Introduction: Apple, China, and the Unwavering Gaze of the Financial Times

Apple’s trajectory in China represents one of the most intricate and high-stakes stories in modern global business. For over two decades, the nation has served as both the backbone of Apple’s manufacturing and one of its most lucrative consumer markets. This dual dependency—on Chinese labor, infrastructure, and consumers—has created a relationship that is as vital as it is fragile. As geopolitical friction between the U.S. and China intensifies, supply chains face unprecedented stress, and domestic competition grows fiercer, Apple finds itself navigating a labyrinth of strategic, political, and ethical challenges. Throughout this unfolding narrative, the *Financial Times* has emerged as a consistent, authoritative voice, offering granular reporting and incisive commentary. Central to this coverage is Patrick McGee’s 2023 book, *Apple in China: The Capture of the World’s Greatest Company*, which reframes Apple’s journey not as a triumph of globalization, but as a cautionary tale of corporate entanglement. This article explores the FT’s pivotal role, McGee’s defining thesis, and the evolving realities shaping Apple’s future in a nation where economic opportunity and political control are inextricably linked.

The Financial Times’ Definit protean Coverage: A Historical Perspective

Since Apple’s initial expansion into China, the *Financial Times* has tracked the company’s evolution with rare consistency and depth. Its reporting has not merely chronicled milestones but dissected the underlying forces—economic, political, and ethical—that define Apple’s engagement with the world’s second-largest economy. From the early days of outsourced assembly to today’s debates over data sovereignty and national security, the FT has provided a continuous thread of analysis, often anticipating shifts before they become mainstream narratives. This sustained scrutiny has made the publication a primary source for investors, policymakers, and corporate strategists trying to understand the complexities of doing business in China.

Early Engagements and Supply Chain Foundations

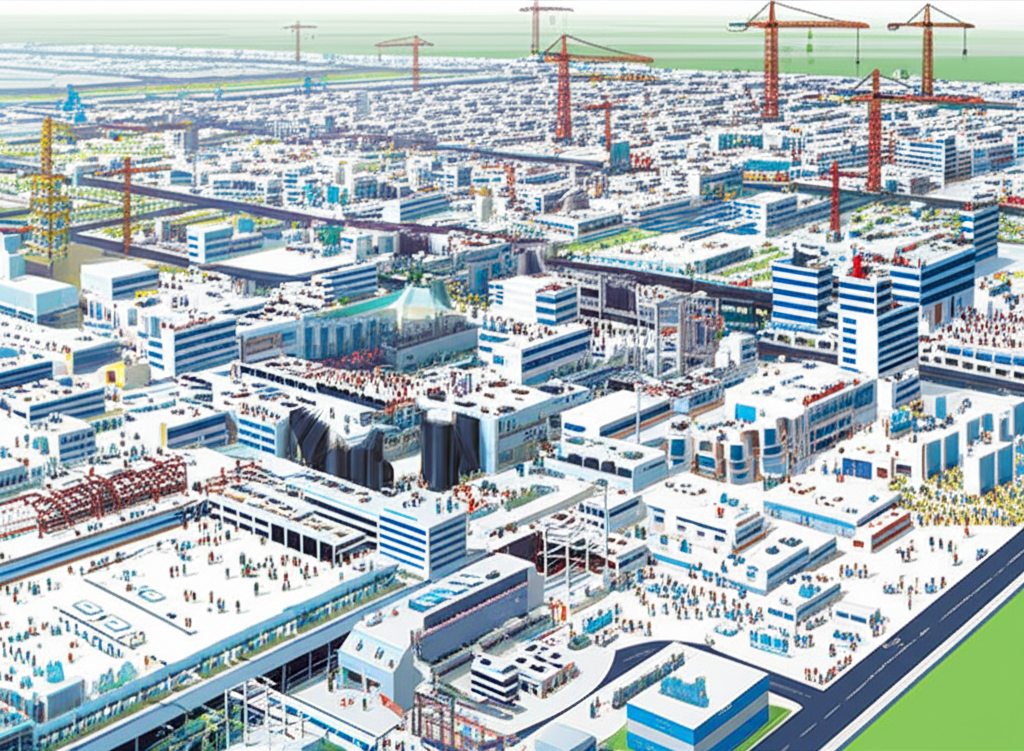

Apple’s initial pivot to China was rooted in pragmatism. In the early 2000s, as demand for iPhones and iPads began to surge, the company needed a manufacturing ecosystem capable of scaling at speed and precision. China offered exactly that: a vast, disciplined workforce, state-supported infrastructure, and a regulatory environment eager to attract foreign capital. The partnership with Foxconn, a Taiwanese manufacturer with sprawling facilities in Shenzhen, Zhengzhou, and beyond, became the cornerstone of Apple’s production model. The FT documented this transformation in real time, highlighting how Apple leveraged China’s industrial capabilities to achieve margins and scale that would have been impossible elsewhere. By the mid-2010s, over 90% of iPhones were assembled in China, a testament to the efficiency of this arrangement—but also a sign of growing vulnerability.

Navigating Growth Amidst Ethical and Labor Concerns

As Apple’s footprint expanded, so did scrutiny over the human cost of its supply chain. Reports of worker suicides, excessive overtime, and unsafe conditions at Foxconn plants drew international attention. The *Financial Times* played a crucial role in amplifying these concerns, publishing investigative pieces that exposed the gap between Apple’s corporate social responsibility pledges and on-the-ground realities. These stories didn’t just spotlight labor abuses—they raised broader questions about the ethics of globalized production. How much responsibility does a brand like Apple bear for conditions in subcontracted factories? Can innovation and efficiency coexist with fair labor practices? The FT’s coverage pushed these issues into boardrooms and policy debates, forcing Apple to implement audits, revise supplier codes, and increase transparency, albeit incrementally.

Patrick McGee’s “Apple in China”: Key Insights and Critical Reception

Patrick McGee, the *Financial Times*’s former San Francisco bureau chief and current global tech correspondent, delivered one of the most comprehensive accounts of Apple’s China dilemma with his 2023 book, *Apple in China: The Capture of the World’s Greatest Company*. Far more than a corporate biography, the book presents a compelling argument: that Apple, in pursuit of growth and operational perfection, has become functionally captured by China’s political and economic system. The term “capture” here doesn’t imply conspiracy, but rather a slow, strategic entanglement that has eroded Apple’s autonomy. McGee’s work has been widely praised for its depth, drawing on interviews with former executives, supply chain insiders, and policymakers. Reviewers in outlets like *The Economist* and *Bloomberg* have hailed it as the definitive account of how a U.S. tech giant became dependent on an authoritarian regime—a dependency that now threatens its global standing.

The Thesis of “Capture”: How Apple Became Intertwined

McGee’s central thesis is that Apple’s relationship with China evolved from a transactional partnership into a strategic dependency. It’s not just about manufacturing; it’s about market access, data governance, and political concession. The book details how Apple made repeated compromises to maintain its presence: storing Chinese iCloud data on servers operated by a state-affiliated company, removing apps deemed sensitive by Beijing, and aligning product launches with Chinese regulatory timelines. These decisions, often made quietly, signal a deeper reality—Apple’s global strategy is now shaped by the priorities of the Chinese Communist Party. McGee argues that this level of integration makes disengagement not just difficult, but potentially catastrophic. The cost of relocating supply chains, losing market share, or defying regulators could outweigh even Apple’s immense financial resilience.

Tim Cook’s Balancing Act: Strategic Dilemmas

At the heart of McGee’s narrative is Tim Cook, Apple’s CEO and the architect of its China strategy. Known for his operational brilliance, Cook transformed Apple into a supply chain marvel by embedding the company deeply within China’s industrial ecosystem. But as U.S.-China relations deteriorated, Cook found himself in an increasingly untenable position. The book portrays him as a leader caught between competing demands: satisfying Chinese regulators to protect market access, responding to U.S. congressional inquiries about data security, and managing investor expectations. McGee illustrates this balancing act through key decisions—such as the 2018 agreement to transfer iCloud data to Guizhou-Cloud Big Data, a local partner, or the repeated removal of apps like WhatsApp and Telegram from the China App Store. Each move preserved Apple’s market position but eroded its image as a defender of user privacy and free expression.

Apple’s Evolving Supply Chain Strategy: Diversification vs. Reliance

In recent years, Apple has quietly begun reshaping its supply chain to reduce overreliance on China. This shift, accelerated by the U.S.-China trade war, pandemic-related disruptions, and rising labor costs, reflects a broader industry trend toward “China-plus-one” sourcing. The *Financial Times* has closely monitored this transition, reporting on Apple’s investments in alternative manufacturing hubs and the logistical hurdles involved. While China remains central—producing roughly 70% of iPhones as of 2024—the diversification effort is real and accelerating, driven by a need to mitigate geopolitical risk rather than pure cost efficiency.

The India and Vietnam Hypothesis: Progress and Pitfalls

India and Vietnam have emerged as the leading alternatives for Apple’s manufacturing diversification. In India, Apple has partnered with Foxconn and Tata to ramp up iPhone production, particularly for the mid-tier iPhone 15 models. The FT has reported on how government incentives, such as production-linked subsidies, are helping attract investment. However, challenges persist: inconsistent power supply, customs delays, and a fragmented component ecosystem mean India is still far from matching China’s integrated manufacturing zones. Vietnam, meanwhile, has become a hub for AirPods and Apple Watches, but its smaller industrial base limits scalability. The FT’s coverage underscores a key insight: while diversification is underway, it’s incremental. Replicating China’s “ecosystem advantage”—where suppliers, logistics, and skilled labor converge within a single region—remains a formidable challenge.

Technological Decoupling and its Realities

Beyond physical manufacturing, Apple faces the broader reality of U.S.-China technological decoupling. This refers to the gradual separation of the two nations’ tech sectors, driven by export controls, investment restrictions, and national security concerns. For Apple, this means navigating a maze of regulations that affect everything from chip sourcing to software development. The FT has analyzed how U.S. restrictions on advanced semiconductors could indirectly impact Apple’s ability to source components, while Chinese regulations on data and cybersecurity force the company to localize operations in ways that compromise global consistency. Complete decoupling remains impractical—Apple still relies on Chinese suppliers for critical components like camera modules and printed circuit boards—but the trend is clear: Apple must now design for fragmentation, a shift that could increase costs and slow innovation.

Geopolitical Headwinds: US-China Relations and Apple’s Future

The deterioration of U.S.-China relations has placed Apple in one of the most difficult positions of any multinational corporation. As tensions escalate over Taiwan, trade, and technology, Apple finds itself caught between two superpowers, each demanding loyalty while offering vital markets. The *Financial Times* has consistently highlighted how this geopolitical squeeze is reshaping Apple’s decision-making, forcing the company to prioritize survival over principle in ways that could have long-term reputational costs.

Regulatory Pressures and Market Access

China’s regulatory environment has become increasingly assertive, particularly in the tech sector. Laws like the Cybersecurity Law, Data Security Law, and Personal Information Protection Law have given Beijing sweeping authority over foreign companies operating in China. For Apple, this has meant complying with data localization mandates, submitting to cybersecurity reviews, and censoring content on its platforms. The FT has documented how Apple has complied with demands to remove VPN apps, news outlets, and messaging tools that could facilitate access to unfiltered information. These concessions allow Apple to maintain a 15-20% smartphone market share in China—one of its largest markets—but they also draw criticism from human rights groups and U.S. lawmakers who see them as complicity in digital authoritarianism.

The Consumer Sentiment Divide

Apple also faces shifting consumer dynamics within China. While it has long enjoyed a premium brand image, nationalist sentiment can quickly turn against foreign companies during periods of geopolitical tension. The FT has reported on instances where Chinese consumers, spurred by state media or social media campaigns, have boycotted foreign brands, including Apple, in favor of domestic alternatives. This trend has been amplified by the resurgence of Huawei, which has regained market share with 5G-capable smartphones despite U.S. sanctions. Combined with strong offerings from Xiaomi, Oppo, and Vivo, this domestic competition is pressuring Apple to innovate faster and tailor its products more closely to Chinese preferences, from payment integrations to AI features optimized for local apps.

The Financial Times’ Methodological Approach to Reporting on China Tech

The *Financial Times*’s ability to deliver authoritative coverage on China’s tech sector stems from a rigorous, multi-layered reporting methodology. Unlike many outlets that rely on secondhand sources or official statements, the FT invests in on-the-ground journalism, maintaining a network of correspondents across Beijing, Shanghai, and Hong Kong. These reporters cultivate relationships with industry insiders, former officials, academics, and supply chain managers, enabling them to uncover stories that evade censorship and state narratives. Their work is further strengthened by data analysis, cross-verification, and long-term institutional memory—allowing them to track trends over years, not just months. This approach is especially critical in covering sensitive topics like labor conditions, regulatory enforcement, and corporate lobbying, where transparency is limited. As a result, the FT’s reporting on Apple and China is not just timely; it’s deeply contextual and often predictive.

Beyond McGee: Future Outlook and Uncharted Territories for Apple in China

While McGee’s book provides a foundational understanding of Apple’s current predicament, the company’s path forward remains uncertain. The interplay of technological innovation, geopolitical volatility, and market competition is evolving rapidly, demanding strategies that are more adaptive than ever. Apple can no longer rely on its brand prestige alone; it must reinvent its engagement with China to survive in a landscape where trust, autonomy, and loyalty are constantly being tested.

The Looming Threat of Local Competitors

One of the most pressing challenges for Apple is the rise of Chinese smartphone manufacturers that are not only competitive on price but also innovative in ways tailored to local users. Huawei’s recent return with 5G-enabled devices, powered by domestically developed chips, has sent shockwaves through the industry. Xiaomi continues to dominate the mid-range market with aggressive pricing and feature-rich devices. According to Statista data, domestic brands collectively hold over 70% of the Chinese smartphone market, leaving Apple to compete primarily in the premium segment. This narrowing window means Apple must differentiate itself beyond hardware—through services, ecosystem integration, and localized software experiences—to retain its high-margin customer base.

Innovation vs. Localization: The Next Frontier

To sustain growth, Apple may need to embrace a deeper level of localization than it has in the past. This goes beyond translating iOS into Mandarin or offering WeChat Pay integration. It means embedding Chinese cultural preferences into product design—such as AI features that understand local dialects, social behaviors, and digital habits. The FT has speculated that Apple could benefit from expanding its R&D presence in China, hiring more local engineers, and forming strategic partnerships with Chinese tech firms to co-develop services. While this could enhance relevance, it also raises concerns about intellectual property and regulatory exposure. The challenge will be balancing global consistency with hyper-local adaptation—a tightrope few multinational companies have mastered.

Conclusion: A Delicate Balance for the World’s Most Valuable Company

Apple’s relationship with China is a microcosm of 21st-century globalization: deeply interconnected, inherently unstable, and shaped by forces beyond any single company’s control. As revealed through the *Financial Times*’s meticulous reporting and Patrick McGee’s groundbreaking analysis, Apple’s success in China has come at a steep cost—strategic autonomy, ethical consistency, and long-term resilience. The company remains tethered to China for manufacturing, market access, and innovation, but that tether is now a source of risk as much as reward. Moving forward, Apple’s ability to navigate this delicate balance will determine not only its profitability but its identity. Can it remain a symbol of innovation and user empowerment while operating within an authoritarian framework? The answer will shape not just Apple’s future, but the broader landscape of global tech.

FAQ (Frequently Asked Questions)

What is the Financial Times’ primary perspective on Apple’s operations in China?

The Financial Times generally adopts a professional, authoritative, and analytical perspective, viewing Apple’s China operations through economic, geopolitical, and ethical lenses. They often highlight the critical reliance Apple has on China for both manufacturing and market access, while also meticulously detailing the growing challenges and strategic dilemmas arising from US-China tensions and evolving regulatory environments.

Who is Patrick McGee, and what is the main argument of his book “Apple in China”?

Patrick McGee is a prominent journalist, notably from the Financial Times, and the author of “Apple in China: The Capture of the World’s Greatest Company.” The book’s main argument is that Apple has become deeply “captured” by the Chinese market and government, leading to significant strategic compromises and an intricate entanglement that makes disengagement exceedingly difficult and costly for the tech giant.

How has Apple’s supply chain strategy in China evolved according to Financial Times reporting?

According to FT reporting, Apple’s supply chain strategy has evolved from an initial deep reliance on China for unparalleled scale and efficiency to a more recent, gradual push for diversification. This shift is driven by geopolitical risks, rising labor costs, and pandemic-induced disruptions, with Apple exploring manufacturing expansion in countries like India and Vietnam, though China remains dominant.

What are the key geopolitical challenges Apple faces in China, as analyzed by the FT?

The FT analyzes several key geopolitical challenges for Apple, including:

- Escalating US-China trade and tech tensions.

- Chinese government regulatory pressures on market access and data localization.

- National security concerns impacting component sourcing and data privacy.

- The challenge of navigating shifting consumer sentiment influenced by nationalism.

Has Tim Cook’s leadership strategy in China been successful, based on FT’s insights?

FT insights, particularly through Patrick McGee’s work, portray Tim Cook’s leadership in China as a complex balancing act. While he successfully deepened Apple’s ties with China, maximizing efficiency and market penetration, this came with significant strategic dilemmas and compromises due to geopolitical pressures and regulatory demands. The long-term success is still being evaluated amidst ongoing challenges.

Where can I find reviews of “Apple in China: The Capture of the World’s Greatest Company” by Patrick McGee?

Reviews of Patrick McGee’s book can be found in major financial and news publications, including the Financial Times itself, The Wall Street Journal, The New York Times, and various tech-focused media outlets. These reviews often provide critical perspectives on the book’s arguments and its significance for understanding Apple’s global strategy.

What impact do Chinese government regulations have on Apple’s market presence?

Chinese government regulations have a substantial impact on Apple’s market presence, affecting aspects such as data localization requirements, app store content policies (including censorship and app removal), and cybersecurity laws. These regulations often necessitate Apple making significant operational and policy adjustments to comply, influencing its service offerings and user experience within China.

Is Apple actively diversifying its manufacturing away from China, and what are the implications?

Yes, Apple is actively pursuing strategies to diversify its manufacturing footprint away from China, particularly by expanding production in countries like India and Vietnam. The implications include increased resilience against geopolitical risks and supply chain disruptions, but also potential challenges such as higher costs, slower scaling, and the need to replicate China’s mature manufacturing ecosystem elsewhere.

How does the Financial Times typically gather information for its in-depth reports on China tech?

The Financial Times gathers information through a rigorous methodological approach, including on-the-ground investigative journalism, leveraging extensive networks of sources (industry insiders, policymakers, academics), data analysis, and cross-verification of facts. This approach allows them to provide nuanced insights despite the challenges of covering sensitive topics within China’s political landscape.

What are the long-term forecasts for Apple’s engagement with the Chinese market?

Long-term forecasts for Apple’s engagement with the Chinese market suggest continued challenges but also significant opportunities. While geopolitical headwinds and rising local competition will persist, China remains a crucial consumer base and innovation hub. Apple is likely to pursue a strategy of deeper localization for products and services, alongside continued supply chain diversification, to navigate this complex environment and maintain its competitive edge.

留言