Introduction to Options Greeks: The Fundamental Drivers of Option Value

Options trading offers powerful leverage and a wide range of strategic possibilities, but it also introduces layers of complexity that go far beyond simply predicting which way a stock will move. Unlike equities, where price movement is the primary driver of value, options are influenced by multiple dynamic variables—each capable of reshaping the position’s risk and reward profile in real time. This is where the Options Greeks come into play. These metrics act as a diagnostic toolkit, helping traders measure how sensitive an option’s price is to changes in the underlying asset, time, volatility, and interest rates. Far from being abstract theory, the Greeks are practical instruments that bring transparency to an otherwise opaque pricing structure.

Understanding the Greeks allows traders to dissect an option’s premium into its core components, revealing not just *what* the price might do, but *why*. For instance, a sudden drop in an option’s value might not be due to adverse price movement—it could be the result of time decay accelerating or implied volatility collapsing. Without this insight, trading options becomes a game of guesswork. The five key Greeks—Delta, Gamma, Theta, Vega, and Rho—each capture a different dimension of risk. Together, they form a comprehensive framework for evaluating, managing, and optimizing options positions with precision.

This article explores each of these critical measures in detail, explaining their mechanics, interplay, and real-world applications. By mastering these drivers, traders gain the ability to anticipate how their positions will respond to shifting market conditions, hedge effectively, and implement strategies with greater confidence and control.

Delta: The Directional Gauge

What is Delta and How Does It Work?

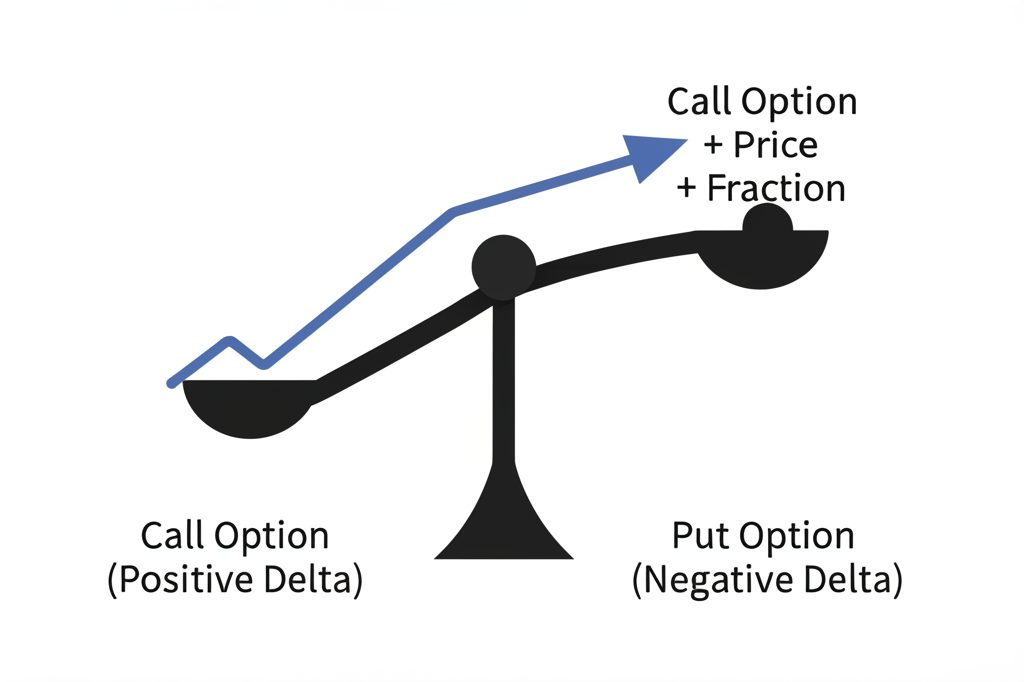

Delta stands as the most intuitive and widely referenced of the Greeks. At its core, Delta quantifies how much an option’s price is expected to change in response to a $1 move in the underlying asset. For call options, Delta ranges from 0 to 1, while for puts, it ranges from -1 to 0. A call option with a Delta of 0.65, for example, should rise by approximately $0.65 if the underlying stock climbs by $1. Conversely, a put option with a Delta of -0.40 would lose $0.40 in value if the stock moves up by $1—or gain $0.40 if the stock falls by the same amount.

This metric serves as a real-time indicator of directional exposure. Traders often use Delta to assess the immediacy of an option’s sensitivity to price action. High Delta options behave more like the underlying stock, while low Delta options react sluggishly to price changes, reflecting their speculative nature.

Interpreting Delta Values: Probability and Position Sizing

Beyond its role in price sensitivity, Delta provides a useful approximation of the likelihood that an option will expire in-the-money (ITM). While not a mathematically exact probability, a call option with a Delta of 0.70 is generally seen as having about a 70% chance of finishing ITM. This interpretation helps traders evaluate whether an option’s premium is justified based on its odds of success.

The value of Delta varies significantly based on an option’s moneyness:

– **Deep In-the-Money (ITM)**: Call options approach Delta values near 1.00, meaning they move almost point-for-point with the underlying. Puts approach -1.00.

– **At-the-Money (ATM)**: These options typically have Deltas around 0.50 for calls and -0.50 for puts, reflecting their balanced uncertainty.

– **Out-of-the-Money (OTM)**: These options have Deltas close to zero, indicating minimal sensitivity and lower odds of expiring profitably.

Delta is also a powerful tool for position sizing. A trader seeking exposure equivalent to 100 shares of stock can replicate that risk by purchasing two call options with a Delta of 0.50 each, resulting in a combined Delta of 100. This flexibility allows traders to fine-tune their market exposure without directly owning the underlying asset.

Key Factors Influencing Delta

Delta is not static—it evolves in response to several market forces:

– **Time to Expiration**: As expiration nears, ITM options see their Delta drift toward 1 or -1, while OTM options’ Delta approaches zero. ATM options maintain a Delta near 0.50 until the final days, when changes can become more abrupt.

– **Strike Price Relative to Spot**: The relationship between the current stock price and the strike price determines moneyness, which directly shapes Delta.

– **Implied Volatility**: Higher volatility tends to inflate the Delta of OTM calls (pulling them closer to 0.50) and reduce the negativity of OTM puts, reflecting increased uncertainty about future price movement.

Practical Use of Delta in Trading Strategies

Delta plays a central role in shaping trading decisions:

– **Directional Plays**: Bullish traders often favor high-Delta calls, while bearish views may lead to low-Delta puts or short calls.

– **Delta Hedging**: Market makers and advanced traders use Delta to neutralize directional risk. For example, a portfolio with a net positive Delta can be hedged by selling shares or buying puts to bring the exposure closer to zero.

– **Spread Trading**: In multi-leg strategies like vertical spreads or iron condors, understanding the net Delta of the entire position is essential for gauging overall directional bias.

Gamma: The Accelerator of Delta

What is Gamma and Why is it Crucial?

While Delta measures the speed of an option’s price change, Gamma captures the acceleration of that change—specifically, how much Delta itself shifts with a $1 move in the underlying. Expressed as a positive number, Gamma reveals how rapidly an option’s directional sensitivity evolves. For instance, an option with a Delta of 0.50 and a Gamma of 0.10 will see its Delta rise to 0.60 after a $1 increase in the underlying.

This dynamic is particularly important for traders holding long options. As the underlying moves in their favor, Gamma causes Delta to increase, amplifying gains. Conversely, when the market moves against them, Delta decreases, naturally reducing exposure. This convex payoff structure is a key benefit of being long options.

Gamma’s Impact: When it’s Highest and Lowest

Gamma is not evenly distributed across all options. Its influence peaks under specific conditions:

– **At-the-Money (ATM)**: These options exhibit the highest Gamma because small price moves can dramatically alter the probability of expiring ITM, causing Delta to swing rapidly.

– **Deep ITM or Deep OTM**: These options have minimal Gamma. Their Deltas are already near the extremes (1 or 0), so further changes are limited.

– **Time to Expiration**: Gamma intensifies as expiration approaches, especially for ATM options. This phenomenon, known as “Gamma risk,” can lead to sharp Delta shifts in the final days, requiring frequent hedging adjustments.

The Dynamic Relationship Between Delta and Gamma

The interaction between Delta and Gamma defines the curvature of an option’s profit and loss profile:

– **Long Options (Calls or Puts)**: These positions have positive Gamma. As the underlying moves favorably, Delta increases, enhancing sensitivity to further gains. When the market moves against the position, Delta decreases, limiting further losses. This results in a convex P&L curve—profits grow faster, losses slow down.

– **Short Options**: These carry negative Gamma. If the underlying moves adversely, Delta increases in magnitude, making the position more sensitive to further losses. This leads to concave P&L behavior—losses accelerate, gains decelerate.

For active traders, especially those managing short options or market-making positions, Gamma is a constant concern. High Gamma means Delta can change rapidly, necessitating frequent rebalancing to maintain desired exposure levels.

Theta: The Cost of Time

What is Theta and How Does Time Decay Work?

Theta measures the daily erosion of an option’s extrinsic value—the portion of the premium derived from time and volatility. Often described as “time decay,” Theta is typically negative for long options, indicating how much value is lost each day as expiration draws closer.

An option’s total value consists of intrinsic value (the difference between the strike and underlying price, if favorable) and extrinsic value (time value plus volatility premium). As time passes, the chance of a favorable move diminishes, reducing the extrinsic component. By expiration, only intrinsic value remains.

Theta’s Impact: Buyers vs. Sellers

Theta creates a fundamental asymmetry in options trading:

– **Buyers (Long Options)**: Face a constant headwind. Even if the underlying stays flat, the option loses value every day. This makes timing crucial—buyers need movement or volatility expansion to offset decay.

– **Sellers (Short Options)**: Benefit from Theta. By collecting premium, they profit as time passes and the option loses value. This makes Theta a key source of income in strategies like covered calls or credit spreads.

Understanding Factors That Influence Theta Decay

Theta decay is not linear—it accelerates as expiration nears:

– **Time to Expiration**: Options with more time have slower daily decay but a larger total extrinsic value to lose. The steepest decay occurs in the last 30–45 days, resembling a “hockey stick” curve.

– **Moneyness**: ATM options have the highest Theta because they possess the most extrinsic value. Deep ITM and deep OTM options, with little or no time value, exhibit minimal Theta.

– **Implied Volatility**: Higher volatility inflates extrinsic value, leading to higher (more negative) Theta. When IV is elevated, there’s more time premium to erode.

Traders must account for Theta when selecting strategies. Those expecting sideways or slightly bullish movement often favor Theta-positive strategies, while buyers must ensure their directional or volatility thesis outweighs the daily cost of holding.

Vega: The Volatility Gauge

What is Vega and Its Link to Implied Volatility?

Vega measures how much an option’s price changes in response to a 1% shift in implied volatility (IV). Despite its name, Vega is not a Greek letter but has become standard terminology. It is always expressed as a positive number: a Vega of 0.15 means a 1% rise in IV increases the option’s value by $0.15.

Implied volatility reflects the market’s forecast of future price fluctuations. Unlike historical volatility, which looks backward, IV is forward-looking and embedded in option prices. Higher IV suggests greater expected movement, driving up premiums. Lower IV indicates calm expectations, reducing option value.

The Importance of Implied Volatility in Option Pricing

IV is a critical input in models like Black-Scholes. It directly impacts extrinsic value—higher IV means higher premiums, even if the underlying hasn’t moved. Vega is highest for ATM options and those with longer durations, as they have more time value to be influenced by volatility shifts. Near-term or deep ITM/OTM options have lower Vega due to limited extrinsic value.

Using Vega in Volatility-Based Strategies

Vega enables traders to profit from volatility shifts independent of price direction:

– **Long Vega (Buying Volatility)**: Strategies like straddles or strangles benefit when IV rises. For example, buying options before an earnings announcement allows traders to capitalize on expected volatility expansion.

– **Short Vega (Selling Volatility)**: Iron condors or short straddles profit when IV contracts or remains stable. Sellers collect premium in high-IV environments, betting that volatility will decline.

– **Vega Hedging**: Traders can balance their portfolio’s volatility exposure. A long Vega position might be offset by selling options to reduce sensitivity to a drop in IV.

Vega provides a direct lens into market sentiment—rising Vega signals uncertainty or anticipation, while falling Vega reflects complacency.

Rho: The Interest Rate Sensitivity

What is Rho and Its Role in Option Valuation?

Rho measures an option’s sensitivity to a 1% change in risk-free interest rates. While often overlooked in short-term trading, Rho can influence pricing, particularly for long-dated options.

The effect differs between calls and puts:

– **Calls**: Rho is usually positive. Higher interest rates reduce the present value of the strike price, making calls more attractive.

– **Puts**: Rho is typically negative. Higher rates increase the opportunity cost of holding the underlying or reduce the present value of future proceeds, making puts less valuable.

When Rho Becomes Significant: Long-Term Options

For short-term options, Rho’s impact is minimal—often just a few cents for a 1% rate change. However, it becomes meaningful in two cases:

– **Long-Term Options (LEAPS)**: With maturities of a year or more, the compounding effect of interest rates magnifies Rho’s influence.

– **Periods of Rate Volatility**: During aggressive Fed tightening or easing cycles, Rho can affect a broader range of options, especially in rate-sensitive sectors.

While most retail traders don’t actively manage Rho, it’s essential for institutional portfolios and long-term strategies where macroeconomic factors play a larger role.

How Options Greeks Interact: Dynamic Interplay in Real Markets

Understanding each Greek in isolation is valuable, but real trading requires seeing how they interact. Markets are never static—price, time, and volatility shift simultaneously, causing all Greeks to evolve together.

Consider a trader buying an ATM call:

– **Initial State**: High Delta (~0.50), high Gamma, significant negative Theta, and high Vega.

– **Stock Rises**: Delta increases due to Gamma, amplifying gains. But if IV drops (common in trending markets), the positive Vega position suffers, partially offsetting gains.

– **Stock Stalls**: Theta becomes the dominant force, eroding value daily. With no movement, Delta stabilizes, but time decay continues to chip away at the premium.

No single Greek tells the full story. A position can be Delta-neutral but have high Gamma and negative Theta, meaning it profits from large moves but loses value over time. Or it might be Theta-positive but Vega-negative, benefiting from time decay while being vulnerable to volatility spikes.

Advanced traders use this interplay to design balanced strategies. For example, combining a long option (positive Gamma, negative Theta) with a short OTM option (negative Gamma, positive Theta) can hedge time decay while maintaining directional exposure. The CBOE offers comprehensive educational resources that delve deeper into these complex relationships, which can be invaluable for advanced traders CBOE Options Institute.

Common Mistakes and Misconceptions About Options Greeks

Despite their power, the Greeks are often misunderstood:

1. **Overreliance on One Greek**: Focusing only on Delta or Theta can blind traders to risks from volatility or time decay.

2. **Treating Greeks as Static**: Greeks change constantly. Assuming Delta stays fixed ignores Gamma’s influence.

3. **Confusing Delta with Probability**: While Delta approximates ITM odds, it’s not a guarantee—model assumptions affect accuracy.

4. **Ignoring Gamma Risk in Short Positions**: Short options have negative Gamma, meaning losses accelerate in volatile markets.

5. **Underestimating Vega**: A drop in IV can erase gains even if the underlying moves favorably.

6. **Neglecting Market Context**: Greeks are model-based. News, events, and sentiment can override theoretical values.

7. **Miscalculating Net Exposure in Spreads**: Multi-leg strategies require net Greek analysis—individual leg Greeks don’t reflect the full picture.

Avoiding these errors is essential for disciplined trading. Resources like Investopedia provide detailed breakdowns of these concepts, helping traders deepen their understanding and avoid common errors Investopedia – Options Greeks.

Applying Options Greeks: Practical Trading Insights and Risk Management

Proactive Risk Management and Position Adjustment

The Greeks are central to modern risk management:

– **Defining Risk**: By analyzing Delta, Gamma, Theta, and Vega, traders can model P&L under different scenarios.

– **Delta Hedging**: Adjusting positions to maintain neutral or desired directional exposure reduces vulnerability to market swings.

– **Gamma Hedging**: Active traders may rebalance Delta frequently to counteract Gamma’s acceleration.

– **Theta Management**: Option buyers may offset decay by selling OTM options to generate positive Theta.

– **Vega Management**: Adjusting volatility exposure based on market outlook helps protect against IV collapse.

Informing Strategy Selection and Optimization

Greeks guide strategic decisions:

– **Directional Outlook**: High Delta strategies suit strong convictions.

– **Volatility Outlook**: Long Vega for expected spikes, short Vega for expected calm.

– **Time Horizon**: Short-term trades are more sensitive to Gamma and Theta; long-term trades emphasize Vega and Rho.

– **Income Goals**: Theta-positive strategies like covered calls or credit spreads generate income from time decay.

Monitoring and Reacting to Market Conditions

Real-time Greek tracking enables dynamic decision-making:

– **Volatility Shifts**: Rising Vega across options may signal growing uncertainty, prompting traders to adjust exposure.

– **Gamma Squeezes**: Rapid Delta changes in ATM options can precede sharp price moves.

– **Risk Alerts**: Setting thresholds (e.g., “alert if portfolio Delta exceeds 50”) helps maintain discipline.

By integrating Greek analysis into every stage of trading—from planning to execution to adjustment—traders gain a structured, data-driven approach to managing risk and optimizing returns.

Conclusion: Mastering Greeks for Confident Options Trading

Mastering the Options Greeks is not an academic exercise—it’s a practical necessity for serious options traders. Delta, Gamma, Theta, Vega, and Rho provide a granular understanding of what drives option prices, how risks evolve, and how positions behave under different conditions. They transform trading from speculation into a disciplined, analytical process.

With this knowledge, traders can move beyond simple directional bets to strategies that account for time, volatility, and interest rates. They can hedge effectively, size positions accurately, and adapt to changing market dynamics. While the learning curve can be steep, consistent application and real-time observation will turn these metrics into indispensable tools. Embrace the Greeks, and you gain not just insight—but control.

Frequently Asked Questions About Options Greeks

What are the primary functions of Delta, Gamma, Theta, Vega, and Rho in options trading, and how do they differ?

The five main Options Greeks measure different sensitivities:

- Delta: Measures an option’s price sensitivity to a $1 change in the underlying asset’s price. It also approximates the probability of an option expiring in-the-money.

- Gamma: Measures the rate at which Delta changes for a $1 change in the underlying. It indicates how dynamic an option’s directional exposure is.

- Theta: Measures the rate at which an option’s extrinsic value (time value) erodes as time passes. It’s often called “time decay.”

- Vega: Measures an option’s price sensitivity to a 1% change in implied volatility. It reflects the impact of market expectations for future price swings.

- Rho: Measures an option’s price sensitivity to a 1% change in interest rates. Its impact is generally less significant for short-term options.

They differ by focusing on distinct market factors: underlying price movement (Delta, Gamma), time (Theta), volatility (Vega), and interest rates (Rho).

How does understanding Options Greeks improve a trader’s risk management and strategic decision-making process?

Understanding Options Greeks significantly enhances risk management and decision-making by:

- **Quantifying Risk:** Allowing traders to measure and anticipate the impact of various market changes on their positions.

- **Guiding Strategy Selection:** Helping choose strategies aligned with views on direction, volatility, and time.

- **Enabling Position Adjustment:** Facilitating proactive hedging (e.g., Delta hedging) to maintain desired risk exposures.

- **Identifying Exposure:** Revealing hidden risks or opportunities related to time decay or volatility shifts.

- **Improving Profit Potential:** By optimizing entries, exits, and adjustments based on Greek insights.

Can Options Greeks be used to predict the future price movements of the underlying asset, or are they purely reactive measures?

Options Greeks are primarily reactive measures, not predictive tools for the underlying asset’s price movements. They quantify how an option’s price will react to a change in the underlying’s price, volatility, time, or interest rates. For example, Delta tells you the expected change in option price given an underlying move, but it doesn’t predict that underlying move itself. While implied volatility (which Vega measures sensitivity to) can reflect market expectations of future price swings, it doesn’t predict the direction of those swings. Traders combine Greek analysis with fundamental and technical analysis to form predictive views on the underlying.

What’s the most effective approach for a beginner to start learning and applying Options Greeks in their trading?

For beginners, an effective approach includes:

- Start with the Basics: Focus on Delta and Theta first, as they are often the most intuitive.

- Learn One by One: Understand each Greek individually before trying to grasp their interactions.

- Paper Trading: Practice applying Greeks in a simulated environment to see their real-time impact without risking capital.

- Analyze Simple Positions: Begin by analyzing single long calls or puts, then move to simple spreads.

- Use an Options Calculator/Platform: Leverage trading platforms or online calculators that display Greeks for options chains.

- Read and Educate: Continuously learn from reputable sources and educational materials.

- Observe Real-Time: Watch how Greeks change as the market moves and time passes.

Why do option prices experience time decay, and which Greek specifically quantifies this phenomenon?

Option prices experience time decay because options are wasting assets with a finite lifespan. As time passes, the probability of the underlying asset moving favorably enough for the option to expire in-the-money decreases, and thus the value of the “time” component of the option’s premium diminishes. At expiration, all time value (extrinsic value) disappears.

The Greek that specifically quantifies this phenomenon is Theta ($\Theta$). Theta measures the rate at which an option’s theoretical value declines for each day that passes, assuming all other factors remain constant.

How do changes in implied volatility directly impact the value of an option contract, and what role does Vega play?

Changes in implied volatility (IV) directly impact an option’s extrinsic value. Higher IV indicates that the market expects larger price swings in the underlying asset, making both call and put options more valuable because there’s a greater perceived chance of the option expiring in-the-money. Conversely, lower IV suggests calmer market expectations, leading to lower option premiums.

Vega ($\nu$) is the Greek that quantifies this impact. It measures how much an option’s price is expected to change for a one-point (or 1%) change in implied volatility. Options with higher Vega are more sensitive to these changes, meaning their prices will move more significantly up or down with fluctuations in IV.

What resources or tools are available for accurately calculating or tracking Options Greeks in real-time?

Numerous resources and tools are available for tracking Options Greeks in real-time:

- Brokerage Platforms: Most reputable online brokerage platforms (e.g., Thinkorswim by Charles Schwab, Interactive Brokers, E*TRADE) offer sophisticated options chains that display Greeks in real-time.

- Financial Data Providers: Services like Bloomberg Terminal, Refinitiv Eikon, or FactSet provide comprehensive options analytics, including Greeks.

- Specialized Options Analytics Software: There are dedicated software solutions for options traders that offer advanced Greek analysis and portfolio management.

- Online Options Calculators: Many financial websites (e.g., Optionistics, CBOE, some financial news sites) offer free options calculators where you can input parameters to see theoretical Greek values.

These tools are essential as manually calculating Greeks for complex positions is impractical in a fast-moving market.

How do various market conditions, such as periods of high volatility or significant interest rate shifts, affect the behavior and influence of different Options Greeks?

Market conditions profoundly affect Greek behavior:

- High Volatility (Implied): During periods of high IV, Vega’s influence becomes paramount. Long option positions (positive Vega) benefit, while short option positions (negative Vega) suffer. Gamma tends to be higher for ATM options, and Theta is also higher (more decay) due to the increased extrinsic value.

- Low Volatility (Implied): Vega’s impact diminishes. Long option positions lose value, and short option positions benefit. Gamma and Theta are generally lower.

- Significant Interest Rate Shifts: When interest rates change significantly, Rho’s influence increases, especially for long-dated options (LEAPS). Rising rates generally make calls more expensive (positive Rho) and puts cheaper (negative Rho).

- Approaching Expiration: Theta decay accelerates sharply, especially for ATM options. Gamma also peaks for ATM options, making Delta highly volatile. Vega’s impact diminishes as there’s less time for volatility to affect the option’s value.

Understanding these shifts is crucial for adapting strategies to the prevailing market environment.

留言