Introduction: Understanding Coinbase’s Financial Landscape

Coinbase Global, Inc. has cemented its place as a central pillar in the digital asset economy, serving millions of users across more than 100 countries through one of the most trusted cryptocurrency exchanges in the world. As crypto continues to evolve from speculative asset class to foundational financial infrastructure, scrutiny of Coinbase’s financial performance—particularly its annual revenue—has intensified among investors, market analysts, and regulatory observers. This deep dive examines the full arc of Coinbase’s revenue journey, from explosive growth during market highs to strategic recalibration amid downturns. We explore historical trends, dissect core income sources, assess profitability, and evaluate forward-looking initiatives that could redefine its role in the next phase of Web3 adoption.

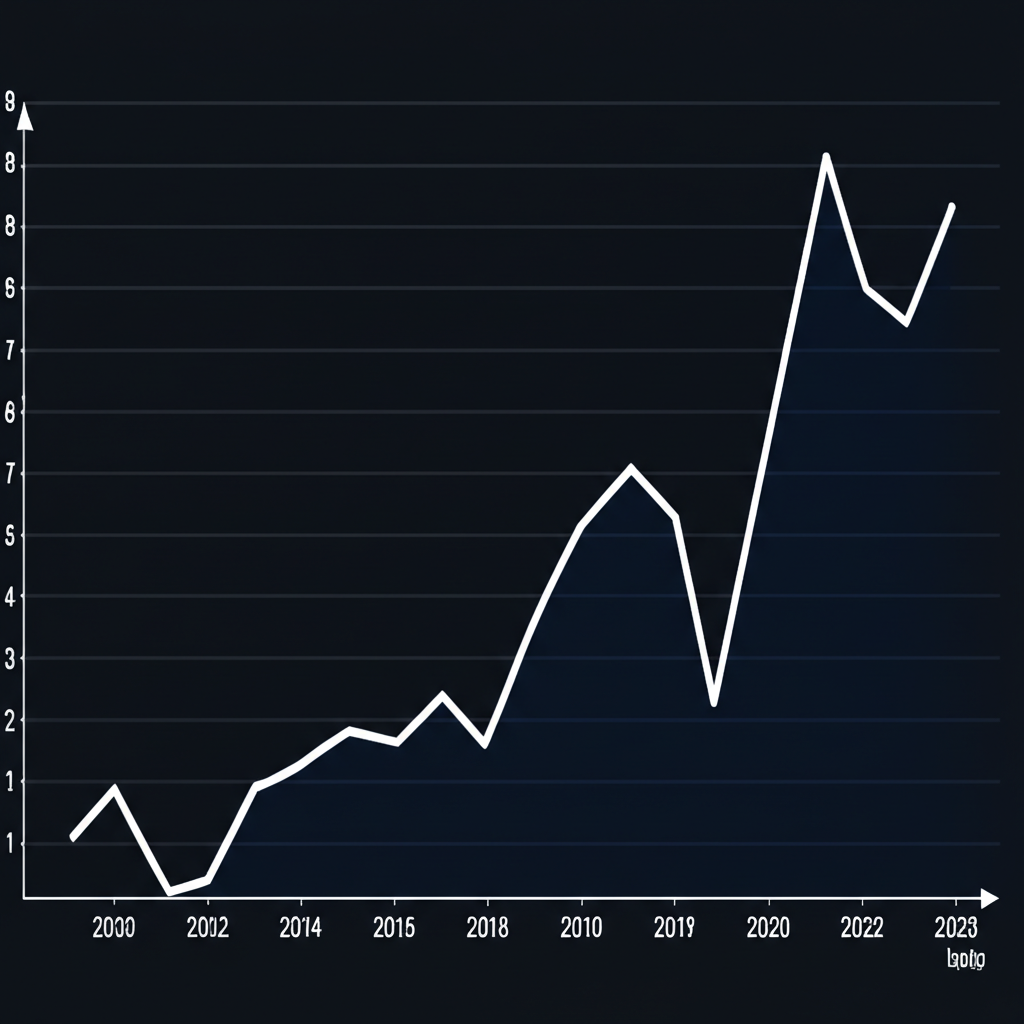

Coinbase Annual Revenue: Historical Performance (2020-Present)

The story of Coinbase’s revenue since 2020 is inseparable from the rhythms of the broader cryptocurrency market. Characterized by dramatic peaks and steep corrections, the company’s top-line figures reflect both the volatility inherent in digital assets and the resilience of its platform. Since going public via direct listing in April 2021, Coinbase has navigated intense market shifts—each phase revealing new insights into its operational agility and long-term viability.

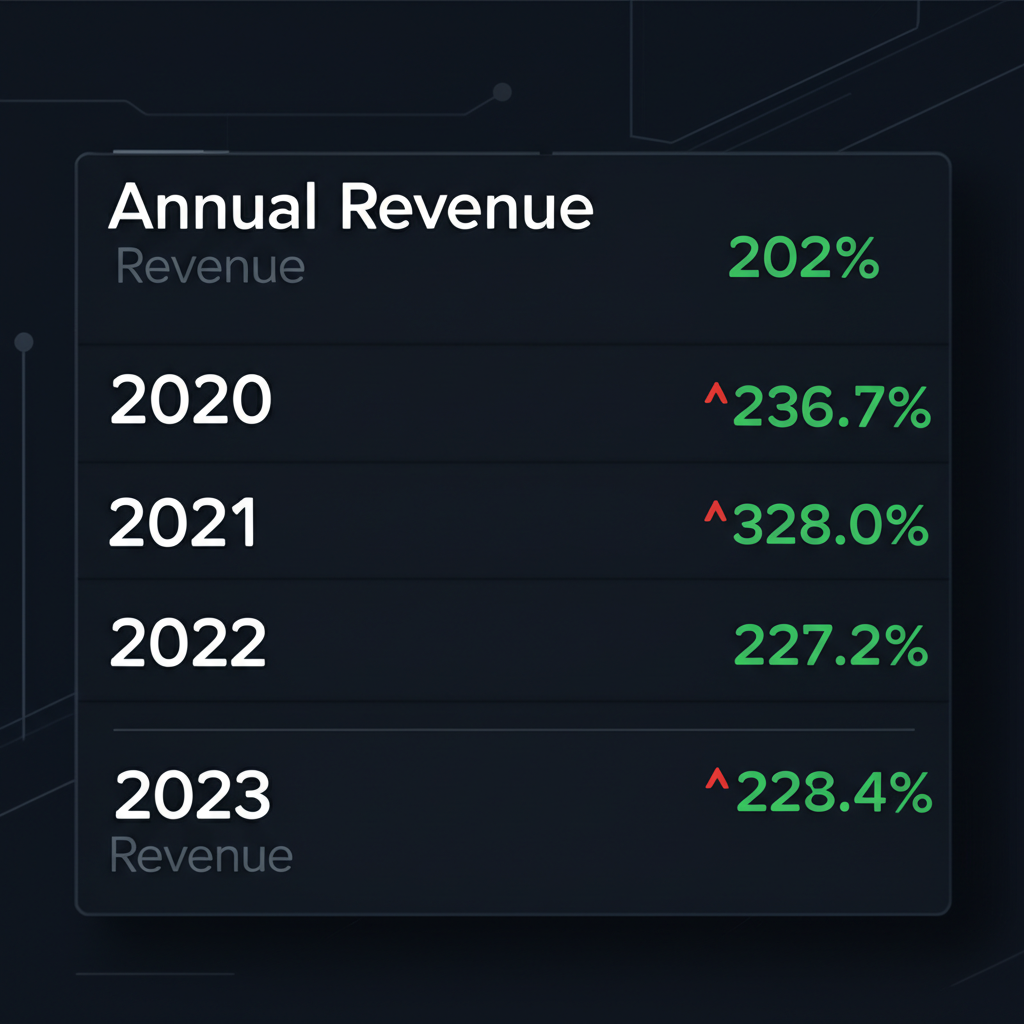

Below is a detailed breakdown of its annual revenue performance:

| Fiscal Year | Annual Revenue (USD Billions) | Year-over-Year Growth |

|---|---|---|

| 2020 | 1.28 | N/A |

| 2021 | 7.36 | +475% |

| 2022 | 3.19 | -56.7% |

| 2023 | 3.10 | -2.8% |

(Data sources: Coinbase Investor Relations & SEC Filings)

The meteoric rise in 2021 was fueled by a perfect storm: surging retail participation, institutional onboarding, record-breaking Bitcoin prices, and growing interest in Ethereum-based ecosystems like DeFi and NFTs. Trading volume skyrocketed, directly boosting transaction-based revenue. The sharp reversal in 2022, however, followed a cascade of macroeconomic pressures—rising interest rates, inflation, and a series of high-profile collapses within the crypto sector, including Terra, Celsius, and FTX. These events triggered a broad loss of confidence, leading to reduced trading activity and capital outflows. By 2023, Coinbase’s revenue stabilized near $3.1 billion, signaling not just survival but early signs of adaptation as non-trading revenue streams began gaining traction.

(An interactive chart depicting Coinbase’s annual revenue from 2020 to 2023 would be placed here, illustrating the peaks and troughs.)

Key Revenue Milestones and Market Context

The 2021 peak wasn’t just a result of higher prices—it was a cultural shift. Cryptocurrency moved from niche tech circles into mainstream finance, with Coinbase playing a central role as onboarding gateway. Its user base expanded from 43 million at the end of 2020 to over 100 million by mid-2021. Institutional clients also increased their footprint, drawn by Coinbase Custody and Prime services. This convergence of retail frenzy and professional capital inflows created an environment where even modest fee percentages translated into massive revenue.

By contrast, 2022 marked a “crypto winter,” where bearish sentiment dominated. Trading volumes declined across the board, and many users shifted from active speculation to long-term holding or exited the market entirely. Regulatory scrutiny intensified, further dampening investor enthusiasm. Yet, Coinbase maintained platform integrity, avoided insolvency, and continued investing in product development—moves that positioned it for recovery when market conditions eventually improved.

Deconstructing Coinbase’s Revenue Streams

While often perceived as a simple trading venue, Coinbase operates a multifaceted business model. Revenue is no longer driven solely by spot trades; instead, the company has systematically built a diversified ecosystem aimed at generating more predictable income. This evolution reflects a strategic pivot from transactional dependency toward sustainable, recurring revenue models—a shift critical for long-term investor confidence.

(A pie chart showing the percentage breakdown of Coinbase’s revenue by source for the most recent fiscal year would be beneficial here.)

Transaction Revenue: The Core Engine

Transaction fees remain the largest contributor to Coinbase’s revenue, accounting for the majority of its income during bull markets. These fees are collected from every trade executed on the platform, whether by retail users buying small amounts of Bitcoin or institutional clients executing large-scale swaps. Retail transactions typically carry higher effective fees due to spread-based pricing and convenience premiums, while institutional trades benefit from negotiated rate structures but contribute meaningfully through volume.

Several key dynamics influence this revenue stream:

- Trading Volume: The volume of assets traded directly determines fee collection. High turnover equals higher revenue.

- Market Volatility: Periods of rapid price swings tend to increase user activity, driving up both buy and sell orders.

- Asset Composition: Different cryptocurrencies come with different fee tiers. Stablecoins often have lower fees, while lesser-known altcoins may carry higher spreads.

- Product Mix: Advanced products like futures, staking-enabled trades, and limit orders can generate incremental fee income beyond basic spot transactions.

Despite its dominance, transaction revenue is inherently cyclical and sensitive to external forces—making it a double-edged sword during volatile periods.

Subscription and Services Revenue: A Growing Diversification

To counterbalance the unpredictability of trading fees, Coinbase has aggressively expanded its “Subscription and Services” segment. This area now represents a cornerstone of its long-term financial strategy, offering revenue that is more stable, recurring, and less tied to market sentiment.

Major components include:

- Staking Services: Facilitating proof-of-stake validation for networks like Ethereum, Solana, and Cosmos, earning a cut of staking rewards.

- Custody Solutions: Secure storage and management of digital assets for hedge funds, asset managers, and corporate treasuries, often under multi-year contracts.

- Interest-Bearing Accounts: Revenue from yield programs such as USDC rewards, where Coinbase earns yield on pooled user balances.

- Coinbase One: A premium subscription launched in 2023 offering zero trading fees, enhanced support, and exclusive benefits, aimed at high-frequency traders.

- Developer Platforms: Monetization of API access, node infrastructure, and blockchain data tools used by Web3 developers and enterprises.

- Node Operations: Earnings from running validator nodes and participating in decentralized network governance.

The progress in this segment is notable. In Q4 2023, Subscription and Services revenue hit approximately $375 million, marking consistent growth quarter-over-quarter. This trajectory suggests Coinbase is successfully transitioning from a pure exchange model to a broader financial services platform.

Profitability and Financial Health: Beyond Top-Line Revenue

Revenue alone doesn’t tell the full story. Equally important is how effectively Coinbase converts sales into profit. Its earnings history reveals a company capable of strong margins in favorable conditions but also vulnerable to downturns due to fixed costs and ongoing investments.

Net Income and Earnings Per Share (EPS)

Coinbase achieved record profitability in 2021, reporting a net income of over $3.6 billion—a direct outcome of sky-high trading volumes and efficient cost leverage. Earnings per share surged accordingly, rewarding early investors.

However, 2022 brought a stark reversal. As revenue plummeted, the company continued spending on talent, technology, and global expansion, resulting in a net loss. While painful in the short term, these investments were strategic, aimed at maintaining leadership during a period when weaker competitors faltered or failed. The stabilization seen in 2023 suggests a return to more balanced operations, with losses narrowing and non-GAAP metrics showing signs of improvement.

(A line chart showing historical Net Income and EPS alongside annual revenue would visually connect these metrics.)

Key Financial Metrics: Gross Profit and Operating Income

Gross Profit measures the efficiency of Coinbase’s core operations after accounting for direct costs—primarily blockchain network fees, transaction processing expenses, and staking reward payouts. A strong gross margin indicates scalable infrastructure and pricing power.

Operating Income, on the other hand, factors in overhead: marketing spend, R&D investment, compliance costs, and administrative functions. This metric reveals whether the business can sustain profitability even when market tailwinds fade. Tracking operating income over time highlights the impact of cost discipline and strategic prioritization—especially relevant during bear markets when revenue compression tests organizational resilience.

Factors Driving Coinbase’s Revenue Performance

Coinbase doesn’t operate in a vacuum. Its financial outcomes emerge from a complex interplay of market forces, user behavior, regulatory developments, and internal innovation.

Cryptocurrency Market Cycles and Volatility

No factor impacts Coinbase more than the ebb and flow of crypto market cycles. Bull runs, typically led by Bitcoin and Ethereum price appreciation, ignite speculative trading, increase wallet activity, and boost staking participation—all of which feed directly into revenue. The 2021 surge was a textbook example of this effect.

Conversely, bear markets suppress volatility and user engagement. When prices stagnate or decline, traders become cautious, volume drops, and even staking yields lose appeal amid broader risk aversion. The correlation between Bitcoin’s price and Coinbase’s transaction volume is particularly strong, making BTC a de facto leading indicator for the company’s near-term revenue outlook.

User Growth, Engagement, and Product Innovation

Beyond market cycles, internal drivers matter. Coinbase’s ability to attract new users and deepen engagement with existing ones determines its long-term growth potential. Features like recurring buys, educational content, and social trading integrations help retain casual investors, while advanced tools cater to active traders.

Product innovation has been central to this effort. The launch of Coinbase Wallet gave users self-custody options, enhancing ecosystem stickiness. The introduction of Base, its Ethereum Layer 2 network, opens new revenue opportunities through dApp development, gas fee collection, and ecosystem incentives. Similarly, expansions in institutional services—such as Coinbase Prime and Custody API integrations—broaden the company’s reach beyond retail.

Regulatory Environment and Compliance Costs

Operating in a heavily scrutinized industry, Coinbase faces significant regulatory exposure. Actions by the U.S. Securities and Exchange Commission, including lawsuits over alleged securities violations, have created uncertainty around product offerings and market access. Compliance efforts require substantial investment in legal teams, risk monitoring, and policy advocacy.

Yet, Coinbase’s proactive regulatory stance may prove a competitive advantage. Unlike some offshore exchanges, it prioritizes adherence to U.S. financial laws, which builds trust with institutional clients and traditional investors. A clear regulatory framework could unlock new products—such as spot Ethereum ETFs—and expand its addressable market. In this sense, compliance isn’t just a cost center—it’s a strategic differentiator.

Coinbase’s Revenue Outlook: Projections and Strategic Initiatives

Looking ahead, Coinbase’s financial trajectory hinges on both macro trends and execution quality. Analyst sentiment is cautiously optimistic, with expectations of gradual revenue recovery as crypto markets stabilize and institutional adoption gains momentum.

Future Revenue Drivers: Diversification and Institutional Growth

While transaction revenue will remain important, the future lies in diversification. The Subscription and Services segment is expected to grow faster than overall revenue, driven by increasing demand for staking, custody, and developer tools. Institutional adoption remains a major catalyst—asset managers, pension funds, and fintech platforms are increasingly exploring crypto integration, creating opportunities for Coinbase’s enterprise-grade solutions.

Key growth levers include:

- Institutional Services Expansion: Scaling prime brokerage, OTC desks, and compliance-ready custody platforms for global financial institutions.

- Staking Ecosystem Development: Adding support for more blockchains and improving user experience to capture a larger share of staking flows.

- International Market Penetration: Expanding into regulated markets in Europe, Asia, and Latin America, where crypto adoption is accelerating.

- Base Network Growth: Driving developer adoption on Base through grants, infrastructure support, and seamless onboarding from Coinbase’s user base.

Analyst estimates for 2024 and 2025 suggest a return to growth, with consensus revenue projections ranging between $4 billion and $5 billion—assuming moderate market recovery and successful execution of these initiatives.

Potential Headwinds and Opportunities

Challenges persist. Competition from decentralized exchanges (DEXs) like Uniswap threatens retail trading volume, while centralized rivals like Binance and Kraken continue expanding globally. Regulatory ambiguity remains a persistent risk, particularly in the U.S., where policy outcomes could limit innovation or restrict market access.

At the same time, opportunities abound. Approval of additional spot crypto ETFs beyond Bitcoin could bring billions in new capital. Broader acceptance of blockchain for payments, identity, and tokenization could expand use cases. And as Web3 matures, Coinbase is well-positioned to serve as a bridge between traditional finance and decentralized systems.

Coinbase Revenue Compared: A Peer Analysis

When benchmarked against peers, Coinbase stands out for its transparency, regulatory posture, and diversification strategy. Unlike privately held exchanges that disclose little financial data, Coinbase offers investors a rare window into the economics of a major crypto platform.

A comparison with Robinhood, which also offers crypto trading, reveals a fundamental difference: Robinhood generates most of its crypto revenue through payment for order flow and has a diversified base in equities and options. Coinbase, by contrast, is deeply specialized in digital assets, making it a purer play on crypto market health.

Within the crypto-native space, Coinbase distinguishes itself from less regulated platforms by prioritizing compliance and institutional readiness. Its higher proportion of non-transactional revenue—especially in custody and staking—aligns it more closely with traditional financial institutions seeking recurring income models. This strategic positioning may translate into greater valuation multiples over time, particularly if the sector moves toward mainstream acceptance.

Conclusion: Coinbase’s Enduring Financial Journey

Coinbase’s financial path over the past four years reflects the broader journey of cryptocurrency—from speculative mania to maturing infrastructure. Its revenue swings underscore the volatility of an emerging asset class, but its strategic responses reveal a company committed to long-term resilience. By expanding beyond trading fees into staking, custody, and Web3 infrastructure, Coinbase is reshaping itself into a comprehensive financial platform for the digital age.

While market cycles will continue to influence short-term results, the company’s focus on innovation, regulation, and diversification provides a foundation for sustainable growth. As crypto adoption evolves—from retail speculation to institutional integration, from simple wallets to complex dApp ecosystems—Coinbase is positioning itself not just as an exchange, but as essential infrastructure for the next generation of finance.

1. What was Coinbase’s total annual revenue for the most recent fiscal year?

For the full fiscal year 2023, Coinbase reported a total annual revenue of approximately $3.10 billion.

2. How has Coinbase’s annual revenue changed over the past five years?

Coinbase’s annual revenue has seen significant fluctuations, mirroring crypto market cycles. It surged from $1.28 billion in 2020 to a peak of $7.36 billion in 2021 during the bull market, then declined to $3.19 billion in 2022 and $3.10 billion in 2023 during the bear market. This shows high volatility but also signs of stabilization.

3. What is the primary source of Coinbase’s revenue, and how diversified are its income streams?

The primary source of Coinbase’s revenue is transaction fees from retail and institutional trading. However, the company is actively diversifying its income streams through “Subscription and Services” revenue, which includes staking, custody, interest income, and Coinbase One subscriptions, making its business model less reliant on just trading volume.

4. Is Coinbase currently profitable, and how does its net income relate to its annual revenue?

Coinbase’s profitability fluctuates significantly. It achieved substantial net income during peak bull markets (e.g., 2021) but experienced net losses during prolonged bear markets (e.g., 2022). Its net income directly correlates with its ability to generate high revenue (primarily transaction fees) that outpaces its operating expenses.

5. What impact do cryptocurrency market cycles have on Coinbase’s annual revenue performance?

Cryptocurrency market cycles have a profound impact. Bull markets, with rising asset prices and increased volatility, drive higher trading volumes and significantly boost transaction revenue. Conversely, bear markets lead to reduced trading activity and a substantial decline in revenue.

6. How does Coinbase’s “Subscription and Services” revenue contribute to its overall financial health?

Subscription and Services revenue provides a more stable and recurring income stream, helping to offset the volatility of transaction-based revenue. Its growth is crucial for enhancing Coinbase’s financial health by diversifying its business model and making its overall revenue less susceptible to crypto market fluctuations.

7. Where can investors access detailed official reports on Coinbase’s annual financial results?

Investors can access Coinbase’s detailed official financial reports, including its annual 10-K filings and quarterly 10-Q filings, on the company’s Investor Relations website and through the U.S. Securities and Exchange Commission’s (SEC) EDGAR database.

8. What are the expert predictions or analyst consensus for Coinbase’s revenue in the upcoming years?

Analyst consensus generally projects an increase in Coinbase’s revenue for 2024 and 2025, assuming a continued recovery in the crypto market. These projections often factor in the growth of its Subscription and Services segment and potential benefits from institutional adoption and new product launches like Base.

9. How does Coinbase’s revenue structure compare to other major players in the fintech or crypto exchange industry?

Coinbase’s revenue structure is distinct, with a strong reliance on crypto transaction fees but a growing emphasis on recurring “Subscription and Services” revenue. This diversification strategy positions it differently from pure-play trading platforms and closer to traditional fintech companies aiming for more predictable income streams, albeit within the volatile crypto sector.

10. What strategic initiatives is Coinbase undertaking to ensure future revenue growth and stability?

Coinbase is pursuing several strategic initiatives, including expanding its institutional offerings, growing its staking and custody services, pursuing international expansion, and developing its Layer 2 network Base. These efforts aim to diversify its revenue base, attract new user segments, and reduce its dependency on volatile retail trading fees.

留言