What Are Emerging Market Local Currency ETFs?

Emerging Market (EM) Local Currency ETFs offer investors a streamlined way to gain exposure to sovereign and corporate debt issued by governments and companies in developing economies, with the key distinction being that these bonds are denominated in the local currency of the issuing country. Unlike dollar-denominated emerging market bonds, which shield investors from local currency swings, these ETFs directly incorporate the performance of volatile EM currencies into their returns. By pooling investor capital to purchase a diversified portfolio of such bonds—typically government-issued securities from countries across Asia, Latin America, Africa, and Eastern Europe—these funds provide accessible, liquid entry into a complex but potentially rewarding segment of global fixed income.

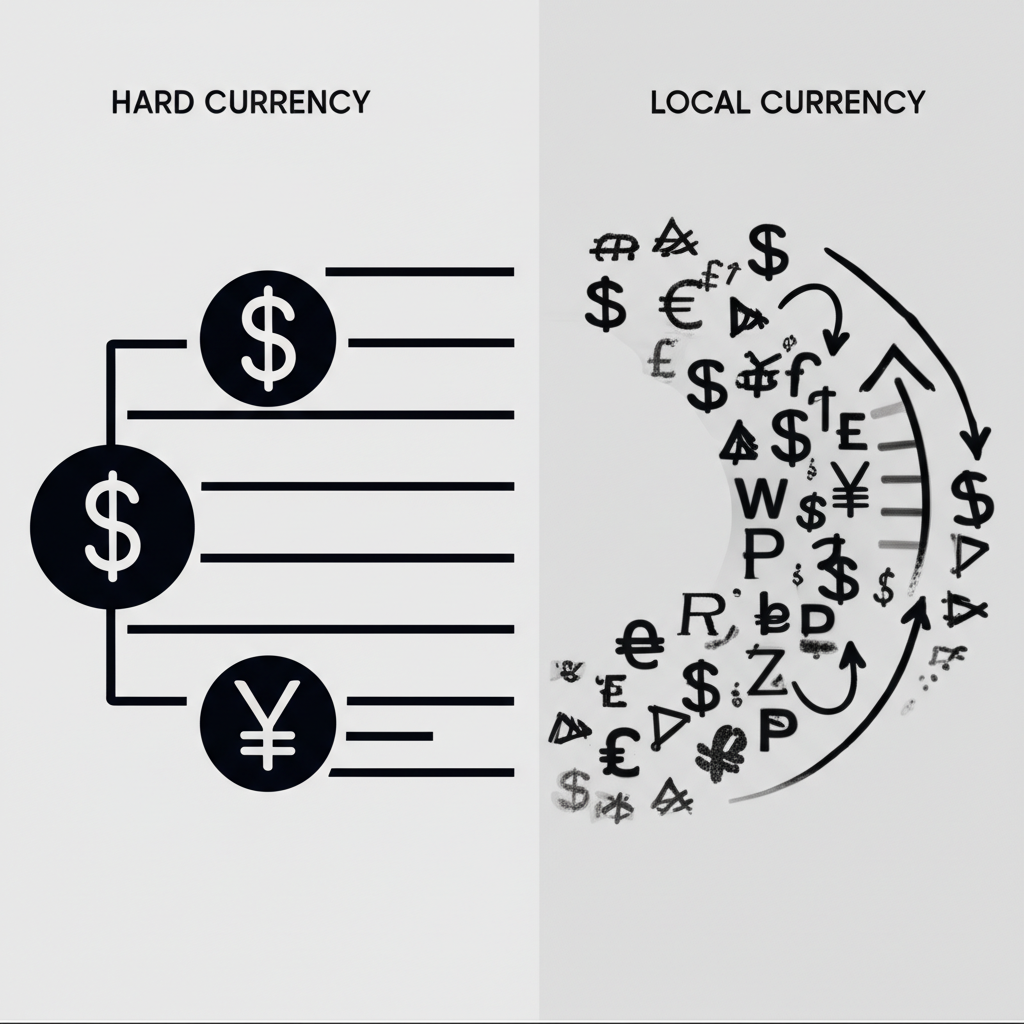

Local vs. Hard Currency Bonds: A Key Distinction

The critical difference between local and hard currency EM bonds lies in currency exposure and its impact on risk and return. Hard currency bonds are usually issued in U.S. dollars or euros, meaning their interest and principal payments are stable in those currencies. This shields investors from exchange rate volatility, making returns primarily a function of credit risk and global interest rate trends. In contrast, local currency bonds expose investors directly to the strength or weakness of the issuing country’s currency. Even if the bond pays a high local interest rate, a sharp decline in that currency against the investor’s home currency can wipe out gains. This added layer of currency risk makes local currency ETFs more complex, but also opens the door to enhanced returns when EM currencies strengthen—offering a dual engine of income and potential appreciation.

Why Invest in Emerging Market Local Currency ETFs? Benefits and Opportunities

For investors looking to expand beyond traditional fixed income markets, Emerging Market Local Currency ETFs present a compelling mix of yield, diversification, and growth potential. While not without risk, their unique characteristics can enhance the strategic depth of a well-balanced portfolio.

* **Diversification:** These ETFs often move independently of U.S. Treasuries and developed market equities, thanks to different economic cycles, monetary policies, and geopolitical dynamics. This low correlation can reduce overall portfolio volatility and provide a buffer during periods of stress in mature markets.

* **Higher Yield Potential:** EM local currency bonds typically offer higher nominal yields than their developed market counterparts. This yield premium reflects the additional risks—currency fluctuations, political uncertainty, and weaker institutions—but for risk-tolerant investors, it can significantly boost income and total returns over time.

* **Exposure to Economic Growth:** Investing in these bonds provides indirect access to the long-term growth trajectories of emerging economies. As countries develop, their financial systems mature, fiscal policies stabilize, and investor confidence grows—factors that can support both bond performance and currency strength.

* **Currency Appreciation Upside:** One of the most distinctive advantages is the potential for capital gains from favorable exchange rate movements. When strong economic fundamentals, improving trade balances, or rising foreign investment drive EM currencies higher, the dollar-denominated returns of these ETFs can be amplified beyond coupon payments alone.

Understanding the Risks: Navigating Emerging Market Local Currency ETFs

Despite their attractive return profile, EM local currency ETFs come with significant risks that demand careful consideration. These are not passive income vehicles; they require active risk awareness and strategic allocation.

* **Currency Volatility:** Exchange rate swings are the dominant risk. Emerging market currencies can be highly sensitive to global sentiment, commodity prices, and domestic policy shifts. A sudden depreciation can erase interest gains, turning a high-yielding bond into a losing investment when converted back to dollars.

* **Interest Rate Risk:** As with all bonds, rising interest rates in emerging economies can reduce the market value of existing fixed-rate bonds. EM central banks may hike rates aggressively to combat inflation or defend their currencies, increasing price volatility in the bond portfolio.

* **Political and Economic Instability:** Governance issues, civil unrest, abrupt policy changes, or geopolitical tensions can trigger capital flight and undermine both bond valuations and currency strength. Countries with weaker institutions are particularly vulnerable during times of stress.

* **Liquidity Risk:** While the ETF structure offers daily liquidity, the underlying bond markets in some EM countries may be thin or illiquid. During periods of market turmoil, this can lead to wider trading spreads and potential pricing inefficiencies, especially for less common issues.

* **Credit Risk:** Although many holdings are government bonds, the risk of default—whether through restructuring or outright non-payment—remains. Diversified ETFs reduce exposure to any single country, but broad-based credit deterioration across regions can still impact performance.

Deep Dive into Currency Dynamics: How FX Impacts Returns

Currency movements are central to the performance of EM local currency ETFs. The income generated—whether coupons or principal repayments—is paid in local currency. When that income is converted into U.S. dollars (or another base currency), the exchange rate at that moment determines its final value. A stronger local currency means more dollars; a weaker one means fewer.

Multiple macroeconomic forces influence the direction and stability of emerging market exchange rates:

* **Interest Rate Differentials:** When EM central banks maintain higher policy rates than developed nations, they attract carry trade investors seeking yield. This capital inflow increases demand for the local currency, supporting its value.

* **Commodity Prices:** For exporters like Brazil, South Africa, or Russia, rising oil, metals, or agricultural prices improve trade balances and generate foreign exchange inflows, often leading to currency appreciation.

* **Balance of Payments Strength:** A country with strong exports, healthy foreign direct investment (FDI), and manageable external debt is more likely to see its currency remain stable or strengthen over time.

* **Inflation Trends:** Persistent inflation undermines a currency’s purchasing power. If inflation outpaces interest rates or central bank credibility is questioned, depreciation often follows.

* **Central Bank Credibility:** Independent and transparent monetary authorities that prioritize price stability foster investor confidence. This institutional strength is a key anchor for currency value.

* **Global Risk Appetite:** During global downturns or financial crises, investors often retreat to safe-haven assets like U.S. Treasuries and the dollar. This “risk-off” environment typically leads to broad-based EM currency selloffs, even in countries with solid fundamentals. As the IMF has noted, shifts in global liquidity and investor sentiment are among the most powerful drivers of capital flows to and from emerging markets.

How to Choose the Best Emerging Market Local Currency ETF

Selecting the right EM local currency ETF involves more than chasing the highest yield. Investors should conduct a thorough evaluation based on several key criteria to ensure alignment with their risk profile and investment goals.

* **Expense Ratio:** Lower fees mean more of the return stays with the investor. Given that these funds are often held for years, even a 10–20 basis point difference in expense ratios can significantly impact long-term performance.

* **Yield and Distribution Frequency:** Examine how the yield is calculated (e.g., 30-day SEC yield) and how often it’s distributed. High yields can be enticing, but they may reflect higher credit or currency risk and should be assessed in context.

* **Portfolio Composition and Credit Quality:** Look under the hood. Which countries dominate the portfolio? What’s the average credit rating? A fund with heavy exposure to lower-rated nations may offer higher yields but also greater volatility and default risk.

* **Duration and Interest Rate Sensitivity:** Duration measures how much a bond fund’s value changes in response to interest rate shifts. A higher duration implies greater sensitivity. Investors should match the ETF’s duration with their outlook on global and local rate trends.

* **Issuer Reputation and Fund Liquidity:** Stick with established asset managers known for transparency and robust risk management. High trading volume and substantial assets under management (AUM) usually mean tighter bid-ask spreads and smoother execution, especially for larger trades.

Top Emerging Market Local Currency ETFs to Consider

Several leading ETFs offer access to this asset class, each with a slightly different approach to indexing and risk management. Understanding their strategies can help investors choose the best fit.

* **VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC):** One of the largest and most widely held, EMLC tracks the J.P. Morgan GBI-EM Global Diversified Index. It provides broad exposure to government bonds denominated in local currencies across a wide range of emerging economies, emphasizing diversification and market representation.

* **iShares J.P. Morgan EM Local Currency Bond ETF (LEMB):** LEMB follows the same benchmark as EMLC, resulting in nearly identical holdings and performance. The primary differences for investors often come down to issuer preference, trading volume, and minor variations in tracking error or expense ratio.

* **WisdomTree Emerging Markets Local Debt Fund (ELD):** ELD takes a more selective approach by tracking a fundamentally weighted index. Instead of allocating by market size, it emphasizes countries with stronger macroeconomic indicators—such as current account surpluses, lower external debt, and higher reserves—aiming to reduce exposure to economically fragile issuers.

* **SPDR Bloomberg Barclays Emerging Markets Local Bond ETF (EBND):** This fund tracks the Bloomberg Barclays EM Local Currency Government Universal Index, offering exposure to a comprehensive universe of local currency sovereign debt. It serves as another solid option for investors seeking broad, market-cap-weighted access.

Comparative Analysis: Performance and Strategic Differences

While EMLC and LEMB offer straightforward, market-cap-weighted exposure, ELD’s fundamental approach introduces a different risk-return profile. For example, during periods when commodity exporters perform well or when debt-saddled nations face pressure, ELD may outperform due to its underweighting of countries with weak external balances.

Alternative weighting methodologies like ELD’s can potentially improve risk-adjusted returns by tilting toward countries with stronger fiscal and monetary discipline. As BlackRock research has suggested, while market-cap indices offer simplicity and liquidity, rules-based strategies that incorporate economic fundamentals may offer better resilience during stress periods by avoiding overexposure to highly leveraged or structurally weak economies.

| Feature | VanEck EMLC | iShares LEMB | WisdomTree ELD | SPDR EBND |

| :—————— | :—————————————- | :—————————————- | :—————————————— | :——————————————– |

| **Index Tracked** | J.P. Morgan GBI-EM Global Diversified | J.P. Morgan GBI-EM Global Diversified | WisdomTree EM Local Debt Index | Bloomberg Barclays EM Local Currency Gov. Universal |

| **Weighting** | Market Cap | Market Cap | Fundamentally Weighted (economic metrics) | Market Cap |

| **Expense Ratio** | Typically around 0.30% – 0.40% | Similar to EMLC | Typically around 0.45% – 0.55% | Typically around 0.30% – 0.40% |

| **Key Differentiator** | Broad, liquid market exposure | Broad, liquid market exposure | Macroeconomic fundamental screening | Broad market access with diverse country exposure |

| **Target Investor** | Broad EM local currency exposure | Broad EM local currency exposure | Risk-aware, fundamentals-focused | Broad EM local currency exposure |

*Note: Expense ratios and performance metrics are subject to change and should be verified with the latest fund data.*

Integrating EM Local Currency ETFs into Your Portfolio

When used thoughtfully, EM local currency ETFs can serve as a strategic component of a diversified investment strategy. They are not core bond holdings for conservative investors, but rather satellite allocations designed to enhance yield and diversification.

* **Portfolio Role:** These ETFs can function as an alternative fixed income sleeve, particularly for investors seeking higher income and willing to accept greater volatility. They can also serve as a tactical bet on emerging market resilience or a weakening U.S. dollar.

* **Correlation Benefits:** Their returns often exhibit low or even negative correlation with U.S. Treasuries and domestic equities, especially during periods of dollar weakness or rising commodity prices. This dynamic can improve overall portfolio efficiency and reduce drawdowns during certain market regimes.

* **Macro Environment Matters:** The timing of entry is crucial. Favorable conditions include a dovish Fed, rising global growth, and strong commodity demand—all of which tend to support EM assets. Conversely, a hawkish U.S. Federal Reserve or rising geopolitical tensions can trigger capital outflows and currency depreciation, creating headwinds.

Scenario Analysis: EM Local Currency ETFs in Different Market Environments

The performance of these ETFs is highly dependent on the global macro backdrop. Understanding how they might behave under different conditions can guide allocation decisions.

* **Strong U.S. Dollar:** A rising dollar typically pressures EM currencies as capital flows back to the U.S. This environment often leads to negative total returns for local currency ETFs, even if local bond yields are high, due to currency losses.

* **Rising Global Inflation:** If inflation climbs, EM central banks may hike faster than their developed market peers, supporting their currencies. While higher rates can depress bond prices in the short term, they may also create attractive entry points for income-focused investors.

* **Commodity Super Cycle:** A sustained rise in oil, copper, or agricultural prices benefits EM exporters. Improved trade balances and foreign exchange inflows can strengthen currencies and boost bond valuations, creating a favorable environment for local currency ETFs.

* **Global Recession vs. Recovery:** During a global downturn, risk-off sentiment leads to EM selloffs. In contrast, a synchronized global recovery often fuels capital inflows into emerging markets, supporting both bond prices and exchange rates.

Tax Implications of Investing in EM Local Currency ETFs

For U.S. investors, the tax treatment of EM local currency ETFs requires careful attention. Interest income distributed by these funds is generally classified as ordinary income and taxed at the investor’s marginal tax rate, not the lower qualified dividend rate.

Additionally, foreign governments may withhold taxes on the interest earned from local bonds. While some ETFs are structured to reclaim or mitigate these withholdings, not all do so effectively. U.S. tax law allows investors to claim a foreign tax credit or deduction for these amounts, but the ability to use the credit depends on the fund’s reporting and the investor’s individual tax situation. Given the complexity, consulting a tax professional is strongly recommended to optimize after-tax returns.

Conclusion: Weighing the Opportunities and Challenges

Emerging Market Local Currency ETFs offer a powerful tool for investors seeking higher yields, geographic diversification, and exposure to the long-term growth of developing economies. The potential for currency appreciation adds a unique return driver not available in hard currency bonds. However, this opportunity comes with heightened risks—currency swings, political uncertainty, and interest rate volatility require a disciplined and informed approach. Success depends on understanding the macroeconomic forces at play, selecting the right fund based on strategy and cost, and integrating these assets in a way that aligns with overall risk tolerance. With careful consideration, EM local currency ETFs can be a valuable addition to a forward-looking investment portfolio.

Frequently Asked Questions (FAQs)

What are the primary differences between emerging market local currency bond ETFs and hard currency bond ETFs?

The main difference lies in the currency denomination. Local currency bond ETFs hold debt issued in the local currency of the emerging market country, exposing investors to currency fluctuations. Hard currency bond ETFs, on the other hand, hold debt typically denominated in major global currencies like the U.S. dollar, largely removing the currency risk component for the investor.

How do emerging market local currency ETFs contribute to portfolio diversification?

These ETFs often have low correlation with developed market bonds and equities. Their performance is driven by a different set of economic cycles, interest rate policies, and currency dynamics in emerging economies, offering a unique source of diversification for a traditional portfolio.

What is the role of currency appreciation potential in the overall returns of an EM local currency ETF?

Currency appreciation is a significant potential driver of returns. If the local currencies of the underlying bonds strengthen against the investor’s base currency, it adds to the total return from interest payments. Conversely, currency depreciation can erode or negate bond yield gains.

Can emerging market local currency ETFs offer better inflation protection compared to developed market bonds?

Potentially. If an emerging market country’s central bank raises interest rates aggressively to combat inflation, it can lead to higher bond yields. Furthermore, if the local currency strengthens due to sound monetary policy, it can help protect purchasing power against inflation. However, uncontrolled inflation can also lead to currency depreciation.

What are the key macroeconomic indicators investors should monitor when considering EM local currency ETFs?

Investors should monitor several indicators, including:

- Interest rate differentials

- Inflation rates

- Current account balances

- Foreign exchange reserves

- Commodity prices (for commodity-exporting nations)

- Political stability and policy predictability

How does political stability in emerging markets impact the performance of these bond funds?

Political stability is crucial. Instability, such as government changes, policy uncertainty, or geopolitical tensions, can lead to capital flight, currency depreciation, and a decline in bond prices, as investors demand higher yields to compensate for increased risk.

What are some of the leading emerging market local currency ETFs available to U.S. investors?

Prominent options include the VanEck J.P. Morgan EM Local Currency Bond ETF (EMLC), iShares J.P. Morgan EM Local Currency Bond ETF (LEMB), WisdomTree Emerging Markets Local Debt Fund (ELD), and SPDR Bloomberg Barclays Emerging Markets Local Bond ETF (EBND).

Is the expense ratio more critical for EM local currency ETFs due to their potentially higher volatility?

Yes, the expense ratio is always critical, but it can be particularly important for funds with higher volatility. Higher expenses directly reduce returns, and in volatile markets, every basis point counts towards preserving capital and maximizing net returns over time.

How should an investor determine the appropriate allocation to emerging market local currency ETFs within their overall investment portfolio?

The appropriate allocation depends on individual risk tolerance, investment horizon, and overall portfolio goals. Given their higher risk and return potential compared to developed market bonds, they typically represent a smaller, strategic allocation within the fixed income portion of a diversified portfolio. A common approach is to consider them as part of a broader “alternative fixed income” bucket.

What are the typical tax implications for U.S. investors holding emerging market local currency ETFs?

For U.S. investors, distributions from these ETFs are generally taxed as ordinary income. There might also be foreign withholding taxes on interest income at the source. U.S. tax law often allows for a foreign tax credit to offset these foreign taxes, but investors should consult with a tax advisor for personalized guidance.

留言