Understanding the Global Race for Helium: Essential Insights for Astute Investors

Helium, often relegated in popular imagination to festive balloons and comical voice alterations, is, in reality, one of the most critical and strategically important elements on Earth. Far from being merely inert and light, its unique properties make it indispensable in a host of high-technology industries that underpin modern life and drive future innovation. As you venture into the world of investing, particularly in sectors poised for significant technological advancement, understanding the supply chain of such fundamental resources becomes paramount. We are witnessing an intensifying global race to secure reliable, long-term sources of helium, spanning from conventional terrestrial extraction to ambitious, even extraterrestrial, endeavors. This exploration will delve into the critical applications of helium, examine the current market dynamics, and introduce you to the companies and projects at the forefront of the effort to unlock new supplies, providing you with the knowledge base to assess this fascinating and vital industry.

- Helium is not only essential for balloons but plays a critical role in various high-tech industries.

- The global demand for helium is increasing, driven by applications in fields like healthcare and aerospace.

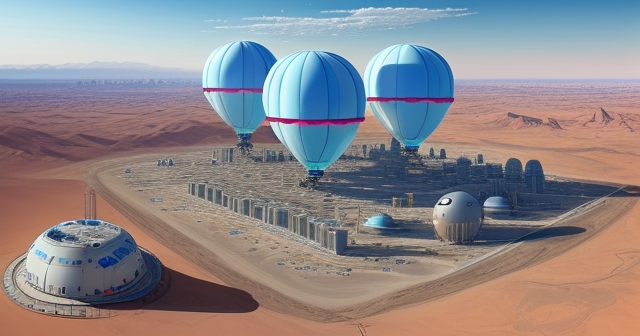

- The quest for helium is transitioning from traditional extraction methods to innovative solutions, including lunar mining.

| Application | Role of Helium |

|---|---|

| Semiconductor Manufacturing | Creates ultra-clean environments to manufacture silicon wafers and integrated circuits. |

| Medical Imaging (MRI) | Cools superconducting magnets in MRI machines, enabling detailed imaging. |

| Aerospace and Rocketry | Purges fuel tanks and pressurizes tanks to ensure safe rocket launches. |

| Scientific Research | Essential for particle accelerators and cryogenics research. |

The Indispensable Properties and Critical Applications of Helium

Why is helium so important, especially for an investor looking beyond the obvious? The answer lies in its extraordinary physical and chemical properties, many of which are unmatched by any other element. Helium has the lowest boiling point of any gas (just above absolute zero, at -269°C or 4.5 Kelvin), it remains a gas at normal temperatures, and it is completely non-reactive. These characteristics make it essential for applications where extreme cold, inertness, or unique physical properties are required. Think of it like a highly specialized tool in the global technological workshop – often invisible, but absolutely necessary for certain crucial tasks.

Let’s explore some key applications, many of which you interact with or benefit from daily, perhaps without realizing helium’s role:

- Semiconductor Manufacturing: In the fabrication of microchips, the precision required is astonishing. Helium is used to create and maintain the inert, ultra-clean environments needed to manufacture silicon wafers and integrated circuits. Any contamination or unwanted reaction could ruin entire batches. Helium’s inertness ensures this doesn’t happen. Consider the foundational role semiconductors play in everything from your smartphone and computer to advanced AI and data centers; without helium, their production would be far more challenging and costly.

- Medical Imaging (MRI): Magnetic Resonance Imaging (MRI) machines are vital diagnostic tools. They rely on powerful superconducting magnets to generate detailed images of the body’s internal structures. To achieve superconductivity, these magnets must be cooled to extremely low temperatures, and the most common and effective coolant is liquid helium. The helium circulation systems in MRI machines are complex and require a steady supply of this cryogenic liquid.

- Aerospace and Rocketry: Helium’s low density and inertness make it invaluable in the aerospace sector. It’s used to purge fuel tanks and lines, particularly for cryogenic fuels like liquid hydrogen and liquid oxygen, ensuring no explosive mixtures form. It’s also used to pressurize fuel tanks, ensuring a steady flow of propellant to the engines. Every rocket launch that relies on cryogenic fuels likely uses helium as a critical component in its ground support and flight systems.

- Fiber Optics Manufacturing: The production of fiber optic cables, which form the backbone of the internet and modern telecommunications, also relies on helium. It’s used in the drawing process of the glass fibers to maintain a controlled atmosphere, preventing oxidation and ensuring the purity and strength of the glass strands.

- Welding: As a shielding gas in arc welding, particularly for reactive metals like aluminum and titanium, helium provides an inert atmosphere to prevent oxidation and ensure a strong, clean weld.

- Scientific Research: From particle accelerators to cryogenics research and various forms of spectroscopy, helium is a fundamental tool for scientists exploring the frontiers of physics, chemistry, and materials science.

- Diving and Maritime: In specialized deep-sea diving mixtures (like Trimix), helium replaces nitrogen to prevent nitrogen narcosis under high pressure, allowing divers to operate at greater depths safely.

These high-tech applications represent the bulk of global helium demand and underscore its status as a critical raw material, far outweighing its more trivial uses. The fact that helium cannot be artificially manufactured in economically viable quantities, and must be extracted from specific geological formations (or potentially extraterrestrial sources), adds a layer of strategic complexity to its supply chain. As you can see, understanding where this vital element comes from and how its supply is secured offers profound insights into the health and growth potential of many other industries.

Understanding the Global Helium Market Landscape

The global helium market is estimated to be a significant industry, valued at approximately $3 billion. While this might seem modest compared to oil or other major commodities, it represents a highly specialized market with concentrated demand from critical sectors. The market is characterized by periods of scarcity and price volatility, primarily because helium is relatively rare and its extraction is often linked to natural gas production.

Historically, a large portion of the world’s helium supply came as a byproduct of natural gas processing, particularly from fields in the United States and Qatar. However, as certain natural gas reserves deplete or geopolitical factors affect supply routes, the stability and reliability of this traditional supply chain become increasingly uncertain. This instability drives the need for diversified sources and dedicated, or “primary,” helium projects.

Imagine the global helium market as a vital, but sometimes fragile, pipeline feeding essential industries. When the flow from traditional sources becomes inconsistent, these industries face disruptions, highlighting the critical need for new pipelines to be built. This is where exploration and mining companies specializing in helium step in. Their mission is not just to find helium, but to develop stable, reliable, and potentially “greener” sources of supply, reducing dependence on volatile byproduct streams and ensuring the continued advancement of technology and medicine.

For investors, this market context presents an opportunity to look at companies directly involved in securing this critical resource. Understanding the market dynamics – the drivers of demand (high-tech applications), the challenges of supply (rarity, extraction complexity, geopolitical risk), and the potential for price fluctuations based on supply/demand imbalances – is key to evaluating the investment potential of companies in this space.

Focus: Terrestrial Helium Exploration and Development

The most immediate and tangible efforts to increase helium supply focus on exploring and developing terrestrial reserves. Unlike helium found as a byproduct of hydrocarbon extraction, companies are increasingly targeting geological formations known to contain significant concentrations of helium as the primary resource. This shift allows for more dedicated infrastructure and reduces dependence on the volatile natural gas market dynamics.

Think of this as searching for specific types of valuable minerals rather than simply finding them by chance while digging for something else. Primary helium projects require specialized geological expertise to identify traps where helium, often generated by the radioactive decay of elements in the Earth’s crust, has accumulated over millennia. Once identified, these potential reservoirs are tested through drilling and analysis to determine the concentration and volume of helium present.

The terrestrial exploration landscape spans several continents, with notable activity in North America and Africa. Each region presents unique geological characteristics, operational challenges, and regulatory environments. Successful exploration involves not just finding helium, but also assessing its extractability, the purity of the reserve, and the economic viability of setting up processing infrastructure.

What does this mean for companies and investors? It means looking at companies with proven geological expertise, successful exploration track records (even preliminary ones), access to capital for drilling and infrastructure development, and the ability to navigate local regulatory frameworks. The path from identifying a potential helium reservoir to actually producing and selling the gas is long and capital-intensive, but successful execution can unlock significant value.

Deep Dive: Pioneering North American Helium Projects

North America is currently a hotspot for terrestrial helium exploration, with several companies actively working to unlock reserves in the United States and Canada. These regions possess specific geological conditions favorable for helium accumulation and benefit from established infrastructure and a relatively predictable regulatory environment compared to some other parts of the world.

Let’s take a closer look at some of the key players and their projects:

-

Pulsar Helium Inc.: Pulsar is making significant strides with its Topaz Project in Minnesota, USA. This project is particularly noteworthy because it targets a non-hydrocarbon system, focusing purely on primary helium. The data indicates a highly encouraging discovery, with one well successfully flowing helium at a concentration of 10.5%. This is a significant concentration, making the reservoir potentially economically attractive. Pulsar’s ambition is further underscored by its plans to build a substantial $50 million extraction and liquefaction plant on the Iron Range in Minnesota. This isn’t just about finding helium; it’s about building the infrastructure to process and deliver it to market. Their collaboration with Chart Industries for specialized low-temperature equipment highlights the technical complexity involved in handling and storing liquid helium. The potential operational timeline of Summer 2026 suggests a relatively rapid development pace, assuming permitting and financing proceed as planned. Pulsar also holds the Tunu Project in Greenland, indicating a broader strategy for exploring other primary helium opportunities globally. For an investor, Pulsar represents a company moving beyond pure exploration into the development and infrastructure phase, a crucial step towards potential revenue generation.

Consider the scale: a $50 million plant is a major capital expenditure, reflecting confidence in the resource but also requiring significant financial backing. Their focus on a non-hydrocarbon source is also strategically important, positioning them uniquely in the market.

-

Helium Evolution Incorporated (HEVI): Operating in southern Saskatchewan, Canada, Helium Evolution is actively exploring the Mankota helium fairway. This region is known for its potential to host significant helium reserves. Recent news of encouraging preliminary test results from their 10-36 Well is a positive indicator for the project’s potential. Exploration is inherently risky, and successful test results are crucial milestones that de-risk projects and provide data to plan further development or appraisal wells. HEVI’s strategy involves exploring multiple prospects within a known helium-rich region. For investors, HEVI represents an exploration-stage company with ongoing drilling activity and potential catalysts tied to test results and resource delineation.

Think of exploration like searching for buried treasure using a map. HEVI is drilling test holes based on their geological map of the Mankota fairway. Each successful test hole brings them closer to confirming the location and size of the treasure.

-

First Helium Inc. (FHELF): Also active in Canada, First Helium is focused on its Worsley Property in Northern Alberta. The data mentions they have completed drilling and cased their 7-15 exploration well at Worsley, preparing it for completion and testing. Similar to HEVI, FHELF is in the crucial exploration and appraisal phase. Completing and casing a well is a significant technical step, setting the stage for flow testing to determine the commercial viability of the discovery. Alberta is a major energy-producing province, providing potential advantages in terms of infrastructure and expertise, though navigating regulations specific to helium (which differs from oil and gas in many ways) is still key. FHELF offers investors exposure to another distinct Canadian helium play, with project milestones centered around successful well testing and potential resource booking.

These North American companies demonstrate different stages of terrestrial helium development, from early-stage exploration (HEVI, FHELF) to more advanced appraisal and infrastructure planning (Pulsar). Each represents a unique opportunity and risk profile for investors interested in the conventional, yet evolving, helium supply chain.

Expanding Horizons: African Helium Prospects

While North America is a key region, the search for helium is truly global. Africa, in particular, holds significant geological potential for large helium reserves, much of which remains underexplored compared to established hydrocarbon basins. Developing projects in Africa often involves navigating different logistical, regulatory, and political landscapes compared to North America or the Middle East.

Helium One Global (HEOG) is a prominent example of a company focused on unlocking this potential. Their Rukwa Helium Project in Tanzania has gained significant attention. A major milestone reported in the data was Helium One Global receiving the first mining license specifically for helium in Tanzania. This isn’t just a technical achievement; it’s a critical regulatory and political de-risking event. Securing a mining license signals government approval and provides the legal framework for developing and ultimately producing from the resource. This news had a tangible impact, causing a significant spike in Helium One Global’s share price on the London Stock Exchange. This illustrates how regulatory milestones can be powerful catalysts for companies in the resource sector.

Why is Tanzania significant? Geological studies have indicated that rift valley systems, like the one in Tanzania where the Rukwa project is located, can be excellent environments for helium accumulation. The helium migrates upwards from the deep crust and gets trapped in overlying rock formations. For investors, Helium One Global represents a frontier exploration opportunity, focused on a potentially vast resource in a region with less established helium production history but supportive government action, as evidenced by the license issuance.

Developing projects in Africa often requires strong local partnerships, expertise in operating in remote environments, and a deep understanding of local regulations and community relations. Success here could significantly diversify the global helium supply chain, adding a major new source outside of traditional producing regions.

The Quantum Leap: Lunar Helium-3 Extraction

Taking the concept of securing future helium supply to an entirely new level is the ambitious vision of extracting resources from the Moon. While terrestrial mining focuses on Helium-4 (the common isotope used in current applications), the lunar focus shifts to Helium-3, a rare isotope on Earth but relatively abundant in the Moon’s upper layer, deposited over billions of years by solar winds.

Interlune, a Seattle-based company, is at the forefront of this audacious endeavor. Their plan is to mine helium-3 from the Moon, targeting its potential use in two revolutionary fields: clean energy (nuclear fusion) and quantum computing. Unlike conventional nuclear fission power plants, fusion aims to replicate the process that powers the sun, potentially offering a clean, virtually limitless energy source. Helium-3 is considered an ideal fuel for a specific type of fusion reaction (D-He3 fusion) that produces far fewer radioactive byproducts than other fusion fuels. Its unique properties are also highly valuable for certain advanced quantum computing applications.

Interlune isn’t just talking about this; they are developing the technology. The data mentions they have built a prototype excavator designed to dig up lunar soil (regolith) and refine helium-3 directly on the Moon’s surface. This highlights the extraordinary technological hurdles that must be overcome – designing equipment that can operate autonomously in the vacuum and extreme temperatures of the lunar environment, extract a gas embedded in fine dust, and then process it efficiently.

The project is envisioned in phases: Crescent Moon, Prospect Moon, and Harvest Moon, suggesting a staged approach from initial technological demonstration and resource assessment to full-scale extraction. The strategic implications are profound. Successfully mining helium-3 from the Moon could position the United States, or whichever nation or company achieves it first, as a leader in space resource utilization and provide a strategic advantage in future energy and technology sectors.

Consider the value proposition: Helium-3 is estimated to be worth a staggering US$20 million per 2.2 pounds (1 kg). This extreme value reflects its scarcity on Earth and its potential in high-impact applications. However, achieving the extraction requires unprecedented investment, technological innovation, and overcoming significant logistical and regulatory challenges related to operating in space. For investors, Interlune represents a long-term, high-risk, high-reward opportunity at the absolute cutting edge of resource development and space technology. It’s a play on the future of energy and computing, contingent on massive technological leaps.

Technological and Operational Challenges in Helium Mining

Whether terrestrial or lunar, helium mining presents significant technical and operational challenges that must be successfully navigated for projects to be economically viable. It’s not simply a matter of finding the gas; you must efficiently and safely extract, process, purify, and transport it.

For terrestrial projects, challenges include:

- Drilling: Accessing deep geological formations requires specialized drilling techniques. Understanding the subsurface geology is critical to placing wells correctly and safely.

- Extraction & Processing: Helium is often mixed with other gases (like nitrogen, methane, or carbon dioxide). It must be separated and purified to very high levels (often 99.999% pure or higher) for high-tech applications. This requires complex processing plants involving cryogenic separation.

- Liquefaction & Storage: For efficient transport and use in many applications (like MRI or rocketry), helium needs to be in liquid form, requiring cooling to near absolute zero. Storing and transporting liquid helium requires highly specialized, insulated containers (dewars) to maintain these extremely low temperatures, which is both technically challenging and expensive.

- Transportation: Moving liquid helium is complex. It can be transported in large ISO containers, but boil-off (loss of helium due to heat transfer) is a constant challenge, requiring careful logistical planning.

For lunar helium-3 extraction, the challenges are exponentially greater:

- Extreme Environment: Operating in the vacuum of space, with extreme temperature variations (-170°C to +120°C on the surface), requires robots and equipment designed to withstand these conditions without human intervention.

- Dust Mitigation: Lunar dust is abrasive and electrically charged, posing significant challenges for mechanical systems, seals, and solar panels.

- Resource Concentration: Helium-3 is embedded in the top few meters of regolith at very low concentrations (parts per billion). Large volumes of soil must be processed to extract useful quantities.

- Power and Processing: Mining and processing large amounts of lunar soil requires significant power, which must be generated locally (e.g., solar or small nuclear reactors). The extraction process likely involves heating the regolith to release the trapped gases, which then need to be separated.

- Transportation Back to Earth: If helium-3 is mined for use on Earth (e.g., in fusion reactors), the logistics and cost of transporting valuable quantities across cislunar space and safely landing it remain immense challenges.

These challenges underscore the expertise, innovation, and capital required to succeed in the helium mining industry. Companies that can demonstrate mastery over these technical hurdles, through successful pilot projects, plant construction, or prototype development, significantly de-risk their operations and enhance their credibility with investors.

Navigating the Investment Landscape: Assessing Helium Companies

For investors interested in gaining exposure to the helium sector, assessing potential investments requires looking beyond traditional metrics. We need to understand the specific stage of each company’s projects, the technical and operational risks involved, the potential market for their specific helium product, and the significant capital requirements.

Consider the different profiles we’ve discussed:

- Exploration Stage (e.g., HEVI, FHELF): These companies are focused on finding and proving up a resource. Their value is primarily tied to the potential size and quality of the helium reserve they hope to discover. Investment catalysts are often exploration results (drilling success, flow test data) and resource reports. Risks are high; they may not find a commercially viable deposit.

- Development Stage (e.g., Pulsar): These companies have identified a potentially viable resource and are working towards building the infrastructure needed for production (like the $50 million plant). Their value is tied to the estimated size and quality of the resource, the progress of engineering and construction, and securing financing. Risks involve construction delays, cost overruns, and successfully bringing the plant online.

- Licensing/Permitting Stage (e.g., Helium One Global): For companies operating in complex regulatory environments, securing necessary licenses and permits (like the Tanzanian mining license) is a critical de-risking step. Value increases as regulatory hurdles are cleared, opening the path to development and production. Risks include delays or inability to secure required permits.

- Lunar Exploration Stage (e.g., Interlune): This is a completely different risk category – pioneering technology and space operations. Value is tied to technological breakthroughs, successful prototype testing, securing funding for lunar missions, and the long-term vision of the market for resources like Helium-3. Risks are extremely high; the technology may not prove viable or economically feasible within a reasonable timeframe.

When you look at these companies, consider their market capitalization relative to their stage of development. An exploration company will typically have a smaller market cap than a company with a proven reserve and a plant under construction. Significant increases in stock price often follow major de-risking events, such as a successful flow test confirming a high helium concentration or the granting of a key mining license. Understanding these potential catalysts is crucial for investors.

Furthermore, consider the management team’s expertise. Do they have experience in resource exploration, project development, and operating in the specific regions where they are active? Partnerships, like Pulsar’s with Chart Industries, can also be indicators of a company’s ability to leverage specialized expertise to overcome technical challenges.

Ultimately, investing in helium mining companies, particularly at the exploration and development stages, involves a degree of risk tolerance. However, given the critical nature of helium and the growing demand from indispensable industries, successful projects could offer significant upside potential. It’s about doing your homework, understanding the specific plays, and assessing the balance between risk and reward in this specialized corner of the resource market.

Regulatory Environment and Geopolitical Factors

The operational environment for helium mining companies is shaped by complex regulatory frameworks and is susceptible to geopolitical dynamics, adding layers of consideration for investors. Regulations cover everything from land access, environmental impact assessments, and permitting for drilling and processing facilities to resource ownership and taxation.

For terrestrial projects, navigating regional and national regulations is key. In North America, while the framework is generally established, specific permits for drilling, plant construction, and operations require detailed applications and adherence to environmental standards. In countries like Tanzania, securing the very first helium mining license, as Helium One Global did, signifies a crucial step in establishing a regulatory path for this specific resource.

For lunar helium-3 extraction, the regulatory landscape is even less defined. Space resource utilization is governed by international treaties like the Outer Space Treaty, which prohibits national appropriation of celestial bodies but is less clear on the specifics of resource extraction by commercial entities. Nations are developing their own frameworks (like the U.S. Commercial Space Launch Competitiveness Act) to provide clarity and encourage private sector activity, but the legal and regulatory framework for lunar mining is still very much in development.

Geopolitical factors also play a significant role in the broader helium market. Because a large portion of historical supply came from a few countries (like the US and Qatar), supply disruptions due to political events, export restrictions, or infrastructure issues in those regions can have a ripple effect globally, leading to price spikes and supply shortages. This volatility highlights the strategic importance of developing new, stable sources of supply in diverse locations.

Consider the impact of global events on supply chains. A disruption in a major helium-producing region can directly benefit companies developing projects elsewhere, as their potential future supply becomes more valuable and strategically important. Understanding the global supply picture and potential points of vulnerability helps in assessing the long-term potential of new helium projects.

Successfully navigating the regulatory environment and mitigating geopolitical risks requires experienced management teams with strong government and community relations capabilities. For investors, assessing a company’s ability to secure and maintain necessary permits and operate effectively within its specific political context is just as important as evaluating its geological prospects and technical capabilities.

Future Outlook and Strategic Importance

The future outlook for helium appears robust, driven by increasing demand from technology, medical, and aerospace sectors, coupled with ongoing uncertainties in traditional supply sources. The global helium industry is not shrinking; it is evolving, with a clear need for new investment in exploration, development, and innovative extraction methods.

The pursuit of primary helium projects, like those in North America and Africa, is crucial for diversifying supply and providing greater stability. These projects aim to build dedicated infrastructure that is not dependent on the economics or operational decisions of the natural gas industry, offering a more reliable source for critical applications.

Looking further ahead, the potential for lunar helium-3 extraction, while technically daunting and economically uncertain in the near term, represents a visionary approach to resource scarcity and clean energy. If successfully developed, it could fundamentally alter the energy landscape and open up entirely new possibilities in quantum computing and other advanced fields.

For investors, the helium sector offers exposure to the foundational elements of the future economy. Investing in companies that are actively working to secure the supply of this critical gas is, in a sense, investing in the future of semiconductor manufacturing, advanced healthcare, space exploration, and potentially even clean fusion power. It’s an investment thesis built on the indispensable nature of a unique element and the innovation required to bring it from challenging environments to essential industries.

We are seeing companies take concrete steps: drilling exploration wells, planning and constructing processing plants, securing vital licenses, and developing groundbreaking technologies for space mining. Each successful step de-risks these ventures and moves the world closer to a more secure and diversified helium supply chain.

As you continue to build your investment knowledge, understanding critical commodities like helium and the efforts to secure their supply provides a deeper appreciation for the intricate connections within the global economy and the foundational role that seemingly invisible elements play in the most advanced aspects of our lives. The story of helium mining is one of scientific challenge, entrepreneurial spirit, and strategic foresight, offering compelling insights for any forward-thinking investor.

Conclusion: The Enduring Value of an Invisible Gas

Helium, the invisible gas, is far more than a party accessory; it is a cornerstone of modern technology, medicine, and space exploration. Its unique properties make it irreplaceable in applications ranging from cooling superconducting magnets in MRI machines to enabling the manufacture of the semiconductors that power our digital world. As global demand from these critical sectors continues to grow, the reliability of traditional helium supply, often linked to volatile natural gas production, faces increasing challenges.

This has ignited a global race to secure new sources, propelling companies to explore and develop terrestrial helium reserves in regions like North America and Africa, and even inspiring ambitious plans to extract rare isotopes from the Moon. Companies like Pulsar Helium, Helium Evolution, First Helium, and Helium One Global are making tangible progress, from drilling successful wells and securing crucial mining licenses to planning significant processing infrastructure. Meanwhile, visionaries at Interlune are pushing the boundaries of technology with the goal of unlocking the immense potential of lunar Helium-3 for future clean energy and quantum computing.

Investing in this sector requires a nuanced understanding of geological potential, technical capabilities in extraction and processing, regulatory environments, and the significant capital required to bring projects online. It involves assessing companies at various stages of development, each presenting a unique risk-reward profile. The success of these ventures is not guaranteed, fraught with technical hurdles, financial requirements, and market volatilities.

However, the strategic importance of a stable and diversified helium supply cannot be overstated. It is essential for the continued advancement of industries fundamental to human progress. For the informed investor, the efforts to unlock new helium sources offer a fascinating opportunity to invest in the foundational elements that will power the technologies of tomorrow. By acquiring knowledge about these critical resources and the companies working to supply them, you gain a deeper insight into the mechanics of the global economy and position yourself to potentially capitalize on the enduring value of this essential, yet often overlooked, element.

helium mining companiesFAQ

Q:What are the main applications of helium in modern industries?

A:Helium is used in semiconductor manufacturing, medical imaging (MRI), aerospace, fiber optics, welding, scientific research, and specialized diving mixtures.

Q:Why is the helium market considered to be volatile?

A:The helium supply is relatively rare and often linked to natural gas production, leading to price fluctuations and periods of scarcity.

Q:What are some challenges faced in helium extraction?

A:Challenges include drilling deep geological formations, extracting and purifying helium from mixed gases, and transporting liquid helium at low temperatures.

留言