Introduction: Navigating Airbnb’s Financial Landscape

Airbnb has redefined how people travel, evolving from a niche lodging platform into a global force in the hospitality sector. Since going public, ABNB has drawn intense scrutiny from investors eager to understand its financial trajectory, growth sustainability, and long-term potential. Each quarterly earnings release acts as a vital pulse check, revealing not just numbers but the underlying momentum of the business. These reports offer clarity on profitability, user behavior, and strategic direction—key inputs for anyone evaluating the stock. This analysis dives deep into Airbnb’s earnings performance, unpacking historical trends, current results, forward-looking guidance, and the broader market dynamics that influence investor decisions.

Latest ABNB Earnings Report: Key Highlights and Performance

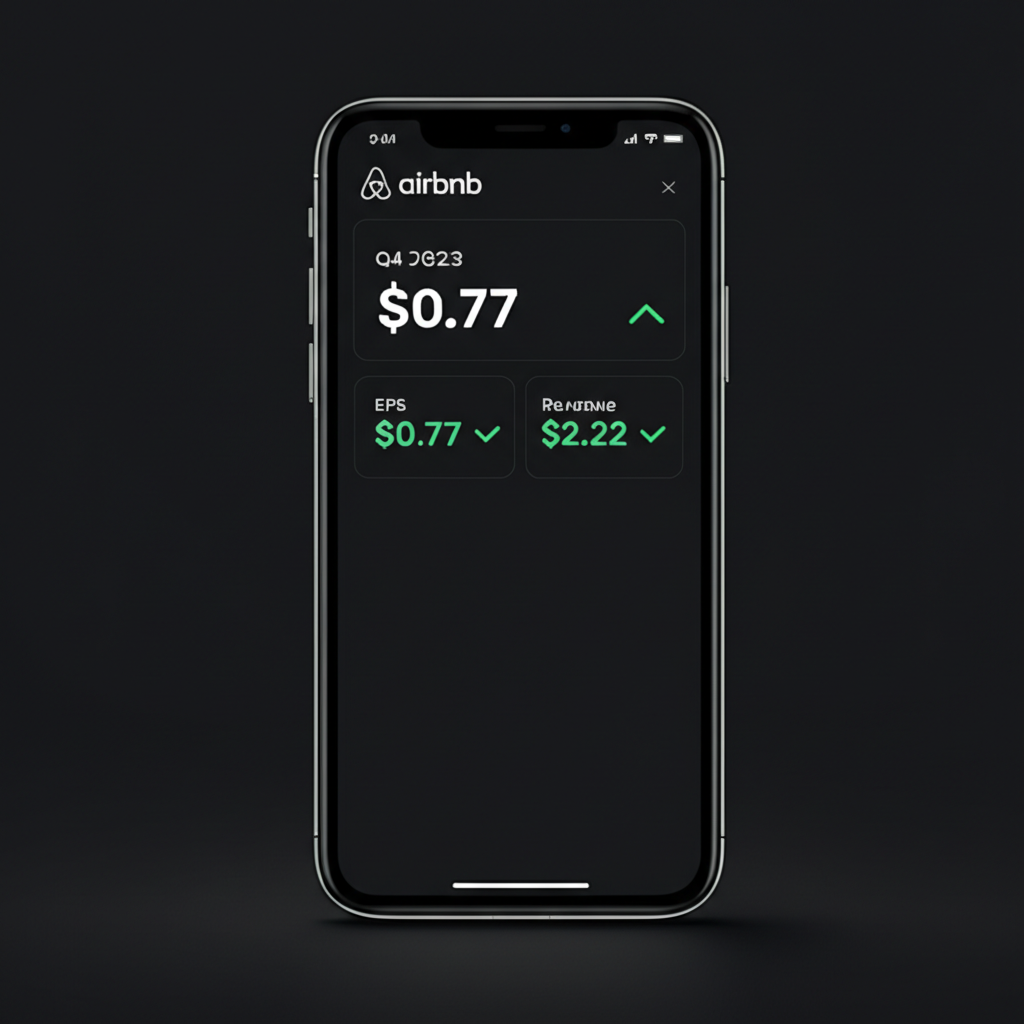

The most recent financial update from Airbnb paints a picture of resilience and strong execution. For Q42023, the company delivered results that not only met but exceeded market expectations, reinforcing confidence in its operational model and pricing strength. These figures come at a time when consumer spending faces headwinds, making the outperformance all the more notable.

Q42023 Earnings Summary: EPS and Revenue

Airbnb reported an Earnings Per Share (EPS) of $0.77 for the fourth quarter of2023, comfortably ahead of the $0.69 forecast by Wall Street analysts. This beat reflects disciplined cost management and sustained demand across its global network. Revenue came in at $2.22 billion, surpassing the anticipated $2.16 billion and marking a17% increase compared to the same period the previous year. The growth was broad-based, with strength seen in both domestic and international markets. These results underscore the platform’s ability to maintain profitability while scaling, a rare combination in the travel-tech space. For detailed financial disclosures, investors can refer to the official updates posted on the Airbnb Investor Relations website.

Operational Metrics and Business Drivers

Beyond the headline financials, key operational indicators reveal the health and scalability of Airbnb’s ecosystem:

- Nights & Experiences Booked: This metric showed solid growth, signaling continued engagement from both travelers and hosts. Notably, cross-border bookings rebounded strongly, indicating a return to pre-pandemic travel patterns and growing comfort with international leisure travel.

- Gross Bookings Value (GBV): At $15.5 billion, GBV hit a high watermark for the quarter, driven by increased booking volumes and higher average daily rates. This suggests travelers are not only booking more but also opting for premium stays.

- Free Cash Flow (FCF): Airbnb generated robust free cash flow, a critical measure of financial health. This internal cash generation allows the company to fund innovation, expand into new markets, and return capital to shareholders without relying on external financing.

Together, these metrics highlight a platform benefiting from strong brand loyalty, a diversified global footprint, and a business model that scales efficiently with demand.

Management Commentary and Outlook

On the earnings call, leadership expressed confidence in the company’s growth trajectory, pointing to strong booking momentum early in2024. Executives emphasized ongoing investments in product enhancements, including tools to improve search accuracy, streamline the booking process, and empower hosts with better analytics. They also discussed expansion efforts in underpenetrated regions, such as parts of Asia and Latin America. For the first quarter of2024, Airbnb provided revenue guidance between $2.03 billion and $2.07 billion. While this reflects seasonal softness typical of Q1, it aligns with analyst expectations and signals stability. The company reiterated its commitment to balanced, profitable growth and prudent use of capital.

ABNB Earnings History: Trends, Surprises, and Growth Trajectory

To fully appreciate Airbnb’s current position, it’s essential to examine its financial journey since its IPO. The company has navigated a turbulent macroeconomic environment, including the pandemic, inflation spikes, and shifting travel behaviors, yet has emerged with a stronger market position.

Quarterly Earnings Performance Over Time

Since its public debut, Airbnb has demonstrated remarkable resilience. Early quarters were marked by volatility as the world adjusted to pandemic-related travel restrictions. However, Airbnb adapted quickly, capitalizing on the shift toward remote work and long-term stays in suburban and rural areas. As international borders reopened, the company experienced a powerful recovery. Over the past two years, both revenue and earnings have followed a clear upward trend, fueled by rising user adoption, improved monetization, and strategic pricing. A historical chart of quarterly EPS and revenue would show a steep climb, particularly from2022 onward, reflecting the company’s ability to convert travel demand into sustainable profits.

The Impact of Earnings Surprises

Airbnb has built a track record of beating earnings estimates, and each positive surprise tends to energize the stock. When actual results exceed expectations—whether in EPS, revenue, or key metrics like GBV—the market often responds with a swift rally. These moments reflect investor confidence in management’s execution and the durability of the business model. Conversely, any miss, though rare in recent quarters, can trigger short-term volatility. For example, even a slight dip in guidance or weaker-than-expected international growth can lead to a pullback, as seen in some past reactions. Financial outlets like CNBC’s ABNB stock page often highlight these movements, providing real-time context for investors.

Growth Catalysts and Challenges Reflected in Earnings

The earnings narrative over time reveals how Airbnb has turned challenges into opportunities. During the pandemic, the company pivoted from urban tourism to experiential and long-term stays, preserving revenue and retaining hosts. In the recovery phase, growth was driven by several factors:

- Resilient consumer demand for travel: Even amid economic uncertainty, people continue to prioritize experiences, favoring unique accommodations over traditional hotels.

- Product innovation: Features like “I’m Flexible” search and enhanced mobile functionality have improved user experience and conversion rates.

- Host ecosystem expansion: Airbnb has successfully attracted new hosts by simplifying onboarding and offering better support tools, increasing supply in high-demand areas.

- Macroeconomic sensitivity: While demand remains strong, rising interest rates and inflation could pressure discretionary spending in the future, potentially affecting booking volumes and pricing power.

These dynamics are consistently reflected in the financials, making earnings reports a window into both performance and strategic adaptation.

Analyst Expectations and Future ABNB Earnings Forecasts

Wall Street’s outlook for Airbnb offers valuable insight into where the stock might be headed. Analysts use financial models, market trends, and company guidance to project future performance, shaping investor sentiment and valuation.

Consensus Estimates for Upcoming Quarters

Looking ahead to2024, analysts expect Airbnb to maintain growth, albeit at a more moderate pace compared to the post-pandemic surge. For Q12024, the consensus EPS estimate stands around $0.22, with revenue projected between $2.03 billion and $2.07 billion—closely matching management’s own guidance. For the full year, forecasts suggest an EPS range of $3.00 to $3.20 on total revenue of $10.0 billion to $10.5 billion. These figures reflect confidence in the company’s ability to grow despite a more challenging macro backdrop. Data providers like Bloomberg and Refinitiv continuously update these estimates as new information becomes available.

Key Factors Influencing Future Projections

Several variables will shape whether Airbnb meets or exceeds these forecasts:

- Global travel recovery: The pace of international travel rebound, particularly in Europe and Asia, will directly impact GBV and revenue.

- Regulatory risks: Cities like Barcelona, Paris, and New York have imposed restrictions on short-term rentals, which could limit supply and affect pricing in key markets.

- Competition: Traditional hotel chains are enhancing their direct booking platforms, while other vacation rental companies are vying for market share. Airbnb must continue innovating to maintain its edge.

- New initiatives: The success of offerings like Airbnb Luxe, Adventures, and integrated travel experiences will determine long-term growth potential.

- Economic conditions: Consumer confidence, employment rates, and inflation will influence travel budgets and booking behavior.

Analysts weigh these factors heavily when adjusting their models and price targets.

Understanding Analyst Ratings and Price Targets

Analyst ratings—ranging from “Strong Buy” to “Sell”—represent institutional perspectives on the stock’s potential. These ratings are typically tied to price targets, which estimate where the stock could trade over the next12 months. A high price target often assumes strong earnings growth, market expansion, and margin improvement. For instance, a “Buy” rating on ABNB usually reflects optimism about its global reach, brand strength, and cash flow generation. Conversely, a “Hold” may suggest the stock is fairly valued given current risks. Investors should view these opinions as part of a broader analysis rather than standalone signals.

ABNB Earnings Calendar: Important Dates for Investors

Staying informed about upcoming earnings announcements is crucial for investors managing positions in ABNB. These dates often serve as catalysts for volatility and strategic decision-making.

When Does Airbnb Report Earnings?

Airbnb traditionally releases its quarterly results about four to six weeks after the close of each fiscal quarter. Based on historical patterns, investors can expect:

- Q1 Earnings: Early to mid-May

- Q2 Earnings: Early to mid-August

- Q3 Earnings: Early to mid-November

- Q4 Earnings: Early to mid-February of the following year

While these are general timelines, the exact dates are confirmed in advance. For the most accurate schedule, investors should monitor the Events & Presentations section on Airbnb’s Investor Relations site.

How to Access Official Earnings Reports and Webcasts

Official financial information is made available through multiple channels:

- Investor Relations Website: The primary source for press releases, financial statements, and supplemental data.

- SEC Filings: Airbnb files its10-Q (quarterly) and10-K (annual) reports with the U.S. Securities and Exchange Commission, accessible via the EDGAR database.

- Earnings Call Webcasts: A live audio broadcast is typically held shortly after the release, featuring management commentary and a Q&A with analysts. Replays and transcripts are posted on the investor site within24 hours.

These resources provide transparency and depth for those conducting due diligence.

Beyond the Numbers: Market Reaction and Investor Sentiment

While financial metrics are foundational, the market’s response to ABNB’s earnings often extends beyond the raw data. Investor psychology, guidance tone, and external narratives all play a role in shaping short-term price action.

Immediate Stock Price Volatility Post-Earnings

It’s common for ABNB’s stock to experience sharp swings in the24 to48 hours following an earnings release. Even when results are strong, the market may react negatively if guidance is conservative or if management highlights risks. Factors influencing volatility include:

- Forward guidance: Often more impactful than past performance. An upward revision can spark a rally; a cautious tone may trigger selling.

- Whisper numbers: Informal expectations that circulate among traders, sometimes higher than official consensus, can lead to disappointment even on a technical beat.

- Implied volatility: Options markets often price in large moves before earnings, reflecting anticipation of significant news.

- Algorithmic trading: High-frequency systems react within milliseconds, amplifying initial price swings.

This environment demands caution for short-term traders and reinforces the importance of a long-term perspective for investors.

Investor Sentiment and Community Discussion

Beyond Wall Street, retail investor sentiment can amplify market reactions. Platforms like Reddit, Twitter, and financial forums often buzz with commentary after earnings, creating momentum—either positive or negative. While not always grounded in fundamentals, these discussions can influence trading volume and short-term price trends. Savvy investors monitor sentiment as a contrarian indicator or to gauge market positioning, but they balance it with rigorous analysis of financials and business metrics.

Earnings’ Role in Long-Term Investment Thesis for ABNB

For long-term holders, each earnings report is a checkpoint against the core investment thesis. Consistent revenue growth, expanding margins, strong free cash flow, and increasing host and guest engagement all support the idea that Airbnb is capturing a growing share of the global travel economy. Conversely, persistent issues—such as regulatory setbacks, slowing user growth, or margin compression—could signal deeper challenges. Ultimately, earnings validate whether the company is executing its strategy to build a durable, scalable platform in an evolving industry.

Conclusion: Synthesizing ABNB Earnings for Informed Decisions

Airbnb’s earnings reports are more than quarterly updates—they are comprehensive snapshots of a dynamic business navigating a complex global market. From the details of EPS and revenue to the nuances of GBV, booking trends, and management strategy, each report offers actionable insights. While short-term stock movements can be unpredictable, a thorough analysis of financials, operational metrics, and forward guidance provides a solid foundation for decision-making. By tracking these reports over time and understanding the forces that drive performance, investors can better assess ABNB’s potential as a long-term holding in the travel and technology sectors.

Frequently Asked Questions (FAQ)

What is the latest reported EPS and Revenue for ABNB?

For Q42023, Airbnb reported an EPS of $0.77 and Revenue of $2.22 billion. These figures surpassed analyst expectations, demonstrating strong financial performance.

Did Airbnb (ABNB) beat or miss its earnings estimates last quarter?

Yes, Airbnb (ABNB) beat both its EPS and Revenue estimates in the most recent quarter (Q42023), signaling robust operational execution and market demand.

When is the next ABNB earnings report date expected?

Airbnb typically reports its quarterly earnings about one month after the quarter ends. For Q1, expect the report in early to mid-May; for Q2, early to mid-August; for Q3, early to mid-November; and for Q4, early to mid-February of the following year. Always check Airbnb’s Investor Relations website for exact dates.

What are the analyst predictions for Airbnb’s (ABNB) future earnings?

Analyst consensus for future quarters typically projects continued growth, albeit potentially at a moderating pace. For the full fiscal year2024, estimates generally fall in the range of $3.00-$3.20 EPS on revenues of $10.0-$10.5 billion, subject to ongoing revisions.

How has ABNB stock typically reacted after past earnings announcements?

ABNB stock often experiences significant volatility immediately following earnings announcements. Positive surprises (beats) usually lead to upward price movements, while misses can result in pullbacks. The market also heavily weighs management’s forward-looking guidance.

Where can I find official Airbnb investor relations documents and earnings call transcripts?

You can find all official documents, including press releases, financial statements, SEC filings (10-Q,10-K), and earnings call transcripts/webcasts, on the Airbnb Investor Relations website.

What key operational metrics should I look at in Airbnb’s earnings reports?

Key operational metrics to watch include:

- **Nights & Experiences Booked:** Indicates demand and platform activity.

- **Gross Bookings Value (GBV):** Total transaction value before cancellations.

- **Average Daily Rate (ADR):** Pricing power and booking value.

- **Free Cash Flow (FCF):** Company’s ability to generate cash for investments.

Is ABNB stock considered a good investment based on its earnings performance?

While past earnings performance has been strong, particularly post-pandemic, whether ABNB stock is a “good investment” depends on individual investment goals, risk tolerance, and a comprehensive analysis of its future growth prospects, competitive landscape, and valuation metrics beyond just earnings. It’s crucial to consult with a financial advisor.

How do macro-economic factors influence Airbnb’s earnings?

Macroeconomic factors significantly impact Airbnb. Economic downturns, high inflation, or rising interest rates can reduce discretionary spending on travel, affecting bookings and average daily rates. Conversely, strong economic growth and stable conditions tend to boost travel demand, positively impacting earnings.

What is the difference between GAAP and Non-GAAP earnings for ABNB?

GAAP (Generally Accepted Accounting Principles) earnings are standardized and follow strict accounting rules, providing a consistent view of financial performance. Non-GAAP earnings, often presented by companies, adjust GAAP figures to exclude certain items (e.g., stock-based compensation, amortization of intangibles) that management believes do not reflect core operational performance. Investors should look at both, understanding that non-GAAP can offer a different perspective but may also be subject to management’s discretion.

留言