Introduction: Navigating the Evolving SPAC Landscape

The financial world thrives on innovation, and few vehicles have stirred as much debate and transformation in recent years as Special Purpose Acquisition Companies, or SPACs. Once celebrated as a revolutionary shortcut to the public markets, SPACs surged in popularity during the 2020–2021 investment boom. But that momentum soon gave way to a period of reckoning—marked by regulatory scrutiny, underwhelming post-merger performances, and a broader market pullback. Today, the SPAC market isn’t roaring back with the same speculative energy. Instead, it’s quietly regaining relevance through a more disciplined, strategic evolution. For investors willing to look beyond the hype, this recalibration presents a new opportunity—one rooted in quality, transparency, and long-term value. This guide offers a comprehensive, data-driven framework to help you cut through the noise, assess SPACs with precision, and identify those with genuine potential in today’s more selective investment climate. We’ll explore the mechanics, analyze current trends, and equip you with the tools to navigate this complex asset class with confidence.

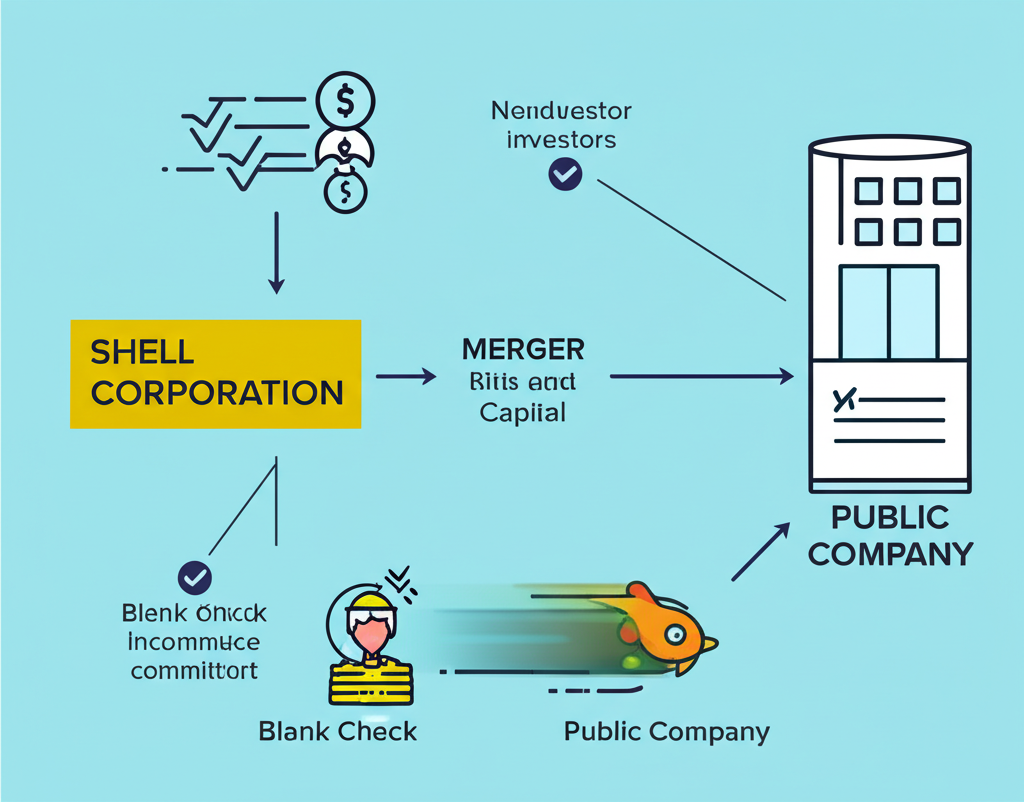

What Exactly is a SPAC and Why Do Investors Watch Them?

At its core, a Special Purpose Acquisition Company (SPAC) is a publicly traded shell entity formed with one mission: to merge with a private company and take it public without the traditional IPO process. Often labeled a “blank check company,” a SPAC raises capital from investors before identifying a target, meaning shareholders commit funds without knowing exactly which business they’re backing. The model gained traction for its speed and flexibility. For emerging companies, a SPAC merger can unlock access to public capital faster than a conventional IPO, often with more predictable valuation terms and fewer roadshow hurdles. For investors, especially retail participants, it offers a rare chance to get in early on high-growth ventures typically reserved for institutional backers. While not without risks, the SPAC structure reshaped how capital flows between private innovation and public markets—making it a critical area of focus for modern portfolios.

The SPAC Lifecycle: From IPO to De-SPAC

Understanding a SPAC’s lifecycle is key to assessing its risks and opportunities. The process unfolds in a structured sequence:

- Formation & IPO: A sponsor—typically a seasoned investor, former executive, or private equity firm—launches the SPAC through an initial public offering. The capital raised, usually $10 per share, is held in a trust account, earning interest while the search for a target begins.

- Target Search: The SPAC has a limited window, typically 18 to 24 months, to find and negotiate a merger with a private company. If no deal is completed within this timeframe, the SPAC liquidates and returns funds to investors.

- Merger Announcement: Once a target is selected, the SPAC discloses a definitive agreement. This announcement often includes a Private Investment in Public Equity (PIPE) round, where institutional investors commit additional capital to support the combined company post-merger.

- Shareholder Vote & Redemption: Existing SPAC shareholders vote on the proposed merger. Crucially, those who disagree with the deal can redeem their shares for their pro-rata share of the trust—usually $10 plus interest—regardless of the current market price.

- De-SPAC & Public Listing: If approved and sufficient capital remains after redemptions, the merger closes. The private company becomes publicly traded under the SPAC’s ticker, which is typically updated to reflect the new entity’s name and identity.

- Post-Merger Operation: The newly public company begins trading like any other stock. Its performance now depends on execution, market conditions, and investor confidence in its business model and leadership.

Current Market Pulse: Are SPACs Making a Comeback?

After a dramatic slowdown following the 2021 peak, the SPAC market is showing signs of quiet resilience. While the frenzy of hundreds of new SPAC IPOs each quarter has faded, activity hasn’t vanished—it’s transformed. According to a PwC report, the number of new SPAC formations remained muted in 2023, but the volume of de-SPAC transactions steadily increased. This shift suggests a market maturing from speculative creation to focused execution. Instead of chasing headlines, sponsors and investors are prioritizing deal quality, integration readiness, and sustainable growth. Regulatory clarity from the U.S. Securities and Exchange Commission (SEC), though initially a headwind, is now providing a more stable framework. Meanwhile, high interest rates and market volatility continue to influence investor behavior, favoring cautious capital allocation over aggressive bets. The result? A leaner, more deliberate SPAC ecosystem—one where fundamentals matter more than hype.

Factors Driving (or Hindering) SPAC Activity

Several macroeconomic and structural forces shape the rhythm of SPAC market activity:

- Interest Rates: Higher borrowing costs make PIPE financing more expensive and reduce the appeal of speculative investments, directly impacting SPAC deal economics.

- Regulatory Environment: The SEC has tightened rules around forward-looking statements and disclosures in SPAC deals, increasing compliance burdens. While this deters weaker sponsors, it also builds long-term credibility for the model.

- Capital Availability: When private funding is abundant, companies may delay going public. Conversely, funding crunches can make the SPAC route more attractive as a way to access public capital quickly.

- Market Volatility: In uncertain markets, investors often retreat to safer assets, reducing appetite for pre-merger SPACs. However, periods of stabilization can revive interest, especially in high-growth sectors.

- Industry Trends: SPACs increasingly cluster around innovation-driven sectors such as artificial intelligence, clean energy, biotech, and next-generation mobility. Sponsors with deep expertise in these areas are better positioned to source and integrate high-potential targets.

Our Curated List: Top SPACs to Watch Right Now

(Note: This list is illustrative, designed to demonstrate the type of information investors should look for. Real-time data and specific recommendations would require dynamic market input.)

| SPAC/De-SPAC Company | Sponsor Team | Target Industry/Focus | Current Status | Rationale for Inclusion |

|---|---|---|---|---|

| Atlas Crest Investment Corp. (ACIC) -> Archer Aviation (ACHR) | Ken Moelis (Moelis & Co.) | Urban Air Mobility (Electric VTOL) | De-SPACed (2021) | Strong sponsor background, pioneering industry, significant strategic partnerships (e.g., United Airlines). Focus on post-merger execution. |

| Gores Guggenheim (GGPI) -> Polestar (PSNY) | The Gores Group | Premium Electric Vehicles | De-SPACed (2022) | Experienced SPAC sponsor, established brand with strong parent company backing (Volvo Cars, Geely), growing EV market share. |

| TPG Pace Beneficial Finance (TPGY) -> EVBox Group | TPG Capital | Electric Vehicle Charging Infrastructure | Terminated (2021) / Re-evaluated for new target | While initial deal terminated, TPG’s deep sector expertise and strong track record make any new target announcement noteworthy, especially in sustainable tech. |

| Vinci Partners Investments (VINI) | Vinci Partners | Latin American Growth Companies | Active SPAC (pre-merger) | Focus on an underserved, high-growth region. Strong local expertise and network from the sponsor. |

| Ares Acquisition Corporation II (AACT) | Ares Management | Diversified (Tech, Healthcare, Industrials, Consumer) | Active SPAC (pre-merger) | Highly reputable institutional sponsor with significant capital and broad industry reach. High potential for a well-vetted target. |

How to Evaluate a SPAC: A Strategic Due Diligence Framework

In a market where deal quality varies widely, a structured evaluation process separates informed investors from speculative traders. Our framework emphasizes a holistic analysis that spans sponsor credibility, target viability, deal structure, and long-term execution potential. This approach moves beyond surface-level excitement and anchors decisions in measurable, verifiable data.

Key Metrics and Red Flags in SPAC Investing

To assess a SPAC effectively, investors must analyze both quantitative indicators and qualitative warning signs.

| Category | Key Metrics to Analyze | Potential Red Flags |

|---|---|---|

| Sponsor Quality | Track record of past SPACs (successful de-SPACs, post-merger performance), industry expertise, reputation, co-investment in PIPE. | Inexperienced or unknown sponsors, multiple failed SPACs, lack of skin in the game (minimal sponsor capital at risk), vague target criteria. |

| Target Company Fundamentals | Revenue growth, profitability, market share, competitive advantages, scalability, management team quality, clear path to profitability. | Exaggerated revenue projections, unproven business model, nascent market with high competition, weak balance sheet, high customer churn. |

| Deal Terms & Valuation | Implied valuation post-merger, PIPE investor participation and terms, potential dilution from warrants/sponsor shares, redemption rates, lock-up agreements. | Unfavorable valuation compared to peers, high redemption rates (indicating lack of investor confidence), significant shareholder dilution, short lock-up periods. |

| Post-Merger Outlook | Integration plans, synergy realization, projected cash flows, operational efficiency, management retention, investor relations strategy. | Lack of clear post-merger strategy, significant management changes post-deal, unrealistic post-merger growth targets, poor communication with investors. |

| Trust Account & Warrants | Amount in trust per share, warrant terms (strike price, expiry, redemption features), potential for warrant dilution. | Trust account value significantly below IPO price (if pre-merger), complex or unfavorable warrant terms, high warrant overhang. |

Investment Strategies for SPACs: Mitigating Risk & Maximizing Opportunity

SPAC investing isn’t one-size-fits-all. Different strategies align with varying risk appetites and investment horizons. Understanding these approaches allows investors to tailor their exposure and manage risk effectively.

**Pre-Merger Common Stock:**

Buying shares before a target is announced offers a relatively conservative entry point. These shares typically trade near the $10 trust value, providing a built-in floor. If the sponsor announces an unappealing target—or fails to find one—investors can redeem their shares and recover their principal. The trade-off is limited upside until a compelling deal is confirmed, and returns depend heavily on sponsor credibility and market timing.

**Warrants:**

SPAC warrants give investors the right to buy common stock at a fixed price, usually $11.50, after the merger. They trade separately from common shares and offer leveraged exposure. However, they’re highly speculative: warrants can expire worthless if the stock doesn’t rise above the strike price, and their value is sensitive to volatility and time decay. They’re best suited for investors with a high risk tolerance and a strong conviction in the post-merger trajectory.

**Post-Merger Stock (De-SPACs):**

Once the merger is complete, the investment shifts from speculation to fundamental analysis. The company is now a public entity with revenue, expenses, and operational risks. Success depends on execution, market adoption, and financial discipline. Investors should evaluate de-SPACs like any growth stock—focusing on margins, cash flow, competitive positioning, and management quality.

**Risk Management Best Practices:**

- Diversify: Avoid concentrating capital in a single SPAC. Spread investments across sponsors, sectors, and stages.

- Know the Trust Value: Always track the trust account balance per share. It defines your redemption floor.

- Scrutinize the Sponsor: Prioritize SPACs led by experienced teams with a history of successful exits and transparent communication.

- Align Time Horizon: Short-term traders may chase merger announcements, but long-term investors benefit more from thorough due diligence and patience.

SPACs vs. Traditional IPOs: A Current Market Comparison

The decision between a SPAC merger and a traditional IPO has significant implications for companies and investors alike.

| Feature | SPACs | Traditional IPOs |

|---|---|---|

| Speed to Market | Generally faster, as the regulatory process for the merger can be quicker than a full IPO. | Can be a lengthy process, often taking 6-12 months or more. |

| Valuation Certainty | More negotiation flexibility on valuation with the SPAC sponsor, potentially less market-sensitive at deal announcement. | Valuation is heavily influenced by roadshow feedback and market demand at the time of pricing. |

| Investor Access | Retail investors can often participate at the IPO stage or acquire shares pre-merger. | Primarily institutional investors receive allocations, retail access is often limited to secondary market trading. |

| Regulatory Scrutiny | Increased scrutiny from SEC, particularly regarding forward-looking statements and projections. | Rigorous and established regulatory framework for disclosure. |

| Dilution Risk | Potential for significant dilution from sponsor shares, warrants, and high redemption rates leading to PIPE dependency. | Dilution primarily from new share issuance, less complex than SPAC structures. |

| Underwriter Role | Investment banks advise on the SPAC IPO and PIPE, but don’t “underwrite” the operating company’s public debut in the same way. | Underwriters play a critical role in pricing, marketing, and stabilizing the stock post-IPO. |

In today’s environment, traditional IPOs have slowed due to market uncertainty, making SPACs a viable alternative for companies seeking liquidity. However, the mixed performance of de-SPACs—highlighted in a Bloomberg analysis—remains a cautionary tale. Investors now demand stronger fundamentals, transparent deal terms, and credible sponsors before committing capital.

The Future of SPACs: Trends and Predictions for 2025 and Beyond

The era of SPACs as speculative lottery tickets appears to be over. What’s emerging is a more sustainable, value-oriented model. Looking ahead, several trends are likely to shape the next chapter:

- Enhanced Due Diligence: Both sponsors and investors are conducting deeper investigations, leading to better-vetted targets and more resilient post-merger performance.

- Sector Specialization: SPACs are increasingly focused on niches where sponsors have domain expertise—such as AI, clean energy, biotech, and advanced manufacturing—improving deal quality and integration outcomes.

- Regulatory Clarity: As the SEC continues to refine disclosure requirements, the legal landscape is becoming more predictable, reducing compliance risks and fostering institutional participation.

- Sponsor Reputation Matters More: Proven track records, transparency, and governance are now critical differentiators. Investors are gravitating toward sponsors with a history of successful exits and strong alignment of interests.

- Regional Focus: SPACs targeting high-growth emerging markets—such as Latin America, Southeast Asia, and Africa—are gaining traction, offering exposure to underserved economies with strong growth potential.

The next generation of SPACs is likely to feature smaller deal sizes, more realistic valuations, and a stronger emphasis on operational readiness. Rather than chasing growth at all costs, the focus is shifting to sustainable business models, clear monetization paths, and disciplined capital allocation.

Conclusion: Staying Ahead in the Dynamic SPAC Market

The SPAC market has evolved from a speculative phenomenon into a more mature, strategic component of the public equity ecosystem. While the days of unchecked growth are behind us, the underlying value proposition—speed, accessibility, and sponsor-driven expertise—remains compelling. For investors, success no longer comes from following the crowd but from applying rigorous analysis, understanding deal structures, and focusing on long-term fundamentals. By prioritizing sponsor quality, target viability, and fair terms, you can navigate the complexities of SPAC investing and uncover opportunities that deliver real value. In this dynamic environment, staying informed, adaptable, and disciplined isn’t just an advantage—it’s a necessity.

What are the current top 10 SPACs to watch for potential investment?

Identifying the “top 10” SPACs requires real-time market data and specific investment criteria, which are dynamic. However, investors should focus on SPACs with highly reputable sponsors, a clear industry focus (e.g., green tech, AI, biotech), a substantial trust account, and low redemption rates. Look for those actively seeking targets or recently merged companies with strong post-merger execution plans.

How do I find a reliable SPAC stock list for 2024 or 2025?

Reliable SPAC lists can be found on financial data platforms like Bloomberg Terminal, FactSet, or dedicated SPAC tracking websites such as SPAC Research. Reputable financial news outlets (e.g., Wall Street Journal, Reuters) also provide updates. Always cross-reference information and consider the source’s credibility.

What criteria should I use to select the best SPACs to watch?

Key criteria include: Sponsor Quality (track record, expertise), Target Industry (growth potential, alignment with sponsor’s focus), Deal Terms (valuation, PIPE financing, potential dilution), Trust Account Size, and Redemption Rates (lower is better). For de-SPACs, focus on the operating company’s fundamentals and execution.

Why are some investors worried about SPACs, and what are the main risks involved?

Worries stem from past underperformance of de-SPACs, potential for significant shareholder dilution, lack of transparency compared to traditional IPOs, and conflicts of interest with sponsors. Main risks include valuation risk (overpaying for targets), redemption risk (SPAC running out of cash), dilution risk from warrants and sponsor shares, and execution risk post-merger.

What are the most successful de-SPAC mergers that have performed well post-transaction?

While many de-SPACs have struggled, some have shown resilience or strong growth, particularly those with solid underlying businesses and strong execution. Examples often cited for their performance post-merger (though performance fluctuates) include companies in sectors like electric vehicles (e.g., Lucid Motors initially), renewable energy, or specific tech niches where the underlying business fundamentals were robust and met expectations. Success is highly subjective and performance varies over time.

Is the SPAC market seeing a resurgence, or are SPACs no longer popular?

The SPAC market is not seeing a full “resurgence” to the speculative levels of 2020-2021, but it is undergoing a recalibration. While new SPAC IPOs are fewer, there’s an increased focus on existing SPACs completing mergers and a greater emphasis on quality and fundamental value over hype. The market is evolving towards a more measured and strategic approach.

How do SPACs differ from traditional IPOs as an investment vehicle?

SPACs offer a potentially faster path to market for companies and allow retail investors earlier access. They involve merging with a “blank check” company rather than directly listing shares. IPOs, on the other hand, are a direct offering of a company’s shares to the public, typically with extensive roadshows and underwriter involvement, often with more rigorous pre-market valuation and regulatory oversight.

What are the key financial metrics to analyze when evaluating a SPAC target company?

When evaluating a target, focus on traditional financial metrics such as revenue growth, gross margins, path to profitability (or existing profitability), cash flow from operations, debt levels, and market share. Compare these against industry peers and the company’s own projections.

Which sectors are attracting the most SPAC activity in the current market?

In the current market, SPAC activity tends to concentrate in high-growth, innovative sectors. These include renewable energy and sustainable technologies, artificial intelligence and advanced software, biotechnology and healthcare innovation, and certain segments of advanced manufacturing or mobility solutions. Sponsors often have specialized expertise in these areas.

Can retail investors profit from “SPACs to watch” or are they primarily for institutional investors?

Retail investors can absolutely profit from SPACs, especially if they conduct thorough due diligence and understand the risks. SPACs are arguably more accessible to retail investors than traditional IPOs, particularly in the pre-merger phase. However, the speculative nature and complexity mean that institutional investors often have greater resources for analysis. Informed retail investors can find opportunities, but prudence is key.

留言