Introduction: Decoding Loke Marine Minerals and Its Stock Outlook

As investors increasingly seek opportunities in sectors aligned with the global energy transformation, interest in deep-sea mining has surged—often bringing the name *Loke Marine Minerals* into the spotlight. A common search query, “Loke Marine Minerals stock,” reflects this growing curiosity. However, it’s essential to clarify from the outset: **Loke Marine Minerals AS is not a publicly traded company**. Based in Norway, it remains privately held, meaning there is no stock symbol, no ticker, and no way for retail investors to buy shares on any exchange. Despite this, the company has garnered significant attention due to its strategic positioning in the emerging deep-sea mining industry. This article offers a thorough and balanced analysis of Loke Marine Minerals—examining its business model, financial backing, technological approach, environmental challenges, and future prospects. For investors, analysts, and stakeholders tracking the evolution of critical mineral supply chains, understanding Loke’s role provides crucial insight into one of the most debated frontiers in sustainable resource development.

What is Loke Marine Minerals? Company Profile and Business Model

Loke Marine Minerals is a Norwegian deep-sea exploration company at the forefront of a new era in mineral sourcing. Founded with the ambition of supporting the global shift toward renewable energy, the company is focused on identifying and potentially extracting high-value minerals from the seabed. Unlike traditional mining operations, Loke’s strategy centers on undersea deposits rich in metals essential for batteries, wind turbines, and solar infrastructure. Its core business model involves securing exploration rights, developing environmentally conscious extraction technologies, and forming partnerships with industrial leaders to bring these resources to market responsibly. By targeting areas within Norway’s continental shelf and potentially beyond, Loke aims to position itself as a domestic and international supplier of critical raw materials with lower geopolitical and social risks compared to conventional mining regions.

The Vision Behind Loke: Mission and Core Objectives

At the heart of Loke Marine Minerals is a mission to support the green transition by providing a reliable, sustainable source of critical minerals. The company argues that terrestrial mining alone may not be sufficient to meet the skyrocketing demand driven by electric mobility and clean energy systems. Copper, cobalt, nickel, and rare earth elements are in rising demand, yet their land-based reserves face depletion, increasing operational costs, and community resistance. Loke sees deep-sea mining as a complementary solution—offering higher-grade ores in concentrated forms while operating in less populated, albeit ecologically sensitive, environments. The company emphasizes that its vision is not just about extraction, but about doing so with minimal ecological disruption. Key objectives include securing long-term exploration licenses, advancing subsea technology through collaboration, conducting comprehensive environmental baseline studies, and engaging with regulators and stakeholders to shape responsible industry standards.

Operational Focus: Target Minerals and Extraction Methods

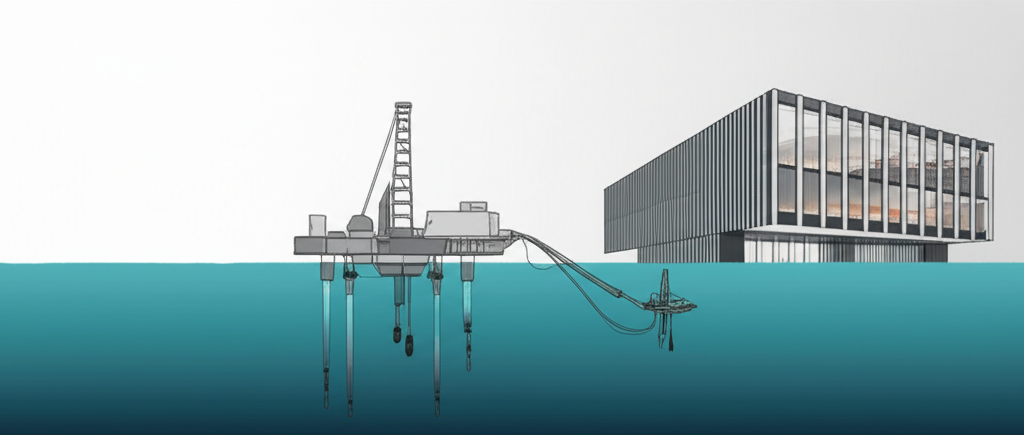

Loke Marine Minerals primarily targets two types of deep-sea mineral deposits: **polymetallic sulphides** and **manganese crusts**. These formations, found along mid-ocean ridges and on underwater mountains (seamounts), contain high concentrations of copper, zinc, cobalt, nickel, and rare earth elements—materials vital for high-performance batteries, electric motors, and advanced electronics. Unlike companies focused on polymetallic nodules in the open ocean, Loke’s focus on sulphide and crust deposits places it in a distinct geological and operational niche. The proposed extraction process involves remotely operated subsea vehicles equipped with precision cutting and collection systems. These machines would harvest mineral-rich material from the seafloor, which is then transported via a riser pipe to a surface support vessel for preliminary processing before being shipped to land-based refineries. Loke collaborates with engineering partners to refine these systems, aiming to reduce sediment plumes, limit noise pollution, and ensure targeted collection—key factors in addressing environmental concerns.

Loke Marine Minerals Financial Landscape: Funding, Investors, and Valuation

As a private enterprise, Loke Marine Minerals operates outside the public markets, relying instead on private investments, strategic alliances, and institutional financing to fund its ambitious goals. This structure allows the company to pursue long-term research and development without the quarterly pressures faced by publicly traded firms. However, it also means that financial details such as revenue, profit margins, or exact valuation are not disclosed to the public. Instead, insights into its financial health must be drawn from funding announcements, partnerships, and regulatory filings.

Key Funding Rounds and Strategic Investments

One of the most significant developments in Loke’s financial journey was the **2023 strategic investment by TechnipFMC**, a global leader in subsea engineering and energy technology. This partnership went beyond capital infusion; it included a joint initiative to co-develop advanced subsea mineral collection systems. The involvement of a major industrial player like TechnipFMC is a strong vote of confidence in Loke’s technical direction and long-term viability. It also brings access to decades of offshore engineering expertise—critical for overcoming the immense technical challenges of deep-sea operations. While specific funding amounts remain undisclosed, the nature of the collaboration suggests a multi-million-dollar commitment. Additional backing likely comes from private equity firms, venture capital funds specializing in cleantech or natural resources, and possibly Norwegian state-linked entities interested in securing domestic access to strategic minerals. These investors are betting on a future where deep-sea mining becomes a regulated and accepted part of the global supply chain.

Unpacking Loke’s Valuation and Financial Health

Valuing a pre-commercial deep-sea mining company like Loke Marine Minerals is inherently speculative. Unlike mature businesses, Loke does not generate revenue from mining operations. Instead, its valuation is derived from intangible assets such as exploration licenses, proprietary technology, partnerships, and the perceived size of its mineral portfolio. Each funding round typically results in a step-up in valuation based on milestones achieved—such as securing permits, advancing prototype designs, or completing environmental surveys. The TechnipFMC deal, in particular, signals that Loke is viewed as a credible and technologically advanced player in a high-risk, high-reward sector. Financial sustainability for Loke depends on its ability to continue attracting capital through successive funding stages. Given the capital-intensive nature of deep-sea exploration—requiring specialized vessels, remote-operated equipment, and extensive environmental monitoring—ongoing investor support will be essential until commercial operations can begin, which may still be years away.

**Table 1: Illustrative Funding Milestones for Private Deep-Sea Mining Companies (Conceptual)**

| Milestone | Year (Approx.) | Type of Funding | Key Investors (Illustrative) | Strategic Impact |

| :———————- | :————- | :——————— | :————————— | :———————————————— |

| Seed/Early-Stage | 2017-2019 | Venture Capital | Private Angels, VC Firms | Initial R&D, license applications |

| Series A/B | 2020-2022 | Private Equity | Industrial Partners, PE | Technology prototyping, further exploration |

| Strategic Investment | 2023 | Corporate Investment | TechnipFMC | Technology co-development, operational scale-up |

| Future Funding (IPO/PE) | TBD | Public Offering/PE | General Public/Institutions | Commercialization, large-scale operations |

The Deep-Sea Mining Industry: Context, Challenges, and Regulatory Environment

The industry in which Loke Marine Minerals operates is still in its infancy but carries outsized implications for the future of global resource supply. Deep-sea mining promises access to vast reserves of critical minerals, yet it remains one of the most controversial and technically demanding fields in modern resource extraction. Success depends not only on engineering breakthroughs but also on navigating a complex web of international law, environmental scrutiny, and public opinion.

Global Outlook on Deep-Sea Mining: Opportunities and Obstacles

Demand for critical minerals is expected to grow exponentially over the next two decades, driven by the expansion of electric vehicles, grid-scale energy storage, and renewable power generation. According to the International Energy Agency, the production of lithium, cobalt, and nickel may need to increase by over 300% by 2040 to meet clean energy targets. Land-based mining faces growing constraints—declining ore quality, water scarcity, labor issues, and community opposition in key producing countries like the Democratic Republic of Congo and Indonesia. This supply gap has intensified interest in alternative sources, with deep-sea deposits offering a compelling, though unproven, solution. Polymetallic sulphides and crusts targeted by Loke can contain metal concentrations several times higher than those found in terrestrial ores. However, the challenges are formidable: operating at depths of 1,500 to 4,000 meters requires equipment capable of withstanding extreme pressure, corrosive saltwater, and remote conditions. The logistical chain—from seafloor to surface to shore—is untested at scale, and the capital required to build and deploy these systems runs into hundreds of millions of dollars.

Navigating the Regulatory Maze: International and National Frameworks

Regulation is perhaps the most uncertain factor shaping the future of deep-sea mining. In international waters—referred to as “The Area” under the United Nations Convention on the Law of the Sea (UNCLOS)—the **International Seabed Authority (ISA)** is tasked with regulating mineral exploration and future exploitation. However, as of 2024, the ISA has not finalized its mining code, leaving companies in a state of regulatory limbo. Some nations have called for a moratorium on deep-sea mining until environmental risks are better understood, while others push for faster commercialization. This global uncertainty contrasts with developments in national jurisdictions. Norway, for example, has taken a proactive stance. In December 2023, the Norwegian Parliament approved a proposal to open parts of its continental shelf for deep-sea mineral exploration, making it one of the first countries to establish a domestic regulatory pathway. For Loke Marine Minerals, this national framework presents a strategic advantage—offering a clearer route to permitting and pilot projects within Norwegian waters, away from the stalled negotiations at the ISA. However, it also brings intense domestic and international scrutiny, particularly from environmental groups concerned about the ecological sensitivity of Arctic and sub-Arctic marine ecosystems.

Recent Developments and Controversies Surrounding Loke Marine Minerals

Like all pioneers in high-risk, high-impact industries, Loke Marine Minerals has found itself at the center of both innovation and controversy. While it has secured key partnerships and advanced its technological roadmap, it also faces mounting pressure from environmental advocates and questions about the financial sustainability of deep-sea ventures.

Addressing Bankruptcy Rumors and Company Challenges

In recent months, reports from environmental watchdogs and media outlets such as Mongabay and Greenpeace have highlighted financial struggles across the deep-sea mining sector. Some companies have paused operations, delayed timelines, or faced investor withdrawals. These developments have occasionally led to speculation that Loke Marine Minerals might be experiencing similar difficulties. However, there is no public evidence to suggest that Loke is insolvent or ceasing operations. On the contrary, its continued collaboration with TechnipFMC and active participation in Norwegian regulatory consultations indicate ongoing operational momentum. The deep-sea mining industry, by nature, requires patient capital. Projects take decades to mature, and profitability is years away. The absence of short-term revenue does not equate to failure—many early-stage technology and resource companies operate under similar conditions. That said, Loke, like its peers, must continuously demonstrate progress to retain investor confidence and avoid the fate of earlier ventures that collapsed under financial strain.

Environmental Impact and Protests: The Sustainability Debate

Environmental concerns remain the single greatest obstacle to the commercialization of deep-sea mining. Organizations such as **Greenpeace**, **WWF**, and **Oceana** have launched global campaigns calling for a moratorium on seabed extraction. Their arguments center on the fragility of deep-sea ecosystems—many of which remain unexplored and poorly understood. Disturbing the seafloor can lead to sediment plumes that smother marine life, release toxic metals, and disrupt habitats that may take centuries to recover. Noise and light from mining operations could also affect deep-diving species like whales and squid. Loke Marine Minerals acknowledges these risks and emphasizes its commitment to environmental responsibility. The company states it is investing in low-impact technologies, conducting baseline biodiversity studies, and designing operations to minimize footprint. However, critics argue that even the most advanced technology cannot eliminate risk in an environment where baseline data is limited. The debate is not just scientific—it’s ethical. Can humanity justify exploiting a largely unknown ecosystem for the sake of technological progress? For Loke, gaining a “social license to operate” will be as important as securing regulatory approval.

Investment Outlook: Is Loke Marine Minerals a Viable Opportunity?

For investors, Loke Marine Minerals represents a high-risk, high-potential opportunity in a frontier market. While direct investment through public stock is not currently available, private equity or venture capital participation may offer exposure to the company’s growth. Evaluating its potential requires weighing technological promise against regulatory, environmental, and financial uncertainties.

Loke Marine Minerals vs. Competitors: A Comparative Look

Loke operates in a competitive landscape with several other deep-sea mining ventures, each with distinct strategies and market positions. The most prominent publicly traded competitor is **The Metals Company (TMC)**, listed on NASDAQ, which focuses on polymetallic nodules in the Clarion-Clipperton Zone of the Pacific Ocean under ISA contracts. Another major player is **Global Sea Mineral Resources (GSR)**, a subsidiary of the Belgian dredging giant DEME, also active in the same international zone. **Moana Minerals**, backed by the Pacific island nation of Nauru, represents a state-sponsored model for accessing seabed resources.

What sets Loke apart is its **geographic and regulatory focus**. By concentrating on Norway’s continental shelf, it sidesteps the regulatory paralysis of the ISA and benefits from a national framework that, while controversial, provides a clearer path to exploration. Additionally, its focus on **polymetallic sulphides and crusts**—rather than nodules—means it targets different mineral assemblages, potentially offering a diversified supply stream. The TechnipFMC partnership further differentiates Loke by integrating proven offshore engineering expertise into its operations, reducing some of the technological risk.

**Table 2: Deep-Sea Mining Companies Comparison**

| Feature | Loke Marine Minerals AS | The Metals Company (TMC) | Global Sea Mineral Resources (GSR) | Moana Minerals |

| :———————- | :————————– | :—————————— | :——————————— | :——————————- |

| **Status** | Private | Public (NASDAQ: TMC) | Private (DEME subsidiary) | Private (affiliated with Nauru) |

| **Focus Minerals** | Polymetallic Sulphides/Crusts | Polymetallic Nodules | Polymetallic Nodules | Polymetallic Nodules |

| **Primary Operating Area** | Norwegian Continental Shelf, other | Clarion-Clipperton Zone (ISA) | Clarion-Clipperton Zone (ISA) | Clarion-Clipperton Zone (ISA) |

| **Key Investors/Partners** | TechnipFMC, Private Equity | ERAS Capital, Maersk | DEME Group | Nauru, Strategic Investors |

| **Regulatory Status** | Exploring Norwegian framework | ISA exploration contracts | ISA exploration contracts | ISA exploration contracts |

| **Public Perception** | Mixed (Norwegian controversy) | Highly scrutinized, activist target | Scrutinized | Linked to small island nations |

Future Prospects and Potential Pathways for Loke

Loke Marine Minerals’ trajectory will depend on several key factors: the pace of Norwegian regulatory development, continued access to capital, technological progress, and public acceptance. Potential future pathways include:

– **Expansion of Private Funding:** Securing additional rounds of venture or private equity investment to advance pilot projects and environmental assessments.

– **Strategic Acquisition:** Becoming a target for larger mining or energy companies seeking to vertically integrate their critical mineral supply chains.

– **Public Listing (IPO):** If the industry matures and regulatory clarity improves, Loke could pursue an IPO, allowing public investors to participate—though this remains a long-term possibility.

– **Joint Ventures and Offtake Agreements:** Partnering with battery manufacturers, automakers, or renewable energy firms to secure future supply deals and share development costs.

Success will require more than technical achievement. Loke must demonstrate that deep-sea mining can be conducted with transparency, environmental integrity, and stakeholder engagement. If it can navigate these challenges, it may emerge as a key supplier in the clean energy economy. If not, it risks joining the ranks of ambitious ventures that failed to bridge the gap between innovation and implementation.

Conclusion: The Complex Future of Loke Marine Minerals

Loke Marine Minerals stands at the intersection of technological ambition, environmental ethics, and global resource demand. While the phrase “Loke Marine Minerals stock” frequently appears in online searches, the reality is that the company remains private, with no current avenue for public investment. Yet its significance extends beyond stock markets. As Norway moves forward with plans to explore its seabed for critical minerals, Loke is positioned as a potential leader in a new domestic industry. Backed by strategic partnerships and focused on sustainable extraction, the company represents a bold attempt to address the mineral needs of the green transition. However, its path is fraught with challenges—scientific unknowns, regulatory hurdles, and fierce opposition from environmental groups. The coming years will be decisive. Whether Loke can turn vision into viable operation will depend not just on engineering and finance, but on its ability to earn public trust and prove that deep-sea mining can coexist with ocean conservation. The outcome may shape not only the company’s fate but the future of how humanity sources the materials that power its sustainable ambitions.

1. Is Loke Marine Minerals a publicly traded company, and does it have a stock symbol?

No, Loke Marine Minerals AS is a privately held company and does not have publicly traded stock or a stock symbol on any stock exchange. Investment is currently through private equity or strategic partnerships.

2. What is the current financial status of Loke Marine Minerals?

As a private company, Loke Marine Minerals does not publicly disclose detailed financial statements. However, it has secured significant funding through private investment rounds and strategic partnerships, notably with TechnipFMC, indicating ongoing financial activity and investor confidence in its long-term potential.

3. Who are the key investors in Loke Marine Minerals?

A prominent strategic investor in Loke Marine Minerals is TechnipFMC, a global technology provider to the energy industry. Other investors likely include private equity firms, venture capital funds, and potentially other industrial partners, though specific details are not publicly available.

4. What minerals does Loke Marine Minerals primarily focus on extracting from the deep sea?

Loke Marine Minerals primarily focuses on exploring and potentially extracting polymetallic sulphides and manganese crusts, which are rich in critical metals such as copper, zinc, cobalt, nickel, and rare earth elements, essential for green technologies.

5. What are the main environmental concerns associated with Loke Marine Minerals’ deep-sea mining operations?

The primary environmental concerns include potential irreversible damage to unique deep-sea ecosystems, disruption of biodiversity, creation of sediment plumes that could affect marine life, and noise pollution. Environmental organizations like Greenpeace have raised significant alarms about these potential impacts.

6. How does Loke Marine Minerals compare to other deep-sea mining companies like The Metals Company or Global Sea Mineral Resources?

Loke Marine Minerals is private and focuses on polymetallic sulphides and crusts, particularly on the Norwegian continental shelf. In contrast, The Metals Company (TMC) is publicly traded (NASDAQ: TMC), and Global Sea Mineral Resources (GSR) is a private subsidiary, both primarily targeting polymetallic nodules in international waters governed by the ISA. Loke’s regional focus and mineral targets differentiate its operational strategy.

7. What is the outlook for the deep-sea mining industry, and how might it impact Loke Marine Minerals?

The deep-sea mining industry faces a complex outlook, driven by increasing demand for critical minerals but constrained by significant environmental concerns and evolving regulatory frameworks. For Loke Marine Minerals, this means potential opportunities if regulations clarify and technology advances, but also ongoing challenges in securing social license and addressing environmental opposition.

8. Has Loke Marine Minerals faced any bankruptcy rumors or significant operational challenges?

While the deep-sea mining industry generally faces high capital requirements and regulatory uncertainties, leading to rumors of financial difficulties for some companies, Loke Marine Minerals has continued to attract strategic investments. Its ongoing partnerships suggest continued operations, despite the inherent challenges of pioneering a new industry.

9. What are the regulatory hurdles Loke Marine Minerals must overcome for its deep-sea projects?

Loke Marine Minerals must navigate both national (e.g., Norway’s recently approved exploration framework) and international regulations. For operations in international waters, the finalization and adherence to the International Seabed Authority’s (ISA) mining code are critical. Each jurisdiction presents specific permitting, environmental assessment, and operational compliance requirements.

10. Is Loke Marine Minerals considered a good investment opportunity in the future?

Assessing Loke Marine Minerals as a “good investment opportunity” depends on an investor’s risk tolerance and long-term outlook on the deep-sea mining sector. While it offers potential exposure to critical minerals for the green transition, the investment is high-risk due to regulatory uncertainties, environmental controversies, and the significant technological and financial hurdles inherent in the nascent industry. Direct investment is currently limited to private equity.

留言