Introduction: KeeTa’s Impact on Hong Kong’s Food Delivery Landscape

The rhythm of Hong Kong’s urban life has long been punctuated by the hum of delivery scooters weaving through neon-lit streets. For years, that scene was dominated by just two players: Foodpanda and Deliveroo. But in a dramatic turn of events, the arrival of KeeTa—backed by China’s Meituan—has injected a new level of intensity into the city’s food delivery ecosystem. What was once a comfortable duopoly now resembles a high-speed race, with KeeTa not just joining the pack but surging ahead in key metrics. This shift isn’t merely about new branding or app features; it reflects a fundamental recalibration of power, pricing, and consumer behavior. Drawing on insights from Measurable AI and recent market developments through May, this analysis unpacks how KeeTa has disrupted the status quo, reshaped competition, and set the stage for a more volatile—and potentially more innovative—era in Hong Kong’s digital dining scene.

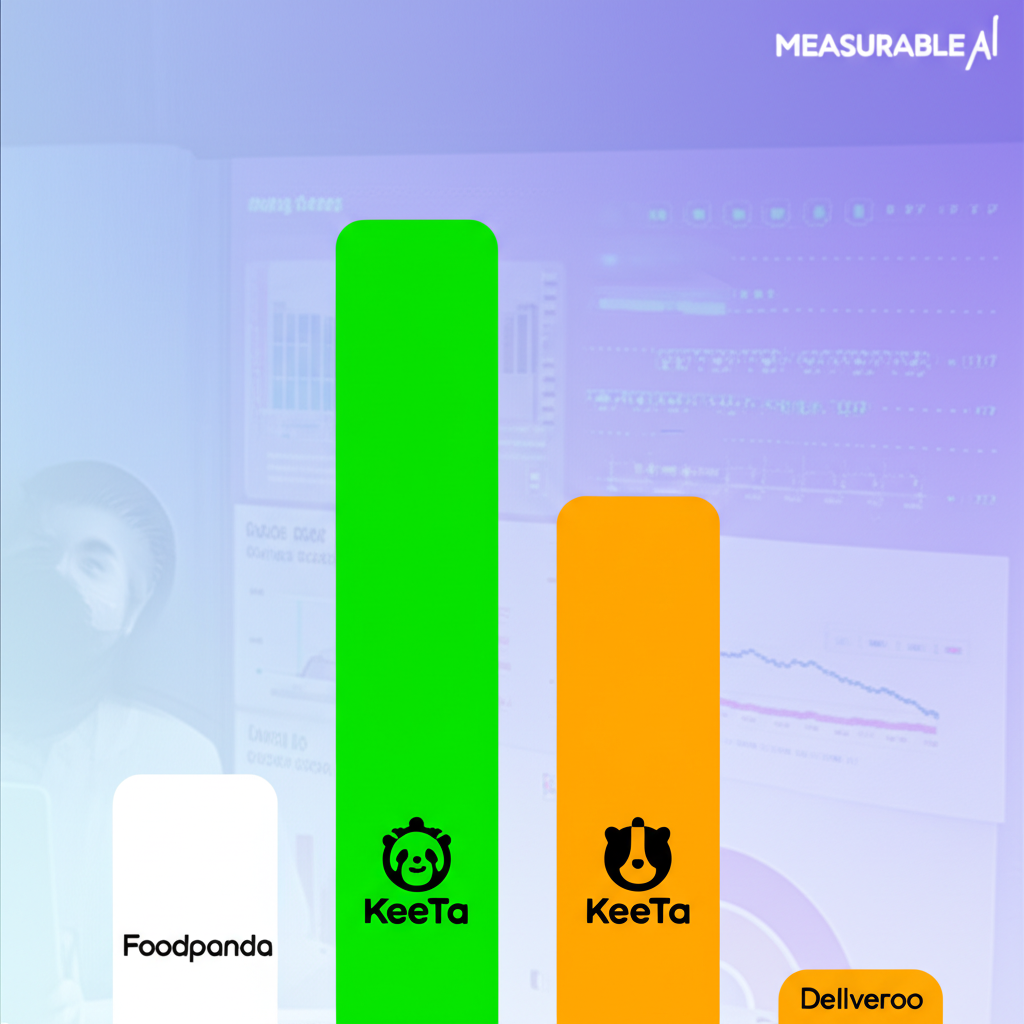

KeeTa’s Ascent: Market Share Dynamics in Hong Kong (May Data Analysis)

KeeTa’s expansion into Hong Kong has unfolded at a pace few anticipated. Unlike gradual market entries seen with other international platforms, KeeTa launched with the force of a full-scale campaign, leveraging Meituan’s vast operational experience and financial reserves. The results, as captured in Measurable AI’s ongoing tracking, reveal a platform gaining momentum with remarkable consistency—especially evident in the data leading up to and including May.

Within months of its debut, KeeTa had already begun siphoning active users and order volume from its rivals. By early 2024, reports—including those cited by the South China Morning Post—indicated that KeeTa had claimed a top-two position in terms of user engagement and completed deliveries. This momentum did not stall; instead, May’s trends suggest a further entrenchment of KeeTa’s presence. While precise market share percentages remain under wraps in proprietary reports, the directional shift is clear: consumers are responding strongly to the platform’s value proposition.

Central to this growth has been a strategy built on accessibility and urgency. By flooding the market with discounts, free delivery offers, and time-limited promotions, KeeTa lowered the barrier to trial for cautious users. Meanwhile, Measurable AI’s methodology—which synthesizes anonymized transaction data, app interaction logs, and behavioral patterns—offers a granular view of shifting loyalties. The numbers don’t lie: Hong Kong’s delivery habits are evolving, and KeeTa is at the heart of that change.

The Hong Kong Food Delivery Triopoly: KeeTa, Foodpanda, and Deliveroo

The competitive fabric of Hong Kong’s food delivery market has been irrevocably altered. What was once a two-horse race has become a three-way sprint, each competitor sprinting at full throttle to maintain position. This triopoly is defined not just by brand rivalry but by contrasting philosophies, operational models, and strategic responses to KeeTa’s shock-and-awe approach.

- KeeTa: Arriving with the full weight of Meituan’s infrastructure, KeeTa operates with a playbook refined over years of hyper-competitive battles in mainland China. Its strategy hinges on rapid market capture through aggressive subsidies, deep discounts, and generous incentives for both customers and delivery personnel. The goal is clear: build scale quickly, dominate mindshare, and establish operational dominance before pivoting toward profitability.

- Foodpanda: As the long-standing market leader, Foodpanda enjoys broad restaurant partnerships, high brand recognition, and a deeply embedded user base. However, KeeTa’s onslaught has forced a strategic reassessment. Foodpanda has responded with its own wave of promotions, enhanced loyalty benefits, and tighter operational controls—moves designed to defend its turf while navigating the squeeze on margins.

- Deliveroo: Known for its curated selection of premium restaurants and sleek user experience, Deliveroo carved out a niche among diners seeking quality and convenience. Yet even this positioning has not insulated it from KeeTa’s disruption. Facing user attrition and pressure on delivery fees, Deliveroo has had to match discounts and rethink rider compensation. As Reuters has noted, Deliveroo’s global challenges around profitability are magnified in dense, competitive markets like Hong Kong, where sustaining differentiation requires constant investment.

The result is a market locked in a cycle of promotional escalation. Delivery fees have dropped, rider incentives have climbed, and restaurant commissions are under scrutiny. While consumers enjoy short-term gains, all three platforms face mounting pressure to balance growth with financial sustainability.

Driving Growth: KeeTa’s Strategic Playbook in Hong Kong

KeeTa’s rise wasn’t accidental—it was engineered. Behind the flashy promotions and viral discounts lies a meticulously calibrated strategy, one that Meituan has deployed with success across China and is now adapting for Hong Kong’s unique dynamics. At its core, KeeTa’s playbook prioritizes velocity over immediate profit, aiming to secure market leadership before competitors can regroup.

The foundation of this strategy is a dual-pronged incentive system. On the consumer side, new users are greeted with steep discounts, free delivery credits, and bundled meal deals that make switching platforms financially appealing. These aren’t minor perks—they’re designed to create a tangible sense of savings, encouraging trial and repeat usage. For delivery riders, KeeTa offered sign-on bonuses, performance-based rewards, and higher per-delivery rates than incumbents, leading to a rapid influx of manpower. This not only ensured reliable service from day one but also weakened rival platforms by drawing away their most critical asset: the riders.

Beyond economics, KeeTa invested heavily in visibility. Digital marketing campaigns across social media, search engines, and local influencer networks helped the brand gain traction quickly. The app interface, honed through years of iteration in mainland China, delivers a smooth, intuitive experience—reducing friction for new users and supporting retention. The entire approach mirrors a classic land grab: win the market first, refine the model later.

Technological Edge and Operational Efficiency

Beneath the surface of discounts and promotions lies a more enduring advantage: technology. Meituan’s dominance in China isn’t just about scale—it’s built on a foundation of data-driven logistics and AI-powered optimization. KeeTa, as its international extension, inherits this sophisticated infrastructure, giving it a hidden but powerful edge in Hong Kong’s fast-paced environment.

- Demand Forecasting: By analyzing historical order patterns, weather, events, and even social media trends, KeeTa can anticipate surges in demand. This allows for proactive rider deployment and better coordination with restaurants, reducing wait times and improving order accuracy.

- Route Optimization: Advanced algorithms calculate the most efficient delivery sequences in real time, minimizing travel distance and delivery windows. This not only speeds up service but reduces operational costs and rider fatigue—critical factors in a city as dense and congested as Hong Kong.

- Personalized Recommendations: The app learns user preferences over time, suggesting restaurants and dishes that align with past behavior. This increases engagement, boosts average order value, and strengthens platform loyalty.

- Dynamic Incentive Allocation: AI models help determine where and when to offer rider bonuses, ensuring coverage during peak hours without overpaying during lulls.

Together, these systems create a feedback loop of efficiency and reliability. While rivals may match KeeTa’s prices temporarily, replicating its backend intelligence is far more difficult—giving KeeTa a long-term structural advantage.

Challenges and Sustainability: The Road Ahead for KeeTa

Despite its impressive gains, KeeTa’s path forward is fraught with uncertainty. Rapid growth fueled by subsidies is a double-edged sword: effective for entry, but unsustainable in the long run. The biggest question hanging over the platform is whether it can transition from a growth-at-all-costs model to one that balances scale with profitability.

As KeeTa begins to scale back its most generous promotions, it risks alienating the very users drawn in by those offers. Price-sensitive customers may drift back to competitors if the value proposition weakens. Similarly, riders lured by high initial pay may leave if incentives taper off, threatening service reliability. Meanwhile, the broader market remains under pressure. With all three platforms competing on price, delivery fees and restaurant commissions are unlikely to rebound soon, limiting revenue upside across the board.

Regulatory scrutiny also looms. As delivery platforms grow in influence, governments are paying closer attention to issues like rider classification, workplace safety, and data governance. Hong Kong’s legal framework around gig work remains in flux, and any new regulations could increase compliance costs or reshape operational models. Additionally, market saturation is a real concern—once the low-hanging user acquisition opportunities are exhausted, growth will become more expensive and harder to achieve.

Lessons from Other Markets: A Comparative View

The challenges KeeTa faces in Hong Kong are not new. Meituan’s own journey in China—and the experiences of other global delivery platforms—offer instructive parallels. In mainland China, Meituan spent years in fierce competition with Alibaba-backed Ele.me, engaging in similar subsidy wars before gradually shifting toward operational efficiency and diversified revenue streams like advertising and enterprise services.

Internationally, platforms like Hungerstation in Saudi Arabia have demonstrated that aggressive entry tactics can yield rapid market share gains, but long-term survival depends on localization and financial discipline. Success isn’t just about replicating a proven formula—it’s about adapting it. Hong Kong’s higher labor costs, smaller geographic footprint, and distinct consumer expectations require nuanced adjustments. For instance, while mainland users may prioritize speed and low cost above all, Hong Kong diners often value service quality, restaurant variety, and app reliability.

KeeTa’s ability to blend Meituan’s scalable technology with hyper-local insights will determine its staying power. The eventual pivot from subsidies to sustainability must be carefully managed—too fast, and the user base erodes; too slow, and losses mount. The goal is not just to win the market, but to own it profitably.

Conclusion: The Evolving Landscape of Hong Kong’s Food Delivery

KeeTa’s emergence has redefined the rules of engagement in Hong Kong’s food delivery market. No longer a static duel between two entrenched players, the landscape is now a dynamic triopoly defined by innovation, competition, and constant adaptation. Data from Measurable AI underscores a clear trend: KeeTa has not only entered the market but has done so with enough force to claim a leading position in key performance indicators, especially through the critical months leading up to May.

The rivalry between KeeTa, Foodpanda, and Deliveroo is pushing the entire industry to improve—faster deliveries, better pricing, and more responsive service. Yet beneath the surface, each platform grapples with the same fundamental challenge: how to grow without bleeding capital. For KeeTa, the answer lies in leveraging its technological backbone and operational precision to transition from a disruptor to a sustainable leader.

As the market matures, the focus will shift from user acquisition to retention, from subsidies to value-added services, and from market share to profitability. The journey is far from over, and the next phase will test not just KeeTa’s resolve, but the resilience of the entire ecosystem. In this high-stakes environment, data-driven intelligence—from firms like Measurable AI—will remain essential for navigating the twists and turns of Hong Kong’s ever-evolving food delivery economy.

Frequently Asked Questions (FAQs)

What is KeeTa’s estimated market share in the Hong Kong food delivery sector as of May [Year]?

While exact real-time figures for May are proprietary and typically found in detailed Measurable AI reports, recent trends indicate KeeTa has established itself as a significant player, often vying for the top two positions in terms of active users and order volume. Its market share has grown rapidly since its launch, significantly disrupting the previous duopoly.

How does Measurable AI collect and analyze data on KeeTa’s performance in Hong Kong?

Measurable AI typically collects anonymized transaction data, app usage patterns, and consumer spending habits from millions of global consumers. For Hong Kong, this would involve analyzing similar data points related to KeeTa, Foodpanda, and Deliveroo to provide insights into market share, order frequency, average order value, and user retention.

What are the primary factors contributing to KeeTa’s rapid growth in the Hong Kong market?

KeeTa’s rapid growth can be attributed to several key factors:

- Aggressive Pricing and Promotions: Substantial discounts, free delivery, and welcome vouchers for new users.

- Rider Incentives: Generous pay and bonuses to attract a large and reliable delivery fleet.

- Meituan’s Expertise: Leveraging Meituan’s advanced technology for logistics and operational efficiency.

- Strong Marketing: Effective campaigns to build brand awareness quickly.

How has KeeTa’s entry changed the competitive strategies of Foodpanda and Deliveroo in Hong Kong?

KeeTa’s aggressive entry has forced Foodpanda and Deliveroo to:

- Increase their own promotional activities and discounts.

- Potentially review their commission structures for restaurants.

- Improve rider benefits and engagement to prevent attrition.

- Focus more on service differentiation and loyalty programs to retain their existing customer base.

Are there any specific “AI models” or technological innovations KeeTa is leveraging in Hong Kong?

While specific models aren’t publicly detailed, KeeTa, backed by Meituan, likely utilizes sophisticated AI for:

- Demand forecasting: Predicting order volumes to optimize rider deployment.

- Route optimization: Efficiently planning delivery paths for faster service.

- Personalized recommendations: Tailoring food suggestions to individual user preferences.

- Dynamic pricing: Adjusting delivery fees based on real-time demand and supply.

What is the long-term outlook for KeeTa’s profitability and sustainability in Hong Kong?

The long-term outlook for KeeTa’s profitability depends on its ability to gradually reduce aggressive subsidies without losing significant market share. Sustainable profitability will require a delicate balance between maintaining a competitive edge, optimizing operational costs through technology, and potentially diversifying revenue streams beyond just delivery fees.

What insights can be drawn from KeeTa’s performance in Hong Kong compared to Meituan’s operations in other markets?

KeeTa’s Hong Kong strategy largely mirrors Meituan’s successful playbook in mainland China: aggressive market entry, heavy subsidies, and leveraging technological efficiency. However, Hong Kong’s smaller scale, higher operational costs, and distinct regulatory environment present unique challenges that require careful adaptation. Lessons from other international food delivery markets also highlight the eventual need to shift from growth-at-all-costs to a more sustainable, profit-focused model.

Are there any regulatory challenges or opportunities impacting KeeTa’s operations in Hong Kong?

As a rapidly growing platform, KeeTa could face regulatory scrutiny regarding:

- Rider welfare and employment status: Ensuring fair pay, benefits, and working conditions for delivery personnel.

- Fair competition: Concerns about predatory pricing or market dominance.

- Data privacy: Compliance with Hong Kong’s data protection laws.

Conversely, opportunities might arise from government initiatives promoting digital services or supporting the gig economy, provided they align with KeeTa’s operational model.

留言