Introduction: The Metaverse – A New Frontier for Investors

What was once the stuff of science fiction is now materializing before our eyes—the metaverse is emerging as a dynamic digital realm where people socialize, work, and play in immersive virtual environments. This next evolution of the internet isn’t just changing how we interact with technology; it’s redefining entire economic landscapes. Built on a fusion of virtual reality (VR), augmented reality (AR), artificial intelligence (AI), blockchain, and high-speed connectivity, the metaverse is shaping a parallel digital economy with the potential to unlock trillions in value. For forward-thinking investors, this isn’t a passing fad but a structural shift akin to the rise of the mobile internet. As industries from gaming to finance begin to embed themselves in virtual worlds, the opportunity to gain early exposure to foundational technologies and platforms has never been more compelling.

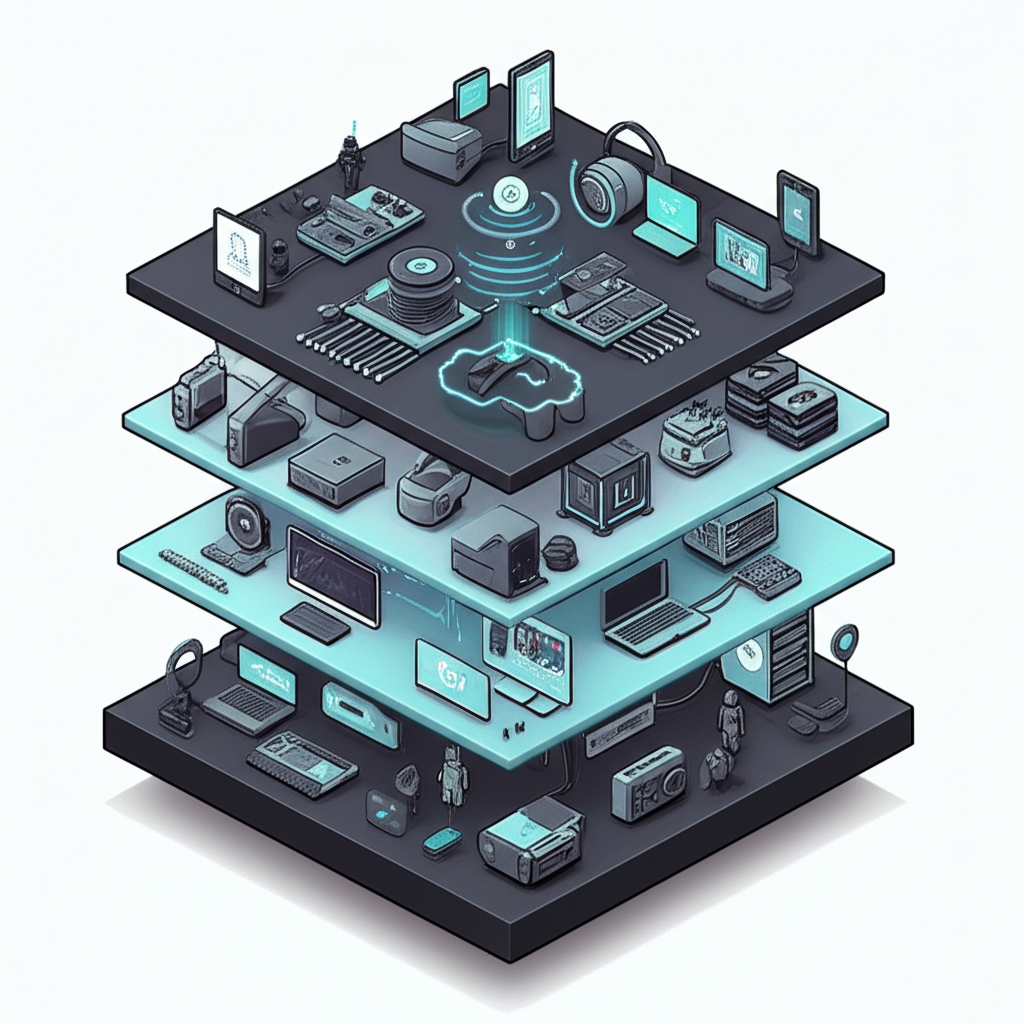

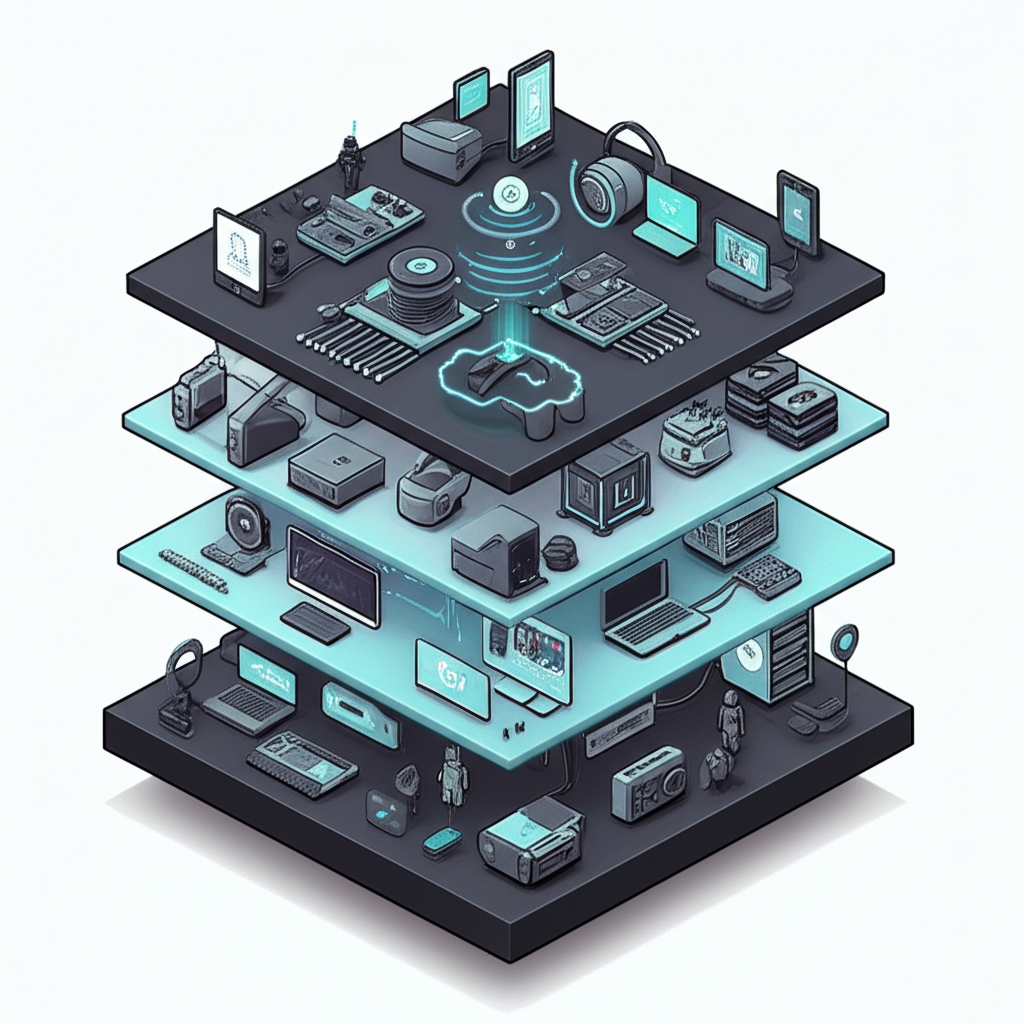

Decoding the Metaverse Ecosystem: Key Investment Segments

Understanding the metaverse as an investment theme requires looking beyond the flashy headlines and diving into its underlying architecture. It’s not a single product or company but a complex, interconnected ecosystem made up of multiple layers, each vital to the functioning and growth of virtual worlds. A strategic investment approach doesn’t focus on just one piece of the puzzle—it recognizes that real value is created across the stack, from the invisible infrastructure powering digital realities to the experiences that keep users engaged. Diversifying across these segments not only captures broader growth but also helps buffer against the volatility inherent in any nascent technology wave.

Infrastructure & Connectivity: The Digital Backbone

At the foundation of every virtual world lies an immense and invisible network of computing power, data centers, cloud platforms, and high-speed connectivity. These technologies form the essential plumbing that allows real-time interactions, persistent environments, and large-scale simulations to function smoothly. Without powerful processors, robust cloud infrastructure, and secure networks, the metaverse would simply grind to a halt. Companies operating in this space may not always be in the spotlight, but they are the silent enablers making immersive digital experiences possible.

Nvidia has emerged as a dominant force, thanks to its high-performance GPUs that power everything from AI training to real-time 3D rendering. Its Omniverse platform further solidifies its position by enabling developers and enterprises to build and simulate digital twins—virtual replicas of real-world systems. Microsoft, through its Azure cloud division, offers scalable computing resources that support not only consumer-facing metaverse platforms but also enterprise applications like virtual collaboration and industrial design. Amazon Web Services (AWS) plays a similar role, providing the global infrastructure needed to host and scale complex virtual environments. These tech giants are not just supporting the metaverse—they are actively shaping its technical foundation.

Hardware & Devices: Gateway to Virtual Worlds

To step into the metaverse, users need tools—physical devices that bridge the gap between the real and the virtual. This hardware layer includes VR headsets, AR glasses, motion trackers, and haptic wearables that deliver tactile feedback. These devices are the entry points to immersive experiences, and their evolution is critical to driving mainstream adoption. As technology becomes more compact, affordable, and intuitive, the barrier to entry for the average user continues to shrink.

Meta Platforms has led the charge with its Meta Quest series, which has achieved significant market penetration by offering standalone VR devices at accessible price points. Apple’s entry with the Vision Pro marks a shift toward high-end spatial computing, blending AR and VR in a sleek, powerful form factor. Sony’s PlayStation VR2 leverages its existing gaming ecosystem to bring immersive experiences to console users, while Qualcomm provides the underlying chipsets—Snapdragon XR platforms—that power many of today’s standalone devices. As these technologies advance, we’re moving closer to a future where seamless, natural interaction within virtual environments becomes the norm.

Platforms & Development Tools: Building the Metaverse

The actual construction of virtual worlds depends on software platforms and development tools that empower creators to design, test, and deploy interactive experiences. These engines serve as the digital workshops where games, simulations, and social spaces are built. They lower the barrier to entry for developers and allow for rapid innovation across industries, from entertainment to architecture.

Unity Software is a cornerstone in this space, offering a real-time 3D development platform used by millions of developers worldwide. Its engine powers a vast range of applications, including mobile games, architectural visualizations, and automotive simulations. Roblox takes a different approach by providing a user-generated content platform where creators—many of them young—can build and monetize their own games and experiences. Epic Games, though still privately held, has made its Unreal Engine a gold standard for high-fidelity graphics and complex virtual environments, widely used in AAA gaming and film production. These platforms are not just tools—they are ecosystems in their own right, fostering communities and economies.

Content & Experiences: The Heart of Engagement

While infrastructure and hardware make the metaverse possible, it’s the content that brings it to life. Engaging experiences—whether they’re virtual concerts, social hangouts, multiplayer games, or branded events—are what attract and retain users. This layer is where creativity and technology converge, turning static environments into vibrant, living worlds.

Roblox continues to stand out, not just as a platform but as a content engine, with millions of user-created experiences drawing in a highly engaged, predominantly younger audience. Take-Two Interactive, the publisher behind blockbuster franchises like Grand Theft Auto and Red Dead Redemption, is exploring how to integrate persistent online worlds into its future titles, potentially creating rich, shared universes. Media giants like Disney are also stepping in, leveraging their vast library of intellectual property to craft immersive experiences—from virtual theme park rides to interactive storytelling. As the line between gaming, entertainment, and social media blurs, content becomes the primary driver of user engagement and monetization.

Decentralized & Web3 Metaverse: The Future Vision

A growing segment of the metaverse is being built on Web3 principles—decentralization, user ownership, and open standards. Unlike traditional platforms controlled by corporations, this vision uses blockchain, cryptocurrencies, and non-fungible tokens (NFTs) to give users true ownership of digital assets and a voice in governance. In these virtual worlds, players can buy virtual land, create assets, and participate in decentralized economies.

Projects like Decentraland and The Sandbox allow users to own, develop, and monetize virtual real estate, often using cryptocurrencies like MANA and SAND. While direct investment in these platforms typically involves buying tokens rather than stocks, publicly traded companies are increasingly involved in building the underlying infrastructure—blockchain networks, NFT marketplaces, and digital identity solutions. The appeal of this model lies in its promise of a more equitable digital future, where users aren’t just consumers but stakeholders. Though still experimental, this decentralized vision could redefine how value is created and distributed in the metaverse.

Top Metaverse Stocks Poised for Long-Term Growth

Identifying the most promising metaverse stocks means looking beyond hype to companies with tangible contributions, sustainable strategies, and competitive moats. The following table highlights leading players across the ecosystem, each playing a distinct role in shaping the future of virtual worlds.

| Company (Ticker) | Primary Metaverse Segment | Key Contribution | Competitive Advantage |

|---|---|---|---|

| Nvidia (NVDA) | Infrastructure, Platforms | GPUs, AI, Omniverse platform | Unmatched GPU tech, enterprise metaverse leadership |

| Meta Platforms (META) | Hardware, Platforms, Content | Quest VR headsets, Reality Labs R&D, Horizon Worlds | Early mover, significant R&D investment, vast user base |

| Microsoft (MSFT) | Infrastructure, Platforms, Enterprise | Azure cloud, Mesh for Teams, Xbox gaming ecosystem | Enterprise dominance, robust cloud infrastructure, gaming IP |

| Apple (AAPL) | Hardware, Ecosystem | Vision Pro, extensive developer ecosystem | Premium brand, integrated hardware/software, strong user loyalty |

| Roblox (RBLX) | Platforms, Content & Experiences | User-generated content platform, vast young user base | Strong community, unique monetization model, UGC focus |

| Unity Software (U) | Platforms & Development Tools | Real-time 3D development platform | Developer ubiquity, cross-platform reach, ease of use |

| Qualcomm (QCOM) | Hardware | Snapdragon XR chipsets, connectivity solutions | Dominance in mobile chipsets, specialized XR platforms |

| Take-Two Interactive (TTWO) | Content & Experiences | Leading game franchises (GTA), potential metaverse integrations | Strong IP portfolio, proven ability to create engaging virtual worlds |

In-Depth Analysis: Nvidia (NVDA) – The AI & Metaverse Engine

Nvidia isn’t just participating in the metaverse—it’s helping to build it from the ground up. Its graphics processing units are the workhorses behind AI training, 3D rendering, and real-time simulations, all of which are essential for creating realistic and responsive virtual environments. The company’s Omniverse platform takes this a step further by offering a collaborative space where engineers, designers, and developers can simulate complex systems, from digital twins of factories to virtual cities.

What sets Nvidia apart is its ability to innovate at the intersection of hardware and software. Its CUDA architecture and AI frameworks like TensorRT give it a technological edge that competitors struggle to match. Financially, the company has seen explosive growth, with its Q1 FY2025 results revealing a record $26.0 billion in revenue—a 262% year-over-year increase. As demand for AI and high-performance computing continues to surge, Nvidia is uniquely positioned to benefit from the metaverse’s growing computational needs. Analysts consistently rank it as a top-tier long-term holding, not just for its current dominance but for its potential to shape the future of digital creation.

In-Depth Analysis: Meta Platforms (META) – Shaping the Social Metaverse

Meta’s rebranding from Facebook signaled a bold pivot toward a new digital future—one centered on immersive, social experiences in virtual and augmented reality. Under Mark Zuckerberg’s leadership, the company has poured billions into its Reality Labs division, developing the Meta Quest headsets and the Horizon Worlds platform. While these investments have yet to turn a profit, they represent a long-term bet on a world where people connect, collaborate, and socialize in 3D spaces.

Meta’s advantage lies in its existing digital ecosystem. With billions of users across Facebook, Instagram, and WhatsApp, it has the potential to onboard massive audiences into its metaverse vision. Its aggressive R&D in areas like eye-tracking, hand gesture recognition, and mixed reality positions it at the forefront of hardware innovation. Though Reality Labs continues to report losses, these are widely seen as necessary costs for building a future platform. For investors who believe in the social metaverse, Meta offers unmatched scale, resources, and commitment.

Metaverse ETFs: Diversification for the Discerning Investor

For those who want exposure to the metaverse without the challenge of picking individual winners, exchange-traded funds (ETFs) provide a practical solution. These funds pool capital into a diversified basket of companies involved in various aspects of the metaverse, reducing the risk associated with any single stock’s performance. ETFs are ideal for investors who believe in the long-term trajectory of the space but prefer a more balanced, hands-off approach.

| ETF (Ticker) | Investment Philosophy | Key Holdings (Examples) | Expense Ratio |

|---|---|---|---|

| Roundhill Ball Metaverse ETF (METV) | Broad exposure to companies involved in the metaverse, across all segments. | Nvidia, Meta Platforms, Roblox, Apple | 0.59% |

| Fidelity Metaverse ETF (FMET) | Focus on companies developing, manufacturing, distributing, or selling products or services related to the metaverse. | Meta Platforms, Apple, Microsoft, Tencent Holdings | 0.39% |

| ProShares Metaverse ETF (VERS) | Seeks to track the performance of companies positioned to benefit from the growth and development of the metaverse. | Nvidia, Apple, Microsoft, Qualcomm | 0.58% |

| Global X Metaverse ETF (VR) | Invests in companies that stand to benefit from the development and commercialization of the metaverse. | Meta Platforms, Apple, Nvidia, Alphabet | 0.50% |

When evaluating a metaverse ETF, investors should consider the fund’s holdings, sector concentration, and expense ratio. Some funds lean heavily on hardware or gaming, while others offer a broader mix. For those seeking a low-effort way to gain diversified exposure, ETFs are an increasingly popular choice.

Navigating the Volatility: Risks and Challenges of Metaverse Investing

Despite its vast potential, the metaverse remains a high-risk, high-reward investment landscape. The technology is still evolving, adoption is uneven, and profitability timelines are uncertain. Investors must be prepared for volatility and avoid getting swept up in short-term speculation.

Key challenges include the risk of inflated valuations driven by hype, unresolved technical barriers like latency and rendering limits, and a lack of regulatory clarity around digital assets and virtual economies. Competition is fierce, with tech giants and startups alike racing to capture market share. Intellectual property protection in user-generated environments remains legally complex, and cybersecurity threats are evolving alongside virtual economies. Most importantly, the metaverse is still in its infancy—mass consumer adoption and proven monetization models are not guaranteed. Success requires patience, research, and a tolerance for uncertainty.

Building a Resilient Metaverse Portfolio: Strategic Allocation

Constructing a durable portfolio in the metaverse space demands more than just picking trending stocks. It requires a disciplined strategy that balances innovation with stability. A resilient approach considers risk tolerance, investment horizon, and the broader ecosystem dynamics.

Start by diversifying across the metaverse stack—infrastructure, hardware, platforms, and content. This reduces reliance on any single technology or company. Combine established tech leaders like Nvidia and Microsoft with more speculative but high-potential players like Unity or Roblox. For core exposure, consider allocating a portion to a well-constructed metaverse ETF. Dollar-cost averaging helps smooth out volatility, especially in a market prone to sharp swings. Maintain a long-term perspective—this is a multi-year, even multi-decade transformation. Regularly review and rebalance your holdings to align with changing market conditions and personal goals. For example, a moderately aggressive investor might allocate 60% to large-cap tech, 20% to mid-cap innovators, and 20% to an ETF for broad diversification.

Emerging Metaverse Niches and Future Trends to Monitor

Beyond the headline-grabbing platforms and devices, several under-the-radar sectors are gaining momentum and could deliver outsized returns. These niches represent the next layer of innovation in the metaverse.

Digital identity is becoming crucial as users move between virtual worlds. Secure, interoperable identity solutions—often built on blockchain—will allow avatars to carry reputations, assets, and credentials across platforms. Cybersecurity tailored for the metaverse is another growing need, protecting virtual assets and personal data from fraud and hacking. AI is evolving to power intelligent NPCs and virtual assistants, making interactions more natural and dynamic. Haptic technology, including gloves and full-body suits, is enhancing immersion by simulating touch and movement.

On the enterprise side, digital twins—virtual replicas of physical systems—are being used for industrial design, urban planning, and employee training. Virtual collaboration spaces are replacing traditional video calls, enabling more natural teamwork. Digital fashion is also booming, with brands creating NFT-based apparel for avatars, tapping into a new form of self-expression and status. Interoperability protocols, which allow assets and identities to move freely between worlds, remain a holy grail for an open metaverse. Companies pioneering these areas could become foundational players in the years ahead.

McKinsey & Company estimates that the metaverse could generate up to $5 trillion in value by 2030, underscoring the scale of opportunity across these diverse domains.

Conclusion: Invest in the Virtual Future with Prudence

The metaverse is not a speculative bubble—it’s a technological and cultural shift with the potential to reshape how we live, work, and connect. From the servers that power virtual worlds to the experiences that captivate users, the ecosystem offers a wide range of investment opportunities. However, the path forward will be uneven, marked by rapid innovation, regulatory shifts, and market corrections. Success requires more than optimism; it demands research, diversification, and patience. By focusing on companies with real technological contributions, maintaining a balanced portfolio, and staying informed about emerging trends, investors can position themselves to benefit from the long-term evolution of the virtual world.

Which metaverse stock is considered the most promising for long-term growth and innovation?

While no single stock is universally “best,” Nvidia (NVDA) is often cited as one of the most promising for long-term growth due to its foundational role in providing the GPUs and AI capabilities essential for building and running the metaverse, alongside its Omniverse platform. Meta Platforms (META) is also a strong contender due to its significant investment and leadership in VR hardware and social metaverse development.

Is it too late to invest in metaverse stocks, or is the market still in its early stages?

The metaverse market is widely considered to be in its relatively early stages of development. While some companies have seen significant growth, mass consumer adoption and the full realization of the metaverse’s potential are still years away. This suggests that there are still ample opportunities for long-term investors, though patience and a high-risk tolerance are required.

What are the biggest risks and potential downsides of investing in metaverse companies?

Key risks include:

- Market Speculation: Potential for inflated valuations and bubbles.

- Technological Hurdles: Significant R&D is still needed for a fully realized metaverse.

- Regulatory Uncertainty: Lack of clear laws for virtual economies and digital assets.

- Intense Competition: Many large tech companies and startups are vying for market share.

- Nascent Adoption: Mass consumer adoption and monetization strategies are not yet fully proven.

- Cybersecurity and IP: New challenges in protecting digital assets and intellectual property.

How can individual investors effectively research and evaluate metaverse stocks?

Individual investors should:

- Understand the company’s specific role in the metaverse ecosystem (e.g., hardware, infrastructure, content).

- Analyze its competitive advantages, innovation pipeline, and R&D investments.

- Evaluate financial health, growth trajectory, and management’s vision.

- Monitor market trends, technological advancements, and regulatory developments in the space.

- Read analyst reports and industry insights from reputable sources.

What is the main difference between investing in a metaverse ETF versus individual stocks?

Investing in a metaverse ETF provides instant diversification across multiple companies involved in the metaverse, reducing individual stock risk. It’s a more passive approach. Investing in individual stocks offers the potential for higher returns if you pick successful companies, but also carries higher risk and requires more in-depth research and active management.

Which companies are key players in building the foundational infrastructure of the metaverse?

Key players in foundational infrastructure include:

- Nvidia (NVDA): For GPUs, AI, and its Omniverse platform.

- Microsoft (MSFT): Through its Azure cloud services and enterprise metaverse solutions.

- Amazon (AMZN): With its AWS cloud computing infrastructure.

- Qualcomm (QCOM): Providing chipsets for VR/AR devices.

What role do Web3, blockchain, and NFTs play in the future of metaverse investing?

Web3, blockchain, and NFTs are crucial for the decentralized vision of the metaverse. They enable:

- True Digital Ownership: Users can own digital assets (land, items) via NFTs.

- Interoperability: Potential for assets to move between different virtual worlds.

- User Governance: Decentralized autonomous organizations (DAOs) for community control.

- Secure Transactions: Blockchain facilitates transparent and secure economic activity.

These technologies are key to creating user-centric, open, and interoperable virtual economies.

Are there any emerging or lesser-known metaverse niches that present high growth potential?

Yes, several niches show high potential, including:

- Digital Identity Solutions: For secure and interoperable avatars.

- Metaverse Cybersecurity: Protecting virtual assets and user data.

- Specialized AI for Virtual Entities: Powering intelligent NPCs and virtual assistants.

- Haptic Technology: Enhancing immersive sensations.

- Enterprise Metaverse Applications: For B2B collaboration, training, and digital twins.

- Digital Fashion & Avatars: A growing market for virtual goods and self-expression.

How can one build a diversified portfolio specifically focused on metaverse investments?

To build a diversified metaverse portfolio:

- Allocate across different metaverse segments (infrastructure, hardware, platforms, content).

- Balance established tech giants with promising pure-play metaverse companies.

- Consider a metaverse ETF for broad, diversified exposure.

- Utilize dollar-cost averaging to mitigate volatility.

- Maintain a long-term investment horizon and regularly rebalance your portfolio.

What are the current market trends and future predictions for the metaverse investment landscape?

Current trends include increasing R&D in VR/AR hardware, growing enterprise adoption of metaverse technologies, and continued development in Web3 and decentralized platforms. Future predictions point towards greater interoperability, more sophisticated AI-powered virtual experiences, the rise of digital economies, and a substantial increase in market size, with some estimates suggesting a multi-trillion-dollar industry by the end of the decade. The focus is shifting from pure consumer entertainment to practical applications in work, education, and social interaction.

留言