What is the Standard Deviation Indicator?

The Standard Deviation indicator is a foundational tool in both statistics and financial analysis, widely used by traders to assess how prices behave over time. At its heart, it measures how much an asset’s price tends to stray from its average value during a defined period. In practical terms, this translates into a clear picture of market volatility. When price movements are erratic and spread far from the mean, standard deviation values rise—signaling high volatility. On the other hand, when prices remain stable and hover close to their average, the indicator dips, reflecting calm market conditions. Traders rely on this metric not only to evaluate risk but also to anticipate turning points, such as the end of consolidation phases or the start of strong trends. By quantifying price dispersion, the indicator provides a data-driven lens through which market behavior can be more objectively analyzed.

The Mathematics Behind the Indicator: How Standard Deviation is Calculated

To truly grasp how standard deviation functions in trading, it helps to understand the math behind it. The indicator doesn’t just guess at volatility—it calculates it precisely using a sequence of logical steps. It begins by determining the average price (mean) over a selected timeframe, such as the last 20 closing prices. Then, for each individual price point, the difference from that mean is calculated. These differences, or deviations, are squared to eliminate negative values and emphasize larger swings. The average of these squared deviations gives us the variance. Finally, taking the square root of the variance returns the value to the original price scale, resulting in the standard deviation.

The formal expression for this process is:

σ = √[Σ(xi − μ)² / N]

- xi represents each individual price

- μ is the average of all prices in the dataset

- N stands for the total number of data points

- Σ indicates the sum of all the calculated values

This systematic approach ensures that every price movement contributes to the final reading, with more extreme moves having a proportionally greater impact due to the squaring step.

STDEV.P vs. STDEV.S: Population vs. Sample Standard Deviation

When applying standard deviation in real-world financial analysis, a key distinction arises between population and sample calculations—commonly labeled as STDEV.P and STDEV.S in spreadsheet software like Excel. While they may appear similar, choosing the right one affects the accuracy of your analysis.

STDEV.P is used when you have access to an entire population of data. In finance, this might apply only in rare cases—such as when analyzing every single price point of an asset since its inception, treating that complete dataset as the full population. Here, the formula divides the sum of squared deviations by N, the total number of observations.

STDEV.S, however, is far more relevant in everyday trading. Since most analyses rely on a limited window—like a 10-day or 20-day lookback—you’re working with a sample of the asset’s full history, not the complete set. To account for this, STDEV.S divides by N−1, a correction known as Bessel’s adjustment. This tweak reduces bias and provides a more accurate estimate of the true population standard deviation based on limited data.

For technical traders, STDEV.S is typically the better choice. Whether you’re analyzing intraday price action or weekly trends, you’re almost always dealing with a subset of historical data. Using the sample-based formula aligns your volatility readings more closely with statistical best practices. For those interested in mastering Excel’s financial functions, resources like the Corporate Finance Institute offer detailed guidance on when and how to apply these tools effectively.

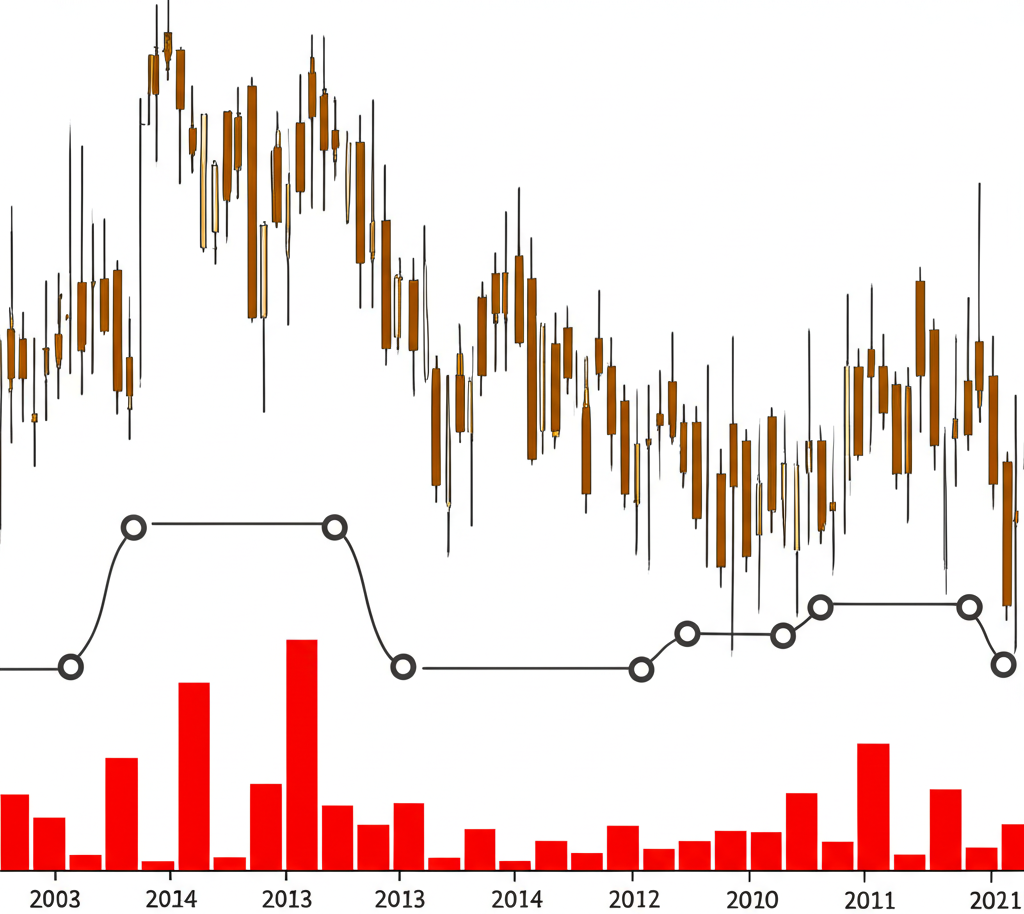

Interpreting the Standard Deviation Indicator: High vs. Low Volatility

Reading the Standard Deviation indicator comes down to understanding what rising or falling values reveal about market psychology and behavior. When the line climbs, it’s a clear signal that price movements are becoming more extreme. This surge often coincides with strong directional moves, breaking news, or heightened uncertainty—all conditions that push traders to act more aggressively. High volatility doesn’t inherently mean prices are going up or down, but it does mean they’re moving with greater force, increasing both the potential for profit and the risk of loss.

Conversely, when the indicator trends downward, it reflects a market in repose. Prices are making smaller moves, staying close to their average, and showing little urgency in any direction. This kind of environment frequently occurs during consolidation phases, where buyers and sellers are in temporary equilibrium, or during quiet periods before a major breakout. For traders, low standard deviation can signal opportunity—either to prepare for a coming surge or to execute range-bound strategies with tighter margins.

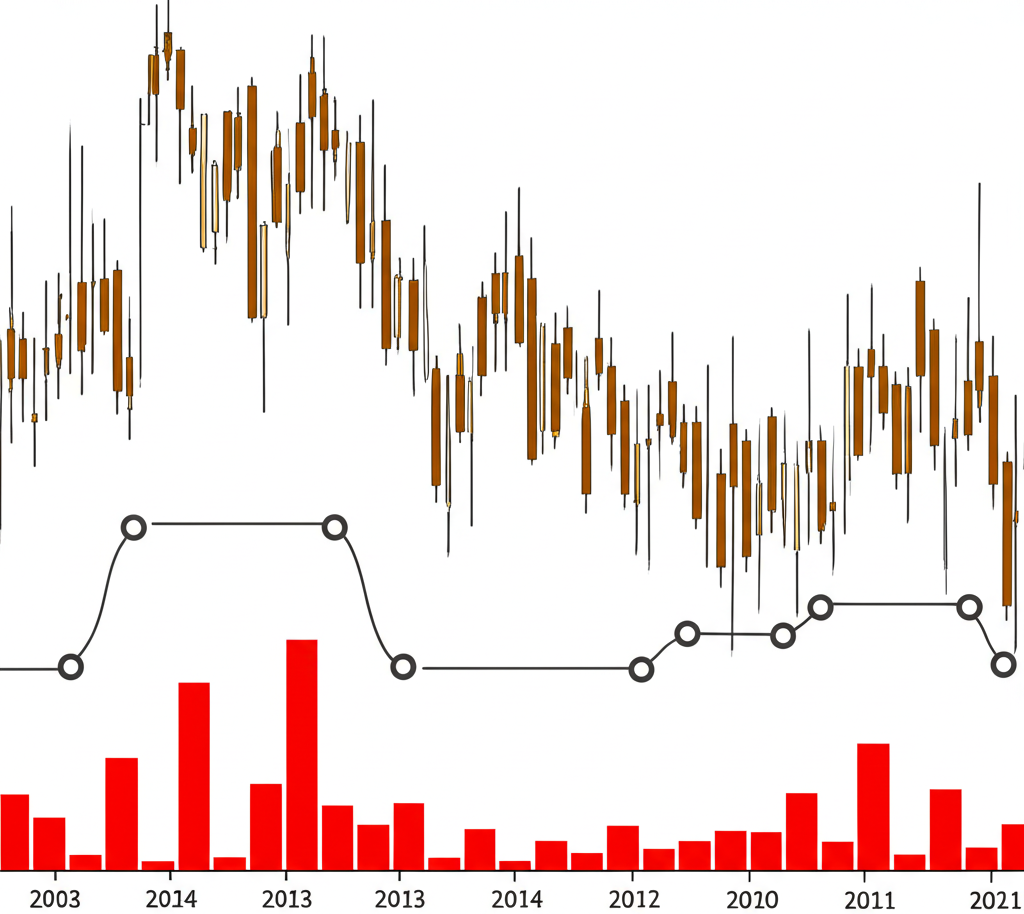

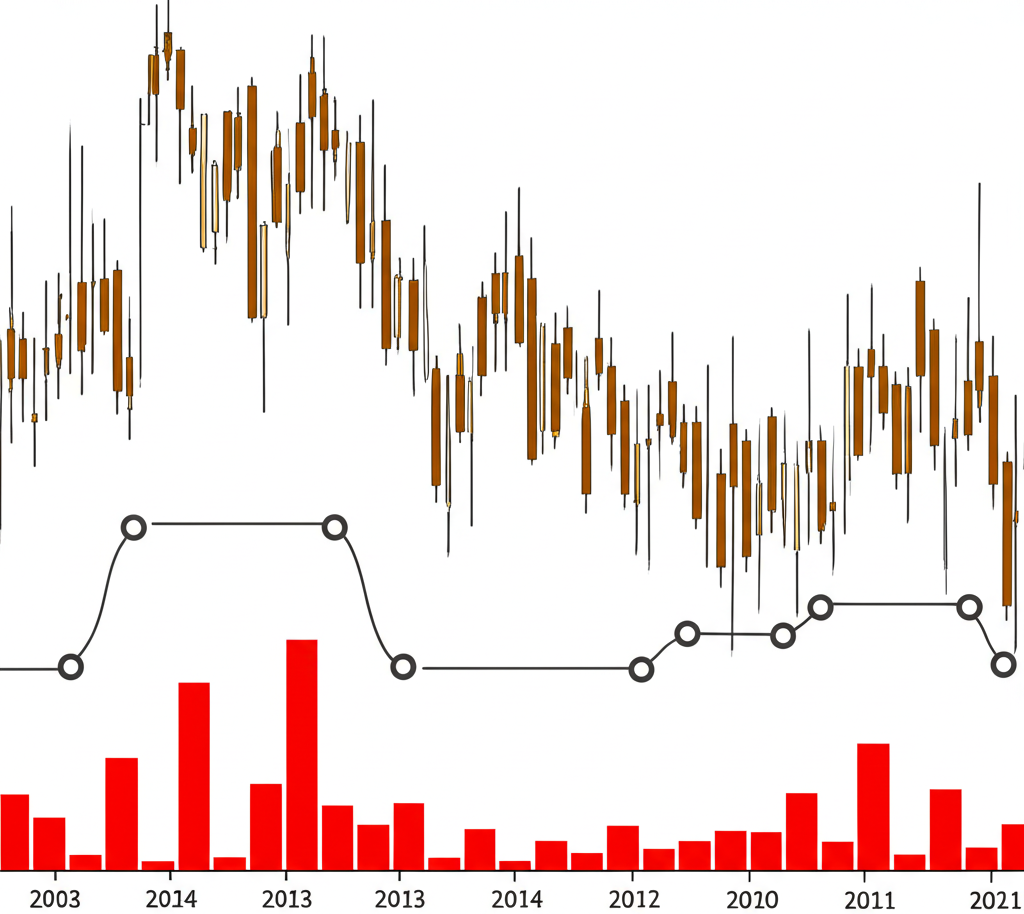

On a price chart, these shifts are often visible even without the indicator. Wide candlesticks, sharp swings, and expanding ranges typically align with rising standard deviation. In contrast, narrow candles, small price changes, and tight trading zones accompany lower readings. Recognizing this visual correlation strengthens your ability to interpret market dynamics in real time.

Understanding Specific Deviations: What Does 1.5 or 2 Standard Deviations Mean?

Beyond simply tracking high or low volatility, the standard deviation indicator allows traders to assess the rarity and significance of price moves. This is rooted in the statistical concept of normal distribution, where certain percentages of data fall within defined ranges from the mean.

- ±1 Standard Deviation: Covers approximately 68% of price movements. Moves within this range are common and considered part of normal market fluctuation.

- ±2 Standard Deviations: Encompasses about 95% of price activity. A move beyond this threshold is relatively rare and may suggest strong momentum or an overextended market.

- ±3 Standard Deviations: Captures nearly all typical price action (99.7%). Moves beyond this level are exceptional and often linked to major news events or emotional market reactions.

So, what does it mean when a stock or cryptocurrency trades 1.5 standard deviations away from its mean? It indicates a meaningful departure from average behavior—more than a routine swing, but not yet extreme. Such a move could reflect strong buying or selling pressure, possibly driven by earnings reports, macroeconomic data, or shifts in investor sentiment.

Traders use these thresholds to inform their decisions. For example, a price breaching 2 standard deviations might prompt caution, as it could signal an overbought or oversold condition. Others may see it as confirmation of a powerful trend. Additionally, these levels help in setting strategic exit points—stop-loss orders can be placed beyond 1 or 2 standard deviations to avoid being shaken out by normal noise, while take-profit targets can be aligned with expected volatility bands.

Practical Applications of the Standard Deviation Indicator in Trading

The Standard Deviation indicator is more than just a theoretical measure—it’s a practical tool with multiple uses across different trading styles. Its primary strength lies in revealing shifts in market dynamics, allowing traders to adapt their strategies accordingly.

- Identifying Volatility Regimes: By monitoring whether standard deviation is rising or falling, traders can classify the market as either trending or consolidating. This helps determine whether to use breakout strategies or range-based approaches.

- Risk Assessment: A higher reading suggests wider price swings, meaning greater uncertainty. This insight directly informs trade sizing and risk tolerance.

- Trend Confirmation: In a strong trend, increasing standard deviation often confirms that momentum is building and participation is broadening, rather than fading.

Standard Deviation and Bollinger Bands: A Powerful Combination

One of the most influential applications of standard deviation in trading is its role in Bollinger Bands, developed by John Bollinger. These bands consist of a central moving average, usually a 20-period simple moving average (SMA), with upper and lower bands plotted two standard deviations above and below the SMA.

The brilliance of Bollinger Bands lies in their adaptability. When market volatility increases, the bands expand outward. When volatility contracts, they tighten—creating what’s known as a “Bollinger Squeeze.” This dynamic behavior makes them highly responsive to changing market conditions.

Traders use Bollinger Bands to spot several key signals:

- Overbought/Oversold Conditions: Prices touching the upper band may indicate overbought territory, while touches of the lower band can suggest oversold levels—though in strong trends, prices can ride along one band for extended periods.

- Potential Breakouts: A period of narrowing bands often precedes a sharp price move. The “squeeze” builds tension, and when the price breaks out, volatility typically expands rapidly.

- Trend Strength: Sustained movement near the upper band in an uptrend (or the lower band in a downtrend) reflects strong momentum and conviction among market participants.

For deeper insights into how these bands are constructed and interpreted, John Bollinger’s official site provides comprehensive resources: BollingerBands.com.

Using Standard Deviation for Trend Confirmation and Reversals

While standard deviation doesn’t predict direction, it can help confirm whether a trend is healthy or showing signs of fatigue. During a robust uptrend, if standard deviation rises alongside price, it indicates that price swings are growing larger—a sign of strong momentum and active participation. This kind of volatility supports the idea that the trend has room to continue.

On the other hand, if a trend persists but standard deviation begins to decline, it may signal weakening momentum. Smaller price movements and reduced dispersion suggest that conviction is waning. This divergence can act as an early warning of a potential pullback, consolidation, or even a reversal. Traders watching for such signals might choose to tighten stop-losses, take partial profits, or prepare for a shift in strategy.

Standard Deviation Indicator Strategies for Different Market Conditions

One of the greatest strengths of the standard deviation indicator is its versatility across various market environments. By adjusting strategies based on volatility levels, traders can align their approach with the current market rhythm.

Volatility Breakout Strategies

Breakout strategies thrive when volatility transitions from low to high. A period of very low standard deviation—often seen as a “volatility contraction”—can set the stage for explosive moves.

Approach: Identify assets that have been trading in a tight range with declining standard deviation. This suggests a coiled spring effect, where energy is building beneath the surface. When the indicator begins to rise, watch for price to break out of key support or resistance levels.

Entry: Enter a long position on a break above resistance or a short on a break below support, especially if confirmed by rising volume and standard deviation.

Risk Management: Place stop-loss orders just inside the previous range to protect against false breakouts. Given the potential for rapid movement, allow some room for initial volatility spikes without exiting prematurely.

Range-Bound Trading Strategies

When standard deviation remains low and stable, it often indicates that the market is oscillating within a defined range. This environment favors mean-reversion strategies.

Approach: Look for assets where price repeatedly bounces between clear support and resistance levels, and standard deviation stays flat. These are ideal candidates for buying near the bottom of the range and selling near the top.

Entry: Initiate long positions as price approaches support and shows signs of stabilization, with standard deviation confirming low volatility. For shorts, enter near resistance under similar conditions.

Risk Management: Set stop-losses just beyond the range boundaries to limit losses if a breakout occurs. Take-profit targets should be set at the opposite end of the range, capturing gains from predictable price swings.

Risk Management and Position Sizing with Standard Deviation

Perhaps one of the most underappreciated uses of standard deviation is in refining risk controls. Volatility directly impacts how much exposure a trader should take on any given position.

- Stop-Loss Placement: In high-volatility environments, price swings are wider. Stops placed too tightly may get triggered by normal noise. Using a multiple of standard deviation (e.g., 1.5x) helps set stops at levels that account for expected movement.

- Take-Profit Targets: Similarly, profit targets can be adjusted based on volatility. In calm markets, smaller gains may be realistic. In turbulent conditions, larger moves are possible, justifying more ambitious targets.

- Position Sizing: Higher volatility means higher risk per share or contract. To maintain consistent risk exposure, traders can reduce position size during high-standard deviation periods and increase it when volatility is low. This dynamic sizing helps preserve capital during turbulent times and capitalize on opportunities when conditions are favorable.

How to Use the Standard Deviation Indicator on Trading Platforms

Adding the Standard Deviation indicator to your charts is simple on most modern trading platforms. Below are step-by-step guides for two of the most widely used systems.

Standard Deviation Indicator on TradingView

TradingView offers intuitive access to technical indicators, making it easy to apply standard deviation to any chart.

- Open the chart of the asset you want to analyze.

- Click on the “Indicators” button, typically found at the top of the chart interface.

- Type “Standard Deviation” into the search bar.

- Select the indicator from the results list.

- Once applied, click the gear icon next to the indicator name to adjust settings.

Key customization options include:

- Length (Period): Determines how many bars are included in the calculation. A 20-period setting is common, but can be adjusted.

- Source: Choose which price point to use—close, open, high, low, or a composite like (high+low)/2.

- Style: Modify line color, thickness, and type for better visual clarity.

Standard Deviation Indicator on MT4/MT5

MetaTrader 4 and 5 come with the Standard Deviation indicator built in, accessible through the platform’s indicator menu.

- Open a chart for your chosen instrument.

- Navigate to the top menu: Insert → Indicators → Oscillators.

- Select “Standard Deviation” from the list.

- A settings window will appear, allowing you to configure the indicator.

Available parameters include:

- Period: The number of bars used in the calculation (e.g., 20).

- Shift: Moves the indicator line forward or backward in time (usually set to 0).

- Apply to: Specifies the price type—Close, Open, High, Low, Median Price, Typical Price, or Weighted Close.

- Style: Customize appearance with color, line weight, and style options.

After adjusting, click “OK” to apply the indicator to your chart.

Advantages and Limitations of the Standard Deviation Indicator

No technical tool is perfect, and standard deviation is no exception. Understanding both its strengths and weaknesses ensures it’s used effectively and in context.

Advantages

- Clear Volatility Measurement: Offers a precise, numerical value for market volatility, making it easier to compare conditions across assets or timeframes.

- Enhances Risk Management: Helps define realistic stop-loss and take-profit levels based on actual price behavior.

- Works Across Markets: Applicable to stocks, forex, cryptocurrencies, commodities, and indices.

- Core Component of Other Tools: Forms the mathematical backbone of indicators like Bollinger Bands, enhancing their reliability.

- Early Warning Signal: Can flag shifts in market dynamics—such as the end of consolidation or weakening momentum—before they’re fully reflected in price.

Limitations

- Lagging Nature: Because it relies on historical data, it reflects past volatility rather than predicting future moves.

- No Directional Insight: It tells you how much prices are moving, but not which way. Must be paired with trend or momentum tools.

- Setting Sensitivity: The choice of period significantly affects responsiveness. Too short, and it’s noisy; too long, and it’s slow to react.

- No Built-in Bias: A spike in standard deviation could mean either a bullish or bearish surge—interpretation depends on other factors.

- Extreme Events: During black swan events or flash crashes, readings can spike dramatically, but such levels may not be sustainable or representative of normal market behavior.

Best Practices for Trading with the Standard Deviation Indicator

To get the most out of this powerful tool, follow these proven strategies:

- Combine with Other Indicators: Never rely on standard deviation alone. Pair it with moving averages to confirm trend direction, or with RSI and MACD to assess momentum and overbought/oversold conditions. For instance, a low standard deviation reading combined with an oversold RSI might highlight a high-probability buying opportunity in a ranging market.

- Match Settings to Your Strategy: Short-term traders may prefer a 10 or 14-period setting for quicker signals, while swing traders often find 20 to 50 periods more reliable. There’s no universal “best” setting—test different lengths on your preferred assets.

- Consider the Broader Context: Is the overall market bullish or bearish? Are major economic reports due? Sometimes, fundamental drivers override technical patterns, so always assess the bigger picture.

- Adapt Risk Controls: Use volatility readings to dynamically adjust your trade parameters. High standard deviation calls for wider stops and smaller position sizes to protect capital.

- Backtest and Forward-Test: Before going live, test your strategy on historical data. Then, run it in a demo account to see how it performs under real-time conditions.

- Avoid Overfitting: While tweaking settings is part of optimization, chasing perfect past performance can lead to strategies that fail in live markets. Focus on robustness, not perfection.

Conclusion

The Standard Deviation indicator is a cornerstone of modern technical analysis, offering traders a clear, quantifiable measure of market volatility. By revealing how far prices deviate from their average, it provides essential insights into risk, trend strength, and potential turning points. Its integration into tools like Bollinger Bands further amplifies its utility. While it doesn’t predict price direction and relies on historical data, its value becomes clear when used in combination with other analytical methods. When applied thoughtfully—paired with sound risk management and a deep understanding of market context—it becomes a powerful ally in navigating the complexities of financial markets. Mastery comes not from memorizing formulas, but from consistent practice, real-world testing, and the wisdom to know when volatility signals opportunity and when it warns of danger.

Frequently Asked Questions (FAQs)

What is the SD mean indicator and how does it relate to volatility?

The “SD mean indicator” refers to the Standard Deviation indicator. It measures how much an asset’s price typically deviates from its average (mean) price over a given period. A higher SD value indicates high volatility (prices are widely dispersed), while a lower SD value indicates low volatility (prices are stable and close to the mean).

How can I accurately indicate standard deviation on my trading chart?

You can add the Standard Deviation indicator from your trading platform’s indicator menu. On platforms like TradingView or MT4/MT5, search for “Standard Deviation” and apply it to your chart. You can then customize its period (e.g., 20) and the price source (e.g., close price) in its settings.

When should a trader choose between STDEV.P (population) and STDEV.S (sample) for market analysis?

For most trading analysis, where you are using a limited historical period (e.g., a 20-period standard deviation) as a subset of the asset’s overall price history, **STDEV.S (sample standard deviation)** is generally more statistically appropriate. STDEV.P (population standard deviation) would only be used if you were analyzing the *entire* available dataset that you consider to be the complete population of prices.

What does it practically mean if a stock’s price is 1.5 standard deviations from its mean?

If a stock’s price is 1.5 standard deviations from its mean, it signifies a significant price move away from its average. While not as common as a 1-standard deviation move (which covers ~68% of price action), it’s not an extremely rare event. It suggests the stock has experienced a notable shift in price relative to its typical fluctuations, potentially indicating strong momentum or a reaction to specific news. For traders, it might signal an overextended move or a strong directional bias.

Can the Standard Deviation indicator be used as a standalone tool for making trading decisions?

No, the Standard Deviation indicator should generally not be used as a standalone tool. It measures volatility but does not provide directional signals. For effective trading decisions, it must be combined with other technical indicators that provide insights into trend direction (e.g., moving averages, ADX) and momentum (e.g., RSI, MACD).

Are there any free Standard Deviation indicator tools or templates available for popular trading platforms?

Yes, the Standard Deviation indicator is a standard, built-in feature on virtually all popular free and paid trading platforms, including TradingView, MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and most brokerage-provided charting software. You do not need to download or purchase external tools for it.

What is the main difference between the Standard Deviation indicator and the Average True Range (ATR)?

Both Standard Deviation and Average True Range (ATR) measure volatility, but they do so differently.

- **Standard Deviation** measures the dispersion of prices around their mean, giving you a statistical sense of how spread out prices are from the average.

- **ATR** measures the average range of price movement over a specified period, taking into account gaps and limit moves. It focuses on the “true range” of each bar (max of current high-low, current high-previous close absolute, current low-previous close absolute).

While both indicate volatility, SD is more about statistical dispersion, while ATR focuses on the average size of price bars.

What are the optimal settings (e.g., period) for the Standard Deviation indicator across different asset classes?

There isn’t a single “optimal” setting for the Standard Deviation indicator, as it depends on the asset, timeframe, and your trading style. A common starting point is a **20-period** setting, which works well for many assets and timeframes. However, for faster-moving markets like cryptocurrency or very short timeframes, a shorter period (e.g., 10-14) might be preferred. For longer-term analysis, a longer period (e.g., 50) can provide a smoother volatility reading. Experimentation and backtesting are crucial to find the best fit.

How can I incorporate the Standard Deviation indicator into a comprehensive cryptocurrency trading strategy?

In cryptocurrency trading, which is known for its high volatility, the Standard Deviation indicator is particularly useful.

- Use rising SD to confirm strong trends or anticipate breakouts from consolidation in volatile crypto pairs.

- Utilize low SD to identify periods of accumulation or ranging behavior before a potential large move.

- Integrate it with Bollinger Bands to spot potential overbought/oversold conditions or “Bollinger Squeezes” that often precede significant price shifts in crypto.

- Adjust position sizing and stop-loss placements based on the current volatility indicated by SD, typically reducing size during high volatility.

Can you provide the basic standard deviation of stock formula and explain its components?

The basic formula for standard deviation ($σ$) of stock prices is:

$σ = \sqrt{\frac{\sum_{i=1}^{N} (x_i – \mu)^2}{N}}$

Where:

- $x_i$: Each individual stock price in your dataset.

- $\mu$: The mean (average) of all the stock prices over the chosen period.

- $N$: The total number of stock prices (data points) in your dataset.

- $\sum$: The summation symbol, meaning you sum up all the calculated values.

This formula measures the average amount by which each stock price deviates from the average price, indicating the stock’s price volatility.

留言