Introduction: Understanding the Brexit Mandate and Its Economic Context

The United Kingdom’s departure from the European Union—commonly referred to as Brexit—stands as one of the most consequential geopolitical and economic shifts of the 21st century. The decision, confirmed by a national referendum in June 2016 with 51.9% voting to leave, set in motion a complex and protracted process that culminated in the UK formally exiting the EU on January 31, 2020. A transition period followed, ending on December 31 of that year, after which new trade and regulatory arrangements took effect. This historic pivot not only redefined the UK’s relationship with its largest economic partner but also sent shockwaves through global financial markets. The British Pound plunged, investor confidence wavered, and businesses scrambled to adapt. Driven by concerns over sovereignty, immigration control, and regulatory independence, the Brexit mandate carried profound economic consequences that continue to unfold. This article offers a detailed, data-driven exploration of how Brexit has reshaped financial markets, altered macroeconomic fundamentals, and created both challenges and opportunities for investors and industries alike.

The Immediate Market Fallout: 2016 Referendum to Transition Period

In the immediate aftermath of the 2016 referendum, global markets reacted with alarm. Stock indices tumbled, credit spreads widened, and volatility spiked across asset classes. The shock stemmed largely from the unexpected outcome; most polls and financial analysts had anticipated a “Remain” victory, leaving markets unprepared for the uncertainty that followed. The UK’s decision to sever ties with the world’s largest trading bloc introduced a host of unknowns: Would trade be disrupted? How would financial services operate across borders? What would happen to supply chains and labor mobility? These questions triggered a flight to safety, with investors pulling back from riskier assets and reevaluating exposure to UK-linked securities. The period between the referendum and the formal exit was marked by political turbulence, stalled negotiations, and recurring bouts of market jitters—each new development capable of reigniting volatility. This environment of prolonged uncertainty discouraged long-term business investment, dampened consumer spending, and set the tone for a decade of economic recalibration.

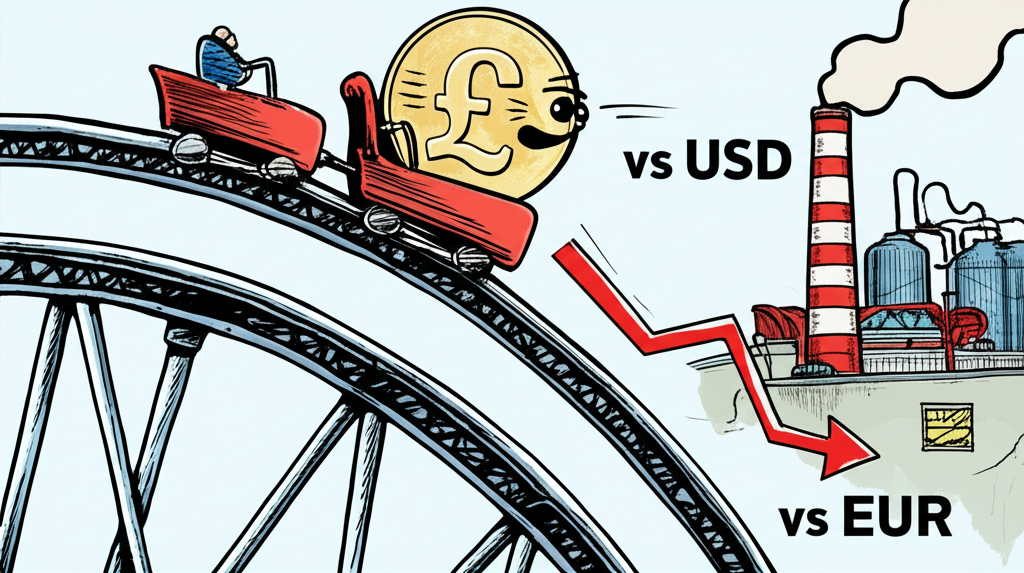

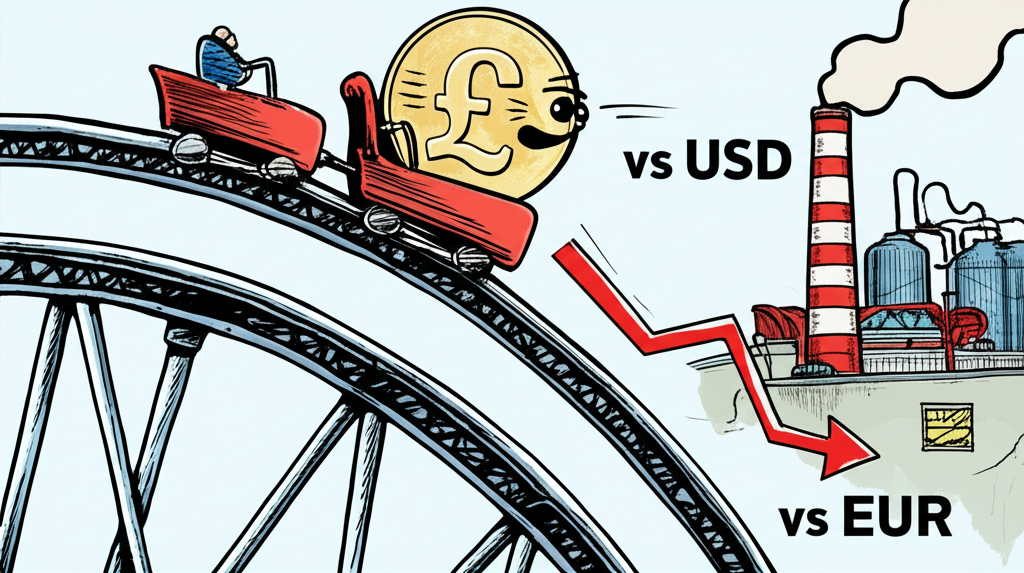

Sterling’s Volatile Journey: The Impact on Exchange Rates

The British Pound bore the brunt of the initial market reaction, suffering its most dramatic single-day decline in over three decades. On June 24, 2016, the GBP/USD exchange rate plummeted by nearly 10%, briefly touching $1.32—a level not seen since 1985. Against the Euro, the drop was around 8%, reflecting widespread concern about the UK’s economic resilience outside the EU. This depreciation was driven by a confluence of factors: fears of reduced foreign investment, the potential for trade barriers, and the erosion of the UK’s attractiveness as a business hub.

Sterling’s struggles did not end there. Over the following years, the currency remained highly sensitive to political headlines, negotiation milestones, and economic data. Each twist in the Brexit saga—from Theresa May’s failed deal to Boris Johnson’s hardline stance—triggered fresh swings in exchange rates. While a weaker pound boosted the competitiveness of UK exports by making them cheaper abroad, it also had a darker side. Import costs rose sharply, particularly for goods and raw materials priced in foreign currencies. This directly fed into inflation, squeezing household budgets and increasing production costs for manufacturers reliant on overseas inputs.

The dual-edged nature of currency depreciation became a defining feature of the post-Brexit economy. While multinational exporters gained a temporary edge, domestic industries and consumers paid the price through higher prices and supply chain strain.

**Table 1: GBP Exchange Rate Performance (Illustrative Percentage Change Post-Referendum)**

| Currency Pair | Immediate Post-Referendum Drop (Approx.) | Long-term Trend (Volatility) |

| :———— | :————————————— | :————————– |

| GBP/USD | -10% | Continued fluctuations |

| GBP/EUR | -8% | Continued fluctuations |

UK Stock Market Performance: FTSE 100 vs. FTSE 250

The UK stock market’s response to Brexit was far from uniform, revealing a stark divergence between different segments of the economy. The FTSE 100, composed of the UK’s largest publicly traded companies—many of which generate the majority of their revenue overseas—initially dipped but quickly recovered. By late 2016, it had not only rebounded but reached record highs. This resilience was fueled by two key dynamics: first, the depreciation of the pound amplified the value of foreign earnings when converted back into sterling. Second, many FTSE 100 firms operate in global industries such as mining, energy, and pharmaceuticals, insulating them from domestic economic headwinds.

In contrast, the FTSE 250, which tracks mid-sized companies with stronger domestic exposure, painted a bleaker picture. These firms are deeply embedded in the UK economy, relying on local consumer spending, domestic supply chains, and intra-EU trade. As uncertainty persisted and trade frictions mounted, their performance lagged significantly. Investor sentiment toward domestically focused equities soured, reflecting concerns about reduced demand, rising input costs, and regulatory complexity.

This split performance underscored a broader truth: Brexit’s economic impact was not evenly distributed. While global giants weathered the storm, smaller and domestically oriented businesses faced a more challenging environment, one that would shape investment strategies for years to come.

Macroeconomic Shifts: Brexit’s Influence on the UK Economy

Beyond the turbulence of financial markets, Brexit has left a lasting imprint on the UK’s macroeconomic foundation. The shift in trade relationships, labor mobility, and regulatory alignment has influenced core economic indicators, from GDP growth and productivity to inflation and investment. Unlike short-term market reactions, these changes reflect structural adjustments with long-term consequences.

GDP Growth and Economic Productivity

Multiple independent analyses have concluded that Brexit has weighed on the UK’s economic growth trajectory. The Office for Budget Responsibility (OBR), the UK’s non-partisan fiscal watchdog, has consistently projected that leaving the EU will reduce the nation’s long-term productivity by around 4% compared to a scenario in which the UK remained a member. This forecast, reiterated in its March 2023 Economic and Fiscal Outlook, attributes the drag to lower trade intensity, reduced business investment, and constraints on labor supply (Source: OBR).

The implications are clear: slower productivity growth translates into weaker GDP expansion. Since the referendum, the UK’s economic performance has consistently underperformed relative to pre-Brexit forecasts and lagged behind many of its G7 peers. The Centre for Economic Performance (CEP) at the London School of Economics has taken this analysis further, estimating that by 2022, the UK economy was 5.5% smaller than it would have been had it stayed in the EU (Source: Centre for Economic Performance). This gap is not the result of a single event but rather the cumulative effect of increased friction in trade, investment, and labor markets—friction that continues to dampen economic momentum.

Trade and Investment Patterns Post-Brexit

One of the most tangible consequences of Brexit has been the transformation of the UK’s trade landscape. The end of frictionless trade with the EU introduced customs declarations, sanitary and phytosanitary checks, and rules of origin requirements—barriers that did not exist before. According to data from the Office for National Statistics (ONS), UK-EU trade intensity declined significantly after the transition period ended. Exports to the EU fell by double digits in several key sectors, including food, vehicles, and machinery, as businesses grappled with new paperwork, delays at borders, and increased compliance costs.

While the UK has pursued new trade agreements with countries like Australia, New Zealand, and Japan, these deals represent a smaller share of overall trade and have yet to compensate for the loss of seamless access to the EU market. Moreover, many of these agreements offer only marginal tariff reductions and do not address non-tariff barriers, limiting their economic impact.

Foreign Direct Investment (FDI) has also been affected. Although the UK remains an attractive destination for capital in sectors like technology and clean energy, overall FDI inflows have shown signs of stagnation. Investor surveys, including those conducted by the Bank of England, highlight persistent concerns about market access, regulatory divergence, and the availability of skilled labor. In response, several multinational firms have relocated parts of their European operations to EU hubs such as Dublin, Amsterdam, and Paris, ensuring uninterrupted access to the single market.

Inflation, Cost of Living, and Labor Market Dynamics

Brexit has played a contributory role in the UK’s elevated inflation and rising cost of living, particularly when viewed alongside external shocks like the pandemic and the war in Ukraine. The depreciation of sterling immediately increased the price of imported goods—from electronics to food—directly affecting consumer prices. Over time, new customs procedures and regulatory checks have added layers of cost and delay to supply chains, further inflating prices for businesses and households alike.

The labor market has also been reshaped. The end of free movement between the UK and the EU has led to acute shortages in sectors that historically relied on EU workers, including hospitality, social care, agriculture, and haulage. These shortages have created a paradox: while unemployment remains low, many businesses report being unable to fill vacancies, constraining output and forcing some to reduce services or scale back operations. Wage growth in affected sectors has risen, but this has not fully resolved the underlying supply-demand imbalance.

The cumulative effect has been a tighter labor market in specific industries, upward pressure on prices, and a squeeze on real incomes—trends that have complicated the Bank of England’s efforts to manage inflation without triggering a deeper economic slowdown.

Sector-Specific Deep Dive: Winners and Losers in the Post-Brexit Economy

While Brexit’s macroeconomic effects are significant, its impact varies widely across industries. Some sectors have adapted with relative success, while others continue to struggle with structural disadvantages introduced by the new trading regime.

Financial Services: Shifting Landscapes and ‘Equivalence’ Debates

London’s status as a global financial center has endured, but not without adjustment. The anticipated mass exodus of financial firms—sometimes dubbed the “Big Bang II”—did not fully materialize, but a quiet migration has taken place. Banks, asset managers, and insurers have shifted tranches of staff, assets, and operations to EU cities to maintain regulatory compliance and client access. Dublin, Frankfurt, and Paris have emerged as key beneficiaries, establishing new trading hubs and back-office functions.

The UK’s ability to operate freely in the EU now hinges on “equivalence” decisions—where the European Commission assesses whether UK financial regulations are sufficiently aligned with EU standards. However, these determinations have been limited in scope and subject to political and economic considerations, leaving many cross-border services in limbo. As a result, some trading activity, particularly in euro-denominated bonds and derivatives, has migrated to continental Europe.

At the same time, the UK government has sought to leverage its newfound regulatory autonomy. Initiatives like the Edinburgh Reforms aim to streamline financial rules, boost competitiveness, and foster innovation in areas such as FinTech and green finance. Whether this strategy can counterbalance the loss of passporting rights remains to be seen.

Manufacturing and Supply Chains: Challenges and Adaptations

For UK manufacturers, Brexit has meant a return to border controls and customs processes not seen in decades. Companies that once relied on just-in-time delivery from EU suppliers now face delays, increased administrative burdens, and higher logistics costs. The automotive sector, in particular, has been affected, with some plants reporting disruptions to production lines due to missing components.

Small and medium-sized enterprises (SMEs) have struggled the most. Unlike larger multinationals, they often lack the resources to hire customs brokers, invest in new software, or reconfigure supply chains. Many have been forced to raise prices, reduce export volumes, or abandon EU markets altogether.

In response, some firms have begun reshoring or near-shoring production, while others are exploring automation to reduce reliance on labor. However, these adaptations take time and capital—resources that are not always available. The result is a manufacturing sector operating under higher friction, with reduced efficiency and competitiveness.

Agriculture and Fishing: Policy Shifts and Market Access

Agriculture and fishing were central to the political narrative of Brexit, promising greater national control over policy and resources. In practice, the outcomes have been mixed. The UK has replaced the EU’s Common Agricultural Policy (CAP) with its own Environmental Land Management (ELM) scheme, which ties subsidies to environmental stewardship rather than land ownership. While this represents a shift in philosophy, the transition has been slow, and farmers face uncertainty over future funding levels.

Access to EU markets for agricultural products has become more complicated. Export health certificates, veterinary checks, and border inspections have created bottlenecks, particularly for perishable goods. Some UK exporters report losing customers due to delays or increased costs.

The fishing industry, though small in economic terms, holds symbolic importance. While the UK now controls access to its waters, the benefits have been limited. UK fish exports to the EU face stringent sanitary checks and bureaucratic hurdles, and negotiations over access and quotas remain tense. Many fishermen argue that promised gains have not materialized, with market access still constrained by trade realities rather than sovereignty.

Global Market Implications: A Wider Lens on Brexit’s Reach

Brexit’s effects extend beyond the UK and EU, influencing global trade dynamics and investor sentiment.

European Union Economies: Trade Friction and Realigned Relationships

EU member states have not been immune to Brexit’s fallout. Countries with strong trade links to the UK—such as Ireland, the Netherlands, and Germany—have experienced disruptions in supply chains and increased administrative costs. Irish businesses, in particular, face unique challenges due to the Northern Ireland Protocol, which creates a de facto customs border in the Irish Sea.

While the overall impact on the EU economy has been muted compared to the UK, the bloc has used Brexit as a catalyst for deeper integration. Efforts to strengthen the single market, harmonize regulations, and enhance defense and energy cooperation have gained momentum. The EU has also accelerated trade negotiations with other partners, from Mercosur to Southeast Asia, reducing its relative dependence on the UK.

Beyond Europe: Impact on US and Other Major Economies

For major non-European economies, Brexit’s direct impact has been limited. However, the event contributed to a broader climate of geopolitical uncertainty, influencing investor behavior and risk assessments. The US, in particular, has watched the UK’s post-Brexit trade strategy closely, with discussions around a potential bilateral trade deal ongoing for years. While no comprehensive agreement has been reached, both countries have pursued sectoral arrangements in areas like digital trade and financial services.

Globally, multinational corporations have had to reassess supply chain resilience, with some opting to diversify away from UK-based operations. The lesson from Brexit, for many, has been the importance of contingency planning in an era of rising protectionism and regulatory fragmentation.

The Uncharted Territory: Future Outlook and Emerging Market Trends

The post-Brexit era remains a work in progress. The full economic consequences will likely take years, if not decades, to fully manifest. What is clear is that the UK is navigating a new economic reality—one defined by greater autonomy but also increased friction.

Policy Responses and Their Market Efficacy

The UK government has introduced a range of measures to mitigate Brexit’s economic costs and unlock new opportunities. Freeports—designated zones with tax incentives and simplified customs procedures—have been established in cities like Liverpool, Glasgow, and Southampton, aiming to stimulate trade and regeneration. While early results are mixed, these zones represent an effort to rebalance regional economies and attract investment.

New trade agreements with non-EU countries are being pursued, but their economic significance remains modest. The government’s push for regulatory divergence—such as reforms in financial services, data protection, and food standards—is intended to boost competitiveness. However, this approach carries risks: too much divergence could further erode market access to the EU, the UK’s largest trading partner.

The success of these policies will depend on striking a delicate balance—capitalizing on independence without isolating the UK from its most important economic relationships.

Investment Implications Across Asset Classes

For investors, the post-Brexit landscape demands a nuanced approach:

* **Equities:** The divergence between the FTSE 100 and FTSE 250 remains relevant. Multinational firms may continue to benefit from a weaker pound and global revenue streams, while domestic-focused companies face headwinds from slower growth and consumer pressure.

* **Bonds:** UK government bonds (gilts) are influenced by inflation expectations, monetary policy, and fiscal sustainability—all of which have been affected by Brexit. Higher borrowing costs and weaker growth prospects have weighed on investor sentiment.

* **Real Estate:** The commercial property market, especially in London, has seen reduced demand from financial firms scaling back EU operations. Residential markets show regional disparities, with some areas benefiting from migration out of the capital.

* **Alternative Investments:** Infrastructure projects, particularly in energy and transport, may attract capital as the UK seeks to boost productivity. Private equity and venture capital could play a larger role in supporting SMEs navigating trade barriers.

Investors must remain vigilant to policy shifts, regulatory changes, and evolving trade dynamics when assessing UK exposure.

The Marketing and Creative Industries: A Unique Market Impact

The UK’s creative sector—encompassing advertising, design, media, and digital content—has faced distinctive challenges post-Brexit. Known for its global influence and innovation, the industry relies heavily on international collaboration and talent mobility.

Restrictions on EU workers have made it harder to recruit skilled professionals in fields like graphic design, video production, and digital marketing. Agencies report longer hiring cycles and higher costs, impacting project timelines and profitability.

Data regulation adds another layer of complexity. While the UK maintains GDPR alignment for now, any future divergence could complicate cross-border data flows, affecting targeted advertising and customer analytics. Additionally, UK-based agencies now face greater administrative hurdles when servicing EU clients, leading some to establish EU subsidiaries to maintain seamless operations.

Client behavior has also shifted. Economic uncertainty has led some brands to tighten marketing budgets, while others are increasing domestic campaigns to offset reduced EU market access. The sector’s ability to adapt—through digital innovation, remote collaboration, and strategic partnerships—will be critical to its long-term success.

Conclusion: A Continually Evolving Economic Landscape

Brexit has fundamentally altered the UK’s economic trajectory, introducing a new era of complexity and adaptation. The immediate financial shock—epitomized by the pound’s collapse and stock market volatility—gave way to deeper structural changes in trade, investment, and productivity. While some sectors and firms have found ways to thrive, others continue to grapple with the realities of reduced integration with the EU.

The long-term consequences are still unfolding. Slower GDP growth, persistent inflation, labor shortages, and shifting investment patterns reflect the cost of disentangling decades of economic alignment. Yet, the UK also has opportunities: to innovate through regulatory reform, to forge new trade relationships, and to invest in emerging industries.

For businesses and investors, success will depend on agility, foresight, and a deep understanding of the evolving landscape. The post-Brexit economy is not a static outcome but a dynamic process—one that will continue to shape markets, policies, and opportunities for years to come.

Frequently Asked Questions (FAQ)

How has Brexit specifically affected the UK stock market since the referendum?

Since the referendum, the UK stock market has shown a bifurcated impact. The FTSE 100, dominated by large multinational companies with significant overseas earnings, often benefited from the weaker British Pound. In contrast, the domestically focused FTSE 250, comprising mid-cap companies, experienced more significant headwinds due reflecting the challenges faced by the UK economy.

What immediate and long-term impacts has Brexit had on the value of the British Pound?

Immediately after the referendum, the British Pound (GBP) experienced a sharp and significant depreciation against major currencies like the USD and EUR. In the long term, GBP has remained volatile, influenced by ongoing political developments, economic data, and the evolving trade relationship between the UK and the EU, generally trading at lower levels than pre-referendum.

Did Brexit lead to a significant decrease in UK trade with the European Union?

Yes, data from the Office for National Statistics (ONS) and various economic analyses indicate a notable decrease in UK trade intensity with the European Union since the end of the transition period. This decline is attributed to new customs checks, regulatory divergences, and increased administrative burdens for businesses.

What are the key economic indicators that show Brexit’s impact on the UK economy today?

Key indicators include slower GDP growth compared to pre-Brexit forecasts and other advanced economies, persistent inflationary pressures partly driven by higher import costs and supply chain issues, shifts in trade patterns (particularly with the EU), and changes in foreign direct investment (FDI) inflows. Labor market dynamics, including specific sector shortages, also reflect Brexit’s influence.

Are there any identifiable positive impacts of Brexit on the UK economy or specific markets?

While comprehensive positive economic impacts are still being assessed, some proponents argue that Brexit offers opportunities for the UK to forge independent trade deals, pursue regulatory divergence to foster innovation (e.g., in FinTech), and gain greater control over domestic policy. Some sectors with a global focus have potentially benefited from the weaker pound, making their exports more competitive.

How has Brexit influenced foreign direct investment (FDI) into the UK?

Brexit has created a mixed picture for FDI. While the UK continues to attract investment in certain areas, overall FDI flows have faced headwinds due to increased uncertainty over market access to the EU, potential regulatory divergence, and concerns about labor availability. Some companies have opted to relocate or expand operations within the EU to maintain seamless access to the single market.

What are the major challenges businesses in the UK’s financial services sector face post-Brexit?

Major challenges include reduced direct access to the EU single market, necessitating the relocation of some operations and staff to EU cities. The lack of comprehensive “equivalence” agreements with the EU creates ongoing uncertainty, affecting cross-border services, trading volumes, and increasing compliance costs for firms operating in both jurisdictions.

How has Brexit impacted the cost of living and inflation rates in the UK?

Brexit has contributed to higher inflation and increased the cost of living in the UK. The depreciation of Sterling made imports more expensive, while new trade barriers and customs checks added to supply chain costs and administrative burdens, which have been passed on to consumers. Labor shortages in key sectors have also exerted upward pressure on wages and prices.

What is the current outlook for UK markets and the economy given ongoing post-Brexit adjustments?

The outlook for UK markets and the economy remains subject to ongoing adjustments. While some initial shocks have subsided, persistent challenges related to trade friction with the EU, labor market imbalances, and lower productivity growth continue to influence forecasts. The UK government’s policies aimed at fostering new trade deals and regulatory divergence will play a crucial role in shaping future economic trajectories.

Has Brexit created any new market opportunities or industries within the UK?

Brexit has prompted the UK to seek new global trade relationships and explore regulatory autonomy in specific areas. This could potentially foster opportunities in sectors like green technology, digital services, or in niche manufacturing areas that benefit from bespoke UK regulations. The establishment of freeports is also an attempt to create new economic hubs, though their long-term success is still being evaluated.

留言