Introduction to UK Options Trading Platforms

Options trading has become an increasingly accessible and strategic tool for UK investors looking to take control of their financial futures. Whether you’re aiming to capitalise on market volatility, protect existing holdings, or diversify beyond traditional stocks and funds, options offer a flexible way to pursue those goals. Yet, with so many platforms available—each touting different features, fees, and levels of support—it’s easy to feel overwhelmed. The UK market is home to a range of brokers, from global powerhouses to niche fintech innovators, all catering to varying types of traders. This guide cuts through the noise, helping both newcomers and experienced investors identify the right options trading platform based on regulation, cost, functionality, and long-term fit. We’ll walk you through everything from regulatory safeguards to tax implications, ensuring you’re equipped with the knowledge to make confident, informed decisions in this dynamic space.

Understanding Options Trading in the UK: Basics and Regulation

Before placing your first trade, it’s essential to understand not just how options work, but also the legal and regulatory framework that governs them in the UK. Without this foundation, even the most promising strategy can quickly run into trouble.

What Are Options and How Do They Work in the UK?

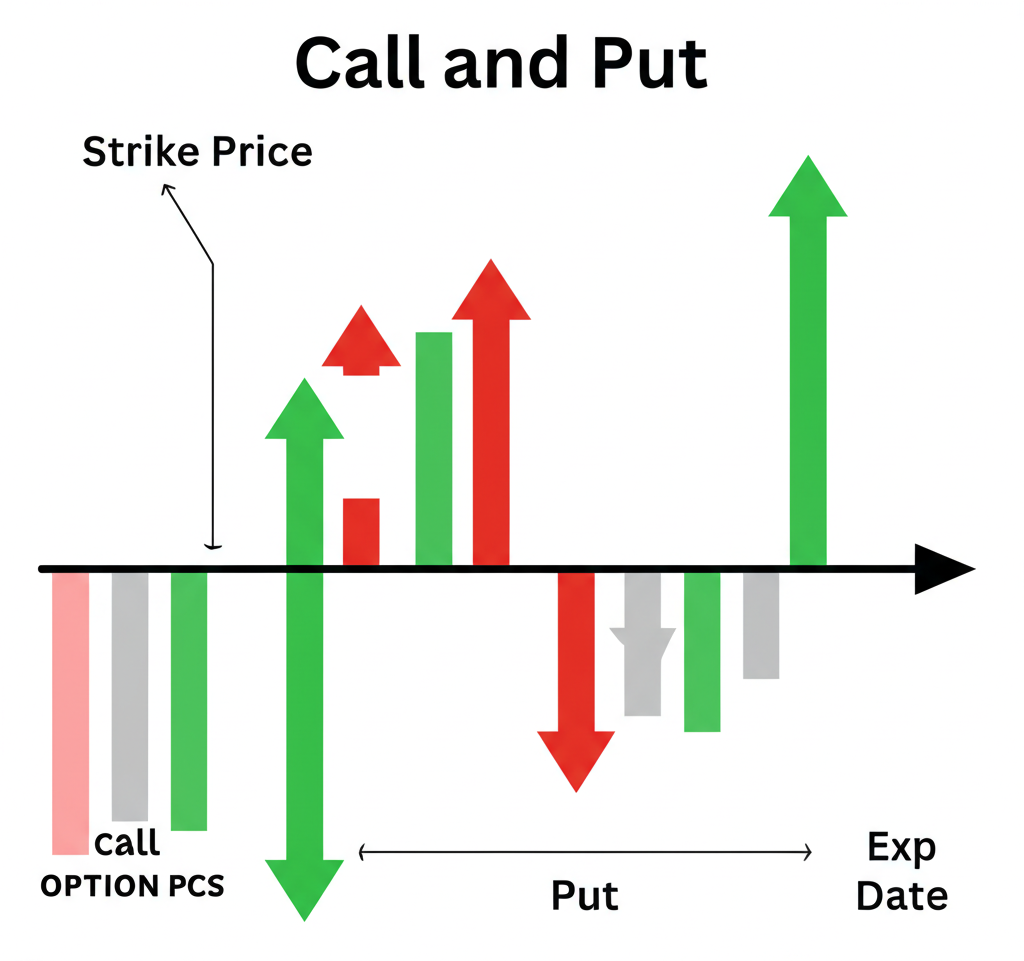

At its core, an option is a contract that grants the buyer the right—but not the obligation—to buy or sell an underlying asset at a set price, known as the strike price, before a specific date, called the expiration date. In return for this right, the buyer pays a fee, known as the premium. This structure allows traders to gain exposure to price movements in assets such as shares, indices, commodities, or currencies without actually owning them.

There are two primary types of options:

– **Call options** give the holder the right to purchase the underlying asset. Investors typically use calls when they expect the price of the asset to rise.

– **Put options** provide the right to sell the asset. These are often used when a decline in price is anticipated, serving either as a speculative play or a protective hedge.

Key components of every option include:

– **Strike Price**: The price at which the asset can be bought or sold.

– **Expiration Date**: The last day the option can be exercised.

– **Premium**: The market price paid for the option.

– **Underlying Asset**: The financial instrument the option is based on, such as a FTSE 100 stock or a US tech index.

In the UK, investors can access both domestic and international markets depending on their broker’s offerings. For instance, you might trade options on British blue-chip stocks like AstraZeneca or Shell, or tap into US markets such as Apple or the S&P 500, provided your platform supports cross-border trading.

The UK Regulatory Landscape: FCA and Investor Protection

One of the UK’s greatest advantages for retail investors is the robust regulatory oversight provided by the Financial Conduct Authority (FCA). Any legitimate trading platform offering services to UK residents must be authorised and monitored by this independent regulator. The FCA enforces strict rules around capital adequacy, client fund segregation, transparency, and fair business practices—all designed to protect consumers and maintain market integrity.

Choosing an FCA-regulated broker isn’t just about compliance; it directly impacts your safety as an investor. Should a regulated firm fail, clients may be eligible for compensation through the Financial Services Compensation Scheme (FSCS), which covers up to £85,000 per person, per institution. This level of protection offers real peace of mind, particularly in volatile markets where financial instability can surface unexpectedly.

You can verify a broker’s regulatory status by visiting FCA.org.uk, where a searchable register lists all authorised firms. Always double-check this before depositing funds.

Listed Options vs. CFD Options: A UK Perspective

Not all options are created equal—and one of the most important distinctions for UK traders lies between listed options and CFD-based options.

**Listed options**, also known as exchange-traded options, are standardised contracts traded on regulated exchanges like ICE Futures Europe or Euronext. When you buy one of these, you’re entering into a transparent, centrally cleared agreement with clear terms. These contracts give you actual rights over the underlying asset and are typically subject to Capital Gains Tax (CGT) when profits are realised. They tend to appeal to more traditional investors who value clarity, liquidity, and regulatory transparency.

On the other hand, **CFD options**—or options offered as Contracts for Difference—are synthetic products that let you speculate on the price movement of an option’s premium without ever owning the actual contract. These aren’t traded on exchanges but are instead offered directly by brokers. While they offer greater flexibility and often come with leverage, allowing you to control larger positions with less upfront capital, they also carry significantly higher risk. Losses can exceed deposits, especially during rapid market swings. Moreover, because CFDs are treated as speculative instruments, any profits are usually considered taxable income rather than capital gains, which could result in a higher tax burden.

For beginners, this difference is crucial. CFD options may seem simpler due to user-friendly interfaces and lower entry barriers, but they demand a strong understanding of leverage and risk management. Meanwhile, listed options, though potentially more complex in execution, align more closely with traditional investment principles.

Key Factors When Choosing a UK Options Trading Platform

Selecting the right platform isn’t just about low fees or flashy tools—it’s about finding a service that aligns with your trading style, experience level, and long-term objectives. Here’s what truly matters when making your decision.

Fees, Commissions, and Spreads: What to Expect

Costs can quietly erode your returns over time, so understanding a platform’s pricing model is critical. Most UK options brokers charge in one or more of the following ways:

– **Per-contract fees**: A fixed amount charged for each options contract traded, common among brokers offering listed options.

– **Tiered pricing**: Higher trading volumes lead to reduced per-contract costs, benefiting frequent traders.

– **Spreads**: The difference between the buy and sell price, particularly relevant for CFD options where commissions might appear low but wider spreads eat into profits.

– **Additional charges**: Watch out for inactivity fees, data subscription costs, currency conversion fees (especially when trading US-listed options), and withdrawal fees.

Always review the full fee schedule, not just headline rates. Some platforms advertise “low-cost” trading but make up the difference through hidden charges or inferior execution quality.

Available Markets and Instruments: From FTSE to Global Indices

Your ability to diversify depends heavily on what markets and assets a platform supports. Ask yourself:

– Does it offer options on UK equities and major indices like the FTSE 100 or FTSE 250?

– Can you access US markets such as Nasdaq or Dow Jones through options on ETFs or individual stocks?

– Are there opportunities in commodities, forex, or cryptocurrencies via options or CFDs?

Brokers like Interactive Brokers provide access to dozens of global exchanges, while others may limit options to a narrower selection. If you’re focused on UK-based assets, ensure the platform covers LSE-listed companies comprehensively. For those eyeing international growth, confirm whether the broker supports direct access or uses synthetic equivalents.

Also, consider whether the platform offers both listed and CFD options. Some traders prefer the transparency of exchange-traded contracts, while others value the flexibility and leverage of CFDs.

Platform Features & Tools: Charting, Analytics, and Order Types

A powerful trading interface can mean the difference between spotting an opportunity and missing it entirely. Look for platforms that offer:

– **Advanced charting tools**: Customisable layouts, multiple timeframes, and technical indicators (RSI, MACD, Bollinger Bands) help you analyse trends and plan entries.

– **Options-specific analytics**: Strategy builders, probability calculators, and Greek metrics (Delta, Gamma, Theta, Vega) allow for deeper risk assessment.

– **Flexible order types**: Beyond basic market and limit orders, advanced traders benefit from stop-loss, take-profit, OCO (One-Cancels-Other), and conditional orders.

– **Real-time data feeds**: Delayed quotes can lead to poor execution, especially in fast-moving markets. Ensure real-time pricing is included or available at a reasonable cost.

Platforms like Interactive Brokers’ TWS and SaxoTraderPRO shine here, offering institutional-grade tools typically reserved for professional traders.

Mobile Trading Experience: Apps for On-the-Go Trading

For many, trading doesn’t happen at a desk—it happens on the go. A high-quality mobile app should mirror the desktop experience as closely as possible. Evaluate:

– **Feature parity**: Can you place multi-leg options trades, view Greeks, and use technical analysis tools on mobile?

– **User interface**: Is navigation intuitive? Can you execute trades quickly under pressure?

– **Security**: Does the app support two-factor authentication (2FA), biometric login, and encrypted connections?

IG and eToro, for example, are known for their polished, responsive mobile applications, making them popular among active traders who need flexibility.

Educational Resources and Customer Support

Learning never stops in options trading. Especially for newcomers, access to quality educational content can accelerate your development and reduce costly mistakes. Look for platforms that offer:

– Step-by-step tutorials on options mechanics and strategies.

– Webinars, video courses, and interactive guides.

– Demo accounts for risk-free practice.

– Strategy templates and case studies.

Equally important is customer support. Is help available when you need it? Check response times across channels—phone, email, live chat—and read user reviews about support quality. Brokers like Charles Schwab and IG stand out for their responsive, knowledgeable support teams.

Minimum Deposits and Account Types

Entry requirements vary widely. Some platforms, like Interactive Brokers, allow you to open an account with no minimum deposit, making them accessible to beginners. Others, such as Saxo Bank, require £500 or more, targeting more serious investors.

Also, consider whether the broker supports tax-efficient accounts. While Stocks and Shares ISAs and SIPPs are popular for long-term investing, options trading within these wrappers is generally restricted. Most providers don’t allow complex derivatives like naked puts or multi-leg strategies inside an ISA. However, some may permit covered calls on shares already held. Always confirm the rules with your provider before assuming tax advantages apply.

Top UK Options Trading Platforms: Detailed Comparison

To help you narrow down your choices, here’s a detailed comparison of leading platforms serving UK traders:

| Platform | Focus/Strength | Key Features | Fees (Options) | Minimum Deposit | Listed/CFD Options | Target User |

| :—————– | :——————————————————- | :————————————————————————— | :——————————————— | :————– | :—————– | :—————————————————– |

| Interactive Brokers | Professional-grade tools, wide market access | Trader Workstation (TWS), global markets, advanced analytics, low commissions | From $0.65 per contract (tiered) | £0 | Listed | Active, experienced traders; institutional investors |

| IG UK | CFD options, user-friendly, comprehensive market access | Award-winning platform, vast CFD range, excellent mobile app, educational | Spreads on CFD options; commissions on listed | £250 | CFD & Listed | Beginners to advanced, CFD focus |

| Saxo Bank UK | Premium experience, sophisticated research, multi-asset | SaxoTraderGO/PRO, extensive asset classes, premium research & analysis | Commissions vary by asset and tier | £500 | CFD & Listed | Experienced, high-net-worth investors |

| Charles Schwab UK | Trust, customer service, integrated wealth management | Broad investment products, research, strong customer support | Varies by product, typically low | £0 | Listed | Long-term investors, those seeking integrated services |

| eToro | Social trading, simplified access, copy trading | CopyTrader, user-friendly interface, crypto, stocks, ETFs | Spreads on CFD options | $100 (£80) | CFD | Beginners, social traders, those seeking simplicity |

Interactive Brokers UK: Advanced Tools for Serious Traders

Interactive Brokers (IBKR) stands out as a top choice for serious options traders who demand depth, global reach, and precision. Its Trader Workstation (TWS) platform is a powerhouse, offering direct market access to over 150 exchanges worldwide, including major US and European options markets. The platform supports complex multi-leg strategies like iron condors and butterfly spreads, complete with visual strategy builders and real-time risk graphs.

What makes IBKR particularly appealing is its competitive pricing model—commissions start as low as $0.65 per contract for US options, with volume-based discounts. Add to that robust mobile functionality, extensive research tools, and support for algorithmic trading, and it’s clear why active traders gravitate toward this platform. While the interface can feel overwhelming at first, the learning curve pays off for those committed to mastering advanced techniques.

IG UK: A Versatile Platform for CFD Options and More

IG has built a strong reputation in the UK for combining ease of use with powerful features. It’s especially well-suited for traders interested in CFD options, offering access to over 17,000 markets, including index options on the FTSE, Wall Street, and Germany 40. The platform’s intuitive design, rich charting suite, and strong mobile app make it a favourite among both new and intermediate traders.

What sets IG apart is its hybrid approach: it offers both CFD and listed options, giving users flexibility. Its educational content is among the best in the industry, with webinars, strategy guides, and a fully functional demo account. While CFD trading brings higher risk due to leverage, IG provides solid risk management tools, including guaranteed stop-loss orders (for a premium), helping traders protect against slippage during volatile events.

Saxo Bank UK: Premium Platform for Experienced Investors

Saxo Bank caters to investors who expect a premium, full-service experience. Its dual-platform setup—SaxoTraderGO for web and SaxoTraderPRO for desktop—delivers a sleek, professional interface with deep analytical capabilities. You’ll find advanced options chains, volatility charts, and strategy analysis tools that rival institutional platforms.

The broker excels in research, offering insights from Saxo’s in-house economists and third-party providers. It supports trading in listed and CFD options across global markets, making it ideal for sophisticated investors building diversified portfolios. While the £500 minimum deposit and higher fee structure may deter casual traders, those who value precision, data, and execution quality often find the investment worthwhile.

Charles Schwab UK: A Legacy of Trust and Service

Following Schwab’s acquisition of TD Ameritrade, its UK presence has grown stronger, bringing with it a legacy of reliability and client-first service. While not as options-focused as IBKR, Schwab offers a solid suite of tools for trading listed options on US and international equities. The platform is clean, intuitive, and backed by exceptional customer support and educational resources.

Schwab is particularly appealing to long-term investors who want a single account for stocks, bonds, ETFs, and options, along with access to comprehensive research and portfolio planning tools. Its integration with broader wealth management services makes it a smart choice for those building holistic financial plans.

eToro: Social Trading and Simplified Options Access

eToro has carved out a unique niche by blending social trading with straightforward access to financial markets. Its CopyTrader feature allows users to automatically replicate the trades of top-performing investors, which can be especially helpful for those still learning the ropes of options.

The platform offers CFD-based options, meaning you’re speculating on price movements rather than holding exchange-listed contracts. While this introduces higher risk due to leverage, it also lowers the barrier to entry. The interface is clean and beginner-friendly, with minimal jargon. However, advanced traders may find the lack of deep analytics and complex order types limiting.

Emerging Players & Robinhood’s UK Options Ambitions

The UK trading landscape is evolving rapidly. While US-based Robinhood disrupted the market with commission-free stock trading, its UK launch has been cautious. Currently, Robinhood UK offers zero-commission trades on stocks and ETFs but does not support options trading. Whether they’ll introduce options in the future remains uncertain, but their model—simple interface, mobile-first design—has influenced newer UK fintechs.

Other emerging platforms are beginning to offer hybrid models, blending automated investing with limited options capabilities. As competition increases, expect more innovation in pricing, user experience, and educational integration.

Taxation on Options Trading in the UK

Taxes play a pivotal role in determining your net returns, and the treatment of options profits in the UK depends heavily on the type of trading you do.

Capital Gains Tax (CGT) vs. Income Tax: The Key Distinction

HM Revenue & Customs (HMRC) distinguishes between investment and trading activities, which directly affects how your profits are taxed:

– **Listed options**: Profits are typically subject to Capital Gains Tax (CGT). Each individual has an annual CGT allowance—£6,000 for the 2023/24 tax year, though this is set to decrease further. Gains above this threshold are taxed at either 10% (basic rate) or 20% (higher rate), depending on your income.

– **CFD options**: Since these are considered speculative contracts, profits are usually treated as income and taxed at your marginal income tax rate, which can be as high as 45%. Additionally, if HMRC determines that your activity constitutes a “trade”—based on frequency, organisation, and profit motive—your entire trading income, even from listed options, could be reclassified as taxable income.

This distinction is not always clear-cut. Frequent, high-volume trading may trigger scrutiny from HMRC, so maintaining accurate records is essential.

Reporting Requirements and Allowances

If your total capital gains exceed your annual CGT allowance—or if you’re deemed to be trading as a business—you must report your profits through a Self Assessment tax return. Keep detailed logs of every trade, including:

– Dates of entry and exit

– Premiums paid or received

– Strike prices and expiration dates

– Associated fees and commissions

These records not only support your tax filings but also help you analyse performance and refine strategies. For official guidance, visit gov.uk/capital-gains-tax.

Tax-Efficient Options Trading: ISAs and SIPPs

While ISAs and SIPPs offer tax-free growth and withdrawals, they come with significant limitations for options traders. Most providers restrict these accounts to straightforward investments like individual shares, funds, and ETFs. Complex strategies such as writing naked puts or straddles are typically prohibited.

That said, some SIPP providers do allow **covered calls**—selling call options against shares you already own within the SIPP—as a way to generate additional income. However, this is tightly regulated and not universally available. Always check with your provider before attempting any options strategy in a tax-advantaged account.

For most active options traders, especially those using CFDs or advanced strategies, operating outside of ISAs and SIPPs is the reality. Plan accordingly for CGT or income tax liabilities.

UK Equivalents to Popular US Trading Platforms (e.g., Thinkorswim)

Many UK traders familiar with the US market often ask: *Is there a UK version of Thinkorswim?* While no platform perfectly replicates Schwab’s iconic toolset, several come close in functionality and depth.

**Interactive Brokers’ TWS** is widely regarded as the closest alternative. It matches Thinkorswim in terms of analytical power, offering tools like the Probability Lab, risk navigator, and dynamic options chains. Its support for complex strategies and global market access even exceeds Thinkorswim in some areas. However, TWS has a steeper learning curve and less visual polish than its US counterpart.

**SaxoTraderPRO** is another strong contender. It delivers a sleek, professional interface with deep research integration, advanced charting, and multi-asset capabilities. While its options-specific tools aren’t quite as intuitive as Thinkorswim’s, they are powerful enough for sophisticated users.

For traders focused on CFDs, **IG’s platform** offers a compelling mix of usability and functionality. Its charting and order execution tools are highly competitive, and the mobile experience surpasses many US platforms.

While the UK market lacks a direct clone of Thinkorswim, the combination of IBKR’s depth and IG’s accessibility gives traders a robust alternative.

How to Get Started with Options Trading in the UK

Starting your options journey doesn’t have to be daunting—if you take it step by step.

1. **Educate Yourself**: Begin with the fundamentals. Understand calls, puts, spreads, and the risks of leverage. Use free resources from brokers, financial websites, and video tutorials.

2. **Assess Risk Tolerance**: Be honest about how much you can afford to lose. Options can expire worthless, and CFDs can trigger margin calls.

3. **Choose a Regulated Broker**: Prioritise FCA authorisation, transparent fees, and platform reliability.

4. **Open and Verify Your Account**: Complete the KYC process, which includes submitting ID and proof of address. Some brokers require a suitability questionnaire before enabling options trading.

5. **Use a Demo Account**: Practice placing trades, testing strategies, and navigating the interface without financial risk.

6. **Develop a Trading Plan**: Define your goals, risk limits, and entry/exit rules. Stick to your plan to avoid emotional decisions.

7. **Start Small**: Begin with simple strategies like buying calls or puts. Gradually explore spreads and covered calls as you gain confidence.

8. **Review and Adapt**: Analyse your trades regularly. Learn from mistakes and refine your approach.

Risks and Strategies for UK Options Traders

Options offer powerful tools, but they come with significant risks that must be managed carefully.

Understanding the Risks of Options Trading

– **Leverage**: Amplifies both gains and losses. With CFDs, you can lose more than your initial deposit.

– **Time Decay (Theta)**: Options lose value as they approach expiry, especially out-of-the-money contracts.

– **Volatility Risk**: Sudden market moves can drastically alter option premiums.

– **Complexity**: Misunderstanding strategies like straddles or iron condors can lead to unexpected losses.

– **Liquidity Risk**: Thinly traded options may be hard to exit at fair prices.

Always use stop-losses where possible and avoid over-leveraging your account.

Common Options Strategies for UK Investors

– **Buying Calls/Puts**: Simple directional bets on rising or falling prices.

– **Covered Call**: Sell a call against stock you own to earn premium income.

– **Protective Put**: Buy a put to hedge against a drop in a stock you hold.

– **Vertical Spreads**: Combine a long and short option to limit risk and cost.

Each strategy has its own risk-reward profile. Test them in a demo account before going live.

Conclusion: Making an Informed Decision

The UK offers a diverse and well-regulated environment for options trading, with platforms to suit every type of investor—from beginners taking their first steps to professionals executing complex strategies. Your choice of broker should reflect your experience, risk appetite, and trading goals.

Prioritise FCA regulation, transparent pricing, and access to the markets and tools you need. Whether you’re drawn to the analytical depth of Interactive Brokers, the user-friendly CFD options on IG, or the premium research at Saxo Bank, there’s a platform that fits your style.

Remember, success in options trading comes not from chasing quick wins, but from disciplined learning, careful risk management, and informed decision-making. With the right foundation, you can navigate the UK options market with clarity and confidence.

Which broker is best for options trading in the UK?

The “best” broker depends on your individual needs. For advanced traders seeking comprehensive tools and global access to listed options, Interactive Brokers UK is often highly recommended. For those interested in CFD options with a user-friendly platform, IG UK is a strong contender. Saxo Bank UK is excellent for experienced investors desiring a premium experience with robust research.

Can I do options trading in the UK?

Yes, options trading is legal and accessible to UK residents. You can trade both traditional listed options and options via Contracts for Difference (CFDs) through various FCA-regulated brokers.

What is the UK equivalent of Thinkorswim?

While no exact equivalent exists, Interactive Brokers’ Trader Workstation (TWS) and Saxo Bank’s SaxoTraderPRO are considered the closest UK platforms to Thinkorswim in terms of advanced analytical tools, comprehensive features, and broad market access for serious options traders.

Does Robinhood UK have options trading?

No, Robinhood UK currently offers commission-free stock and ETF trading but does not provide options trading services as of this update.

Are there any free options trading platforms in the UK?

While some platforms may offer commission-free stock trading, true “free” options trading in the UK is rare. Most platforms charge commissions per contract or spreads for options, though some platforms like eToro might have lower overall fees for their CFD options by incorporating costs into spreads.

What are the tax implications of options trading in the UK?

Profits from listed options are generally subject to Capital Gains Tax (CGT). Profits from CFD options are typically treated as income for tax purposes. If your trading activity is deemed a “trade,” all profits could be subject to Income Tax. It’s advisable to consult with a tax professional for personalised advice.

What is the minimum deposit for options trading in the UK?

Minimum deposits vary significantly by platform. Some brokers like Interactive Brokers may have no minimum to open an account, while others like IG or Saxo Bank might require £250 or £500, respectively. Check each platform’s specific requirements.

Is options trading legal in the UK?

Yes, options trading is completely legal in the UK, provided you trade through brokers that are authorised and regulated by the Financial Conduct Authority (FCA).

What is the difference between listed options and CFD options in the UK?

Listed options are standardised contracts traded on regulated exchanges, giving you the right to buy/sell the underlying asset. CFD options are Contracts for Difference where you speculate on the price movement of an option’s premium without owning the underlying contract. CFD options are typically leveraged and carry higher risk, and their profits are usually taxed as income, unlike listed options (CGT).

How do I choose the best UK options trading app?

To choose the best app, evaluate its:

- **Functionality:** Does it offer the tools you need (charting, order types)?

- **User Interface:** Is it intuitive and easy to navigate?

- **Security:** Does it have strong authentication?

- **Reviews:** Check user reviews for reliability and performance.

- **Broker Integration:** Ensure it seamlessly connects with your main trading account.

留言