Introduction: Why Integrate MT4 Data with Excel?

In the fast-moving world of Forex and CFD trading, MetaTrader 4 (MT4) remains a cornerstone platform, trusted for its powerful charting, technical analysis tools, and support for automated trading strategies. Yet, while MT4 excels at executing trades and displaying market movements, its built-in reporting and analytical features often fall short for traders who want deeper insights or customized performance tracking. This is where Microsoft Excel steps in as a vital extension. By integrating MT4 data with Excel, traders unlock a new level of control—transforming raw numbers into dynamic dashboards, conducting detailed performance reviews, and building personalized reports that go far beyond standard account statements. Whether you’re monitoring live prices, analyzing past trades, or stress-testing a new strategy, linking MT4 with Excel turns isolated data points into meaningful, actionable intelligence. This guide walks you through every practical method to make that connection seamless and effective.

Understanding the Core Methods for MT4 to Excel Connectivity

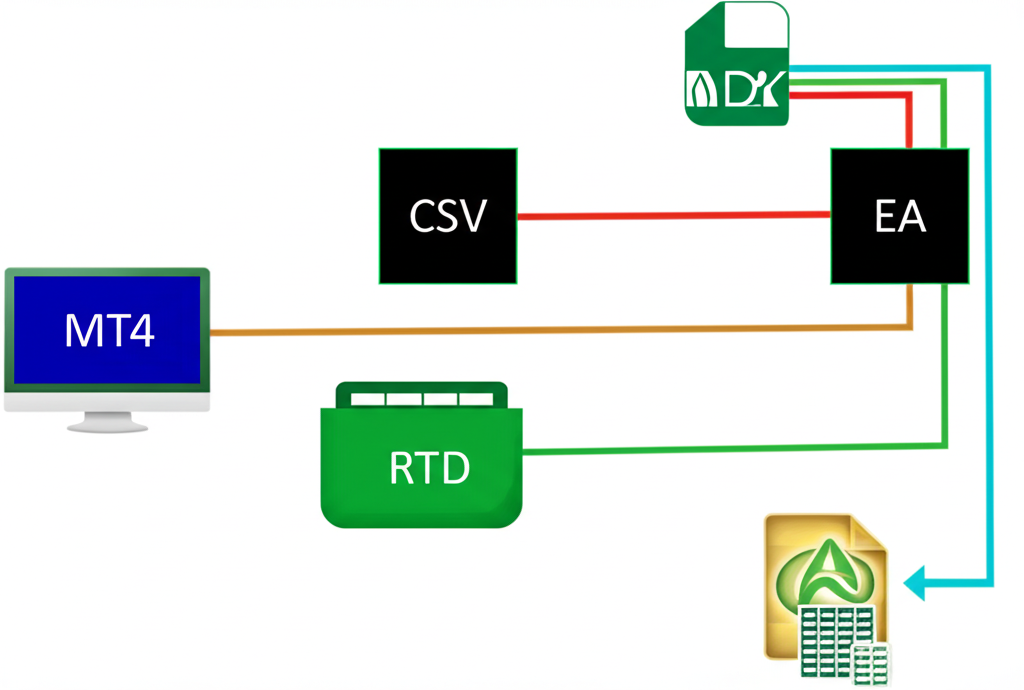

Connecting MetaTrader 4 to Excel isn’t a one-size-fits-all process. There are several distinct approaches, each suited to different use cases and technical skill levels. The most common methods include Dynamic Data Exchange (DDE) for real-time price feeds, exporting historical trade data via CSV or HTML reports, Real-Time Data (RTD) integration often powered by custom MQL code, and using Expert Advisors (EAs) or scripts to log data directly to files that Excel can read. DDE offers a quick way to bring live quotes into a spreadsheet with minimal setup. CSV and HTML exports are ideal for in-depth analysis of past trades. Meanwhile, RTD and custom EAs provide advanced users with granular control over what data is shared and how frequently it updates—perfect for building custom trading dashboards or logging complex metrics like indicator values or spread behavior. Choosing the right method depends on whether you need live updates, historical records, or a mix of both.

Method 1: Connecting MT4 to Excel via DDE (Dynamic Data Exchange)

Dynamic Data Exchange (DDE) is a Windows-based communication protocol that allows applications to exchange data in real time. MT4 includes a built-in DDE server, making it one of the simplest ways to stream live market prices directly into Excel. Though it’s an older technology, DDE remains popular due to its straightforward setup and immediate feedback—no programming required. It’s particularly useful for traders who want to monitor bid and ask prices across a few key currency pairs without leaving Excel.

* **How DDE works and its role in MT4 integration:**

DDE functions by turning MT4 into a data publisher and Excel into a subscriber. When you enter a DDE formula in Excel, the spreadsheet reaches out to MT4, requesting specific data such as the current bid price for EURUSD. MT4 responds in real time, and the value appears in your cell. This connection stays active as long as both programs are running and the data continues to update with each new tick. For those interested in the underlying technology, Microsoft provides detailed documentation on how DDE operates at the system level.

* **Step-by-step: Enabling the DDE server in MT4**

1. Launch your MetaTrader 4 platform.

2. Press `Ctrl+O` or go to **Tools > Options**.

3. Navigate to the **Server** tab.

4. Check the box labeled **”Enable DDE server”**.

5. Click **OK** to apply the changes.

*(Insert Screenshot: MT4 Options window with “Enable DDE server” checked)*

* **Step-by-step: Using DDE formulas in Excel**

1. Open a blank Excel workbook.

2. In any cell, type a DDE formula using the format: `=MT4|TOPIC!ITEM`.

3. For the **bid price** of EURUSD: `=MT4|BID!EURUSD`

4. For the **ask price**: `=MT4|ASK!EURUSD`

5. For the **day’s high**: `=MT4|HIGH!EURUSD`

6. For the **day’s low**: `=MT4|LOW!EURUSD`

7. For the **last traded price**: `=MT4|LAST!EURUSD`

8. For **volume** (if available): `=MT4|VOLUME!EURUSD`

Replace `EURUSD` with any symbol visible in your MT4 Market Watch.

*(Insert Screenshot: Excel spreadsheet with DDE formulas and live data updating)*

* **Pros and cons of using DDE**

* **Pros:**

– No coding needed—just copy and paste formulas.

– Provides instant, live price updates.

– Easy to set up for monitoring a small number of symbols.

* **Cons:**

– Limited to basic price data—no historical OHLCV or trade history.

– Can slow down your system with many active links.

– Occasionally unstable over long periods, requiring reconnection.

– Does not support complex data like custom indicators or order book details.

Method 2: Exporting Historical Trade Data from MT4 to Excel (CSV/HTML)

When it comes to evaluating your trading performance, nothing beats a thorough review of your past trades. MT4 allows you to export your complete account history into a detailed report, which can then be imported into Excel for further analysis. This method is essential for calculating key performance metrics, identifying patterns in your trading behavior, and generating custom reports that reflect your unique strategy.

* **How to export your MT4 account history**

1. Open MetaTrader 4 and locate the **”Account History”** tab at the bottom of the terminal window.

2. Right-click inside the tab to bring up the context menu.

3. Choose a time range—options include “All History,” “Last Week,” or “Custom Period.”

4. After selecting your desired range, right-click again and choose **”Save as Detailed Report”**.

5. Pick a save location and confirm. MT4 will generate an HTML file containing all your trades, balance changes, and transaction details.

*(Insert Screenshot: MT4 Account History tab with right-click menu showing “Save as Detailed Report”)*

* **How to import the data into Excel**

* **Option 1: Direct HTML import**

– Open Excel and go to **File > Open**.

– Change the file type filter to “All Files” and select your HTML report.

– Excel will attempt to render the table structure. You may need to clean up extra rows or headers.

* **Option 2: Copy-paste from browser**

– Open the HTML file in a web browser.

– Select the main data table, copy it (`Ctrl+C`), and paste it into Excel (`Ctrl+V`).

– Excel usually recognizes the columns and formats them correctly.

* **Option 3: Convert to CSV for cleaner import**

– Use a free online tool or script to convert the HTML table to CSV.

– Alternatively, use Excel’s **Data > Get Data > From Web** to import the HTML content directly.

– Once imported, use Power Query to clean and transform the data as needed.

* **Option 4: Import native CSV (if generated by EA)**

– Go to **Data > Get Data > From Text/CSV**.

– Select your CSV file and click **Import**.

– In the Power Query Editor, verify the delimiter (comma, semicolon), adjust data types, and click **Load**.

*(Insert Screenshot: Excel’s “Get Data” menu for importing from Text/CSV)*

* **Exporting chart data for deeper analysis**

While not built into MT4, you can use MQL4 scripts to export historical OHLCV (Open, High, Low, Close, Volume) data from any chart to a CSV file. These scripts loop through past bars and write each data point to a text file, enabling backtesting or statistical modeling in Excel.

* **Why this method shines**

This approach is perfect for post-trade analysis. You can calculate win rates, average profit per trade, drawdown periods, and monthly performance trends. Unlike MT4’s standard reports, Excel lets you filter, sort, and visualize your data exactly how you want—giving you a clearer picture of what’s working and what needs improvement.

Method 3: Real-Time Data Streaming using RTD (Real-Time Data) and Custom EAs

For traders who need more than just bid and ask prices, Real-Time Data (RTD) combined with custom MQL4/MQL5 Expert Advisors (EAs) offers a robust and scalable solution. While DDE is limited in scope, RTD—built on Microsoft’s COM architecture—provides a more stable and efficient way to stream complex data into Excel. Alternatively, many traders opt for a simpler file-based approach using EAs that write data directly to CSV files.

* **RTD as a modern alternative to DDE**

RTD is designed for high-frequency data delivery and is generally more reliable than DDE under heavy loads. It’s commonly used in financial environments where stability and performance matter. Excel supports RTD through the `RTD()` function, allowing it to subscribe to data servers—including custom ones built with MQL. For a deeper dive into how RTD works in Excel, check out Microsoft’s official RTD documentation.

* **Using custom MQL4/MQL5 EAs for data export**

There are two main approaches:

– **RTD Server (Advanced):** An MQL-based EA acts as an RTD server, exposing real-time data via a COM interface. Excel then uses a formula like `=RTD(“MyMT4Server”,,”EURUSD”,”Bid”)` to pull in values. This requires advanced knowledge of MQL and COM programming.

– **File Writing (Practical and Accessible):** A more common method is to use an EA that writes data to a CSV file on every price update. This file can then be monitored by Excel, which refreshes the data at regular intervals.

* **How a data-logging EA works (conceptual overview)**

1. **In MT4:**

– Attach an EA to any chart.

– In the `OnTick()` function, gather data such as Bid, Ask, Spread, Volume, and Time.

– Use `FileOpen()` and `FileWrite()` functions to append this data to a CSV file (e.g., `LiveFeed.csv`).

– Close the file after writing.

2. **In Excel:**

– Use **Data > Get Data > From Text/CSV** to import the file.

– In Power Query, set the connection to **”Refresh data when opening the file”** and enable **”Refresh every X minutes”**.

– This creates a near real-time data feed driven entirely by the EA.

*(Insert Diagram/Flowchart: MT4 EA -> Writes to CSV -> Excel Imports/Refreshes CSV)*

* **Advantages and requirements**

* **Advantages:**

– Can export any data accessible in MQL—indicators, account equity, custom logic.

– More stable and scalable than DDE.

– Fully customizable output format.

* **Requirements:**

– Requires MQL4/MQL5 programming skills to build the EA.

– Alternatively, many free and paid EAs are available online that offer ready-to-use CSV export functionality.

Choosing the Right MT4-Excel Integration Method for Your Needs

Not every trader needs the same tools. The best method depends on your goals, technical comfort, and the type of data you want to work with. Below is a comparison to help you decide.

| Feature / Method | DDE (Dynamic Data Exchange) | CSV/HTML Export (Account History) | RTD via Custom EA (File Write) |

| :———————— | :————————————————— | :————————————————– | :————————————————- |

| **Real-time Data** | Yes (Live quotes) | No | Yes (Highly customizable) |

| **Historical Data** | No | Yes (Account history, some chart data via scripts) | Yes (Can be programmed to log historical data) |

| **Ease of Setup** | Very Easy | Easy | Moderate to Difficult (requires MQL/third-party) |

| **Technical Skill Req.** | Low (Basic Excel formulas) | Low (Basic Excel import) | Moderate to High (MQL coding or advanced setup) |

| **Data Granularity/Custom** | Limited (Bid, Ask, High, Low, Last, Volume) | Fixed (Trade details, balance changes) | High (Any data accessible by MQL) |

| **Performance** | Can be resource-intensive, sometimes unstable | Offline process, no real-time performance impact | Generally robust, performance depends on EA design |

| **Typical Use Case** | Quick live quote monitoring for a few symbols | Post-trade analysis, performance reporting, audit | Custom real-time dashboards, complex data logging |

**Guidance by use case:**

– **Monitor live prices with minimal effort?** Use **DDE**.

– **Analyze past trades, win rates, or monthly profits?** Export to **CSV/HTML**.

– **Need real-time spread, indicator values, or multi-symbol data?** Build or use a **custom EA with CSV output**.

– **Want OHLCV data for backtesting?** Use an MQL script to export chart history to CSV.

Beyond Connectivity: Leveraging Excel for MT4 Data Analysis & Trade Tracking

Getting data into Excel is just the beginning. The real value comes from analyzing it. With Excel’s full suite of tools, you can turn a simple trade log into a powerful performance dashboard.

* **Essential Excel functions for traders**

– **`SUM`, `AVERAGE`, `MAX`, `MIN`:** Calculate total profit, average trade duration, or maximum drawdown.

– **`IF`:** Categorize trades—e.g., `=IF(Profit>0,”Win”,”Loss”)`.

– **`VLOOKUP` or `INDEX/MATCH`:** Pull in additional data, like strategy names or risk levels, from a separate lookup table.

* **Visualizing your performance**

– **Equity Curve:** Plot cumulative profit over time to see your account’s growth trajectory.

– **Drawdown Chart:** Show peak-to-trough declines to assess risk exposure.

– **Monthly Profit Bar Chart:** Compare performance across different periods.

*(Insert Screenshot: Example of an Equity Curve chart in Excel derived from MT4 data)*

* **Using PivotTables for deep insights**

1. Select your full trade history.

2. Go to **Insert > PivotTable**.

3. Drag “Symbol” to **Rows**, “Profit/Loss” to **Values** (set to SUM).

4. Add “Date” to **Columns** and group by month or year.

This lets you instantly see which pairs are most profitable or how your performance varies by season.

*(Insert Screenshot: Example of an Excel PivotTable summarizing trade data by symbol)*

* **Automating with VBA (for advanced users)**

While not covered in detail here, VBA macros can automate repetitive tasks—like cleaning imported HTML data, formatting reports, or generating charts with a single click. The potential for customization is nearly limitless.

* **Turning data into decisions**

By calculating KPIs such as profit factor, risk-reward ratio, or Sharpe ratio, you gain clarity on your strategy’s strengths and weaknesses. This data-driven approach helps you refine your rules, reduce emotional trading, and improve long-term results.

Common Issues & Troubleshooting Tips for MT4-Excel Integration

Even the best setups can run into hiccups. Here’s how to fix the most common problems.

* **DDE Server Not Active / DDE link does not update:**

1. **Check MT4 DDE Server:** Make sure “Enable DDE server” is enabled in **Tools > Options > Server**.

2. **Excel Security Settings:** If Excel blocks the connection, go to **File > Options > Trust Center > Trust Center Settings > External Content** and enable “Enable Dynamic Data Exchange Server Launch” and “Recommend.”

3. **Verify Formula Syntax:** Ensure your formula is correct—e.g., `=MT4|BID!EURUSD`. Confirm the symbol is in your Market Watch.

4. **Restart MT4:** Sometimes a simple restart fixes initialization issues.

5. **Excel Calculation Mode:** Ensure calculation is set to **Automatic** under **Formulas > Calculation options**.

*(Insert Screenshot: Excel Trust Center Settings for External Content)*

* **Excel formulas not updating (for RTD/CSV methods):**

1. **Check File Path:** Ensure the CSV file path in Excel is correct and the file isn’t moved or renamed.

2. **EA Status:** Confirm the EA is running and actively writing data. Check the MT4 log for errors.

3. **Refresh Settings:** In **Data > Queries & Connections**, right-click your query, select **Properties**, and enable “Refresh data when opening” and “Refresh every X minutes.”

*(Insert Screenshot: Excel Query Properties for Refresh Settings)*

* **”Security Warning” messages in Excel:**

1. Always click **Enable Content** when prompted if you trust the source.

2. Add your working folder to Excel’s **Trusted Locations** via **File > Options > Trust Center > Trusted Locations > Add new location…** to avoid repeated warnings.

* **Data format errors after importing CSV/HTML:**

1. **Delimiter Issues:** In Power Query, select the correct delimiter (comma, semicolon).

2. **Date/Time Mismatch:** Use Power Query to convert MT4’s date format (e.g., “2023.10.27”) to Excel’s date type.

3. **Numbers as Text:** Change data types in Power Query to ensure calculations work.

4. **Clean Imported Data:** Use `TRIM()`, `CLEAN()`, or Power Query’s remove duplicates and split columns features.

* **Optimizing performance with large datasets:**

1. **Minimize DDE Links:** Only use essential DDE formulas.

2. **Use Manual Calculation:** For large spreadsheets, set calculation to **Manual** and press F9 only when needed.

3. **Use Power Query:** It’s more efficient than in-sheet formulas for large data imports.

4. **Archive Old Data:** Move historical trades to separate files to keep your main workbook fast and responsive.

Conclusion: Empower Your Trading Decisions with MT4 and Excel

Linking MetaTrader 4 with Excel isn’t just a technical trick—it’s a strategic advantage. Whether you’re pulling live prices with DDE, analyzing past performance from exported reports, or building a custom dashboard with a data-logging EA, this integration puts you in control. Excel transforms raw trade logs into clear insights, helping you understand your strengths, spot weaknesses, and refine your approach. The methods covered here—ranging from beginner-friendly DDE to advanced MQL solutions—offer a path for every trader. Start small, experiment with one method, and gradually build a system that fits your style. With the right setup, your MT4 data becomes more than numbers—it becomes a roadmap to better trading.

Frequently Asked Questions (FAQs)

What are the primary methods for connecting MT4 to Excel?

The primary methods include Dynamic Data Exchange (DDE) for live quotes, exporting historical data via CSV or HTML reports, and using custom MQL4/MQL5 Expert Advisors (EAs) or scripts to stream real-time data or log information to files that Excel can then import.

How can I export my historical trade data from MT4 into an Excel spreadsheet?

You can export historical trade data by going to the “Account History” tab in MT4, right-clicking, selecting a period, and then choosing “Save as Detailed Report.” This generates an HTML file that can be opened in a browser, copied, and pasted into Excel, or imported via Excel’s “Get Data” functions after conversion to CSV.

Is it possible to stream live MT4 market data directly into Excel, and how?

Yes, it’s possible. The simplest method is using MT4’s built-in DDE server by enabling it in MT4 options and then using DDE formulas like =MT4|BID!EURUSD in Excel. For more robust and customizable streaming, you can use a custom MQL4/MQL5 Expert Advisor to write live data to a CSV file that Excel can continuously monitor and refresh.

What is the correct MT4 DDE Excel formula, and what common issues should I look out for?

The correct DDE Excel formula generally follows the format =MT4|TOPIC!ITEM. For example, =MT4|BID!EURUSD retrieves the Bid price for EURUSD. Common issues include the MT4 DDE server not being active, incorrect symbol names, or Excel security warnings preventing updates.

Why is my MT4 DDE link not updating in Excel, and what are the troubleshooting steps?

If your DDE link isn’t updating, check the following:

- Ensure “Enable DDE server” is checked in MT4’s Tools > Options > Server.

- Verify Excel’s calculation options are set to “Automatic.”

- Confirm Excel’s Trust Center settings allow Dynamic Data Exchange.

- Check for correct formula syntax and that the symbol is active in MT4’s Market Watch.

- Try restarting both MT4 and Excel.

Can I use custom MQL4/MQL5 Expert Advisors to automate data export to Excel?

Yes, custom MQL4/MQL5 Expert Advisors (EAs) can be programmed to automate data export. EAs can periodically write various data points (e.g., live prices, indicator values, account equity) to a CSV or text file, which Excel can then be configured to automatically import and refresh at set intervals.

What are the key benefits of analyzing MT4 trading data within Excel?

Analyzing MT4 data in Excel allows for custom reporting, advanced performance tracking (e.g., equity curves, drawdown analysis), detailed backtesting, personalized dashboards, and the ability to combine trading data with other financial information for a holistic view of your portfolio.

How can I track my MT4 trading performance effectively using Excel’s features?

You can track performance by importing your historical trade data and then using Excel functions (SUM, AVERAGE), creating charts (equity curves, drawdown charts), and leveraging PivotTables to summarize performance by symbol, strategy, or time period. This helps identify strengths, weaknesses, and areas for improvement.

Are there any free tools or indicators available to facilitate MT4-Excel integration?

While MT4 has built-in DDE and report export, many free custom MQL4/MQL5 scripts and indicators are available on forums and communities (like MQL5.com) that are designed to export various data types to CSV files, which can then be imported into Excel. Searching for “MT4 CSV exporter” or “MT4 data logger” can yield many options.

What are the main differences between using DDE and RTD for MT4 data in Excel?

DDE is simpler to set up for basic live quotes but is a legacy technology, can be resource-intensive, and offers limited data types. RTD (Real-Time Data), often used with custom EAs, is generally more robust, efficient, and allows for highly customizable data streams from MT4 to Excel, but typically requires more technical setup or a specialized third-party solution.

留言