Navigating Market Divergence: ASX 200 vs. S&P 500 Analysis

Hello, and welcome to this deep dive into two pivotal global equity benchmarks: Australia’s S&P/ASX 200 and the United States’ S&P 500. As investors, understanding the engines that drive major markets is fundamental to building a robust portfolio. Recently, we’ve observed a notable divergence in the performance trajectories of these two indices. While US markets have soared to fresh all-time highs, the S&P/ASX 200 has shown more restrained movements. This presents an intriguing landscape for Australian investors, prompting questions about local market dynamics versus the compelling growth story unfolding overseas. Let’s explore the characteristics of each index, compare their recent and long-term performance, and identify accessible avenues for Australian investors to gain exposure to these global trends.

Some key points about the ASX 200 and S&P 500 include:

- The ASX 200 includes the largest companies in Australia, while the S&P 500 encompasses the largest companies in the U.S.

- The performance of these indices can vary significantly due to sector composition differences.

- Understanding both indices is vital for Australian investors looking to diversify their portfolios.

Understanding Australia’s Benchmark: The S&P/ASX 200

When we talk about the performance of the Australian share market, the conversation almost invariably centres on the S&P/ASX 200 Index. Think of it as the primary report card for the Australian equity landscape. It’s officially recognised as the institutional investable benchmark in Australia, meaning it’s the standard against which large fund managers and institutional investors measure their performance. The index specifically tracks the performance of the 200 largest index-eligible stocks listed on the Australian Securities Exchange (ASX). Why the top 200? Because together, these companies are highly representative of the broader Australian market, offering a snapshot of its health and direction. The index is designed to be liquid and tradable, facilitating various investment products built upon its foundation.

Anatomy of the ASX 200: Construction and Composition

How is the S&P/ASX 200 constructed? Its composition is determined by float-adjusted market capitalization. This is a crucial point. Instead of just using the total market value of a company, float-adjusted market capitalization only considers the shares readily available for public trading – the ‘float’. Shares held by insiders, governments, or restricted stock are typically excluded. This makes the index a more accurate reflection of what an investor can actually buy and sell in the open market. The index is overseen by S&P Dow Jones Indices, a leading global index provider, which ensures the methodology is transparent and consistently applied. As of July 2024 data, the S&P/ASX 200 accounts for approximately 80% of Australia’s total equity market capitalization, reinforcing its status as Australia’s preeminent benchmark index. Understanding the index constituents, their sector breakdown, and country breakdown provides valuable insight into the Australian economy’s structure. While we won’t list all 200 companies here, the top 10 by weight often include major banks, mining companies, and healthcare giants, reflecting key sectors of the Australian economy.

The structure of the S&P/ASX 200 is quite different from indices like the S&P 500. The ASX 200 tends to have significant exposure to sectors such as financials (especially banking) and materials (mining and resources). This contrasts with the US market, which has a much larger representation from technology and growth-oriented companies. This sectoral difference is a key factor in understanding why the performance of the two indices can diverge significantly, as we will see shortly. The index is also identified by various tickers, including AS51 (Bloomberg) and ^XJO / ^AXJO (ASX Index), which you will often encounter when looking up its price and historical data.

Recent Trajectory of the S&P/ASX 200

Let’s look at the recent performance numbers for the S&P/ASX 200, using data points often cited in the market. As of early July 2024, the index had shown varied performance across different timeframes. Over a single day, it might register a modest loss, perhaps -0.76%. Looking back a week, it might be slightly down, maybe -0.06%. The one-month performance could show a more significant dip, like -1.23%. However, stretching the view further, the year-to-date (YTD 2024) figure might reveal a positive return, perhaps +2.27%, and the one-year performance could look healthier at +10.24%. These short-term fluctuations are normal and reflect the daily ebb and flow of investor sentiment and economic news. It’s essential to look beyond single-day movements to get a clearer picture. The 52-week range for the index, say from 6,751.3 to 7,910.5, gives you a sense of the price volatility over the past year, showing where the peaks and troughs have been. Keep in mind that performance figures can sometimes vary slightly depending on the source (like Yahoo Finance, Market Index, or Bloomberg) due to differences in data aggregation times or calculation bases, but the general trend remains consistent.

The S&P 500 and Nasdaq: US Markets at Record Peaks

Crossing the Pacific, we encounter a very different market narrative. The United States equity markets, particularly the S&P 500 Index and the Nasdaq Composite Index, have recently been making headlines by hitting fresh all-time highs. This performance has been a significant story throughout the year, especially considering the volatility experienced earlier. The US market demonstrated remarkable resilience, recovering strongly from its April lows to push into new territory. The S&P 500, often regarded as the best single gauge of large-cap U.S. equities, tracks 500 leading publicly traded companies in the US. The Nasdaq Composite, on the other hand, is heavily weighted towards technology and growth companies. We’ve seen specific US stock examples like Nvidia Corp (NVDA) reaching incredible milestones, hitting highs around $160.98, symbolising the strength concentrated in the technology sector. This rally in the US has been driven by various factors, including strong corporate earnings (especially from tech giants), excitement around artificial intelligence, and a generally optimistic outlook on the US economy compared to other developed nations. The energy and momentum in the US market have been palpable, creating a significant contrast with the Australian scene.

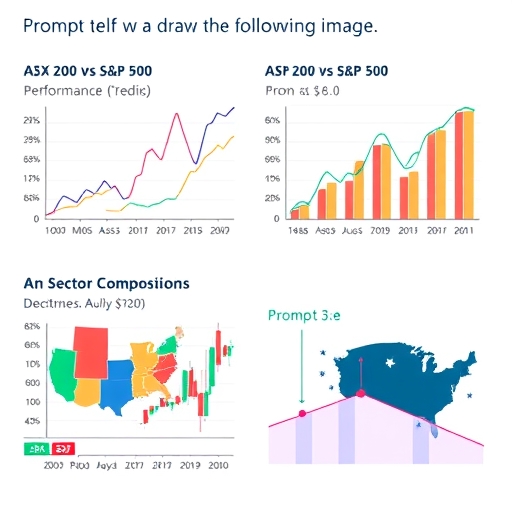

Comparing the Giants: Performance Disparity Over Five Years

Now, let’s zoom out and look at the performance comparison over a more meaningful investment horizon – five years. This is where the divergence between the S&P/ASX 200 and US markets becomes particularly stark. While the S&P/ASX 200 Index (XJO) delivered a respectable 5-year return of 42%, this figure pales in comparison to the returns offered by investments tracking the US market over the same period. For instance, Australian-listed, US-focused Exchange-Traded Funds (ETFs) that track the S&P 500 or the broader US market have significantly outperformed the ASX 200. Consider these examples:

| Investment | 5-Year Return |

|---|---|

| S&P/ASX 200 Index (XJO) | 42% |

| Vanguard US Total Market Shares Index AUD ETF (VTS) | 105% |

| iShares S&P 500 AUD ETF (IVV) | 110% |

| Global X Fang+ ETF (FANG) | 175% |

These numbers tell a powerful story. An investor who allocated capital to a broad US market ETF like VTS or IVV five years ago would have more than doubled their initial investment, achieving returns that were more than double what the primary Australian benchmark delivered. The performance of FANG, which focuses on influential technology and growth stocks like Nvidia and potentially Tesla, shows the even more explosive growth potential within specific high-performing US sectors, albeit with potentially higher risk.

Why the Divergence? Sectoral and Economic Factors

Understanding *why* this performance gap exists is crucial. It’s not simply random chance; it’s a result of fundamental differences between the two markets and the economic environments they operate within. As we touched upon earlier, the sectoral composition plays a major role. The S&P/ASX 200 is heavily weighted towards Financials and Materials. Performance in these sectors is closely tied to domestic interest rates, commodity prices (like iron ore, coal, gold), and the health of the Australian housing market. While these sectors can perform well, they haven’t experienced the same kind of transformative, high-growth surge seen in the US technology sector over the past decade. The S&P 500 and Nasdaq, conversely, have a much larger proportion of companies in Information Technology, Communication Services, and Consumer Discretionary sectors – areas that have benefited immensely from technological innovation, globalization, and strong consumer demand. Companies like Nvidia Corp represent the cutting edge of this growth, driving index performance to levels the ASX 200 cannot match based on its current composition.

Macroeconomic conditions also contribute. Different interest rate environments set by central banks like the Reserve Bank of Australia (RBA) and the US Federal Reserve impact borrowing costs, corporate profitability, and investor risk appetite differently in each country. Global factors, such as trade policies (like those potentially imposed by figures like Donald Trump) and geopolitical events, can affect commodity prices and global supply chains, which in turn disproportionately impact the resource-heavy ASX 200 compared to the US market, which might be more sensitive to shifts in global consumer spending or technology regulation. Analyzing these factors helps us move beyond simply observing performance numbers to understanding the underlying drivers.

Accessing US Market Growth: Essential ETFs for Australian Investors

Given the compelling performance of US markets, many Australian investors seek ways to gain exposure without the complexities of trading directly on US exchanges. Fortunately, there are readily accessible options available right here on the Australian Securities Exchange (ASX) in the form of Exchange-Traded Funds (ETFs). These ETFs are listed in AUD and trade like regular shares through your brokerage account, but they hold underlying US stocks or track US indices. They offer a simple, cost-effective way to participate in the US market’s growth. The data highlighted several popular and high-performing US-focused ETFs available on the ASX. Let’s take a closer look at some specific examples recommended for ASX investors.

One popular choice is the iShares S&P 500 AUD ETF (IVV). As the name suggests, this ETF aims to track the performance of the S&P 500 Index. By investing in IVV, you are effectively gaining exposure to the 500 largest US companies, broadly mirroring the US economy’s leaders. Another excellent option is the Vanguard US Total Market Shares Index AUD ETF (VTS). VTS offers even broader exposure, tracking a much larger universe of US stocks – essentially the entire investable US equity market. This includes large, mid, and small-cap companies. While IVV and VTS both offer diversified US exposure, VTS provides slightly wider coverage. For investors specifically interested in the high-growth technology and internet giants that have driven much of the recent US rally, the Global X Fang+ ETF (FANG) is an option. This ETF typically holds a concentrated portfolio of prominent US tech and consumer discretionary companies, representing a higher-risk, higher-potential-reward strategy compared to the broad-market or S&P 500 ETFs.

Evaluating US-Focused ETFs: Exposure, Costs, and Choices

When choosing among these US-focused ETFs listed on the ASX, it’s important to consider their specific exposures and costs. Both IVV and VTS offer diversified portfolios and are known for their low Management Expense Ratios (MERs), which are the annual fees charged as a percentage of the assets managed. According to the data, VTS has an incredibly low MER of 0.03%, while IVV is just slightly higher at 0.04%. These low costs are a significant advantage, as fees can eat into long-term returns. FANG, being a more specialised and actively managed (in terms of constituent selection, though index-tracking) ETF, has a higher MER, listed at 0.35%. This is still reasonable for a thematic ETF but highlights the trade-off between broad diversification/low cost and targeted, potentially higher-growth exposure.

Choosing the right ETF depends on your investment goals and risk tolerance. Do you want broad exposure to the entire US market (VTS), focus specifically on the 500 largest companies (IVV), or target the high-flying tech giants (FANG)? Each provides a different risk-return profile. Understanding the difference between tracking the S&P 500 and the total market is key – while the S&P 500 represents about 80% of US market capitalization, VTS captures closer to 99.5%. For many investors seeking core US equity exposure, the low-cost, broad diversification offered by IVV or VTS makes them compelling choices, particularly when comparing their long-term performance against the S&P/ASX 200.

Beyond ETFs: Index-Linked Products on the ASX 200

While ETFs are popular for gaining passive exposure to indices, the S&P/ASX 200 also serves as the basis for other tradable financial products, catering to different investment strategies, including hedging and speculation. The data points mention various index-linked products available. These include:

- S&P/ASX 200-linked ETFs: Besides IOZ and STW mentioned earlier, there are others like Smartshares S&P/ASX 200 ETF (AUS), Lyxor Australia (S&P/ASX 200) ETF D EUR (LYPU), and Xtrackers S&P ASX 200 ETF 1D, traded in Australia, Germany, and New Zealand. These offer slightly different structures or listing venues but aim to replicate the index performance.

- S&P/ASX 200 Futures: Futures contracts are agreements to buy or sell the index at a predetermined price on a specific date. They are used by institutions and experienced traders for hedging portfolio risk or speculating on the index’s future direction. Examples include S&P/ASX 200 Gross TR Index (AT) and S&P/ASX Index (AP), often referred to collectively or by their SPI 200 name (AP). Futures trading involves significant leverage and risk.

- Options: Options contracts give the holder the right, but not the obligation, to buy or sell the underlying index (via a cash settlement) at a specific price before or on a certain date. Options offer flexible strategies but are also complex and carry risk.

These products provide ways to gain leveraged exposure, hedge existing portfolios, or express short-term views on the direction of the Australian market benchmark. While potentially lucrative, futures and options are generally more suited to experienced traders due to their complexity and leverage compared to simply buying shares of an index-tracking ETF.

Anticipating Market Catalysts: RBA and Global Trade Dynamics

Looking ahead, several key events could act as catalysts for both the Australian and US markets. For the S&P/ASX 200, the upcoming Reserve Bank of Australia (RBA) board meeting is a pivotal event. The RBA’s decisions on interest rates and its commentary on the economic outlook can significantly impact investor sentiment, particularly for interest-rate-sensitive sectors like financials and real estate, which have large weights in the ASX 200. Investors will be watching closely for any signals regarding potential rate cuts or hikes, which could influence the valuation of Australian companies and the direction of the index.

On the global stage, the potential influence of US trade policy remains a factor. The data mentions a specific deadline, such as Donald Trump’s July 9 trade deal deadline, which caused cautious reactions in markets, including a reported -0.6% dip in S&P 500 futures. Changes in US trade policy, such as the imposition of tariffs on goods from major trading partners, can have ripple effects across global supply chains, impact corporate profitability (both in the US and internationally), and influence commodity prices. Given Australia’s reliance on commodity exports, US trade actions can indirectly affect the performance of the ASX 200’s significant materials sector. These upcoming events highlight the interconnectedness of global financial markets and the importance of monitoring key policy decisions alongside fundamental company analysis.

Strategic Considerations for Australian Investors

So, what does this comparison mean for you as an investor in Australia? Firstly, it reinforces the importance of understanding the benchmarks you use to measure performance. The S&P/ASX 200 is vital for tracking the local market, but it represents only a portion of the global equity opportunity. Secondly, the significant outperformance of US markets over recent years, particularly the S&P 500, makes a compelling case for considering international diversification. Relying solely on the ASX 200 means potentially missing out on significant growth drivers present in other developed equity markets.

For Australian investors, gaining exposure to the US market is straightforward and cost-effective thanks to ASX-listed ETFs like IVV and VTS. These offer broad, low-cost access to the engines of the US economy. Whether you prefer the focused diversity of the S&P 500 or the wider coverage of the total US market, there are options available to align with your strategy. Even a modest allocation to international equities can improve your portfolio’s diversification and potentially enhance long-term returns. Finally, staying informed about upcoming macroeconomic catalysts, both locally (like the RBA meeting) and globally (like US trade policy developments), is crucial for navigating potential market volatility and making informed investment decisions. By understanding these dynamics and utilising the available tools like ETFs, you can better position your portfolio for success in the global investment landscape.

s&p 500 asx 200FAQ

Q:What is the main difference between the S&P/ASX 200 and S&P 500?

A:The S&P/ASX 200 tracks the largest companies in Australia, while the S&P 500 tracks the largest companies in the U.S., leading to variances in performance based on sector exposure.

Q:How can Australian investors access the U.S. market?

A:Australian investors can access the U.S. market through Exchange-Traded Funds (ETFs) listed on the ASX that track U.S. indices or stocks.

Q:Why is there a performance disparity between the ASX 200 and S&P 500?

A:The performance disparity is primarily due to sectoral differences, economic conditions, and varying growth opportunities in technology versus resources-oriented sectors.

留言