Introduction: Why “ARKK Twitter” Matters to Investors

In today’s fast-moving financial environment, social media has evolved far beyond casual conversation—it’s now a central hub for real-time market intelligence, investor dialogue, and institutional transparency. Nowhere is this shift more evident than in the world of ARK Invest, the pioneering investment firm led by Cathie Wood. Its flagship ETF, ARKK, has become synonymous with high-conviction bets on disruptive innovation, drawing attention from both retail and institutional investors worldwide. As a result, monitoring ARK’s activity on Twitter (now X) has become essential for anyone tracking the fund’s strategy, portfolio changes, or broader market sentiment. This guide explores how ARK leverages X not just as a communication tool, but as a strategic extension of its investment philosophy—and how investors can use this digital footprint to sharpen their own research.

ARK Invest and Cathie Wood’s Official Presence on Twitter (X)

ARK Invest has redefined how asset managers interact with the public by embracing digital platforms, particularly X, as a core component of its outreach and transparency model. Unlike traditional firms that operate behind closed doors, ARK uses its social presence to offer direct access to research, trade activity, and strategic insights—transforming passive followers into informed participants. This approach not only strengthens investor trust but also amplifies the reach of its disruptive innovation thesis.

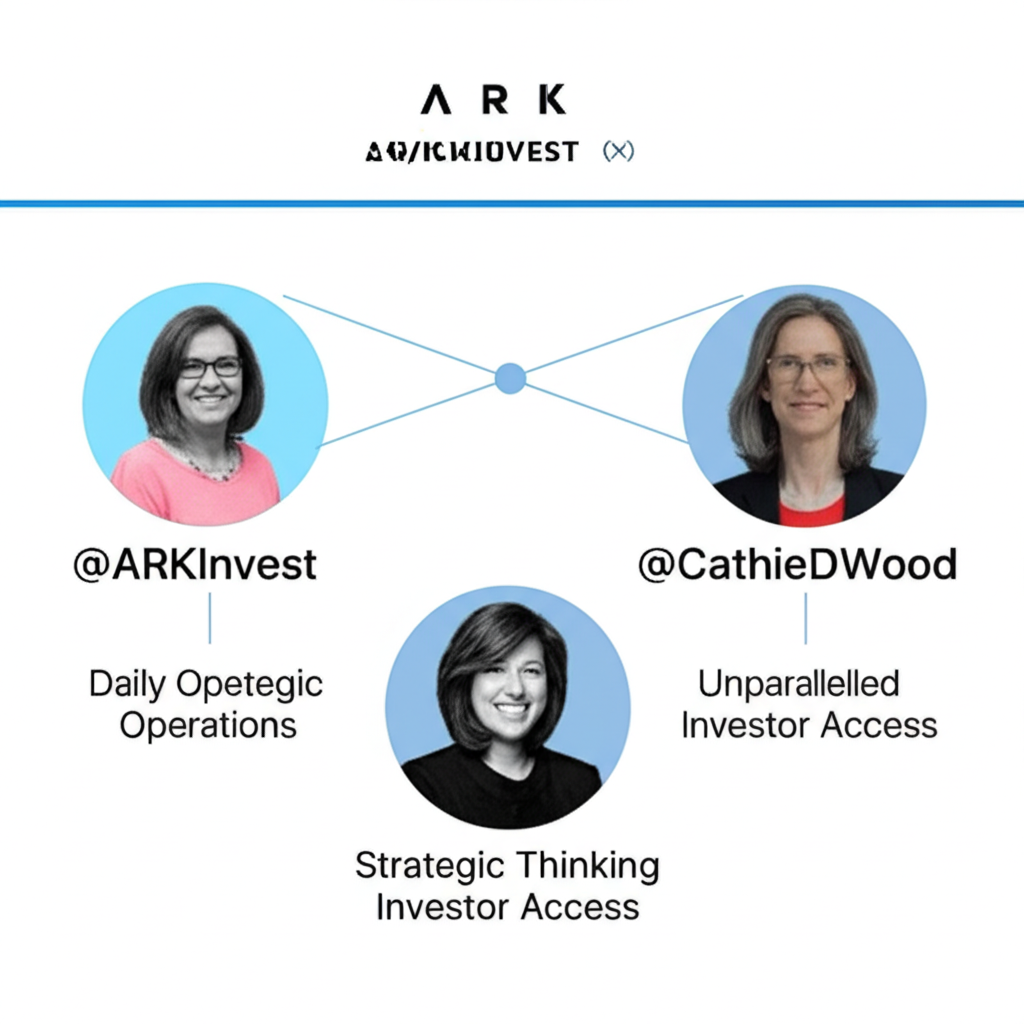

Identifying the Core Accounts: @ARKInvest and @CathieDWood

The foundation of ARK’s X strategy rests on two verified, high-impact accounts: @ARKInvest and @CathieDWood. The @ARKInvest handle functions as the firm’s official mouthpiece, delivering data-rich updates such as daily trade summaries, analyst commentary, and links to in-depth research reports. These posts provide a rare glimpse into the mechanics of an actively managed ETF, revealing not just what ARK is buying or selling, but why.

Meanwhile, @CathieDWood offers a more personal and visionary perspective. Here, Cathie shares her macroeconomic outlook, commentary on emerging technologies like AI and genomics, and reflections on long-term market inflection points. While @ARKInvest grounds the conversation in data, @CathieDWood elevates it with narrative and conviction. Together, they form a powerful dual-channel system—one analytical, the other aspirational—that gives followers a complete view of ARK’s strategy. To avoid misinformation, investors should always verify the blue checkmark and confirm URLs, as impersonation accounts occasionally circulate misleading claims.

ARK’s Transparency Strategy: Daily Trades and Research Disclosures

What truly sets ARK apart is its commitment to radical transparency—an ethos that plays out daily on X. While most fund managers disclose holdings quarterly, ARK publishes its trade activity every business day after market close. This means investors can see exactly which stocks ARK added or reduced across its ETFs, including ARKK. These disclosures are not just symbolic; they serve as real-time signals of shifting priorities and evolving convictions.

Beyond trade data, ARK regularly shares proprietary research directly on X, including excerpts from its annual “Big Ideas” report and deep dives into specific innovation themes. These posts often link to full whitepapers, enabling followers to explore the underlying assumptions and financial models. This open-access model reflects ARK’s belief that financial insight should not be gatekept by institutions but shared widely to foster smarter, more informed investing.

| Twitter (X) Account | Primary Content | Focus/Perspective |

|---|---|---|

| @ARKInvest | Daily trade summaries, research reports, market commentary, links to articles. | Official firm announcements, data-driven insights, portfolio transparency. |

| @CathieDWood | Macroeconomic views, investment philosophy, technological trend analysis, personal insights. | Strategic vision, thought leadership, contextual understanding of ARK’s approach. |

Extracting Key Insights from ARK’s Twitter (X) Activity

For investors, ARK’s X feed isn’t just a news stream—it’s a live feed of strategic decision-making. Decoding this activity requires more than passive scrolling; it demands attention to patterns, context, and timing. When used effectively, it can serve as an early indicator of thematic shifts, emerging opportunities, and portfolio recalibrations within ARKK.

Real-Time Portfolio Insights: Understanding Daily Trade Disclosures

ARK’s daily trade updates are among the most valuable resources available to investors. Each evening, the @ARKInvest account posts a breakdown of buys and sells across its ETFs. A sudden accumulation in a particular stock—say, a genomics firm or an AI startup—can signal growing confidence in that company’s disruptive potential. Conversely, a large sell-off might reflect valuation concerns, thesis adjustments, or portfolio rebalancing.

These disclosures are especially useful for identifying new positions before they appear in official filings. For example, when ARK began accumulating shares in a then-obscure electric vehicle company, early followers of the daily trades were able to investigate the move before it gained mainstream attention. While past actions don’t guarantee future results, they offer a real-time lens into ARK’s evolving strategy, helping investors align their research with active portfolio management.

Cathie Wood’s Market Commentary and Vision for Disruptive Innovation

Cathie Wood’s tweets often transcend stock picks—they paint a broader picture of technological transformation. Her commentary frequently ties macroeconomic trends, such as falling interest rates or advancements in compute power, to long-term growth themes like automation, digital wallets, or CRISPR-based therapies. These insights help contextualize ARKK’s holdings, showing how individual companies fit into larger innovation ecosystems.

For instance, during periods of market volatility, Wood has used X to reinforce ARK’s long-term horizon, reminding followers that disruptive technologies often face short-term headwinds before achieving exponential growth. This narrative consistency helps investors stay grounded during drawdowns and avoid emotional reactions to temporary price swings.

Community Engagement: Q&A Sessions and Interactive Content

ARK Invest doesn’t just broadcast—it listens. The firm actively engages with its audience through Q&A sessions, live X Spaces, and direct replies. These interactions range from technical discussions about valuation models to broader debates about innovation timelines. When ARK hosted a live audio session on the future of AI in healthcare, it attracted thousands of participants, including analysts, retail investors, and industry experts.

These events serve multiple purposes: they clarify complex research, build community trust, and allow ARK to gather feedback from the investor base. They also humanize the firm, showing that its strategies are not generated in a vacuum but shaped through dialogue. ARK’s transparency policy explicitly supports this two-way communication, reinforcing its mission to democratize financial insight.

Analyzing Investor Sentiment and Community Discussions Around ARKK on Twitter (X)

Beyond official channels, the broader ARKK conversation on X reflects the pulse of the retail investor community. From bullish momentum plays to heated debates over valuation, the platform captures the full emotional spectrum of market participants. Monitoring this discourse can reveal emerging narratives, sentiment shifts, and potential risks.

Twitter (X) as a Barometer for ARKK Investor Sentiment

The volume and tone of ARKK-related tweets often correlate with fund performance. During bull runs, hashtags like #ARKK and #DisruptiveInnovation trend frequently, accompanied by charts, success stories, and bullish forecasts. In contrast, during correction periods, the same space fills with skepticism, calls for strategy overhauls, and critiques of ARK’s concentration risk.

While sentiment alone shouldn’t drive investment decisions, it can act as a qualitative counterpoint to quantitative data. A sudden spike in negative chatter, for example, might signal growing discomfort among retail holders—a potential early warning of redemption pressure. Conversely, sustained positive engagement could indicate strong conviction and holding power, even during volatility.

Common Themes, Debates, and Misconceptions in the ARKK Community

The ARKK community is passionate, and that passion often fuels debate. Frequent discussion points include the performance of major holdings like Tesla, Zoom, or Roku, the sustainability of ARK’s high-growth thesis in rising rate environments, and whether certain stocks still qualify as “disruptive.”

One common misconception is that ARK trades frequently for short-term gains. In reality, the firm maintains a long-term horizon, typically holding positions for five years or more. Another frequent error is conflating ARK’s research opinions with guaranteed outcomes—some investors treat Cathie Wood’s tweets as price targets, when they are better understood as forward-looking hypotheses subject to revision.

The Impact of Social Media Buzz on ARKK’s Perception and Market Dynamics

Social media can amplify both accurate insights and misleading narratives. A single viral tweet from a prominent financial influencer—positive or negative—can temporarily sway ARKK’s trading volume or price action. During the 2021 tech rally, enthusiastic commentary on X helped fuel retail inflows into ARKK. In 2022, critical takes on valuation and innovation fatigue contributed to outflows.

This sensitivity underscores the importance of media literacy. While buzz can influence short-term sentiment, ARKK’s long-term trajectory depends on the performance of its underlying holdings and the realization of ARK’s innovation theses. Investors must learn to separate signal from noise, recognizing that social media often prioritizes emotion over analysis.

Strategic Engagement: Leveraging ARK’s Twitter (X) for Informed Investment Decisions

To benefit from ARK’s X presence without falling into common traps, investors need a disciplined, multi-layered approach. Social media should inform research—not replace it.

Best Practices for Following ARK Invest on Twitter (X)

Start by following only the verified accounts: @ARKInvest and @CathieDWood. Enable notifications for these accounts to catch time-sensitive updates. To streamline your feed, create a dedicated X List that includes ARK’s official accounts, trusted financial journalists (like @lizmannon or @ericjackson), and independent analysts known for thoughtful ARK commentary.

When ARK shares a research link or trade summary, take the time to read the full report. A tweet might highlight a key point, but the whitepaper often contains crucial caveats, assumptions, and data models that shape the investment case.

Distinguishing Official Communication from Speculation and Misinformation

The line between fact and fiction on X can blur quickly. Always verify that information originates from @ARKInvest or @CathieDWood. Be cautious of accounts with slight misspellings (e.g., @ARK_Invest or @CathieWoodOfficial), which are often impersonators. If a tweet claims ARK has taken a massive position in a new stock, wait for confirmation in the next day’s trade report or on ARK’s official website.

When in doubt, cross-reference claims with SEC filings, earnings reports, or reputable financial news sources. Never act on a single unverified tweet—especially if it promises “insider” knowledge or imminent price surges.

Integrating Social Insights into Your Broader Investment Research Framework

The true value of ARK’s X activity lies in its ability to spark deeper inquiry. A daily trade might introduce you to a company you hadn’t considered. Cathie Wood’s commentary on AI deflation could inspire a fresh look at cloud infrastructure stocks. Community discussions might highlight risks or catalysts worth investigating.

But these insights must be validated. Use them as starting points for fundamental analysis—review financial statements, assess competitive advantages, and evaluate macroeconomic tailwinds. Social media is best used as a radar for emerging ideas, not a replacement for due diligence. By combining real-time digital intelligence with rigorous research, investors can develop a more dynamic, informed perspective on ARKK and the innovation economy it targets.

Conclusion: The Enduring Influence of Twitter (X) in ARK Invest’s Ecosystem

Twitter (X) is no longer just a social platform—it’s a critical node in ARK Invest’s communication and transparency infrastructure. Through daily trade disclosures, research sharing, and direct engagement, ARK has transformed how investors access and interpret fund activity. For followers of ARKK, the platform offers an unfiltered view into portfolio dynamics, strategic vision, and market sentiment.

Yet its value depends on how it’s used. When approached with discipline, skepticism, and a commitment to verification, X becomes a powerful tool for enhancing investment research. It allows investors to stay ahead of filings, understand the rationale behind bold bets, and gauge the mood of the broader market. As financial communication continues to evolve, the ability to navigate ARK’s digital presence will remain a key skill for anyone serious about disruptive innovation investing.

Frequently Asked Questions about ARKK and Twitter (X)

What are the primary benefits for investors following ARK Invest and Cathie Wood on Twitter (X)?

The primary benefits include gaining real-time insights into ARK’s daily trade activities, understanding Cathie Wood’s macroeconomic views and investment theses, accessing ARK’s research and analysis on disruptive innovation, and observing investor sentiment surrounding ARKK. It offers unparalleled transparency and direct access to the firm’s strategic thinking.

How transparent is ARK Invest about its daily trades and portfolio changes on Twitter (X)?

ARK Invest is highly transparent. It typically posts a summary of its daily buys and sells across its ETFs, including ARKK, on its official @ARKInvest Twitter (X) account every evening after market close. This commitment to daily disclosure is a cornerstone of their investor relations strategy, offering immediate insights into portfolio adjustments.

Are there specific hashtags or keywords to follow on Twitter (X) for ARKK-related news and discussions?

Yes, common hashtags include #ARKK, #ARKInvest, #CathieWood, #DisruptiveInnovation, #InnovationETF, and #ARKTrades. Following these, along with keywords like “ARKK performance” or “ARK portfolio,” can help investors track relevant news and discussions. Creating a dedicated Twitter List can also filter content effectively.

Can Twitter (X) sentiment accurately predict ARKK’s short-term stock movements?

While Twitter (X) sentiment can be a real-time indicator of public perception and investor confidence, it is generally not a reliable tool for accurately predicting ARKK’s short-term stock movements. Social media buzz can amplify perceptions and influence short-term behavior, but ARKK’s performance is driven by its underlying holdings, market conditions, and ARK’s long-term investment theses. It should be used as a complementary tool, not a predictive one.

What kind of content should investors expect from Cathie Wood’s personal Twitter (X) account?

Cathie Wood’s personal account, @CathieDWood, primarily shares her high-level macroeconomic views, insights into technological paradigm shifts, investment philosophy, and reactions to broader market trends. She often provides strategic context for ARK’s investment decisions and champions the long-term potential of disruptive innovation. It’s less about daily trades and more about her overarching vision.

How does ARK Invest use Twitter (X) to engage with its community and answer investor questions?

ARK Invest engages with its community on Twitter (X) through various interactive formats. This includes hosting Q&A sessions, participating in X Spaces (live audio conversations) to discuss market topics or research, and sometimes directly replying to investor inquiries. This direct engagement fosters transparency and allows investors to gain deeper clarity on ARK’s strategies and holdings. Their transparency policy supports this open dialogue.

What are the risks of relying solely on Twitter (X) for ARKK investment research and decisions?

Relying solely on Twitter (X) for investment research carries significant risks, including exposure to misinformation, speculative opinions, and emotional trading decisions based on unverified buzz. The platform lacks the depth of fundamental analysis found in official reports and can be prone to herd mentality. It should always be used as a supplementary tool to traditional financial research, not a primary one.

Beyond official accounts, which other Twitter (X) profiles or communities offer valuable ARKK insights?

Beyond the official @ARKInvest and @CathieDWood accounts, valuable insights can often come from reputable financial journalists, independent market analysts, and well-regarded financial commentators who cover disruptive technologies and ETFs. Look for accounts with a proven track record of insightful analysis and a commitment to factual reporting. Always prioritize verified accounts and cross-reference information.

Has ARK Invest’s Twitter (X) strategy evolved over time, and what does it signify?

ARK Invest’s Twitter (X) strategy has consistently emphasized transparency and direct communication, evolving primarily in its utilization of newer platform features like X Spaces for deeper engagement. This signifies ARK’s ongoing commitment to democratizing financial information and staying at the forefront of digital communication in the financial sector, adapting to how investors consume information.

How can investors differentiate between genuine ARK Invest updates and misinformation on Twitter (X)?

To differentiate, always verify the source: ensure the information comes from the official, verified @ARKInvest or @CathieDWood accounts. Cross-reference any significant claims or news with official ARK Invest website publications, SEC filings, or reputable financial news outlets. Be skeptical of unverified accounts, sensational headlines, or claims that seem too good to be true. Critical thinking and due diligence are paramount.

留言