Introduction to Commodities Trading: Why and What

For investors looking to step beyond the conventional mix of stocks and bonds, commodities trading presents a compelling alternative. These physical goods—ranging from crude oil and gold to soybeans and live cattle—form the backbone of global commerce, reacting directly to real-world shifts like weather patterns, political instability, and economic cycles. Unlike financial assets, commodities are tangible, which means their value is closely tied to supply and demand in the real economy. This direct link makes them uniquely positioned to offer inflation protection and diversification benefits. Whether you’re drawn by the potential for high returns or the strategic value of hedging, this guide breaks down the essentials of commodities trading and equips newcomers with the knowledge to enter the market with confidence.

What Are Commodities? Understanding the Basics

At its most basic level, a commodity is a raw material or primary agricultural product that can be bought and sold, with the key feature being interchangeability. A bushel of wheat from one farm is essentially the same as one from another, provided it meets the required quality standards. This standardization allows commodities to be traded efficiently on global exchanges.

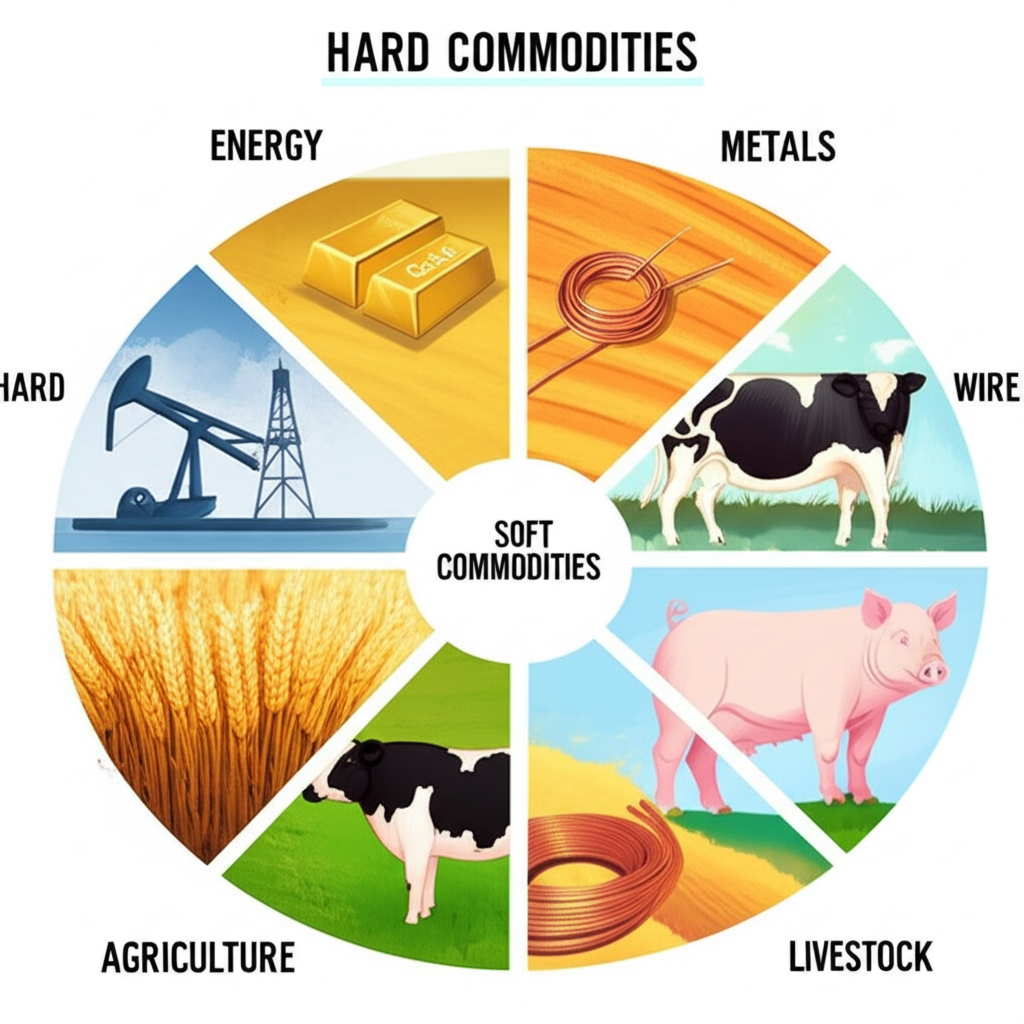

Commodities are typically grouped into four main categories:

* **Energy:** Includes crude oil, natural gas, gasoline, and heating oil. These are vital for energy production, transportation, and industrial operations. Events like geopolitical conflicts or changes in OPEC policy can have immediate and dramatic effects on prices.

* **Metals:**

* **Precious Metals:** Gold, silver, platinum, and palladium. These are valued not only for industrial uses—such as electronics and medical devices—but also as stores of value during times of uncertainty.

* **Industrial Metals:** Copper, aluminum, nickel, and zinc. These are essential for construction, manufacturing, and infrastructure development. Their prices often reflect the health of the global economy.

* **Agricultural Products:** Wheat, corn, soybeans, coffee, sugar, and cotton. These are subject to seasonal cycles and are highly sensitive to weather, making them some of the most volatile assets in the market.

* **Livestock and Meats:** Live cattle, feeder cattle, and lean hogs. These commodities are influenced by feed costs, disease outbreaks, and consumer demand for meat.

Another useful way to classify commodities is by distinguishing between **hard** and **soft** types. Hard commodities are those that are mined or extracted—such as oil, gold, and copper. They tend to be more stable in supply but can be disrupted by geopolitical risks or operational issues. Soft commodities, on the other hand, are grown or raised—like corn, coffee, and cattle. These are more vulnerable to environmental factors such as droughts, floods, or pest infestations, which can cause sudden supply shocks.

Why Trade Commodities? Benefits and Opportunities

There are several strategic reasons why both individual and institutional investors include commodities in their portfolios:

* **Portfolio Diversification:** One of the most significant advantages is the low correlation between commodities and traditional financial assets. When stock markets decline—especially during periods of economic stress—commodities like gold often move in the opposite direction. This inverse relationship can help smooth out portfolio returns and reduce overall volatility.

* **Inflation Hedge:** As inflation rises, the prices of raw materials and goods tend to increase. This means that commodities often retain or even increase their purchasing power during inflationary periods. For example, when the cost of living climbs, so do the prices of oil, metals, and food. Holding commodities can therefore act as a natural buffer against eroding real returns.

* **Profit from Price Volatility:** While volatility is often seen as a risk, it also creates opportunities. Commodity prices can swing sharply due to unexpected events—like a hurricane disrupting oil production or a drought affecting grain yields. Traders who understand these dynamics can position themselves to benefit from such moves.

* **Exposure to Global Economic Trends:** Commodities offer a direct way to participate in the growth of emerging markets. As countries industrialize, their demand for energy, metals, and infrastructure materials surges. This long-term structural shift can drive sustained price increases, creating favorable conditions for traders and investors alike.

How to Trade Commodities: Instruments and Markets

Gaining exposure to commodities doesn’t mean you need to take physical delivery of oil barrels or wheat sacks. Instead, a variety of financial instruments allow investors to speculate on price movements or hedge risk without handling the underlying assets.

Commodity Trading Instruments: Futures, Options, and More

The choice of instrument depends on your experience, risk tolerance, and investment goals. Here’s a breakdown of the most common options:

* **Futures Contracts:** A futures contract is a binding agreement to buy or sell a specific quantity of a commodity at a predetermined price on a set future date. These are standardized and traded on regulated exchanges like the Chicago Mercantile Exchange (CME). Futures offer leverage, meaning a small amount of capital can control a large position. For example, a trader might enter a contract to buy 1,000 barrels of West Texas Intermediate (WTI) crude oil at $80 per barrel six months from now. If the market price rises to $85, the trader profits $5,000; if it drops to $75, they lose the same amount. While the profit potential is high, so is the risk.

* **Options on Futures:** Unlike futures, options give the buyer the right—but not the obligation—to enter a futures contract at a specified price before a certain date. This provides flexibility and limits downside risk to the premium paid. For instance, buying a call option on a gold futures contract allows a trader to benefit from rising prices without being forced to take delivery if prices fall.

* **Commodity Exchange-Traded Funds (ETFs) and Exchange-Traded Notes (ETNs):** These are among the most accessible entry points for beginners. ETFs like SPDR Gold Shares (GLD) or the iShares S&P GSCI Commodity-Indexed Trust (GSG) track the performance of individual commodities or baskets of commodities. They trade like stocks on major exchanges, offering liquidity, transparency, and lower barriers to entry. ETNs function similarly but are debt instruments issued by financial institutions, carrying credit risk but often tracking indexes more precisely.

* **Commodity Stocks:** Investing in companies involved in the extraction, processing, or transportation of commodities—such as ExxonMobil, Freeport-McMoRan, or Bunge—provides indirect exposure. While these stocks tend to move with commodity prices, they’re also influenced by company-specific factors like management performance, debt levels, and operational efficiency.

* **Contracts for Difference (CFDs):** CFDs allow traders to speculate on price changes without owning any underlying asset. They are leveraged products, meaning small price movements can lead to large gains or losses. While popular in some regions, CFDs are not available to retail investors in the U.S. due to regulatory restrictions and their high-risk nature.

| Instrument | Leverage | Risk Level (Beginner) | Ownership of Underlying | Key Benefit |

|---|---|---|---|---|

| Futures | High | High | No (Contract) | Direct exposure, high profit potential |

| Options on Futures | Moderate | Moderate (Limited loss to premium) | No (Right to contract) | Defined risk, flexibility |

| Commodity ETFs/ETNs | Low/None | Low to Moderate | No (Shares in fund) | Diversification, ease of access |

| Commodity Stocks | None | Low to Moderate | Yes (Shares in company) | Indirect exposure, company-specific factors |

Understanding Commodity Market Dynamics

Commodity prices don’t move in isolation. They respond to a complex web of global forces, often in unpredictable ways. Understanding these drivers is essential for making informed trading decisions.

* **Supply and Demand:** The foundation of all price movement. A surplus in supply—such as a record-breaking soybean harvest—can drive prices down. Conversely, a spike in demand—like increased oil consumption in fast-growing economies—can push prices higher.

* **Geopolitical Tensions:** Conflicts in oil-producing regions, trade sanctions, or political instability can disrupt supply chains. For example, tensions in the Middle East often lead to sharp increases in crude oil prices due to fears of supply interruptions.

* **Weather Conditions:** Agricultural commodities are especially vulnerable. Droughts, floods, hurricanes, and unseasonable temperatures can damage crops, reduce yields, and send food prices soaring. Even livestock markets can be affected by extreme weather impacting feed availability.

* **Macroeconomic Indicators:** Data such as GDP growth, employment figures, and central bank interest rate decisions influence investor sentiment. Strong economic growth typically boosts industrial demand for metals and energy, while rising interest rates can strengthen the U.S. dollar, making dollar-denominated commodities more expensive for foreign buyers.

* **Technological Change:** Innovations in renewable energy, battery storage, or precision farming can alter long-term demand. For example, the rise of electric vehicles is increasing demand for lithium and copper while potentially reducing long-term oil consumption.

* **Currency Movements:** Since most commodities are priced in U.S. dollars, exchange rate fluctuations play a critical role. A stronger dollar makes commodities more expensive for buyers using other currencies, potentially reducing global demand and lowering prices.

Getting Started: A Step-by-Step Guide for Beginners

Breaking into commodities trading doesn’t have to be overwhelming. With a structured approach, even those with limited experience can begin building a solid foundation.

Choosing the Right Commodity Trading Platform

The broker you choose will shape your entire trading experience. Key factors to consider include:

* **Regulatory Compliance:** Always verify that the platform is regulated by a recognized authority. In the U.S., futures brokers must be registered with the Commodity Futures Trading Commission (CFTC) and be members of the National Futures Association (NFA).

* **Fees and Commissions:** Compare trading costs across platforms. Some charge per trade, while others offer commission-free ETF trading. Be aware of hidden fees like data subscription charges or inactivity fees.

* **Available Instruments:** Ensure the platform supports the products you want to trade—whether that’s futures, options, ETFs, or stocks.

* **Research and Tools:** Look for platforms that provide real-time quotes, advanced charting, economic calendars, and educational content. These resources are invaluable for beginners learning the ropes.

* **Customer Service:** Responsive support can make a big difference when technical issues arise or when you have questions about account setup.

* **Broker Types:**

* **Full-Service Brokers:** Offer personalized advice, portfolio management, and in-depth research, but typically charge higher fees.

* **Discount Brokers:** Focus on low-cost trade execution and self-directed investing. Platforms like E*TRADE, TD Ameritrade, and Interactive Brokers fall into this category and are popular among retail traders.

Opening and Funding Your Trading Account

Once you’ve selected a broker, the next step is setting up your account:

1. **Application:** Complete an online form with personal details, employment information, and investment objectives. You’ll also be asked about your trading experience and risk tolerance.

2. **Verification:** Submit government-issued ID and proof of address to meet Know Your Customer (KYC) requirements. This process ensures compliance with anti-money laundering regulations.

3. **Funding:** After approval, deposit funds via bank transfer (ACH or wire), debit card, or electronic payment systems. Be mindful of minimum deposit requirements, which vary by broker.

Before depositing any money, conduct due diligence. Check the broker’s regulatory status on the NFA’s BASIC database, read customer reviews, and ensure the platform uses strong security measures like two-factor authentication.

A Practical Commodity Trading Example

Let’s walk through how a beginner might engage in commodity trading using a simple, low-risk approach.

**Scenario:** Maria, a new investor, wants to benefit from rising gold prices driven by increasing inflation concerns, but she’s not ready to trade futures.

**Steps:**

1. **Research:** She explores gold-related investment vehicles and settles on GLD (SPDR Gold Shares), one of the largest and most liquid gold ETFs. She reviews its expense ratio, trading volume, and how closely it tracks the spot price of gold.

2. **Broker Selection:** She chooses a discount broker that offers commission-free ETF trading and has a user-friendly platform with educational tools.

3. **Account Setup:** Maria opens an account, verifies her identity, and deposits $5,000.

4. **Trade Execution:**

* GLD is trading at $180 per share. She decides to buy 10 shares.

* She places a limit order to buy at $180 or lower to avoid slippage.

* The order fills, and she now holds $1,800 worth of GLD.

5. **Monitoring:** She follows inflation data, Federal Reserve announcements, and geopolitical news that could impact gold.

6. **Outcome 1 (Profit):** Two months later, inflation rises faster than expected, and gold climbs to $195. Maria sells her shares for $1,950, realizing a $150 gain.

7. **Outcome 2 (Loss):** If gold drops to $170 due to stronger-than-expected economic data, she might sell to limit her loss to $100.

This approach allows Maria to participate in the commodity market with controlled risk, no leverage, and no need to understand the complexities of futures contracts.

Commodity Trading Strategies and Risk Management

Entering the market is just the beginning. Long-term success depends on a clear strategy and disciplined risk control.

Basic Commodity Trading Strategies for Beginners

* **Fundamental Analysis:** This involves studying the underlying forces that affect supply and demand. For example, a trader might analyze USDA crop reports for corn or EIA energy data for crude oil. Following economic calendars and central bank statements also falls under this approach.

* **Technical Analysis:** By examining historical price charts and trading volume, traders look for patterns that suggest future price movements. Tools like moving averages, RSI (Relative Strength Index), and support/resistance levels help identify entry and exit points. While it requires practice, even basic chart reading can improve decision-making.

* **Trend Following:** One of the simplest strategies—buy when prices are rising, sell when they’re falling. For instance, if crude oil has been in a steady uptrend for several weeks, a trend follower might enter a long position.

* **Momentum Trading:** This focuses on commodities showing strong recent price movements. Traders look for assets breaking out of consolidation patterns or hitting new highs, assuming the momentum will continue in the short term.

* **Arbitrage (Advanced):** This involves exploiting price differences of the same commodity across different markets or contract months. It requires fast execution and is generally not suitable for beginners.

For those just starting out, the best approach is to start small, focus on one or two commodities, and use instruments like ETFs to limit complexity. Building knowledge gradually is more effective than trying to master everything at once.

Essential Risk Management in Commodity Trading

Given the inherent volatility of commodity markets, risk management isn’t optional—it’s essential.

* **Stop-Loss Orders:** Automatically close a position if the price moves against you by a certain amount. For example, if you buy GLD at $180, setting a stop-loss at $175 limits your downside to 2.8%.

* **Position Sizing:** Never risk more than 1–2% of your total trading capital on a single trade. This ensures that even a losing trade won’t significantly damage your account.

* **Diversification:** Spread your exposure across different commodity sectors—energy, metals, agriculture—to reduce the impact of a downturn in any one area.

* **Leverage Caution:** While futures and CFDs offer high leverage, they can quickly amplify losses. Beginners should avoid or use leverage sparingly until they have more experience.

* **Continuous Education:** Markets evolve. Stay informed by reading financial news, attending webinars, and reviewing economic reports from sources like the EIA, USDA, and central banks.

The Regulatory Landscape and Investor Protection

Understanding CFTC and NFA Roles

In the United States, the integrity of the commodity markets is safeguarded by two key regulatory bodies:

* **Commodity Futures Trading Commission (CFTC):** Established in 1974, the CFTC is an independent federal agency tasked with regulating the derivatives markets. Its mission is to ensure market transparency, prevent fraud and manipulation, and protect market participants. It oversees futures exchanges, clearinghouses, and brokerage firms. According to the CFTC’s official mission statement, it also aims to “promote the integrity, resilience, and vibrancy of the U.S. derivatives markets.”

* **National Futures Association (NFA):** As a self-regulatory organization authorized by the CFTC, the NFA enforces compliance among futures professionals. All firms and individuals dealing in futures must be NFA members. The NFA conducts audits, investigates misconduct, and maintains the BASIC database, which allows the public to check a firm’s registration and disciplinary history. As noted on the NFA’s “About NFA” page, it plays a critical role in protecting investor interests.

Together, these agencies:

* Register and license brokers and traders.

* Enforce rules on fair trading and financial responsibility.

* Monitor for market manipulation.

* Offer dispute resolution services.

* Provide educational resources to help investors make informed decisions.

**Avoiding Scams:** Be cautious of offers promising guaranteed returns, high-pressure sales tactics, or “get rich quick” schemes. Always verify a broker’s registration through the NFA BASIC system before opening an account.

Conclusion: Your Journey into Commodity Trading

Commodities trading offers a powerful way to diversify your portfolio, hedge against inflation, and capitalize on global economic trends. Whether you’re drawn to the stability of gold, the energy of crude oil, or the growth potential of industrial metals, the market offers something for every investor. But success doesn’t come from speculation alone—it comes from preparation, education, and disciplined risk management.

Begin by mastering the fundamentals: understand what commodities are, how they’re categorized, and what drives their prices. Start with beginner-friendly instruments like ETFs to gain exposure without the complexity of futures. Choose a regulated broker, open your account carefully, and practice with small positions. Use tools like stop-loss orders and position sizing to protect your capital. Most importantly, commit to lifelong learning—read market reports, follow economic indicators, and stay updated on global events.

By taking a thoughtful, step-by-step approach, you can build a solid foundation for long-term success in the dynamic world of commodities trading.

Frequently Asked Questions (FAQs)

How do beginners start commodity trading with limited capital?

Beginners with limited capital should typically start with commodity ETFs (Exchange-Traded Funds) or ETNs (Exchange-Traded Notes). These instruments allow you to gain exposure to commodity prices without directly trading high-leverage futures contracts. They are traded like stocks, often with lower minimum investments and the ability to buy fractional shares on some platforms.

What are the main differences between trading commodities and stocks?

The main differences lie in the underlying assets and their price drivers:

- Underlying Asset: Stocks represent ownership in a company, while commodities are raw materials.

- Price Drivers: Stock prices are influenced by company earnings, industry trends, and economic outlook. Commodity prices are primarily driven by global supply and demand, geopolitical events, weather, and currency fluctuations.

- Leverage: Commodity trading, especially futures, often involves higher leverage than stock trading, magnifying both potential gains and losses.

- Diversification: Commodities often have a low correlation with stocks, making them a good tool for portfolio diversification.

Can I trade commodities on platforms like Robinhood?

While Robinhood primarily focuses on stock and options trading, it does offer access to some commodity-related ETFs (e.g., gold ETFs, oil ETFs). However, it generally does not offer direct access to commodity futures or options on futures contracts. For direct commodity futures trading, you would need a specialized futures broker.

What are the most volatile commodities to trade, and which are safest for beginners?

Most volatile: Energy commodities (like crude oil and natural gas) and some agricultural commodities (due to weather dependency) can be highly volatile.

Safest for beginners: There isn’t a truly “safe” commodity, but for beginners, accessing commodities through ETFs that track broad indices (e.g., a diversified commodity ETF) or precious metals (like gold ETFs) might be considered relatively less volatile than individual futures contracts due to inherent diversification or stable demand, respectively. Diversified ETFs are generally recommended for their ease of access and reduced direct exposure risk.

How does leverage work in commodity trading, and what are its risks?

Leverage allows you to control a large position in a commodity with a relatively small amount of capital (margin). For example, with 10:1 leverage, $1,000 of your capital can control $10,000 worth of a commodity contract. The primary risk is that while leverage can amplify profits, it also significantly amplifies losses. A small adverse price movement can quickly wipe out your initial margin, leading to margin calls or even losses exceeding your initial investment.

What resources are available for continuous learning in commodity trading?

Many resources are available for continuous learning:

- Brokerage Platforms: Many offer educational modules, webinars, and research reports.

- Financial News Outlets: Reputable sources like Bloomberg, Reuters, The Wall Street Journal, and Financial Times provide daily market analysis.

- Regulatory Bodies: The CFTC and NFA websites offer investor education materials and warnings about scams.

- Books and Online Courses: Numerous books on commodity trading, technical analysis, and fundamental analysis are available, as are structured online courses from educational platforms.

- Economic Reports: Regularly review reports from the EIA (Energy Information Administration), USDA (U.S. Department of Agriculture), and global central banks.

Is commodity trading taxable, and how is it reported?

Yes, gains from commodity trading are generally taxable. In the US, profits from futures contracts are often taxed under Section 1256 contracts, which receive favorable tax treatment (60% long-term capital gains, 40% short-term capital gains), regardless of how long the contract was held. However, trading commodity ETFs or stocks of commodity companies are typically taxed under standard capital gains rules (short-term for assets held less than a year, long-term for assets held longer). It’s crucial to consult with a tax professional for personalized advice, as tax rules can be complex and vary by jurisdiction and instrument.

Which commodities are typically recommended for beginners to start with?

For beginners, it’s often recommended to start with commodities that are relatively easier to understand and have accessible trading instruments, such as:

- Gold: Often seen as a safe-haven asset, its drivers (inflation, geopolitical risk) are relatively straightforward. Accessible via ETFs.

- Broad Commodity Indices: ETFs that track a diversified basket of commodities can offer exposure with built-in diversification, reducing reliance on a single commodity’s performance.

Avoid highly volatile or complex commodities like natural gas futures until you have more experience.

留言