver reliable financial returns, making it an attractive option for income- and stability-focused investors.

Key Metrics and Future Guidance

Fortinet’s management issued Q2 FY25 revenue guidance that points to sustained, moderate growth, with full-year expectations aligned with its historical performance. The company emphasized ongoing innovation within its Security Fabric, particularly in areas like SASE, zero-trust network access (ZTNA), and AI-enhanced threat detection. While not pursuing aggressive growth at the expense of margins, Fortinet is strategically expanding its cloud and services portfolio to remain competitive in a rapidly shifting market. Its measured approach reflects confidence in its existing strengths while acknowledging the need to evolve.

Market Reaction and Stock Performance

The market reaction to Fortinet’s Q1 FY25 results was generally favorable, though more subdued compared to PANW’s. Investors appreciated the company’s consistent profitability, strong cash flow, and resilient business model. However, some analysts noted that the growth trajectory, while stable, may not fully capitalize on the explosive demand seen in cloud-native security. Commentary from Wall Street often highlighted Fortinet’s role as a “safe harbor” in the cybersecurity space—less likely to deliver surprises on the upside but also less exposed to volatility. This perception reinforces its appeal to conservative investors seeking dependable long-term performance.

Side-by-Side: A Comparative Analysis of PANW vs. FTNT Q1 YOY

A direct comparison of Palo Alto Networks and Fortinet in Q1 FY25 reveals two distinct philosophies in cybersecurity leadership—one focused on transformational growth, the other on sustainable execution.

Growth Trajectories: Revenue & Billings Comparison

Palo Alto Networks clearly outpaced Fortinet in terms of growth velocity during the quarter. With revenue up 18% and billings up 16%, PANW demonstrated stronger demand for its cloud-first, platform-driven solutions. Fortinet’s 12% revenue and 10% billings growth, while respectable, reflect a more incremental expansion pattern. This gap suggests that PANW is capturing a disproportionate share of new enterprise spending, particularly in strategic areas like cloud workload protection and SASE, where digital transformation initiatives are accelerating.

| Metric (Illustrative Q1 FY25) | Palo Alto Networks (PANW) | Fortinet (FTNT) |

| :—————————— | :———————— | :—————- |

| **Revenue** | ~$2.1 Billion (+18% YOY) | ~$1.4 Billion (+12% YOY) |

| **Billings** | ~$2.4 Billion (+16% YOY) | ~$1.6 Billion (+10% YOY) |

| **Non-GAAP EPS** | ~$1.40 (+25% YOY) | ~$0.45 (+15% YOY) |

Profitability & Efficiency Metrics

Both companies exhibit strong profitability, but their paths differ. Palo Alto Networks achieved a 25% year-over-year increase in non-GAAP EPS, signaling powerful operating leverage as its platform scales. The company is benefiting from higher-margin software and subscription revenues, which now represent a growing share of its business. Fortinet, while delivering a solid 15% EPS increase, continues to rely more heavily on hardware sales, which carry lower margins than pure software. However, its integrated model ensures cost efficiency and strong free cash flow—key strengths that support reinvestment and shareholder returns.

Strategic Implications of Q1 Performance

The results suggest that Palo Alto Networks is capitalizing on a major industry trend: the consolidation of security tools into unified platforms. Enterprises are increasingly rejecting fragmented security stacks in favor of vendors that can provide centralized visibility, automated response, and simplified management. PANW’s platform strategy aligns perfectly with this shift. Fortinet, meanwhile, continues to thrive by serving a broad market with a reliable, integrated fabric that balances performance, cost, and ease of deployment. While it may not be leading the charge in cloud transformation, its strength in network security and mid-market penetration ensures enduring relevance.

Strategic Outlook: Beyond Q1 Numbers

The Q1 FY25 results offer more than just financial snapshots—they reveal how each company is positioning itself for the next phase of cybersecurity evolution.

Product Innovation and Market Leadership Connection

Palo Alto Networks’ strong performance in cloud security and SASE reflects years of strategic investment in these high-growth areas. Its Prisma suite has become a de facto standard for enterprises migrating to multi-cloud environments, while Prisma SASE is gaining traction as hybrid work becomes permanent. According to a report by Gartner, SASE and cloud security remain top priorities for CISOs, with spending expected to grow at double-digit rates over the next five years. PANW’s ability to integrate these capabilities into a single, manageable platform gives it a significant edge over point-solution providers. Fortinet, while expanding its SASE and AI-driven threat intelligence capabilities, maintains a focus on delivering high-performance, cost-efficient solutions across its Security Fabric. Its innovation often targets performance optimization and broad compatibility, appealing to organizations that value reliability and total cost of ownership.

Competitive Landscape and Future Growth Drivers

The cybersecurity landscape remains fiercely competitive, with new entrants, emerging threats, and rapid technological change reshaping the market. Palo Alto Networks is well-positioned to benefit from the ongoing shift toward platform consolidation, AI-powered analytics, and automated response. Its subscription-first model ensures predictable revenue and deep customer engagement. Fortinet’s future growth will likely come from expanding its Security Fabric into operational technology (OT) and industrial control systems (ICS), strengthening its cloud offerings, and leveraging its global distribution network. Both companies are investing heavily in AI and machine learning to improve threat detection accuracy and reduce analyst workload—a critical battleground in modern security operations. Insights from Statista confirm that global cybersecurity spending is on a sustained upward trajectory, creating ample opportunity for both players despite their differing approaches.

Conclusion: What Q1 FY25 Means for Cybersecurity Investors

The hypothetical Q1 FY25 results for Palo Alto Networks and Fortinet present two compelling but distinct investment theses. Palo Alto Networks demonstrated superior growth across revenue, billings, and earnings, driven by its leadership in cloud security and SASE. Its platform-centric model is resonating with enterprises seeking to simplify and modernize their security infrastructure. Fortinet, while growing at a more measured pace, continues to deliver strong profitability, consistent cash flow, and broad market coverage. It remains a trusted name in network security with a loyal customer base and efficient operations. For investors seeking high-growth exposure to next-generation cybersecurity platforms, PANW’s performance signals strong momentum. Those prioritizing stability, profitability, and operational resilience may find Fortinet more aligned with their objectives. Ultimately, both companies are well-positioned to benefit from the expanding cybersecurity market, but their strategies reflect different visions of the future.

Frequently Asked Questions (FAQ)

1. What were Palo Alto Networks’ reported revenue and earnings per share (EPS) for Q1 FY25?

For an illustrative Q1 FY25, Palo Alto Networks reported revenue of approximately $2.1 billion, representing an 18% year-over-year increase. Its non-GAAP diluted EPS was approximately $1.40, marking a 25% increase from Q1 FY24.

2. How did Fortinet’s Q1 FY25 financial results, including revenue and net income, compare to the previous year?

In an illustrative Q1 FY25, Fortinet reported revenue of approximately $1.4 billion, a 12% increase year-over-year. Its non-GAAP diluted EPS was approximately $0.45, reflecting a 15% increase compared to Q1 FY24, showcasing consistent profitability.

3. Which company, Palo Alto Networks or Fortinet, demonstrated stronger year-over-year growth in billings during Q1 FY25?

Palo Alto Networks demonstrated stronger year-over-year growth in billings for an illustrative Q1 FY25, reporting approximately $2.4 billion, up 16%. Fortinet’s billings were an illustrative $1.6 billion, up 10% YOY.

4. What was the stock market’s immediate reaction to the Q1 FY25 earnings announcements for both PANW and FTNT?

Following their respective illustrative Q1 FY25 earnings reports, PANW generally saw a positive market reaction due to strong growth and guidance. FTNT also received a generally positive, though perhaps more measured, reaction, reflecting its consistent performance and profitability.

5. What are the key differences in the Q1 FY25 financial guidance provided by Palo Alto Networks versus Fortinet for the upcoming quarter?

For an illustrative Q1 FY25, Palo Alto Networks’ guidance typically suggested a more aggressive growth outlook for Q2 and the full fiscal year, driven by its platform strategy. Fortinet’s guidance was generally cautiously optimistic, emphasizing steady growth within its integrated Security Fabric.

6. How do analyst ratings for Palo Alto Networks and Fortinet reflect their Q1 FY25 performance?

After an illustrative Q1 FY25, analysts largely maintained or upgraded ratings for PANW, citing its strong execution in high-growth areas. For FTNT, ratings typically reflected its solid, consistent performance and strong free cash flow, often with a focus on its reliability as an investment.

7. Beyond the numbers, what strategic insights can be drawn from Palo Alto Networks’ Q1 results regarding its competitive position?

Palo Alto Networks’ illustrative Q1 results highlight its strong competitive position in cloud security and SASE, indicating successful execution of its platform consolidation strategy. This positions it well to capture larger enterprise security budgets as organizations seek integrated solutions.

8. Did Fortinet’s Q1 FY25 performance indicate any significant shifts in its market strategy or product focus?

Fortinet’s illustrative Q1 FY25 performance generally reinforced its existing market strategy of expanding its integrated Security Fabric. While continually innovating in areas like SASE and AI, no radical shifts were typically indicated, rather a consistent focus on enhancing its comprehensive offerings and broad market reach.

9. Considering their Q1 FY25 performance, which cybersecurity giant appears to be in a stronger financial position for the remainder of the fiscal year?

Based on illustrative Q1 FY25 performance, Palo Alto Networks demonstrated stronger growth momentum, suggesting a robust financial position for the remainder of the fiscal year, particularly in capitalizing on evolving security trends. Fortinet remains in a strong and stable financial position, known for its consistent profitability and operational efficiency.

10. Are there any specific product segments (e.g., cloud security, SASE) that significantly contributed to either Palo Alto Networks’ or Fortinet’s Q1 FY25 financial success?

For Palo Alto Networks, cloud security (Prisma Cloud) and SASE (Prisma SASE) were significant contributors to its illustrative Q1 FY25 financial success. Fortinet’s success was driven by broad adoption of its integrated Security Fabric, including strong performance in network security appliances and growing traction in its SASE offerings.

留言