Mastering Market Momentum: A Comprehensive Guide to Reading the ADX Indicator

Welcome, fellow journeyers into the fascinating world of financial markets! As you navigate the complexities of trading, you quickly realize that simply knowing the direction of price isn’t enough. The market might be heading up or down, but how strong is that move? Is it a powerful surge or a hesitant crawl? Understanding this strength is crucial for making informed decisions, managing risk, and identifying high-probability trading opportunities. This is where the Average Directional Index, or ADX, becomes an invaluable tool in your technical analysis arsenal.

Think of market trends like rivers. Some are raging torrents, others are gentle streams, and sometimes the water barely moves at all in a calm lake. The ADX indicator doesn’t tell you which direction the river is flowing (that’s the job of other tools or parts of the ADX family), but it tells you just how fast and strong the current is. It’s a powerful meter designed to quantify the intensity of a price trend, regardless of whether that trend is bullish (upward) or bearish (downward).

Developed by the legendary technical analyst J. Welles Wilder Jr. in his 1978 book “New Concepts in Technical Trading Systems,” the ADX is part of a larger system known as the Directional Movement Index (DMI). While often plotted as a single line, the ADX itself is derived from two other related lines that *do* indicate direction: the Positive Directional Indicator (+DI) and the Negative Directional Indicator (-DI). Together, these three lines paint a more complete picture of the market’s directional movement and, more importantly for the ADX, its *strength*.

In this guide, we will delve deep into how to read the ADX indicator effectively. We’ll break down its components, explore what its different values mean, discuss how to use it in various trading scenarios, and highlight its limitations. By the end, you should have a robust understanding of this powerful tool and be equipped to integrate it into your trading strategy to better gauge market momentum and make more confident trading decisions. Are you ready to unlock the secrets of trend strength?

The ADX offers several advantages and considerations for traders:

- Quantifies trend strength without indicating direction.

- Helps filter out noise in choppy markets.

- Can be combined with other indicators for enhanced analysis.

By understanding these points, traders can better leverage the ADX in their technical analysis efforts.

Deconstructing the ADX: Components of Directional Movement

To truly understand how to read the ADX indicator, we first need to look at its building blocks. As mentioned, the ADX is the average of the Directional Movement Index (DX), which itself is calculated from the +DI and -DI lines. While we won’t get bogged down in manual calculation (your trading platform does that for you!), understanding what these lines represent is key to proper interpretation.

The system starts by measuring directional movement. Wilder defined two metrics:

- Positive Directional Movement (+DM): This measures the upward movement over a specific period. It’s essentially the portion of the current period’s price range that is above the previous period’s high. If the current high is lower than or equal to the previous high, or if the current low is higher than the previous high, +DM is zero.

- Negative Directional Movement (-DM): This measures the downward movement over a specific period. It’s the portion of the current period’s price range that is below the previous period’s low. If the current low is higher than or equal to the previous low, or if the current high is lower than the previous low, -DM is zero.

It’s important to note that a period can only have +DM or -DM, but not both. If both conditions are met (e.g., current high is above previous high AND current low is below previous low), then only the larger of the two movements counts as directional movement for that period. If neither condition is met (e.g., inside bar), both +DM and -DM are zero.

Next, we need the True Range (TR). The TR accounts for gaps and measures the volatility of a period. It’s the greatest of the following three values:

- Current high minus current low

- Current high minus previous close

- Previous close minus current low

Why is TR important? Because directional movement is normalized by volatility. A large price move means more in a less volatile market than the same move in a highly volatile market. TR provides the necessary scaling factor.

From +DM, -DM, and TR, we calculate the Positive Directional Indicator (+DI) and the Negative Directional Indicator (-DI). These are smoothed averages (usually using a Wilder’s smoothing method, similar to an Exponential Moving Average but with a specific calculation) of +DM and -DM, respectively, divided by a smoothed average of the True Range, then multiplied by 100. The standard period for smoothing is 14.

The formulas look something like this (simplified, focusing on the concept):

- +DI = (Smoothed +DM / Smoothed TR) * 100

- -DI = (Smoothed -DM / Smoothed TR) * 100

These +DI and -DI lines are crucial because they tell us about the direction. When +DI is above -DI, it suggests that the upward directional movement is currently stronger than the downward directional movement, hinting at a bullish bias. Conversely, when -DI is above +DI, it suggests downward movement is stronger, indicating a bearish bias.

The ADX itself is then calculated from the Directional Movement Index (DX), which is the absolute difference between +DI and -DI, divided by their sum, multiplied by 100. The DX is then smoothed (again, typically over 14 periods) to create the ADX line. This smoothing process is key to reducing whipsaws and making the ADX a less choppy indicator.

So, while the +DI and -DI tell you *which* direction is stronger, the ADX line tells you *how strong* that dominant direction is. It’s a measure of consensus or conviction in the market regarding the current trend.

Below is a summary of the components of the ADX calculation:

| Component | Description |

|---|---|

| +DM | Positive Directional Movement indicating upward movement. |

| -DM | Negative Directional Movement indicating downward movement. |

| TR | True Range measuring volatility. |

| +DI | Positive Directional Indicator derived from +DM and TR. |

| -DI | Negative Directional Indicator derived from -DM and TR. |

| DX | Directional Movement Index calculating trend strength. |

| ADX | Average Directional Index representing trend strength. |

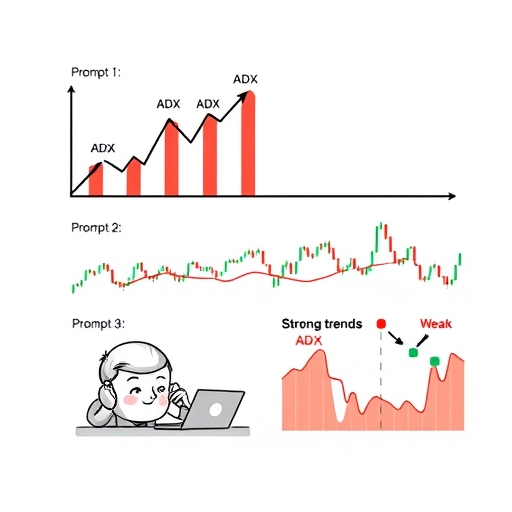

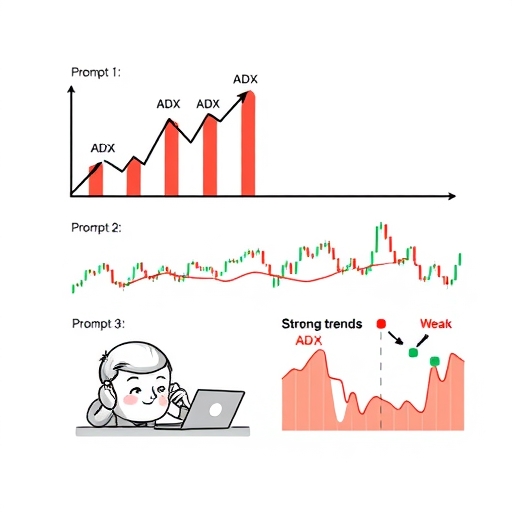

Reading the ADX Line: Quantifying Trend Strength

Now that we know where the ADX comes from, let’s focus on how to read the ADX line itself. This is the core of using the indicator for trend strength analysis. The ADX is plotted as a single line, usually ranging from 0 to 100. Unlike many oscillators (like RSI or Stochastic) that signal overbought or oversold conditions at extreme high or low values, high values on the ADX indicate *strong* trend strength, and low values indicate *weak* or non-existent trend strength.

Here’s a general breakdown of how to interpret different ADX values:

- ADX below 20 (sometimes cited as 25): Weak or Absent Trend. When the ADX line is below this threshold, it suggests that the market is in a period of consolidation, range-bound trading, or is moving sideways. There is no clear dominant directional movement. Trend-following strategies are typically less effective in these conditions, and the market may be prone to whipsaws. This is like being in a calm lake or a very slow-moving river.

- ADX between 20/25 and 50: Strong Trend. When the ADX rises above the 20 or 25 level, it indicates that a trend is beginning to form or is already underway and gaining strength. As the ADX moves higher within this range, the trend is considered increasingly strong. This is the environment where trend-following strategies tend to be most profitable. The river current is picking up speed and intensity.

- ADX above 50: Very Strong Trend. Readings above 50 signify an extremely strong trend. This could be a powerful and sustained move. While this confirms strong momentum, values entering the 60s or 70s (or even higher, though rare) can sometimes suggest the trend is becoming parabolic or nearing a point of exhaustion or saturation. This isn’t a signal to automatically reverse, but it warrants caution and closer monitoring. The river is reaching flood stage.

Understanding these levels is fundamental to reading the ADX. A rising ADX line signifies increasing trend strength (the momentum is building), while a falling ADX line signifies decreasing trend strength (momentum is waning). Crucially, a falling ADX does *not* necessarily mean the trend is reversing; it simply means the conviction behind the current direction is weakening, which could lead to consolidation, a retracement, or eventually a reversal.

For example, if the price of an asset has been rising, and the ADX is also rising from 20 towards 40, this confirms a strengthening bullish trend. You have more confidence that the upward move is likely to continue. However, if the price is still rising, but the ADX starts falling from 40 back towards 25, it tells you that while the price is still going up, the momentum behind the move is fading. This might be a signal to tighten your stop loss or consider taking partial profits.

Remember, the ADX only measures strength. You need the +DI and -DI lines (or price action itself) to understand the direction of the trend whose strength the ADX is measuring.

Below is a table showing how to interpret the ADX values:

| ADX Value | Interpretation |

|---|---|

| Below 20/25 | Weak or absent trend, market consolidation. |

| 20/25 – 50 | Strong trend building; profitable for trend followers. |

| Above 50 | Very strong trend; watch for potential exhaustion. |

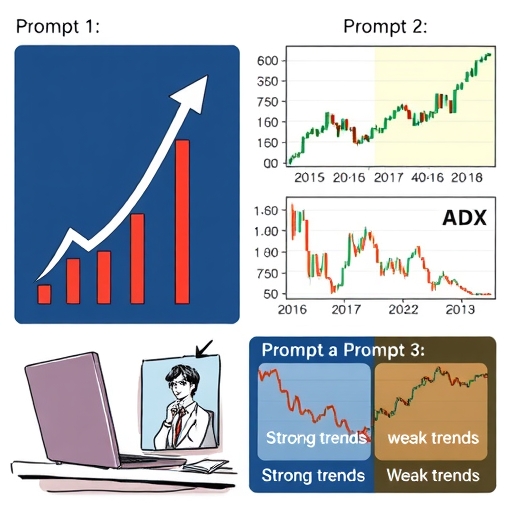

Interpreting Direction: The Role of +DI and -DI Lines

While the ADX line tells you *how strong* a trend is, the +DI and -DI lines tell you *which direction* the market has the strongest directional movement. They are essential complements to the ADX and are often plotted alongside it below the price chart.

Here’s how to interpret the relationship between the +DI and -DI lines:

- +DI above -DI: Bullish Bias. When the green +DI line crosses and remains above the red -DI line, it indicates that the positive directional movement is currently stronger than the negative directional movement over the chosen period (typically 14). This suggests a potential upward trend or bullish momentum in the market.

- -DI above +DI: Bearish Bias. Conversely, when the red -DI line crosses and remains above the green +DI line, it indicates that the negative directional movement is stronger. This suggests a potential downward trend or bearish momentum.

These crossovers are often used as potential entry signals, similar to how moving average crossovers are used. A crossover where the +DI moves above the -DI is often interpreted as a buy signal, while a crossover where the -DI moves above the +DI is seen as a sell signal.

However, here’s where the ADX line comes into play and why understanding how to read all three lines together is critical: +DI/-DI crossovers can produce many false signals in markets with weak or no clear trend (i.e., when ADX is below 20/25). A market could be simply oscillating within a range, causing the +DI and -DI lines to cross back and forth frequently without a sustained move developing.

This is why traders often use the ADX to *confirm* the strength of a potential signal generated by a +DI/-DI crossover. A common rule is to only consider a crossover signal valid if the ADX line is above the 20 or 25 threshold. This ensures that you are attempting to trade directional movement signals only in markets that the ADX indicates have sufficient underlying trend strength to potentially sustain a move.

By analyzing the relative positions of the +DI and -DI *in conjunction* with the ADX value, you can filter out weaker signals and focus on trading opportunities where the market exhibits both directional bias and underlying strength.

Following is a table summarizing the interpretations of the +DI and -DI crossovers:

| Crossover Condition | Interpretation |

|---|---|

| +DI crosses above -DI | Potential buy signal (bullish bias). |

| -DI crosses above +DI | Potential sell signal (bearish bias). |

Strategic Applications: Using ADX in Your Trading Strategy

Knowing how to read the ADX indicator’s components and values is just the beginning. The real power comes from applying this knowledge strategically. The ADX is primarily a trend-following tool, best utilized in trending markets, but it can also help identify ranging conditions where different strategies might be more appropriate.

1. Confirming Trend Following Signals:

As discussed, one of the most classic applications is using the ADX to confirm +DI/-DI crossovers. You look for crossovers where +DI crosses above -DI (buy) or -DI crosses above +DI (sell). You then check the ADX line:

- If the ADX is below 20/25, you might disregard the crossover as potentially false in a weak trend.

- If the ADX is above 20/25 and ideally rising, it lends significant credibility to the crossover signal, suggesting a strong trend is forming or continuing.

This combination helps you avoid entering trades based on whipsaws in choppy markets and increases your confidence when entering trades aligned with strong trends.

2. Identifying Trend Strength for Position Sizing and Management:

The ADX can inform decisions about how aggressively to trade or how to manage existing positions. In strong trends (ADX > 25), you might:

- Be more comfortable taking larger positions (within your risk limits).

- Consider letting profits run for longer, perhaps using wider trailing stops, as the strong ADX indicates the trend has momentum.

In weak or ranging markets (ADX < 20/25), you might:

- Reduce position sizes.

- Avoid trend-following entries altogether and instead look for range-bound strategies (like buying near support and selling near resistance).

- Use tighter stop losses if you do trade, acknowledging the lack of strong directional commitment from the market.

Furthermore, observing a rising ADX tells you the trend is gaining momentum, while a falling ADX suggests it’s losing momentum. If you are in a profitable long trade in a strong uptrend (ADX > 25), and the ADX starts to fall towards 25, it’s not necessarily a sell signal, but it’s a warning that the move might be slowing down. This might prompt you to tighten your stop, take some profit, or prepare for a potential pullback or consolidation.

3. Confirming Breakouts:

Breakouts from consolidation patterns (like triangles, rectangles, or flag patterns) are often signals of potential new trend initiation. However, many breakouts fail, resulting in false signals. The ADX can help filter these.

When price breaks out of a defined range or pattern, look at the ADX. If the ADX is below 20/25 *before* the breakout, and then *rises sharply above 20/25* shortly after the breakout occurs, it provides strong confirmation that the breakout is being fueled by increasing trend strength and is more likely to lead to a sustained move. A breakout without a corresponding increase in ADX strength is more suspect.

4. Identifying Potential Trend Saturation:

While high ADX values (above 50) confirm strong trends, exceptionally high readings can sometimes hint at trends that are becoming parabolic or overextended. These are trends that have moved very far, very fast. While the ADX itself doesn’t signal a reversal, exceptionally high values combined with other signals (like price action showing signs of slowing momentum, or divergence on other oscillators) could suggest that the trend is in its late stages or vulnerable to a sharp pullback or correction.

In such cases, a trader might avoid initiating new trend-following positions, look to take profits on existing trades, or prepare for a potential shift in market character. This requires careful judgment and should always be combined with other analysis.

Trading the ADX effectively requires practice and combining its signals with other tools. For those interested in applying these concepts, especially in markets like Forex, choosing the right platform is key. If you’re exploring options, Moneta Markets is an Australia-based platform offering over 1000 instruments and supporting popular platforms like MT4 and MT5, which come equipped with ADX and other technical indicators.

Advanced Techniques: Divergence and ADX Peaks

Beyond the basic interpretation of ADX levels and its interaction with the DI lines, experienced traders often look for more nuanced signals. Two such advanced techniques involve analyzing divergence and the behavior of ADX peaks.

ADX Divergence:

Divergence occurs when price action moves in one direction, but an indicator moves in the opposite direction or fails to confirm the price move. While less common or discussed than divergence on oscillators like RSI or MACD, divergence can also occur with the ADX and can provide valuable warnings about waning momentum.

A typical scenario is when price makes a higher high in an uptrend, but the ADX makes a lower high. Price is moving up, suggesting the trend continues, but the ADX is falling or failing to rise with the price, indicating that the strength or conviction behind the move is weakening. This “non-confirmation” by the ADX doesn’t guarantee a reversal, but it suggests the current trend’s momentum is fading, potentially leading to consolidation, a deeper retracement, or even a reversal.

Conversely, in a downtrend, if price makes a lower low, but the ADX makes a higher low (or fails to make a lower low), it suggests that the downward momentum is weakening despite price hitting new lows. Again, this is a signal to be cautious about the continuation of the trend.

ADX divergence can serve as an early warning sign. It tells you that the “fuel” for the current price move might be running low. When you see this, it’s wise to re-evaluate your position, tighten stops, or potentially reduce exposure. It’s another layer of information ADX provides about the *health* of the trend.

Analyzing ADX Peaks and Swings:

The cyclical nature of the ADX line itself can also offer insights. The ADX tends to peak when a trend is strongest and then decline as momentum fades, often leading to a range-bound period before the next trend potentially emerges.

- Rising ADX from low levels: Often signals the beginning of a new trend (especially if combined with a +DI/-DI crossover above the 20/25 level).

- ADX peaking and turning down from high levels: Indicates that the current trend is losing momentum and entering a period of consolidation or retracement.

- ADX hitting new highs: Confirms that the current trend is accelerating and is exceptionally strong.

- ADX failing to reach previous highs: If the market is trending, but the ADX peaks at lower levels than the previous ADX peak, it suggests the current phase of the trend is weaker than the last impulse. This can be a form of non-confirmation or internal divergence within the indicator’s own behavior.

Observing these swings and peaks in the ADX line helps you understand the ebbs and flows of market momentum within a larger trend or across market cycles. It’s about reading the rhythm of the market’s strength.

Calculation Overview and Practical Settings

While you don’t need to perform the calculations manually on a day-to-day basis, having a conceptual understanding of how the ADX is calculated reinforces why it behaves the way it does. As we touched upon, it’s a multi-step process that ultimately smooths the measure of directional movement normalized by true range.

The main steps involve:

- Calculating +DM, -DM, and TR for each period.

- Smoothing these values over a specified period (the default is typically 14 periods).

- Calculating the +DI and -DI by dividing the smoothed +DM and -DM by the smoothed TR, respectively, and multiplying by 100.

- Calculating the Directional Movement Index (DX) for each period based on the current +DI and -DI values: DX = (Absolute difference between +DI and -DI) / (Sum of +DI and -DI) * 100.

- Smoothing the DX values over the same specified period (default 14) to get the ADX line.

The smoothing mechanism (often Wilder’s smoothing) is crucial as it makes the ADX line less reactive to single-period price swings and helps it paint a clearer picture of the underlying trend strength over time. Because it’s an average of DX over previous periods, the ADX is considered a lagging indicator. It confirms strength that has already occurred or is currently occurring, rather than predicting future strength.

The standard setting for the ADX and its components (+DI, -DI) is 14 periods. This is the setting originally recommended by J. Welles Wilder and is the most commonly used. It provides a balance between responsiveness to recent price action and sufficient smoothing to avoid excessive whipsaws.

However, like most technical indicators, the period setting can be adjusted. Using a shorter period (e.g., 7 periods) will make the ADX more sensitive to recent price changes. It will react faster to developing trend strength but may also produce more false signals or whipsaws in choppy markets. Using a longer period (e.g., 20 or 25 periods) will make the ADX smoother and less responsive. It will filter out more noise but will lag price action more significantly, potentially delaying entry or exit signals.

There is no single “best” setting; the optimal period can vary depending on the asset being traded, the timeframe you are analyzing, and your personal trading style. We strongly recommend experimenting with different settings through backtesting and paper trading to see what works best for you in the markets you trade.

Trading platforms typically handle all these calculations automatically. When you add the ADX indicator to your chart, you usually only need to specify the period (defaulting to 14). The platform will then plot the ADX line, and often the +DI and -DI lines alongside it, allowing you to focus on interpretation and strategy rather than the math.

For traders utilizing platforms like MT4, MT5, or Pro Trader, the ADX is a standard built-in indicator, easily accessible for charting and analysis across various asset classes, including Forex pairs, commodities, and indices. Selecting a broker that offers these platforms and a wide range of instruments, perhaps like Moneta Markets with its diverse offerings and strong regulatory backing, can streamline your technical analysis efforts.

Limitations and Best Practices for Using ADX

While the ADX is a powerful tool for gauging trend strength, like any technical indicator, it is not infallible. Understanding its limitations is just as important as knowing how to read it correctly. Relying solely on the ADX can lead to poor trading decisions. Here are some key limitations and best practices for using the ADX effectively:

Limitations:

- Lagging Indicator: The ADX is calculated using historical data and smoothing, making it a lagging indicator. It confirms strength that is already present rather than predicting future strength. This means signals might come after a trend is well underway, potentially leading to less favorable entry prices compared to leading indicators or price action analysis.

- Not Directional by Itself: The ADX line *only* measures strength, not direction. You must look at the +DI and -DI lines or price action to determine if the strong trend is up or down.

- False Signals in Choppy Markets: While ADX helps identify weak trends (ADX < 20/25), during prolonged periods of consolidation, the +DI and -DI lines can cross frequently, generating numerous potential buy/sell signals that do not result in sustained moves. If you strictly trade crossovers above 20/25 ADX, this limitation is somewhat mitigated, but it's still possible for ADX to briefly cross 20 during a range and generate a false signal.

- Extreme ADX Values Don’t Signal Reversal: An extremely high ADX value (e.g., 60, 70+) indicates incredible trend strength and momentum, but it does *not* mean the trend is automatically going to reverse. It means the trend is very strong. While such readings *can* precede reversals or sharp pullbacks due to trend exhaustion, the ADX itself doesn’t provide the reversal signal. You need other tools to identify potential tops or bottoms.

- ADX Can Stay Low Before Big Moves: Sometimes, a market can coil in a tight range with very low ADX (< 20) for an extended period right before a massive breakout and sustained trend. The ADX will only start rising *after* the breakout occurs, meaning you might miss the initial explosive move if waiting solely for ADX confirmation above 20/25.

Best Practices:

- Combine with Other Indicators: Never use ADX in isolation. Combine it with other technical analysis tools that provide different types of information.

- Use price action analysis (candlestick patterns, chart patterns) to identify potential entry/exit points and confirm ADX signals.

- Combine ADX with moving averages to confirm trend direction and potential support/resistance levels. For example, only take ADX-confirmed buy signals if price is above a key moving average.

- Use oscillators like RSI or Stochastic to gauge momentum and identify potential overbought/oversold conditions or divergence, especially when ADX is showing high values.

- Combine ADX with support and resistance levels. A breakout above resistance confirmed by a rising ADX > 25 is more compelling.

- Use it to Filter Trades: ADX is excellent as a filtering tool. Use it to identify *which* markets or assets are currently trending strongly on your desired timeframe, then use other indicators or price action to time your entry within those trending markets. Avoid trend-following strategies in markets where ADX is consistently below 20/25.

- Consider Multiple Timeframes: Look at the ADX on multiple timeframes. A strong trend on a daily chart (high ADX) might be undergoing a pullback or consolidation on an hourly chart (falling ADX). This provides context for short-term movements within a larger trend.

- Always Use Risk Management: Regardless of how strong the ADX indicates a trend is, market conditions can change rapidly. Always use stop losses to protect your capital and manage your position size appropriately based on your risk tolerance and the volatility of the asset.

- Backtest and Paper Trade: Before applying any ADX-based strategy with real capital, backtest it rigorously on historical data and practice it on a paper trading account. See how the indicator performs on the specific assets and timeframes you trade.

By understanding these limitations and adhering to best practices, you can leverage the power of the ADX while minimizing its potential pitfalls. It’s a tool designed to enhance your understanding of the market, not a magic bullet for guaranteed profits.

Beyond the Basics: Applying ADX in Different Market Scenarios

Let’s explore how the ADX can be applied in various market scenarios, bringing together our understanding of its different readings and components. Remember, the goal is to use ADX to gain a clearer perspective on the market’s underlying strength and momentum, complementing other tools.

Scenario 1: Identifying a New Uptrend

Imagine a stock has been trading sideways for weeks, its price oscillating within a narrow range. During this time, the ADX line is likely below 20, perhaps meandering between 10 and 15, indicating a weak or non-existent trend. The +DI and -DI lines might be intertwined, crossing frequently or staying close together.

Suddenly, the stock’s price breaks decisively above the upper boundary of its trading range. At the same time, the +DI line crosses above the -DI line, and crucially, the ADX line starts to hook upward and quickly rises above the 20 or 25 level. This confluence of events – a price breakout, a bullish DI crossover, and a rising ADX confirming increasing strength – provides a high-conviction signal that a new uptrend is likely beginning. This is the environment where you’d consider a long position, perhaps using the breakout level as a reference for stop-loss placement.

Scenario 2: Managing an Existing Downtrend

Suppose you are short an asset that is in a clear downtrend. Price is making lower highs and lower lows. The -DI line is well above the +DI line, confirming the bearish direction. The ADX is high, say above 30 and rising, signaling strong downward momentum.

As the downtrend continues, the ADX eventually starts to fall from its highs, maybe dropping from 45 towards 30. Price might still be moving lower, but the falling ADX tells you the *strength* of the selling pressure is decreasing. This doesn’t mean reverse! But it does suggest the trend might be entering a corrective phase (a bounce higher) or consolidation. You might decide to tighten your stop loss to protect accumulated profits, take partial profits, or become more vigilant for signs of potential reversal on other indicators or price patterns.

Scenario 3: Trading a Range-Bound Market

Consider a currency pair that is trading strictly between defined support and resistance levels. The market isn’t making significant progress in either direction. In this situation, you would expect the ADX line to be consistently below 20. The +DI and -DI lines might crisscross frequently or hover near each other.

When the ADX is below 20, it’s a strong signal that trend-following strategies are likely to fail. Instead, you would look for range-bound strategies: buying near the support level when price bounces, and selling short near the resistance level when price retreats. The low ADX confirms that the market is currently favorable for these types of trades, which focus on anticipating price reversals at the boundaries of the range rather than capitalizing on sustained directional moves.

Understanding how to read the ADX in these varied contexts allows you to adapt your trading approach to the prevailing market conditions. It empowers you to say, “Okay, the ADX tells me this market is currently ranging, so I should use a range strategy,” or “The ADX confirms a strong trend here, so I can be more confident in a trend-following approach.”

When trading different instruments and applying these strategies, the versatility of your trading platform is a real asset. Platforms supporting multiple asset classes and robust charting tools are essential. Finding a platform that suits your needs, whether you’re focusing on Forex, indices, or commodities, is a critical step in your trading journey.

The Power of Confluence: Combining ADX with Other Tools

We’ve emphasized that the ADX should not be used in isolation. Its true power emerges when combined with other technical indicators and analysis techniques. This concept is known as “confluence” – when multiple, independent indicators or analysis methods point to the same conclusion, strengthening the validity of a potential trade signal.

Let’s look at a few examples of how ADX can be used in conjunction with other popular tools:

ADX and Moving Averages:

Moving Averages (MAs) are excellent for identifying the direction of a trend and potential support/resistance. ADX tells you the strength of that trend.

- Strategy: Look for price to be clearly above an important moving average (e.g., 50-period or 200-period MA) for a bullish bias, AND the ADX to be above 25 and rising, confirming the strength of that upward movement. Conversely, look for price below the MA and ADX > 25 and rising for a strong bearish trend.

- Use ADX to filter MA crossover signals: Only consider a bullish MA crossover if the ADX is above 20/25. This helps filter out weak crossovers in choppy markets.

ADX and Oscillators (RSI, Stochastic):

Oscillators are useful for identifying momentum shifts, potential overbought/oversold conditions, and divergence, often in ranging markets or during corrections in trends. ADX clarifies whether the market is trending or ranging.

- Strategy in trending markets: If ADX is above 25 and rising (strong trend), use oscillators to identify potential entry points during pullbacks. For example, in a strong uptrend, wait for price to pull back and RSI to dip towards 40-50 (not necessarily oversold) before re-entering in the direction of the trend, confirmed by the strong ADX.

- Strategy in ranging markets: If ADX is below 20 (weak trend/range), use oscillators to identify overbought/oversold conditions at the boundaries of the range. For example, sell short near resistance when RSI is overbought, confirmed by the low ADX indicating range-bound conditions are likely to persist.

- Use ADX to confirm oscillator divergence: If you spot bullish divergence on RSI (price makes lower low, RSI makes higher low), but ADX is high and rising (strong downtrend), be very cautious. The ADX suggests the trend strength is still dominant, and the divergence might fail. However, if ADX is falling from high levels or is already low when the divergence appears, it adds weight to the potential for a trend change or significant retracement.

ADX and Chart Patterns / Price Action:

Chart patterns (like flags, pennants, triangles) and specific price action signals (like engulfing bars, pin bars) provide context and potential entry/exit signals. ADX confirms the strength of the environment in which these patterns or signals occur.

- Strategy: A bullish flag pattern appearing after a strong uptrend, combined with a rising ADX above 25 as price breaks out of the flag formation, is a powerful continuation signal.

- Use ADX to confirm breakout patterns: As discussed earlier, a breakout from a consolidation pattern (like a triangle) is significantly more reliable if the ADX is simultaneously rising from below 20 to above 25.

By seeking confluence, you build stronger cases for your trades. ADX provides the crucial context of *strength*, helping you decide whether to trust directional signals from other indicators or price action, or whether the market environment is better suited for non-trending strategies.

Integrating ADX into Your Trading Plan

Successfully using the ADX indicator isn’t just about knowing how to read the lines; it’s about integrating its insights into your overall trading plan. A trading plan is your roadmap, outlining your approach, rules, and risk management procedures. The ADX can play a vital role in several aspects of this plan:

1. Market Selection and Filtering:

Use ADX on your watchlist of potential assets to quickly identify which markets are currently exhibiting strong trends on your preferred trading timeframe. If you are a trend follower, you can filter out assets with ADX below 20, focusing your analysis effort on those with rising or high ADX readings. If you prefer range trading, you’d look for assets with consistently low ADX.

2. Entry Rules:

Define clear entry rules that incorporate the ADX. For example:

- “Enter a long position only if price breaks above resistance, +DI is above -DI, AND the ADX is above 25.”

- “Enter a short position on a bearish engulfing bar only if price is below the 20-period moving average AND the ADX is above 20.”

- “Enter a range-bound buy near support only if ADX is below 20.”

Having specific criteria involving ADX helps remove subjectivity from your entry decisions.

3. Position Sizing:

Adjust your position size based on trend strength indicated by ADX. While always adhering to your core risk management principles (e.g., risking no more than 1-2% of capital per trade), you might allocate slightly larger positions to trades that are strongly confirmed by a high and rising ADX in the direction of a clear trend, compared to trades taken in less certain conditions.

4. Stop Loss Placement and Management:

While ADX doesn’t give precise stop levels, its insights into momentum can help inform stop management. In strong trends (high ADX), you might use wider stops or trailing stops based on volatility (like ATR, which is related to TR from the ADX calculation) to give the trade room to breathe. As ADX starts falling, signaling waning momentum, you might tighten your stops or move them to breakeven sooner to protect profits from a potential retracement or range formation.

5. Exit Strategy:

ADX can contribute to exit decisions. A falling ADX from high levels, especially combined with divergence or other reversal signals from other indicators, can be a prompt to take profits or exit a position, even if price hasn’t reversed yet. Conversely, a high and rising ADX encourages you to stay in a profitable trend trade and avoid premature exits.

6. Performance Evaluation:

When reviewing your past trades, analyze the ADX behavior around your entry and exit points. Did trades taken in markets with high ADX perform better? Did trades taken when ADX was low result in whipsaws? This analysis helps you refine your ADX usage and identify which scenarios it is most effective in for your particular trading style and the assets you trade.

Integrating ADX systematically into your trading plan ensures you are using it consistently and objectively. It transforms the indicator from just a line on a chart into a functional component of your decision-making process.

If your plan involves trading Forex or CFDs, selecting a broker with robust platforms and a commitment to client support can significantly enhance your trading experience. Consider factors like regulatory compliance, range of instruments, execution speed, and customer service. Moneta Markets, regulated by entities like FSCA, ASIC, and FSA, offers these features along with services like funds segregated in trust accounts and 24/7 support, which are key considerations for traders globally.

Practical Tips and Common Pitfalls

As you begin incorporating the ADX into your analysis, keep these practical tips in mind and be aware of common pitfalls traders encounter.

Practical Tips:

- Default Settings Are a Good Start: The 14-period setting is standard for a reason; it’s a well-tested balance. Begin with this setting before experimenting with others.

- Observe ADX Behavior on Different Assets: The “typical” high and low ADX values can vary slightly depending on the volatility and nature of the asset class. Pay attention to how ADX behaves on stocks versus Forex pairs versus commodities, for example.

- Focus on the Slope: More than the absolute value (unless it’s below 20/25), pay close attention to the *slope* of the ADX line. Is it clearly rising (increasing strength) or falling (decreasing strength)? The direction of the slope is often more immediately informative than the exact number (once above 25).

- Use It for Confirmation, Not Prediction: ADX is best used to confirm the presence and strength of a trend, not to predict that a trend is about to start or end.

- Visually Separate the Lines: Ensure your trading platform clearly displays the ADX, +DI, and -DI lines in different colors so you can easily distinguish their movements and relationships.

Common Pitfalls to Avoid:

- Trading Crossovers Below ADX 20/25: This is one of the most frequent mistakes. Trading +DI/-DI crossovers when ADX is low is likely to result in false signals and whipsaw losses. Wait for ADX confirmation.

- Using ADX for Overbought/Oversold: High ADX means strong trend, *not* necessarily overbought. A strong uptrend can continue for a long time with a high ADX. Don’t exit a profitable trend trade simply because ADX is high; wait for other signals of weakness or reversal.

- Ignoring ADX in Ranging Markets: Just because you are not trend following doesn’t mean ADX is useless. A consistently low ADX confirms that range-bound strategies are appropriate and signals to avoid trend-following entries.

- Over-Optimizing the Period Setting: While adjusting the period can be beneficial, don’t spend excessive time trying to find a “perfect” setting through aggressive optimization. Minor variations are unlikely to drastically improve results, and overly optimized settings can fail in different market conditions. Stick close to the standard or slightly shorter/longer variations (e.g., 10-20 periods).

- Getting Caught Up in the Calculation Details: You don’t need to recalculate ADX every period. Understand the concept, trust your platform, and focus on interpreting the lines.

By being mindful of these points, you can enhance your effectiveness with the ADX and avoid some common pitfalls that lead to frustration and trading losses.

Conclusion: Leveraging ADX for Confident Trading

As we conclude our deep dive into the Average Directional Index, we hope you feel more confident in your ability to read and interpret this powerful technical indicator. The ADX is not just another line on your chart; it is a sophisticated tool designed to quantify the strength of market trends, providing a vital piece of information that many other indicators miss.

We’ve learned that the ADX line itself measures *strength*, with values above 25 indicating a strong trend and values below 20/25 signaling a weak or ranging market. We’ve also seen how the +DI and -DI lines indicate the dominant *direction* of the directional movement, with crossovers providing potential signals that are ideally confirmed by a strong ADX reading.

Integrating ADX into your trading strategy allows you to filter out weaker signals, gain confidence in trading strong trends, manage existing positions based on momentum shifts, and adapt your approach based on whether the market is trending or ranging. Whether you’re identifying new trend beginnings, managing ongoing trades, or confirming breakouts, the ADX provides valuable context.

Remember its limitations: ADX is a lagging indicator, doesn’t predict direction on its own, and can produce false signals in choppy markets if not used correctly. Its power lies in confluence – using it alongside price action, moving averages, oscillators, and solid risk management practices.

Ultimately, mastering the ADX indicator is another step in your journey towards becoming a more skilled and adaptable trader. It empowers you to look beyond simple price movements and understand the underlying force driving the market. By consistently applying what you’ve learned about reading the ADX, backtesting your strategies, and always prioritizing risk management, you can enhance your trading performance and navigate the financial markets with greater clarity and confidence.

Keep practicing, keep learning, and may the trend strength be with you!

how to read adx indicator FAQ

Q:What does the ADX measure?

A:The ADX measures the strength of a trend without indicating its direction.

Q:When should I consider buying or selling based on the ADX?

A:Consider buying when the +DI is above the -DI and the ADX is above 20. Consider selling when the -DI is above the +DI under similar conditions.

Q:What ADX value indicates a strong trend?

A:An ADX value above 25 indicates a strong trend, while values above 50 indicate a very strong trend.

留言