Introduction: Navigating the Complex Landscape of Credit Suisse Financials

Credit Suisse once stood as a pillar of Swiss financial strength, a name synonymous with discretion, stability, and global reach. Over recent years, however, its financial foundations weakened under the weight of internal missteps and external shocks. The culmination of this decline came in 2023 with its emergency acquisition by UBS—a move orchestrated to prevent systemic instability in the global banking system. This pivotal event transformed the way we interpret Credit Suisse’s financial history, turning it from a living institution into a critical case study in risk, resilience, and regulatory intervention. For investors, analysts, and policymakers, dissecting its financial arc is no longer just about understanding a failed strategy; it’s about grasping the vulnerabilities embedded within modern finance. This article provides a comprehensive, analytical deep dive into Credit Suisse’s financial statements, disclosures, and strategic decisions, connecting the dots between operational failures, capital erosion, and the ultimate absorption into a larger entity.

Credit Suisse Official Reports: Annual, Quarterly, and Regulatory Filings

The backbone of any meaningful financial assessment lies in official corporate disclosures. For Credit Suisse, these reports—annual, quarterly, and regulatory—offer the most direct window into its operational health, governance practices, and exposure to risk. Though no longer issued independently, these documents remain essential for tracing the bank’s trajectory and understanding the conditions that led to its downfall. They also serve as foundational inputs for evaluating the integration process now underway within UBS. By examining these filings, stakeholders can reconstruct the timeline of deterioration, analyze the impact of strategic decisions, and assess the transparency and responsiveness of management in the face of mounting challenges.

Decoding the Credit Suisse Annual Reports (2022 & 2021)

The 2022 annual report stands as a somber endpoint—the final full-year statement of a once-proud institution struggling to maintain credibility. It revealed a pre-tax loss of CHF 7.3 billion, a sharp drop in assets under management, and growing concerns over capital resilience, despite a Common Equity Tier 1 (CET1) ratio of 14.1%. This figure, while technically above regulatory minimums, masked deeper issues: declining client confidence, rising funding costs, and the lingering impact of past scandals. In contrast, the 2021 report already signaled deep distress, documenting the fallout from two major crises: the collapse of Greensill Capital and the default of Archegos Capital Management. These events triggered combined losses exceeding CHF 9 billion, forced leadership overhauls, and exposed critical weaknesses in risk oversight. The shift between 2021 and 2022 is telling—not just in the worsening numbers, but in the narrative tone. Where 2021 still projected a path to recovery, 2022 conveyed an institution in retreat, grappling with existential questions.

Current Financial Disclosures: Credit Suisse International Annual Report and Latest Quarterlies

Following the UBS takeover, standalone quarterly updates from Credit Suisse ceased. The bank’s financial activity is now fully integrated into UBS’s reporting cycle. However, certain legal entities, such as those covered under the Credit Suisse International Annual Report, continue to file limited disclosures. These are not strategic overviews but administrative snapshots—often detailing asset transfers, liability settlements, or regulatory compliance for specific jurisdictions. They reflect the mechanics of integration rather than independent performance. For example, recent filings from international branches show reductions in headcount, changes in local capital allocation, and the rebranding or closure of operations. While less prominent, these documents remain valuable for tracking the pace and scope of the wind-down, particularly in markets where legacy structures persist during the multi-year consolidation process.

Accessing Primary Sources: SEC Filings and Investor Archives

For those conducting rigorous analysis, direct access to original filings is indispensable. Historical financial statements, including full annual reports, quarterly results, and detailed regulatory submissions, are now preserved in the archives of UBS’s investor relations portal. This centralized repository ensures continuity for researchers and market participants. Additionally, because Credit Suisse had operations and securities traded in the U.S., it was required to file reports with the Securities and Exchange Commission under the 20-F form for foreign private issuers. These filings, accessible through the SEC’s EDGAR database, offer granular insights into risk factors, segment performance, and executive compensation—details that sometimes exceeded those in public annual reports. The combination of UBS-hosted archives and SEC records forms a complete evidence trail for forensic financial review. UBS Investor Relations now hosts archived Credit Suisse documents, providing a consolidated point of access for historical data.

Core Financial Statements: An In-depth Examination

The true state of a bank is revealed not in press releases or management commentary, but in its core financial statements. The balance sheet, income statement, and cash flow statement collectively form the bedrock of financial analysis. For Credit Suisse, these documents trace a story of erosion—of capital, liquidity, and trust. By dissecting each, we gain a clearer picture of how operational failures translated into financial collapse.

Credit Suisse Balance Sheet: Assets, Liabilities, and Equity Analysis

At its peak, Credit Suisse’s balance sheet reflected the scale of a global financial player, with hundreds of billions in assets ranging from client loans to trading securities. But by 2022, this balance sheet was contracting rapidly. Total assets declined significantly, driven by both client withdrawals and strategic divestitures. On the liability side, customer deposits—a core source of stable funding—eroded, forcing the bank to rely more on wholesale and short-term financing, which increased vulnerability. Shareholder equity, the buffer against losses, was repeatedly depleted by write-downs and restructuring charges. While the CET1 ratio remained above regulatory floors, the quality of that capital came into question. A substantial portion consisted of contingent convertible bonds (CoCos) and other hybrid instruments, which could be written down in times of stress—raising doubts about the bank’s ability to absorb further shocks without state support.

Income Statement: Revenue Streams, Expenses, and Profitability Metrics

The income statement reveals the erosion of profitability. Credit Suisse generated revenue from wealth management, investment banking, and Swiss domestic operations. However, these streams were increasingly overshadowed by extraordinary losses. In 2021 and 2022, provisions for litigation, restructuring costs, and losses from distressed exposures—most notably Archegos—dominated the results. For instance, the CHF 4.7 billion charge from Archegos single-handedly turned a potential profit into a massive loss for the first quarter of 2021. Even in quarters where core operations were stable, the weight of past failures dragged down net income. This pattern of volatile, loss-driven results made it difficult for investors to assess the underlying health of the business, further damaging confidence and making capital raising more expensive.

Cash Flow Statement: Operational, Investing, and Financing Activities

Cash flow is the lifeblood of any financial institution. Credit Suisse’s cash flow statements in the final years showed increasing strain. Operating cash flows, which should reflect the bank’s ability to generate cash from lending and fee-based services, turned negative in key periods. This was a red flag—indicating that core operations were not self-sustaining. The bank increasingly relied on financing activities to plug the gap: issuing debt, drawing on central bank facilities, or raising equity. While such measures provided short-term relief, they signaled deteriorating fundamentals. Moreover, investing activities reflected a shift from expansion to contraction, with the sale of assets to improve liquidity rather than strategic growth. This defensive posture underscored the bank’s loss of strategic initiative.

Key Performance Indicators and Regulatory Capital Framework

Numbers alone tell only part of the story. Key performance indicators and regulatory metrics provide context, allowing for comparison with peers and assessment against industry standards. For Credit Suisse, these metrics painted a consistent picture of underperformance and growing risk.

Essential Financial Ratios and Performance Metrics

A few critical ratios highlight the bank’s struggles:

* **Return on Equity (ROE):** This measure of profitability was persistently negative or near zero in the years leading up to the acquisition, far below industry benchmarks. It indicated that the bank was destroying shareholder value.

* **Cost-to-Income Ratio:** Often exceeding 80%, this ratio revealed deep inefficiencies. Despite multiple restructuring plans, Credit Suisse failed to bring its cost base in line with revenue, limiting its ability to invest in growth or weather downturns.

* **Net Interest Margin (NIM):** While affected by broader interest rate trends, Credit Suisse’s NIM lagged behind peers, reflecting challenges in pricing power and asset quality.

* **Capital Adequacy Ratios (CET1):** While the CET1 ratio remained above regulatory minimums, it was under constant pressure. Market analysts questioned its sustainability, given the potential for further losses and the reliance on less stable forms of capital.

These metrics, taken together, suggested a bank caught in a downward spiral: low profitability, high costs, and eroding capital, all of which contributed to a loss of market confidence.

Credit Suisse Pillar 3 Disclosures and Capital Requirements

Pillar 3 disclosures under the Basel III framework were designed to promote market discipline through transparency. Credit Suisse’s reports provided detailed breakdowns of its risk exposures—credit, market, and operational—as well as the composition of its regulatory capital. These documents were critical for investors and regulators alike, offering insight into the quality of the bank’s assets and the robustness of its risk models. In the final months, FINMA and other regulators closely scrutinized these disclosures, particularly as concerns grew about liquidity coverage and the valuation of illiquid assets. The fact that FINMA had to intervene underscores the limitations of disclosure alone—transparency does not guarantee stability when underlying risks are poorly managed. FINMA’s statements often referenced the capital position of Credit Suisse in the lead-up to the acquisition, highlighting the importance of these disclosures.

Strategic Integration: Credit Suisse Subsidiaries and the UBS Acquisition’s Financial Impact

The UBS acquisition was not merely a change in ownership—it was a structural and financial reset. The integration process involves untangling a global network of subsidiaries, reconciling divergent systems, and redefining business priorities. The financial impact is profound, affecting balance sheet composition, earnings quality, and long-term strategy.

Understanding Credit Suisse AG Subsidiaries and Global Legal Entities

Credit Suisse operated through a complex array of subsidiaries—Credit Suisse AG, Credit Suisse (Schweiz) AG, and numerous international branches and holding companies. Each had its own regulatory obligations, capital requirements, and risk profile. This structure allowed for geographic and operational flexibility but also created opacity. In the integration process, UBS must decide which entities to absorb, which to wind down, and which to sell. Some, particularly in wealth management, are being folded into UBS’s existing infrastructure. Others, especially those tied to high-risk investment banking activities, are being scaled back or liquidated. The legal entity disclosures, once a source of pride in global reach, now serve as a roadmap for deconstruction.

Analyzing the Financial Implications of the UBS Acquisition on Credit Suisse

From an accounting perspective, the acquisition created several immediate effects. UBS acquired Credit Suisse at a nominal price, resulting in negative goodwill—a one-time accounting gain reflecting that the fair value of net assets exceeded the purchase price. This gain, however, is not cash; it is offset by substantial restructuring charges, integration costs, and the expected losses from winding down non-core operations. The combined balance sheet is now one of the largest in the world, raising new questions about systemic risk. UBS has committed to achieving significant cost synergies—estimated at CHF 8 billion annually—by eliminating redundancies. However, realizing these savings while retaining key talent and clients remains a formidable challenge. The 2023 UBS Annual Report will be the first true test of whether the integration is on track, offering detailed disclosures on asset quality, client retention, and synergy progress.

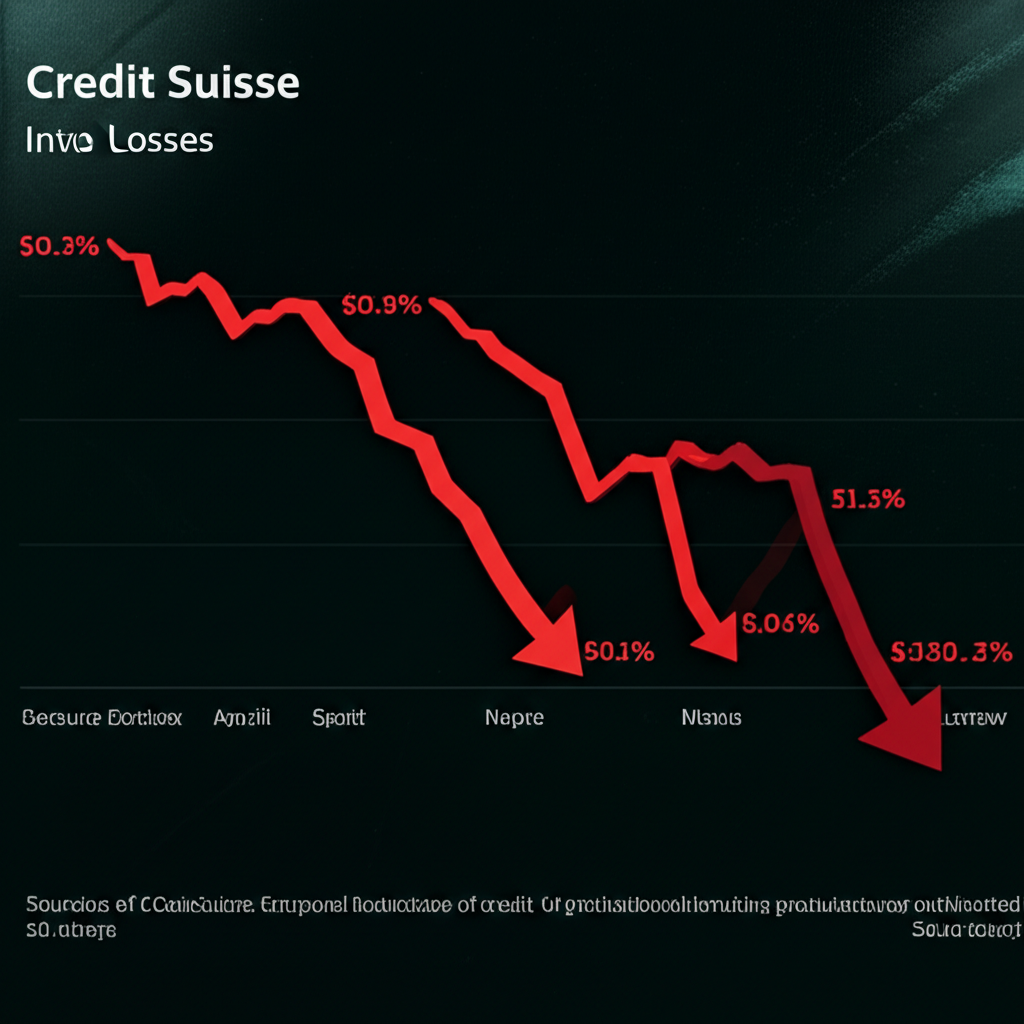

Historical Financial Challenges and Resilience: A Narrative Analysis

The decline of Credit Suisse was not the result of a single event, but a cascade of failures that compounded over time. Each crisis eroded trust, tightened funding, and limited strategic options. The collapse of Greensill Capital in early 2021 was a turning point. Credit Suisse had invested heavily in supply chain finance funds that froze when Greensill failed, leading to a CHF 4.4 billion write-down. This wasn’t just a financial loss—it damaged the bank’s reputation as a prudent investor.

Almost immediately afterward, the Archegos default struck. As a major prime broker, Credit Suisse faced massive margin calls when the family office defaulted, resulting in a CHF 4.7 billion loss in a single quarter. The speed and scale of the loss shocked markets and exposed critical gaps in risk monitoring. These two events alone wiped out years of earnings and triggered a wave of client withdrawals.

Beyond these crises, the bank suffered from chronic strategic drift. Frequent leadership changes and shifting priorities—from global investment banking to wealth management and back—prevented the execution of a coherent long-term plan. Costs remained high, while revenue growth stalled. Even as competitors adapted to low interest rates and digital disruption, Credit Suisse struggled to respond. The result was a steady erosion of market capitalization and investor confidence, culminating in a liquidity crisis that forced the Swiss government to broker the UBS takeover. The Financial Times provided extensive coverage of these events, detailing their financial ramifications.

Future Outlook and Investor Perspective Post-Acquisition

The integration of Credit Suisse into UBS is one of the most complex financial restructurings in recent history. The success of this merger will depend on more than just cost-cutting—it will hinge on cultural alignment, client retention, and regulatory compliance. UBS has positioned the deal as a strategic enhancement, particularly in global wealth management, where the combined entity now holds an even larger share of ultra-high-net-worth clients.

For investors, the focus has shifted from Credit Suisse’s standalone risks to the execution risks of the integration. Key concerns include:

* The ability to realize projected cost synergies without disrupting client service.

* The pace of asset disposals and the financial impact of winding down investment banking operations.

* Potential client attrition, especially among those loyal to the Credit Suisse brand.

* The cultural integration of two large, proud institutions with different operating styles.

The near term will likely be marked by volatility—restructuring charges, balance sheet adjustments, and regulatory scrutiny. But the long-term vision is clear: to create a leaner, more focused, and financially resilient global bank. Success will be measured not just in profits, but in stability and trust regained.

Conclusion: The Evolving Legacy of Credit Suisse’s Financials

The financial history of Credit Suisse is a cautionary tale of how operational failures, poor risk management, and strategic indecision can unravel even the most established institutions. Its annual reports, balance sheets, and regulatory disclosures collectively chart a path from prominence to dissolution. The acquisition by UBS was not a rescue in the traditional sense, but a structural intervention to prevent broader financial contagion.

Today, the legacy of Credit Suisse lives on—not as an independent entity, but as a set of integrated operations, absorbed lessons, and regulatory reforms. For financial professionals, the importance of scrutinizing disclosures, understanding capital frameworks, and assessing qualitative risks has never been clearer. The journey of Credit Suisse reminds us that in banking, reputation and trust are as vital as balance sheet strength—and once lost, they are nearly impossible to regain.

Frequently Asked Questions (FAQs)

What were the primary financial results reported in the Credit Suisse Annual Report 2022?

The Credit Suisse Annual Report 2022 detailed a significant pre-tax loss of CHF 7.3 billion, largely driven by substantial client outflows, provisions for litigation, and restructuring costs. It also reported a decrease in assets under management and a CET1 ratio of 14.1%, reflecting a challenging year for the bank.

How does Credit Suisse’s balance sheet reflect its financial stability before the UBS acquisition?

Prior to the UBS acquisition, Credit Suisse’s balance sheet showed signs of deteriorating financial stability. Key indicators included a reduction in total assets, largely due to client withdrawals and divestitures, and a significant erosion of shareholder equity resulting from sustained losses. While capital ratios generally met regulatory minimums, market confidence in the bank’s long-term stability was severely impacted.

Where can I access the official Credit Suisse International Annual Report?

Following the acquisition, official Credit Suisse reports, including the Credit Suisse International Annual Report, are typically archived and made available through the UBS Investor Relations website. You may need to navigate to the dedicated section for Credit Suisse historical documents.

What are the key differences between Credit Suisse’s quarterly report and its annual report?

A quarterly report provides a snapshot of the bank’s financial performance and position over a three-month period, offering more frequent updates. An annual report, in contrast, covers the entire financial year, providing a more comprehensive and audited overview, including detailed strategic reviews, risk assessments, and corporate governance disclosures. Annual reports typically offer greater depth and context.

Could you elaborate on the financial performance of Credit Suisse AG subsidiaries?

Credit Suisse AG subsidiaries encompassed a wide range of legal entities operating across various regions and business segments (e.g., Swiss banking, wealth management, investment banking). Their individual financial performance varied significantly, contributing to the overall group’s results. In the lead-up to the acquisition, some subsidiaries, particularly in wealth management, maintained relatively stable performance, while others, especially those exposed to investment banking risks, faced challenges. Their financials are now being integrated and consolidated within UBS’s reporting.

What is the significance of the Credit Suisse Pillar 3 report for regulatory compliance?

The Credit Suisse Pillar 3 report was crucial for regulatory compliance under the Basel III framework. It provided detailed public disclosures on the bank’s risk exposures (credit, market, operational) and capital adequacy, allowing market participants to assess its risk profile and capital strength. This transparency was vital for maintaining market discipline and demonstrating adherence to international and national regulatory standards, as overseen by bodies like FINMA.

How did the UBS Annual Report address the integration of Credit Suisse’s financials?

The UBS Annual Report for 2023 and subsequent periods details the consolidated financials, which now include the former Credit Suisse operations. It addresses the integration through reporting on asset and liability consolidation, the recognition of any goodwill or “badwill” from the acquisition, restructuring costs, synergy targets, and the performance of the combined business segments. It provides insights into the strategic rationale and the financial progress of the merger.

What specific financial challenges led to Credit Suisse’s acquisition by UBS?

Credit Suisse faced a confluence of financial challenges that led to its acquisition, including significant losses from scandals like Greensill Capital and Archegos Capital Management, persistent client outflows eroding its asset base, declining profitability, and a loss of market confidence. These issues severely impacted its capital position, liquidity, and overall financial stability, making a standalone recovery increasingly untenable.

What are the expected long-term financial impacts of the Credit Suisse integration into UBS?

The long-term financial impacts for UBS are expected to include enhanced market leadership in global wealth management, a strengthened Swiss banking franchise, and significant cost synergies from operational integration. It also entails the challenge of de-risking Credit Suisse’s former investment banking activities and managing the cultural and operational complexities of merging two large institutions. The aim is to create a more resilient and profitable combined entity.

How can individual investors interpret the complex financials of Credit Suisse?

Individual investors should focus on key metrics such as net income/loss, capital adequacy ratios (CET1), and client asset flows. Reviewing the annual and quarterly reports (now primarily within UBS’s disclosures) for management’s discussion and analysis provides crucial context. Understanding the impact of major events and how they translate into financial figures is also vital. For complex details, consulting primary sources like SEC filings and seeking advice from financial professionals is recommended.

留言