Answering the Core Question: Do Forex Brokers in Thailand Use Margin Call Systems?

Yes — without exception. Reputable international forex brokers serving clients in Thailand all employ automated margin call mechanisms as a standard component of their trading infrastructure. These systems are not optional add-ons but essential safeguards built into modern trading platforms to manage risk for both traders and brokers.

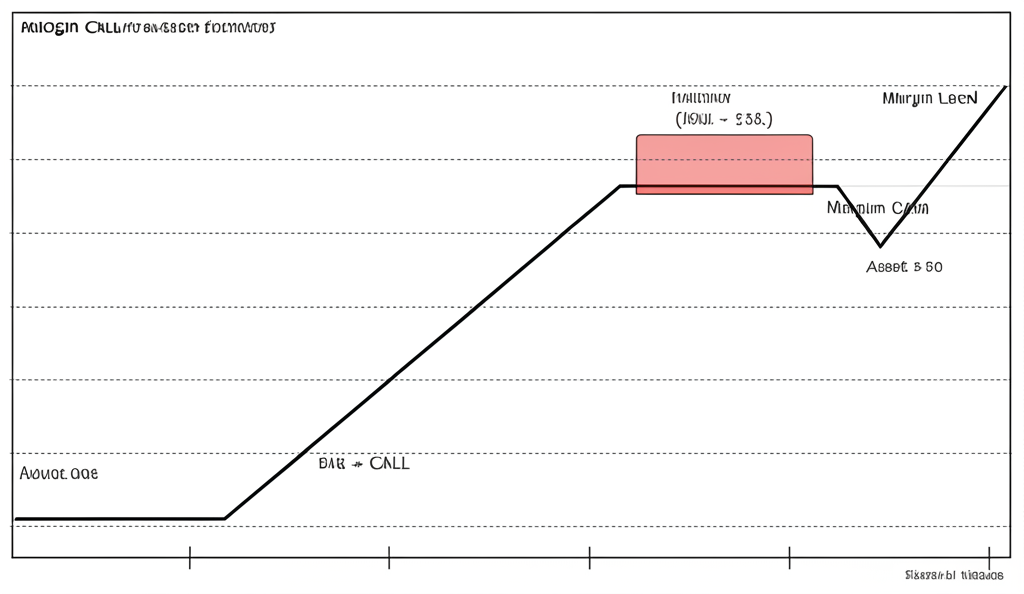

A margin call occurs when your account equity drops below the required maintenance margin for your open positions. It acts as a formal alert, signaling that additional funds may be needed or that positions must be adjusted to avoid forced liquidation. If market movements continue against your positions and equity declines further, the account will reach the stop-out level. At this point, the broker’s system automatically begins closing losing trades — typically starting with the most unprofitable ones — to prevent the account from falling into a negative balance.

While the presence of margin and stop-out systems is universal among regulated brokers, their effectiveness hinges on the specific thresholds used and, more importantly, whether they’re backed by Negative Balance Protection (NBP). This feature ensures that even in extreme market volatility — such as during news spikes or flash crashes — traders cannot lose more than their deposited capital. In essence, NBP transforms trading risk from potentially unlimited to strictly limited, making it the cornerstone of a secure trading environment.

How We Ranked the Best Thai Forex Brokers for US Traders in 2025

When evaluating brokers for US citizens trading from Thailand, we prioritized long-term safety over short-term incentives like sign-up bonuses or promotional spreads. Our ranking methodology focuses on structural reliability, regulatory strength, and the practical execution of risk controls — elements that directly impact your ability to trade with confidence.

The assessment was built around five critical criteria:

- Risk Management Systems: We scrutinized each broker’s margin call and stop-out levels, but placed the greatest emphasis on the availability and enforceability of Negative Balance Protection. Brokers that guarantee NBP across all account types scored highest, as this is the ultimate defense against catastrophic losses.

- Regulatory Oversight: Only brokers licensed by top-tier authorities such as the Australian Securities and Investments Commission (ASIC) or Cyprus Securities and Exchange Commission (CySEC) were considered. These regulators impose strict capital requirements, mandate client fund segregation, and enforce transparent dispute resolution processes — crucial protections for overseas traders.

- Trading Costs: We analyzed real-world trading conditions, including average spreads on major pairs like EUR/USD, commission structures for ECN accounts, and swap rates for overnight holdings. Transparency in pricing was weighted heavily.

- Platform Stability and Tools: A reliable platform is non-negotiable. We evaluated brokers based on their offering of MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both renowned for stability, advanced charting, and compatibility with algorithmic trading strategies.

- Customer Support Accessibility: For US traders navigating time zone differences, responsive multilingual support is vital. We assessed responsiveness, availability (including weekends), and the quality of assistance provided through live chat, email, and phone channels.

The 5 Best Forex Brokers in Thailand for 2025: A Focus on Margin & Risk

Beyond flashy marketing, the true value of a forex broker lies in its risk infrastructure. Below is our curated list of the top five brokers for US traders in Thailand, ranked according to their commitment to capital protection, regulatory compliance, and operational transparency.

1. Moneta Markets: Best Overall for US Traders with Superior Risk Tools

Moneta Markets leads our 2025 rankings due to its exceptional balance of security, user experience, and trader-centric risk policies — making it particularly well-suited for Americans operating from Thailand.

- Risk Management: Moneta Markets stands out with a trader-friendly 80% margin call threshold and a 50% stop-out level, giving clients more breathing room during volatile market swings. More importantly, it offers Negative Balance Protection on every account type, ensuring US traders are shielded from debt in the event of extreme market moves.

- Regulation: Under the oversight of ASIC and South Africa’s Financial Sector Conduct Authority (FSCA), Moneta Markets adheres to rigorous financial standards. This dual-regulation model enhances accountability and instills greater confidence among international clients.

- Platform & Usability: The broker supports both MT4 and MT5, along with its own intuitive web-based platform. Account setup is streamlined for global users, and funding options include wire transfers, credit cards, and e-wallets — all accessible to US-based traders.

- US Trader Focus: With competitive spreads, a low $50 minimum deposit, and clear communication about risk parameters, Moneta Markets has clearly designed its services with expatriate and international traders in mind.

2. Pepperstone: Best for Low Spreads and Fast Execution

Pepperstone has earned a strong reputation among active traders for its ultra-competitive pricing and high-speed order execution — ideal for scalpers and algorithmic systems relying on precision.

- Risk Management: The broker implements a standard margin call at 90% and a 50% stop-out level across MT4 and MT5. Retail clients benefit from Negative Balance Protection, a requirement under its ASIC and FCA licenses, adding a critical layer of financial safety.

- Trading Costs: Pepperstone’s Raw account delivers some of the tightest spreads in the industry, often dipping to 0.0 pips on major pairs, with low commissions. This cost efficiency can significantly boost performance over time, especially for high-frequency traders.

- Regulation: Holding licenses from ASIC, the UK’s Financial Conduct Authority (FCA), and CySEC, Pepperstone operates under multiple jurisdictions, reinforcing its credibility and operational integrity.

3. IC Markets: Top Choice for High-Volume and Algo Traders

IC Markets is a preferred destination for algorithmic traders and those executing large volumes, thanks to its true ECN model and deep liquidity pool.

- Risk Management: It uses a margin call level of 100% and a stop-out at 50%, which is typical for ECN brokers handling high trade volume. Negative Balance Protection is active for retail clients, aligning with its regulatory obligations and protecting against adverse slippage.

- Trading Environment: The Raw Spread account provides direct access to tier-one liquidity providers, enabling spreads as low as 0.0 pips and minimal latency. This environment supports strategies that depend on speed and narrow bid-ask spreads.

- Platform Support: Full compatibility with MT4, MT5, and cTrader gives users flexibility, particularly those running expert advisors (EAs) or custom scripts across different platforms.

4. FP Markets: Excellent for a Diverse Range of Assets

FP Markets delivers a comprehensive trading experience, offering over 10,000 instruments including forex, indices, commodities, and cryptocurrencies — a strong option for US traders looking to diversify.

- Risk Management: Margin calls are triggered at 100% equity-to-margin ratio, with stop-outs at 50%. Retail clients are covered by Negative Balance Protection, consistent with its ASIC and CySEC licensing.

- Asset Diversity: The broad market access allows traders to hedge or spread exposure across asset classes, which can be particularly useful during periods of geopolitical or economic uncertainty.

- Regulation: Regulated by ASIC and CySEC, FP Markets maintains segregated client funds and complies with stringent reporting standards, ensuring a trustworthy trading environment.

5. Vantage: Strong for Social Trading and Beginner-Friendly Features

Vantage appeals to both newcomers and experienced traders, especially those interested in social and copy trading solutions that allow them to mirror successful strategies.

- Risk Management: With a margin call at 80% and stop-out at 50%, Vantage offers early warnings before forced closures. It also provides Negative Balance Protection, an essential safeguard for less experienced traders.

- Social Trading: Integrated with ZuluTrade and Myfxbook Autotrade, Vantage enables seamless copying of top-performing traders, lowering the learning curve for beginners.

- Account Accessibility: A $50 minimum deposit and simple onboarding process make it easy for new traders to get started without significant upfront capital.

Comparison Table: 2025’s Top Forex Brokers in Thailand for US Traders

Use this comparison to evaluate key risk parameters and operational details at a glance.

| Broker | Margin Call Level | Stop Out Level | Negative Balance Protection | Regulation | Minimum Deposit |

|---|---|---|---|---|---|

| Moneta Markets | 80% | 50% | Yes | ASIC, FSCA | $50 |

| Pepperstone | 90% | 50% | Yes | ASIC, FCA, CySEC | $200 |

| IC Markets | 100% | 50% | Yes | ASIC, CySEC | $200 |

| FP Markets | 100% | 50% | Yes | ASIC, CySEC | $100 |

| Vantage | 80% | 50% | Yes | ASIC, CIMA | $50 |

Is Forex Trading Legal in Thailand for Foreigners and US Citizens?

There is no outright ban on individuals engaging in forex trading in Thailand. However, the local regulatory landscape does not currently license or oversee retail forex brokers. The Securities and Exchange Commission (SEC Thailand) and the Bank of Thailand (BOT) focus primarily on domestic financial institutions, equity markets, and anti-fraud enforcement, rather than regulating international margin trading platforms.

As a result, foreign traders — including US citizens — typically use offshore brokers regulated by established authorities such as ASIC, CySEC, or the FCA. These regulators enforce robust client protection rules, including capital adequacy, fund segregation, and dispute resolution mechanisms. Trading with such brokers is widely practiced and considered legally permissible for individuals residing in Thailand, as long as they comply with their home country’s tax and reporting obligations.

A US Trader’s Checklist: 4 Steps to Start Trading Forex in Thailand

Navigating the transition to trading from Thailand doesn’t have to be complex. Follow these steps to ensure a secure and compliant start.

- Verify Risk Policies: Before funding your account, review the broker’s official terms for margin call levels, stop-out thresholds, and confirmation of Negative Balance Protection. Don’t rely solely on promotional material — check the legal documentation.

- Check Regulation: Confirm the broker’s license status on the official website of the regulating body (e.g., ASIC or CySEC). A valid, verifiable license is your best defense against unscrupulous operators.

- Test the Platform: Open a demo account to experience the broker’s interface, order execution speed, and customer service firsthand. This step is invaluable for identifying potential issues before going live.

- Plan Your Funding: Evaluate deposit and withdrawal methods available to US citizens. Consider processing times, fees, and currency conversion costs. Most brokers accept international wire transfers, credit cards, and select e-wallets, but policies can vary.

Conclusion: Making the Right Choice for 2025

While margin call systems are standard across the board, they represent just the starting point of effective risk management. For US traders based in Thailand, the defining factor in broker selection should be the strength of the entire risk framework — particularly the presence of Negative Balance Protection.

Without NBP, a sudden market gap or slippage during high-impact news could leave you owing money to your broker. With it, your maximum loss is capped at your account balance — no exceptions. This single feature transforms trading from a high-stakes gamble into a controlled financial activity.

Among the brokers reviewed, Moneta Markets emerges as the top choice for 2025. Its combination of a conservative 80% margin call level, universal Negative Balance Protection, low entry barrier, and strong ASIC regulation delivers a balanced and secure trading experience tailored to the needs of American expatriates and global traders alike.

Is forex trading legal in Thailand for foreigners in 2025?

Yes, it is generally considered legal for foreigners and US citizens to trade forex in Thailand. While there is no local regulation for retail forex brokers, individuals are free to open accounts with reputable international brokers that are regulated by top-tier authorities in other countries, such as Australia (ASIC) or the UK (FCA).

Is Exness a legal and safe broker to use in Thailand?

Exness is an international broker that accepts clients from Thailand and is regulated by several authorities, including the FCA and CySEC. It is considered a legal option for Thai residents. However, traders should always conduct their own due diligence and compare its features, especially its risk management policies, with other top-tier brokers to find the best fit.

What is the typical margin call level for brokers in Thailand?

Margin call levels vary among brokers but typically range from 80% to 100%. For example, a broker like Moneta Markets sets its margin call at a trader-friendly 80%, giving you a clear warning, while its stop-out is at 50%. It’s crucial to check the specific percentages of any broker you consider, as this directly impacts how much buffer you have before your positions are at risk of automatic closure.

Can I use my US bank account to fund a forex account in Thailand?

Yes, most international brokers serving clients in Thailand allow funding from foreign bank accounts, including those from the US. The most common methods are international wire transfers and credit/debit card payments. Be sure to check with your chosen broker for their specific supported methods and any potential fees from your bank or the broker itself.

Do I need to pay taxes on forex profits in Thailand as a US citizen?

This is a complex issue. As a US citizen, you are generally required to report your worldwide income to the IRS, regardless of where you live. Your tax obligations in Thailand would depend on your residency status and the source of the income. It is highly recommended to consult with a tax professional who is knowledgeable in both US expatriate and Thai tax laws to ensure full compliance.

What is Negative Balance Protection and why is it important?

Negative Balance Protection (NBP) is a crucial safety feature that ensures a trader’s account balance cannot go below zero. If a sudden and extreme market movement causes your losses to exceed your deposit, the broker absorbs the loss. This is arguably the most important risk management tool because it guarantees you can never lose more money than you have in your account, protecting you from unforeseen debt.

Which trading platform is most popular in Thailand, MT4 or MT5?

Both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are extremely popular in Thailand and globally. MT4 is still widely used due to its simplicity and vast library of custom indicators and expert advisors (EAs). MT5 is the more modern version, offering more timeframes, technical indicators, and access to more markets like stocks. Leading brokers, including Moneta Markets, offer both platforms, allowing traders to choose the one that best suits their strategy.

What is the minimum deposit to start forex trading in Thailand?

The minimum deposit varies significantly between brokers. Some brokers allow you to start with as little as $50, while others may require $200 or more. For instance, brokers like Moneta Markets and Vantage offer low entry points around $50, making them highly accessible for traders who want to start with a smaller amount of capital.

留言