The Shadow of 1987: Understanding Black Monday

On October 19, 1987, the financial world stood still as global markets plunged into chaos. The Dow Jones Industrial Average collapsed by 508 points—representing a staggering 22.6% drop in a single day. It remains the largest one-day percentage decline in the index’s history. This seismic event, forever known as Black Monday, sent shockwaves through stock exchanges from Hong Kong to London, Tokyo to New York, revealing just how fragile and interconnected the modern financial system could be.

The sheer speed of the crash stunned investors, analysts, and policymakers alike. There was no major geopolitical incident, no economic collapse, no bank failure—just a sudden, violent unraveling of market confidence. What made it even more unsettling was the lack of a clear trigger. Instead, a perfect storm of structural vulnerabilities, technological automation, and global interdependence turned a correction into a catastrophe. Black Monday wasn’t just a market crash; it was a wake-up call about the hidden risks embedded in modern finance.

Unraveling the Causes of the 1987 Crash

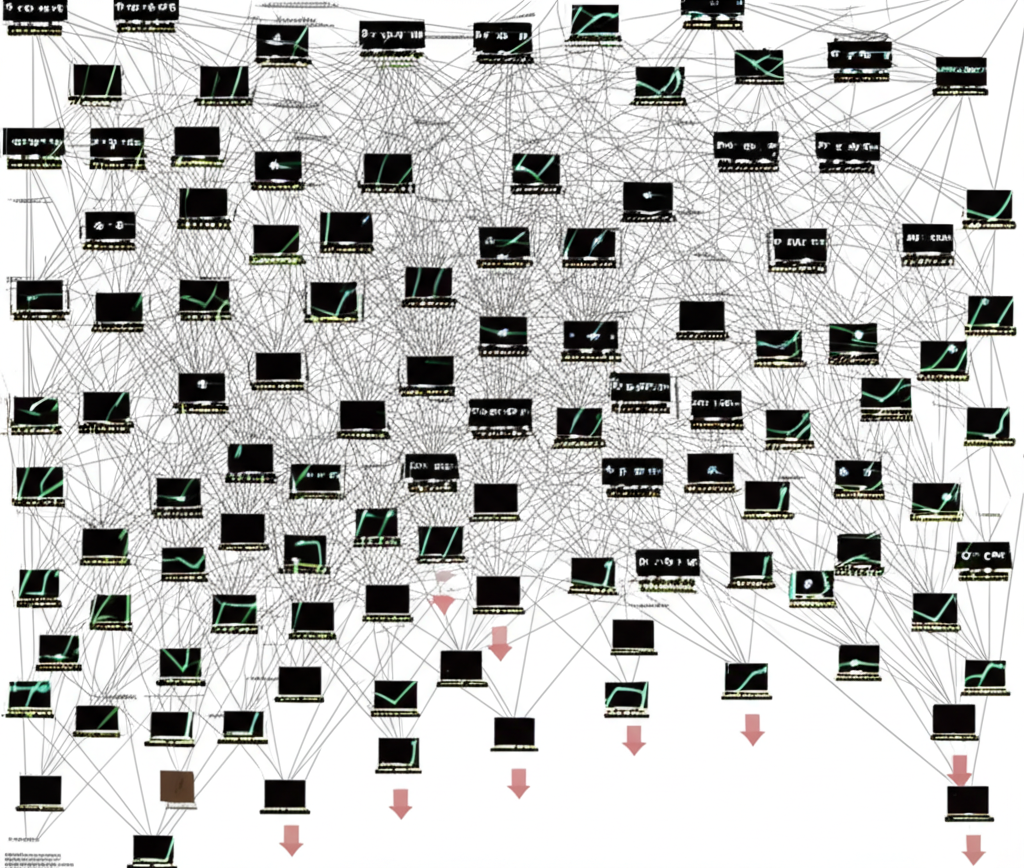

The roots of the 1987 crash run deep, tied not to one single cause but to a chain reaction of interlocking factors. At the heart of the collapse was the rise of **program trading**, a relatively new phenomenon at the time where computer algorithms executed large volumes of trades based on preset market conditions. While designed to enhance efficiency, these systems had an unintended consequence: they amplified volatility during moments of stress.

A particularly influential form of program trading was **portfolio insurance**. Institutional investors used this strategy to hedge against losses by automatically selling stock index futures as prices fell. On paper, it made sense. In practice, it backfired spectacularly. As markets dipped slightly on Black Monday, these automated sell orders activated en masse. Each wave of selling drove prices lower, which triggered more selling—a self-reinforcing downward spiral that quickly spiraled out of control.

But technology wasn’t the only factor. Global market linkages played a critical role. The sell-off began in Asian markets, with Hong Kong’s Hang Seng Index dropping sharply before U.S. markets opened. European markets followed suit, setting a bearish tone. By the time Wall Street opened, the momentum was already in freefall.

Underlying economic conditions also fed investor anxiety. The Federal Reserve had been raising interest rates to combat inflation, making borrowing costlier and equities less attractive. The U.S. trade deficit was widening, and the dollar was weakening. Though the economy wasn’t in recession, the mood was uneasy. When combined with automated selling and global contagion, these pressures created the conditions for a historic crash. For a deeper understanding of how program trading influenced the collapse, Investopedia provides a comprehensive breakdown of its mechanics and impact.

The Immediate Aftermath and Road to Recovery

In the hours after the crash, uncertainty reigned. Trading volumes overwhelmed systems, delays mounted, and fears spread that the financial infrastructure itself might buckle. Yet, in one of the most pivotal moments of modern central banking, the Federal Reserve acted swiftly. Under the leadership of newly appointed Chairman Alan Greenspan, the Fed issued a public statement affirming its commitment to “provide liquidity to support the economic and financial system.” It was a signal to banks and markets alike: funding would be available, and the system would not freeze.

The effect was immediate and profound. Confidence began to stabilize. While the psychological impact of losing nearly a quarter of market value in a single day was immense, the actual economic fallout was limited. Unlike other crashes, Black Monday did not lead to a recession. In fact, the recovery was remarkably fast. The Dow regained much of its lost ground within weeks, and by 1989, the S&P 500 had fully recovered its pre-crash levels. This rapid rebound underscored a key insight: the crash was less about fundamental economic weakness and more about a temporary breakdown in market mechanics.

Are We on the Brink? Analyzing Today’s Market for a Black Monday Repeat

More than three decades later, the memory of Black Monday lingers—especially during times of market stress. Whenever volatility spikes, headlines flare with questions: Could it happen again? Is a “Black Monday repeat today” on the horizon? While history rarely repeats in exact form, the echoes are hard to ignore. Investors now scrutinize current conditions through the lens of 1987, searching for warning signs in today’s complex financial landscape.

The idea of a “Black Monday 2025” may sound alarmist, but it reflects genuine concerns about market fragility. Today’s economy faces inflationary pressures, aggressive monetary tightening, and geopolitical instability—all factors that can erode investor confidence. The question isn’t whether markets will experience turbulence, but whether the safeguards put in place since 1987 are enough to prevent another flash crash.

Economic Indicators Raising Contemporary Red Flags

Several macroeconomic trends today mirror the prelude to the 1987 crash, albeit in different forms. Inflation, which surged after the pandemic and intensified due to global conflicts, has forced central banks to raise interest rates at a pace not seen in decades. Higher rates increase borrowing costs, slow economic activity, and reduce the appeal of growth stocks—potentially triggering a revaluation of equity markets.

Geopolitical tensions—from ongoing wars to trade restrictions—add another layer of uncertainty. Supply chains, already strained by pandemic-era disruptions, remain vulnerable. Any major shock could ripple through markets, just as it did in 1987. Meanwhile, certain sectors, particularly technology and high-growth equities, have seen valuations climb to levels that some analysts describe as stretched. In a rising-rate environment, these assets are especially sensitive to changes in discount rates and investor sentiment.

While today’s economy is structurally different from 1987, the underlying theme is familiar: elevated risk, heightened uncertainty, and the potential for rapid shifts in market psychology.

Expert Warnings and Prevailing Market Sentiment

Financial experts are divided on the likelihood of a 1987-style crash, but few dismiss the risks entirely. Some, like investor Bill Ackman, have warned that persistent inflation could force the Federal Reserve to maintain a hawkish stance longer than expected—raising the risk of a hard landing. Others point to the growing complexity of financial markets, where high-frequency trading and algorithmic strategies dominate.

Market sentiment remains cautious. While there’s no widespread panic, investor surveys and volatility indices suggest a mood of watchfulness. The VIX, often called the “fear gauge,” spikes regularly during periods of uncertainty. Analysts increasingly advise prudence, recommending that investors stress-test their portfolios against sudden drawdowns. The consensus isn’t that a crash is imminent, but that complacency is dangerous.

1987 vs. Today: Similarities and Crucial Divergences

To assess the risk of a modern-day Black Monday, it’s essential to compare the financial ecosystems of 1987 and today. While some conditions appear similar, the structural defenses in place now are far stronger—born from hard lessons learned in the aftermath of the crash.

Echoes of the Past: What Resembles 1987?

There are undeniable parallels. One is the presence of elevated valuations in certain market segments. Just as the 1987 bull run led to stretched price-to-earnings ratios, today’s tech-heavy indices have seen explosive growth, raising concerns about overvaluation. When sentiment shifts, these sectors can correct sharply.

Another similarity is the dominance of automated trading. While 1987’s program trading was primitive by today’s standards, the principle remains: algorithms can accelerate market moves. High-frequency trading (HFT) now accounts for a significant portion of daily volume, capable of executing thousands of trades per second. In times of stress, this speed can amplify volatility.

Global interconnectedness has also deepened. News and trades move instantly across time zones. A sell-off in Tokyo can trigger reactions in London before Wall Street opens. This integration increases efficiency—but also the speed at which panic can spread.

Modern Market Safeguards: How the System Has Evolved

The most important difference between then and now lies in the regulatory and structural reforms that followed Black Monday. The financial system is no longer defenseless against a flash crash.

The cornerstone of these reforms is the **circuit breaker** system. If the S&P 500 drops 7%, 13%, or 20% in a single day, trading is temporarily halted. These pauses give participants time to reassess, reduce panic, and prevent automated systems from feeding off each other. In 1987, no such mechanism existed—trading continued unabated as markets collapsed.

Banks and financial institutions are also far more resilient. Post-1987 and especially after the 2008 crisis, regulators imposed stricter capital requirements. Firms must now hold larger buffers to absorb losses, reducing the risk of systemic failure. Risk management has evolved, with sophisticated tools to monitor leverage, exposure, and market concentration.

Trading technology has advanced in tandem. While algorithms can still contribute to volatility, exchanges now employ real-time surveillance to detect anomalies and halt suspicious activity. These improvements, documented in reports by the Federal Reserve, reflect a system that learns from its past failures.

| Feature | 1987 Market Conditions | Today’s Market Conditions |

|---|---|---|

| Regulatory Safeguards | Limited circuit breakers; less stringent capital requirements. | Comprehensive circuit breakers; enhanced capital requirements for banks; robust risk management. |

| Algorithmic Trading | “Program trading” and portfolio insurance were nascent but impactful. | High-frequency trading (HFT) and complex algorithms are pervasive, but with improved oversight. |

| Market Interconnectedness | Significant global links, but slower information flow. | Highly interconnected global markets with instant information dissemination. |

| Central Bank Response | Reactive liquidity provision after the crash. | Proactive macroprudential policies; established liquidity frameworks. |

| Economic Context | Rising interest rates, trade deficit, weakening dollar. | Persistent inflation, aggressive interest rate hikes, geopolitical tensions. |

Beyond the Headlines: Distinguishing Black Monday from Other Market Shocks

Not all market crashes are created equal. Understanding what sets Black Monday apart helps clarify its legacy and avoid conflating it with other financial crises.

Black Monday (1987) vs. The 1929 Crash (Black Tuesday/Thursday)

The 1929 crash, marked by Black Thursday and Black Tuesday, was far more devastating in both depth and duration. On October 29, 1929, the Dow fell 11.7%, following a 12.8% drop the previous day. But unlike 1987, the 1929 collapse was rooted in speculative excess, margin debt, and a fragile banking system. It triggered the Great Depression, with the market ultimately losing 90% of its value by 1932. The Dow didn’t return to its pre-crash peak until 1954.

In contrast, Black Monday was a liquidity crisis without immediate economic fallout. There were no bank runs, no widespread bankruptcies. The recovery was swift, underscoring that the crash was more about market mechanics than economic fundamentals.

Comparing with Other Modern Financial Crises (e.g., 2008, COVID-19)

The 2008 Global Financial Crisis and the 2020 pandemic sell-off offer further contrasts. The 2008 crisis was a systemic failure—a collapse of the housing and banking sectors fueled by subprime mortgages and complex derivatives. It led to a deep recession and required massive government intervention.

The 2020 crash, triggered by the global spread of COVID-19, was an exogenous shock. Markets plunged as economies shut down, but unprecedented fiscal and monetary support led to a rapid rebound.

Black Monday stands apart as a **mechanism-driven crash**—a failure of process rather than fundamentals. It was accelerated by technology, not by credit bubbles or global pandemics. This distinction is crucial for understanding its place in financial history.

Preparing for Uncertainty: Investor Strategies for Market Volatility

While no one can predict the next market shock, investors can prepare. The lessons of Black Monday emphasize resilience, discipline, and long-term thinking.

Diversification, Asset Allocation, and Risk Management

Diversification remains the first line of defense. Spreading investments across asset classes—stocks, bonds, real estate, commodities—reduces exposure to any single market segment. Even within equities, diversifying across sectors and regions can limit damage during sector-specific downturns.

Asset allocation should reflect individual goals, risk tolerance, and time horizon. A young investor may tolerate more volatility for higher returns, while someone nearing retirement may prioritize capital preservation. Regular rebalancing ensures the portfolio stays aligned with these objectives.

Risk management includes avoiding excessive leverage, maintaining liquidity, and using tools like stop-loss orders with caution—especially in fast-moving markets where such orders can be executed at unfavorable prices. Above all, knowing your risk tolerance helps prevent emotional decisions during turbulent times.

The Importance of a Long-Term Perspective and Emotional Resilience

Perhaps the most powerful tool an investor can have is emotional discipline. Panic selling locks in losses and often leads to missing the recovery. Historical data shows that markets have always recovered from major crashes, including Black Monday, the dot-com bust, the 2008 crisis, and the 2020 pandemic sell-off.

Consider this: a $1,000 investment in the S&P 500 made just before Black Monday, held for the long term and reinvesting dividends, would have grown substantially over the following decades. Despite the crash, the long-term trend remained upward. According to S&P Dow Jones Indices, the S&P 500 has delivered strong average annual returns over multi-decade periods, recovering from every major downturn in its history.

Market volatility is inevitable. But for those who stay the course, time has historically been a powerful ally.

Conclusion: The Unpredictability of Markets and Enduring Lessons

The possibility of a “Black Monday repeat” is less about predicting an identical event and more about recognizing the fragility that can exist beneath the surface of even the most advanced financial systems. While the exact conditions of 1987 are unlikely to return, the core lessons remain vital: markets can move faster than anyone expects, technology can amplify risk, and investor psychology plays a critical role.

Today’s markets are better equipped than ever. Circuit breakers, stronger banks, and improved oversight provide real protection. Yet new challenges—persistent inflation, geopolitical instability, and the relentless pace of algorithmic trading—keep the conversation alive.

For investors, the path forward is clear: stay informed, stay diversified, and stay focused on the long term. The market’s history is not a script, but a guide. It reminds us that while crashes are painful, they are also temporary. And with the right preparation, they don’t have to be devastating.

Frequently Asked Questions (FAQ)

What exactly happened on Black Monday 1987, and how significant was the crash?

On October 19, 1987, the Dow Jones Industrial Average plunged 22.6% in a single trading session, marking the largest one-day percentage drop in its history. This event, known as Black Monday, had a global impact, with stock markets around the world also experiencing severe declines. It highlighted vulnerabilities in market structures and triggered significant regulatory reforms.

What were the primary causes and contributing factors that led to the Black Monday crash of 1987?

Several factors converged to cause the 1987 crash, including:

- Program Trading and Portfolio Insurance: Automated selling strategies designed to protect portfolios inadvertently amplified the market decline.

- Global Market Interconnectedness: Declines in Asian and European markets preceded and influenced the U.S. market.

- Economic Concerns: Rising interest rates, a trade deficit, and a weakening U.S. dollar contributed to investor anxiety.

- Lack of Circuit Breakers: There were no mechanisms to halt trading and cool panic during the rapid sell-off.

Are current global economic and market conditions indicative of a potential Black Monday repeat?

While some current conditions, such as persistent inflation, aggressive interest rate hikes, and geopolitical tensions, raise concerns, direct parallels to 1987 are limited. Modern markets have significant safeguards that did not exist then. Experts are divided, with many acknowledging risks but few predicting an exact repeat of the 1987 event.

How have financial regulations and market structures changed since 1987 to prevent a similar flash crash?

Key changes since 1987 include:

- Circuit Breakers: Automated trading halts are triggered at specific market decline thresholds to prevent panic selling.

- Enhanced Capital Requirements: Financial institutions are required to hold more capital, increasing their resilience.

- Improved Risk Management: More sophisticated tools and protocols for monitoring and managing systemic risk.

- Trading Technology Advancements: While enabling faster trading, these also include better surveillance systems.

What actionable strategies can individual investors employ to prepare for and navigate market volatility?

Investors can prepare by:

- Diversification: Spreading investments across various asset classes, sectors, and geographies.

- Appropriate Asset Allocation: Aligning investment mix with personal risk tolerance and time horizon.

- Risk Management: Avoiding excessive leverage and maintaining an emergency fund.

- Long-Term Perspective: Focusing on long-term goals and avoiding emotional, impulsive selling during downturns.

How long did it take for the stock market to recover its value after Black Monday 1987?

The recovery from Black Monday 1987 was surprisingly quick compared to other major crashes. The S&P 500, for example, largely recovered its pre-crash levels within approximately two years. This rapid rebound was aided by the Federal Reserve’s swift liquidity injection and the fact that the crash did not immediately trigger an economic recession.

Is the concept of “Black Monday 2025” a credible threat according to financial experts?

While discussions about a “Black Monday 2025” or similar future downturns are common during periods of market uncertainty, most financial experts do not predict an identical event. They acknowledge the possibility of market corrections or bear markets due to various economic and geopolitical factors, but the specific technical triggers of 1987 are largely addressed by current regulations. The term often serves as a metaphor for a severe, rapid market crash rather than a literal prediction.

How does Black Monday 1987 differ from other major market downturns, such as the 1929 crash or the 2008 financial crisis?

Black Monday 1987 was primarily a technical, liquidity-driven flash crash exacerbated by automated trading strategies. In contrast:

- 1929 Crash: Was rooted in rampant speculation, weak regulation, and led to the prolonged Great Depression.

- 2008 Financial Crisis: Was a systemic credit crisis stemming from subprime mortgages and complex financial instruments, leading to widespread bank failures.

- COVID-19 Sell-off (2020): Was an externally induced shock from a global pandemic, leading to rapid government and central bank intervention.

What role do algorithmic trading and technological advancements play in the current discussion around market stability?

Algorithmic trading (including high-frequency trading) and technological advancements enable incredibly fast and high-volume transactions. While they improve market efficiency, they also raise concerns that they could amplify market movements during periods of stress, similar to how program trading contributed to the 1987 crash. However, modern systems also incorporate sophisticated surveillance and circuit breakers to manage these risks.

If I had invested $1,000 in the S&P 500 right before Black Monday 1987, what would its value be today?

While specific calculations depend on exact dates and dividend reinvestment, a $1,000 investment in the S&P 500 just before Black Monday 1987, held through today, would be worth significantly more. This illustrates the long-term resilience and growth potential of the stock market, even after severe downturns. Historical data consistently shows that maintaining a long-term investment perspective allows investors to recover from and ultimately benefit from market growth over decades.

留言