Introduction: What Are Market Data Fees and Why Do They Matter?

In today’s financial landscape, access to timely and accurate information is not just an advantage—it’s a necessity. Market data fees represent the cost of tapping into this essential flow of information: real-time prices, historical trends, order book depth, volume activity, and more. These charges are levied by exchanges, brokers, and data vendors to cover the infrastructure required to collect, process, and deliver vast amounts of trading data across global markets. While they may appear on a brokerage statement as just another line item, their impact on trading performance can be profound. Whether you’re a casual investor reviewing weekly charts or a high-frequency trader executing hundreds of orders per second, understanding market data fees is critical. They influence not only your bottom line but also the quality and timeliness of the information you rely on. This guide unpacks the structure, cost drivers, and strategic considerations behind **market data fees**, offering practical insights for minimizing expenses while maintaining access to the data that fuels informed decisions.

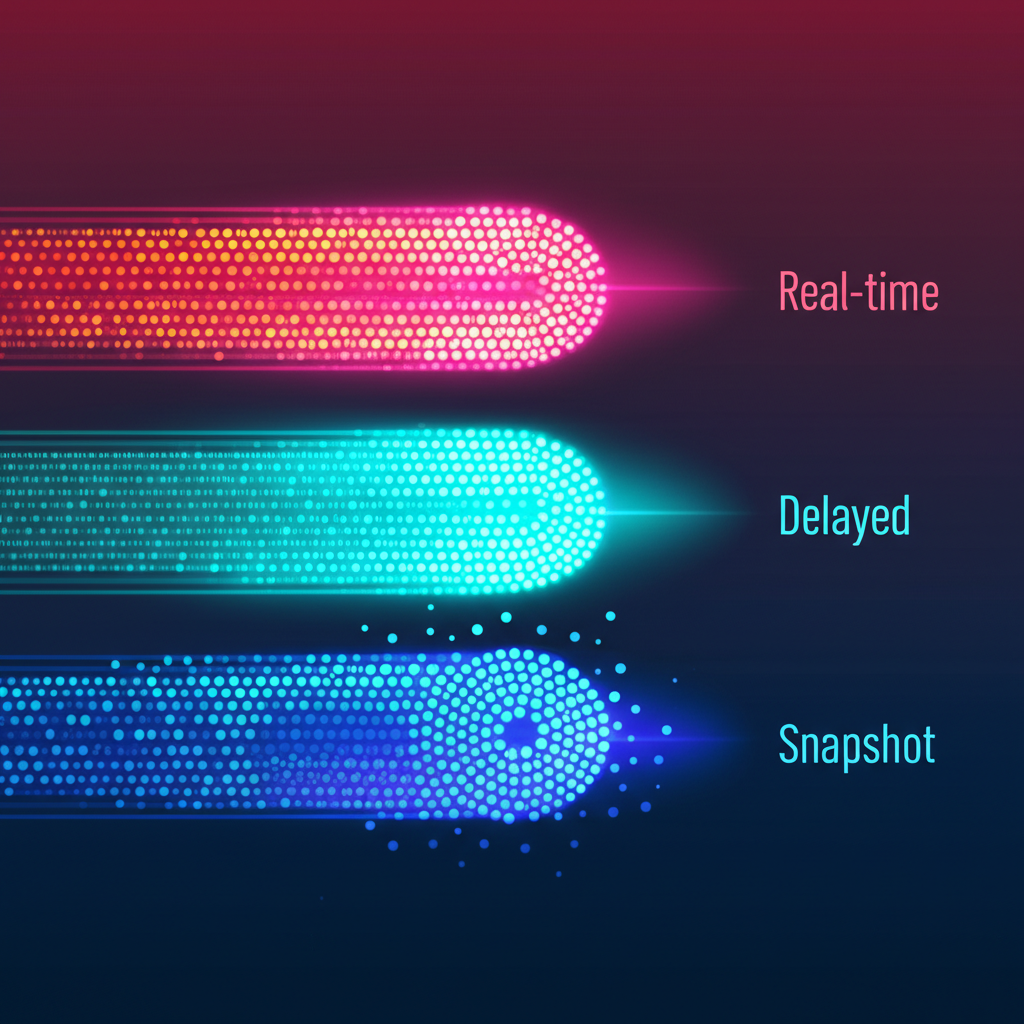

The Anatomy of Market Data: Real-time, Delayed, and Snapshot Data

Not all market data is created equal. The type of data you choose to access directly affects both its utility and cost. Traders often assume that faster data is always better, but the reality is more nuanced—your strategy should dictate your data choice, not the other way around.

Real-time Market Data: The Gold Standard and Its Costs

Real-time data delivers price updates, bid-ask spreads, and trade volumes the moment they occur on an exchange. For strategies that depend on speed—such as scalping, arbitrage, or momentum trading—this immediacy is non-negotiable. Even a 100-millisecond delay can mean the difference between a profitable entry and a missed opportunity. Because real-time feeds require robust, low-latency infrastructure and constant bandwidth, they come with the highest price tags in the **market data** ecosystem. Exchanges invest heavily in data centers, fiber-optic networks, and redundancy systems to ensure reliability, and those costs are passed on to users. This data is often referred to as the “gold standard” not only for its timeliness but also because it provides the most complete picture of current market sentiment and liquidity.

Delayed Market Data: A Cost-Effective Alternative

Delayed market data typically lags behind real-time updates by 10 to 20 minutes. While this makes it unsuitable for active trading, it remains a valuable resource for long-term investors and those conducting fundamental analysis. Many retail brokers offer delayed data at no additional cost, especially for major U.S. equities. This accessibility makes it an ideal starting point for beginners or anyone focused on macroeconomic trends rather than microsecond fluctuations. If your investment thesis hinges on earnings reports, company fundamentals, or sector rotation over weeks or months, paying for real-time data would be an unnecessary expense. Delayed data strikes a balance between affordability and usefulness, particularly when used in conjunction with free tools like economic calendars or news aggregators.

Snapshot Market Data: On-Demand Information

Snapshot data provides a one-time quote for a security when requested, rather than streaming continuously. It’s like checking the temperature outside rather than monitoring it every second. This model is especially appealing for traders who don’t need constant updates but want accurate pricing at specific moments—such as before placing a manual trade. Brokers like Interactive Brokers offer **IBKR snapshot market data** as a cost-efficient alternative to full-time subscriptions. Users may receive a set number of free snapshots per month, with small fees applied for additional requests. For infrequent traders or those managing a diversified portfolio without active day-to-day monitoring, snapshots can significantly reduce **market data expenses** while still providing reliable, up-to-date information when needed.

Who Charges Market Data Fees? Understanding the Ecosystem

The journey of market data from exchange floor to your screen involves multiple intermediaries, each adding a layer of cost and service. Understanding who controls the data and how they monetize it is key to managing your overall expenses.

Stock Exchanges and Regulators: The Primary Gatekeepers

The original source of all market data is the exchange itself—entities like the NYSE, Nasdaq, and CME Group. These organizations are responsible for collecting trade activity, consolidating order flow, and distributing standardized data feeds. As gatekeepers, they set the baseline pricing for access to their proprietary data streams. While they claim these fees cover operational and technological investments, critics argue that some exchanges have leveraged their monopoly-like position to charge premium rates. Regulatory bodies such as the SEC and FINRA play a supervisory role, ensuring fair access and transparency, though they rarely intervene directly in pricing decisions unless systemic issues arise.

Brokers and Trading Platforms: Your Access Point

Most individual traders never interact directly with exchange fee schedules. Instead, they access market data through brokers and trading platforms, which act as resellers. These intermediaries purchase data licenses from exchanges and then repackage them into user-friendly subscriptions. While many brokers pass through exchange fees with minimal markup, others add administrative charges or platform-specific fees. Some, like Interactive Brokers Market Data Subscriptions, offer granular control, allowing users to subscribe to specific exchanges and data levels individually. Others bundle data access with account benefits—for example, offering free real-time Level 1 data to clients who maintain a minimum balance or meet trading volume thresholds.

Third-Party Data Vendors: Advanced Solutions

For institutional players, hedge funds, and algorithmic traders, standard exchange feeds often fall short. This is where specialized vendors like Bloomberg, Refinitiv, and Exegy step in. These companies go beyond raw data delivery—they aggregate information from multiple sources, enhance it with analytics, and offer customizable, high-speed data solutions. Their services include advanced charting, sentiment analysis, backtesting tools, and direct API integrations, all tailored to professional-grade trading environments. While their offerings are powerful, they come at a steep price, often costing thousands per month. However, for firms relying on data-driven strategies, the value often justifies the cost.

Key Factors Influencing Market Data Costs

The final price you pay for market data isn’t arbitrary. It’s shaped by a combination of user classification, data depth, geographic scope, and usage intent—all of which can dramatically alter the cost structure.

Professional vs. Non-Professional Status: A Critical Distinction

One of the most impactful cost drivers is your classification as a professional or non-professional user. Exchanges define professionals as individuals or entities using data for business purposes, managing client funds, or employed by a financial institution. This includes hedge fund analysts, registered advisors, and proprietary traders. Non-professionals are retail investors using data solely for personal decision-making. The fee difference is stark—professional subscriptions can be 5 to 10 times more expensive than their non-professional counterparts. Misclassifying yourself can lead to compliance violations or unexpected bill spikes. It’s crucial to review your broker’s criteria carefully and declare your status accurately.

| Criteria | Non-Professional Status | Professional Status |

|---|---|---|

| Usage Purpose | Personal investment decisions | Business purposes, trading for others, managing funds |

| Employment | Not employed by a financial institution | Employed by a financial institution (broker-dealer, investment adviser, etc.) |

| Registration | Not registered with any securities agency (e.g., SEC, FINRA) | Registered with a securities agency |

| Data Display | Typically for personal display on a single device | May involve multiple displays, redistribution, or non-display usage |

| Cost Impact | Significantly lower fees | Significantly higher fees (often 5-10x or more) |

Data Level (Level 1, Level 2): Depth of Information

The richness of the data you receive directly correlates with cost. Level 1 data includes basic metrics like the last traded price, best bid, and best ask—sufficient for most retail investors. Level 2 data, however, reveals the full order book, showing multiple price levels and sizes on both the bid and ask sides. This depth allows traders to gauge supply and demand, anticipate price movements, and identify large institutional orders. While invaluable for active traders, Level 2 access comes at a premium due to the increased data volume and processing requirements. Choosing between Level 1 and Level 2 should be driven by your strategy—not by what seems most advanced.

Geographic Coverage and Asset Classes

Costs scale with the breadth of your data needs. Accessing U.S. equities is generally less expensive than subscribing to global markets, where fees accumulate across multiple exchanges and regulatory jurisdictions. Similarly, traders interested in multiple asset classes—such as stocks, options, futures, and forex—will face higher cumulative costs, as each category typically requires a separate subscription. For example, a trader focused solely on S&P 500 stocks may only need a few data bundles, while a global macro trader might require access to European bond markets, Asian equity indices, and commodity futures—each with its own fee structure.

Usage Type: Display vs. Non-Display

A lesser-known but critical distinction is whether data is used for display or non-display purposes. Display usage refers to data shown directly to a human on a screen—this covers the majority of retail trading activity. Non-display usage, however, involves data consumed by machines, such as algorithmic trading systems, backtesting engines, or internal analytics platforms. Because non-display data can be processed at scale and used to generate automated trading signals, exchanges impose much higher fees for this type of access. These charges are standard for quantitative firms and institutional traders but can catch retail algo traders off guard if they’re unaware of the rules.

Common Market Data Fee Structures and Examples

Market data pricing models vary widely across brokers and exchanges, making it essential to understand how costs are structured.

Broker-Specific Pricing Models (e.g., Interactive Brokers, Schwab, Amp Futures)

- Interactive Brokers (IBKR): Known for its transparent and modular approach, IBKR allows users to subscribe to individual exchange feeds—such as NYSE or Nasdaq—with separate fees for Level 1 and Level 2 data. They clearly differentiate between professional and non-professional rates and offer **IBKR snapshot market data** as a low-cost alternative for occasional use. Clients can mix and match data bundles, making it ideal for traders with specific needs.

- Schwab: Schwab Market Data access is often included at no extra cost for clients who meet activity or balance requirements. Real-time Level 1 data for major U.S. exchanges is typically free, while Level 2 data may require a subscription. This model rewards loyalty and trading frequency, reducing barriers for long-term investors.

- Amp Futures: Catering specifically to futures traders, Amp Futures offers data packages tied to major exchanges like CME, ICE, and Eurex. Their Amp Futures Market Data Fees page details monthly costs for various bundles, with professional users facing significantly higher rates. The pricing is straightforward, focusing on exchange-specific access rather than broad data suites.

Major Exchange Fee Lists (e.g., NYSE, Nasdaq, CME Group, ICE)

Exchange fee schedules form the backbone of market data pricing. Common components include:

- Monthly Access Fees: Recurring charges for specific data products (e.g., Nasdaq TotalView, NYSE ArcaBook).

- Per-User Fees: Applied when multiple individuals access the same data feed, especially under professional accounts.

- Data Product Tiers: Different pricing for Level 1, Level 2, options chains, and bond data.

- Administrative Fees: Sometimes added by brokers to cover distribution and support costs.

Hidden Costs and Redistribution Fees

What appears as a simple subscription can sometimes hide additional charges:

- Unexpected Surcharges: Some brokers apply small connectivity or platform fees that aren’t prominently disclosed.

- Redistribution Fees: If you share data across multiple users in a firm or integrate it into internal systems, exchanges may charge redistribution fees—sometimes amounting to thousands per month.

- Non-Display Usage Fees: As previously noted, using data for automated systems triggers separate, often steep, pricing tiers.

The Trader’s Perspective: Value, Frustration, and The “Game Changer”

Behind the pricing models and data tiers are real people trying to make sense of a complex system. Online discussions, particularly under **”Market data fees Reddit”**, reveal a mix of appreciation and frustration.

Is Paying for Market Data Worth It? Assessing ROI

For many, the question isn’t just about cost—it’s about value. Does the data improve your edge enough to justify the expense? A long-term investor analyzing quarterly reports likely won’t benefit from real-time Level 2 feeds. But for a day trader relying on order flow to time entries, that same data can be a game changer. The return on investment depends on how directly the data influences your decision-making. If faster or deeper data leads to better entries, tighter risk management, or fewer slippage losses, it may pay for itself many times over.

Common User Pain Points and Misconceptions

Traders frequently express frustration over:

- The complexity of tiered pricing and unclear eligibility rules.

- Unexpected charges appearing on statements, such as automatic upgrades to professional status.

- Issues like “IBKR data issues,” where users report discrepancies in data feed reliability or unexpected costs within their account.

- Misunderstandings about what’s included in free packages versus what requires an upgrade.

Strategies to Effectively Manage and Optimize Market Data Fees

Smart data management isn’t about cutting corners—it’s about aligning your subscriptions with your actual needs.

Assess Your Data Needs: Don’t Overpay for What You Don’t Use

Start by asking:

- What is my trading style? (Day trading, swing trading, long-term investing)

- Which asset classes do I actually trade?

- Do I need real-time data, or can I rely on delayed or snapshot pricing?

Avoid paying for Level 2 data if you never look at the order book, or for international markets if you only trade U.S. stocks.

Leverage Broker Promotions and Bundles

Many brokers offer incentives:

- Free real-time data for active traders or those with qualifying account balances.

- Bundled packages that combine multiple exchanges at a discount.

- Introductory offers for new users—always check for limited-time promotions.

Understanding Data Refresh Rates and Alternatives

Consider alternatives for non-critical analysis:

- Use free delayed data for securities you’re not actively trading.

- Take advantage of **snapshot market data** for occasional price checks.

- Supplement with free economic calendars and news feeds for fundamental context.

Monitor Statements and Review Subscriptions Regularly

Subscriptions can quietly accumulate:

- Review your brokerage statement monthly for **market data expenses**.

- Cancel unused or redundant feeds—especially after changing strategies.

- Adjust your plan as your trading evolves to avoid overpaying.

Future Trends in Market Data Pricing and Access

The market data landscape is shifting. Emerging trends include:

- Micro-subscriptions: Pay-per-query or per-tick pricing models for algorithmic users.

- New Technologies: Blockchain could enable decentralized, lower-cost data distribution, while AI enhances analytics and predictive modeling.

- Regulatory Scrutiny: Growing pressure to reduce exchange monopolies on data pricing, potentially making real-time data more accessible to retail investors.

- API-Driven Access: More traders are moving away from traditional terminals in favor of custom-built dashboards powered by direct API integrations.

Conclusion: Making Informed Decisions About Market Data Fees

Market data fees are an unavoidable reality for anyone serious about trading. But they don’t have to be a burden. By understanding the differences between real-time, delayed, and snapshot data, recognizing the impact of professional classification, and knowing how exchanges, brokers, and vendors structure their pricing, you can make smarter choices. The goal isn’t to eliminate costs—it’s to ensure every dollar spent on data delivers measurable value. Whether you’re a beginner or a seasoned trader, taking control of your **market data expenses** through regular review, strategic bundling, and careful subscription management can make a tangible difference in your long-term profitability.

1. What is the primary difference between market data fees for professional and non-professional traders?

The primary difference lies in the cost and usage restrictions. Professional traders, defined by exchanges as those using data for business, for others, or being employed by a financial firm, pay significantly higher fees (often 5-10 times more) than non-professional traders, who use data solely for personal investment decisions. This distinction is strictly enforced by exchanges and brokers.

2. How can I determine which market data subscription is right for my specific trading style and budget?

To determine the right subscription, assess your trading frequency (active vs. long-term), asset classes (stocks, options, futures), and strategy’s reliance on speed (real-time vs. delayed). Day traders often need real-time Level 2 data, while long-term investors may only need free delayed data. Compare broker packages and consider starting with basic subscriptions, upgrading only if your strategy demands it.

3. Are there any platforms or brokers that offer free real-time market data, and what are their limitations?

Yes, many brokers offer free real-time Level 1 market data for major US exchanges to non-professional clients, often contingent on maintaining a certain account balance, making a minimum number of trades per month, or opting into specific promotional bundles. Limitations can include restricted access to Level 2 data, specific asset classes, or international markets, which typically require paid subscriptions.

4. What are “non-display” market data fees, and how do they apply to algorithmic trading or internal data consumption?

“Non-display” market data fees are charged when data is consumed by automated systems (e.g., algorithmic trading bots, internal analysis tools) rather than being shown on a screen to a human user. These fees are significantly higher and more complex than display usage fees, reflecting the potential for automated decision-making, competitive advantage, and redistribution within an organization. They are standard for institutional and advanced quantitative trading firms.

5. How do exchange fees typically impact the overall cost of a market data package purchased from a broker?

Exchange fees form the foundational cost component of any market data package. Brokers typically acquire data from exchanges and then pass these costs, often with a small administrative markup, directly to their clients. Therefore, a significant portion of what you pay for a market data subscription directly covers the fees charged by the originating exchanges like NYSE or Nasdaq.

6. What proactive steps can I take to review and potentially reduce my current market data expenses?

- Regularly review your brokerage statements for market data charges.

- Assess if you’re utilizing all subscribed data feeds; cancel any redundant or unused subscriptions.

- Consider downgrading from real-time to delayed or snapshot data for assets you don’t actively trade.

- Check if your broker offers promotions, free data tiers based on trading volume, or bundled packages.

7. Do market data fees usually include access to historical data, or is that considered a separate service and cost?

While many brokers and platforms offer some level of historical data as part of their standard service or alongside a real-time subscription, extensive or highly granular historical data (e.g., tick-by-tick data going back many years) is often considered a separate premium service. This can incur additional fees, especially for institutional users or those requiring large datasets for backtesting and quantitative analysis.

8. Why do market data fees vary so significantly across different exchanges, asset classes, and geographical regions?

Fees vary due to differing operational costs, regulatory landscapes, and competitive environments of each exchange. Different asset classes (stocks, options, futures) require distinct data collection and dissemination infrastructures. Geographical regions also have unique market structures and participant bases, leading to varied pricing models reflecting the value and demand for data in those specific markets.

9. What are the key implications of relying on delayed versus real-time market data for my active trading strategy?

Relying on delayed data for an active trading strategy can lead to significant disadvantages, including missed entry/exit points, inaccurate pricing, and reduced profitability. A 10-20 minute delay can mean that prices have moved substantially, rendering your analysis obsolete. Real-time data is crucial for strategies sensitive to immediate price movements, whereas delayed data is suitable for longer-term, less time-sensitive strategies.

10. Is it possible to pay for market data on a per-use or pay-as-you-go basis, as opposed to a fixed monthly subscription?

Yes, some brokers and data providers offer pay-as-you-go options, particularly for snapshot market data. Instead of a continuous real-time feed, you might pay a small fee per snapshot request or receive a limited number of free snapshots per month. This can be a cost-effective solution for traders who only need occasional price checks rather than constant data streams, helping to manage their overall market data expense.

留言