Understanding Stock Beta: Your Compass for Market Movement

Hello, aspiring investors and traders! Are you ready to navigate the sometimes choppy waters of the stock market? One of the most fundamental concepts you’ll encounter in finance, especially when thinking about risk, is something called stock beta. Think of beta as your compass, helping you understand how much your individual stock, or even your entire portfolio, is likely to swing compared to the overall market tide.

In simple terms, beta (β) is a measure of an asset’s sensitivity to market-wide movements. It quantifies the relationship between an asset’s returns and the returns of a relevant market benchmark over a specific period. Why is this important? Because it helps you gauge the systematic risk of an investment – the risk inherent to the entire market or market segment, which cannot be diversified away. As we delve deeper, you’ll see how beta becomes an indispensable tool for assessing risk and building a resilient investment strategy.

We often talk about stock prices going up or down, but understanding *why* they move and *how much* they move in response to broad market shifts is crucial. Is your stock likely to surge dramatically when the market is booming, or does it tend to hold steady? Conversely, how severely might it drop if the market experiences a downturn? Beta gives us a quantitative answer to these questions, providing a snapshot of an asset’s historical behavior relative to the benchmark.

Consider this: If the entire stock market, represented by an index like the S&P 500, goes up by 1%, how much, on average, would you expect your particular stock to move? Beta attempts to answer that by looking at past data. Understanding this relationship helps you anticipate potential swings and align your investments with your comfort level for volatility. Ready to demystify this powerful metric?

In summary, here are some critical aspects of stock beta to remember:

- Beta helps assess systematic risk for investments.

- It provides a quantitative measure of an asset’s response to market movements.

- Understanding beta assists in aligning investments with personal volatility tolerance.

Beta Unpacked: More Than Just Volatility

It’s easy to confuse beta with general volatility. Volatility simply refers to the degree of variation in a trading price over time – how much a stock price goes up and down, regardless of *why*. Beta, however, is more specific. It measures the portion of an asset’s volatility that is correlated with the movement of the overall market. This is the critical distinction.

Beta isolates systematic risk (also known as market risk). This is the risk that affects all assets in the market to some degree, driven by macroeconomic factors like interest rate changes, inflation, political events, or recessions. You cannot eliminate systematic risk through diversification because it impacts everything. Beta helps you measure your exposure to this inescapable market risk.

On the flip side, there’s unsystematic risk (also known as specific risk or idiosyncratic risk). This is the risk unique to a particular company or industry – things like management changes, product recalls, labor strikes, or regulatory issues impacting only that specific entity. Unsystematic risk *can* be reduced or effectively eliminated through proper diversification, holding a variety of assets that are not perfectly correlated.

So, while a stock with high volatility might have high unsystematic risk (maybe it’s a small biotech company with binary event risk) or high systematic risk (maybe it’s a tech giant very sensitive to economic cycles), beta specifically focuses on that second part – the sensitivity to the market’s broader movements. A high-beta stock is expected to have larger price swings *specifically* because of its strong correlation with the market’s direction. A low-beta stock tends to be less affected by market-wide movements.

Think of a ship on the ocean. General volatility is how much the ship pitches and rolls due to *all* factors – engine vibrations, waves from other boats, passenger movement, and the giant ocean swells. Beta, in this analogy, is primarily measuring the ship’s sensitivity *only* to the giant ocean swells (the systematic market movements), not the smaller, ship-specific disturbances. Makes sense?

Deciphering Beta Values: Reading the Market’s Language

Understanding the number beta represents is straightforward once you grasp the baseline. Beta is calculated relative to a market benchmark. The most common benchmark for US stocks is the S&P 500 index. By definition, the S&P 500 has a beta of 1.0. This is our standard reference point.

| Beta Value | Interpretation |

|---|---|

| Beta = 1.0 | Expected to move in lockstep with the market. |

| Beta > 1.0 | More volatile than the market. |

| Beta < 1.0 | Less volatile than the market. |

It is important to remember the following when analyzing beta:

- A higher beta indicates greater sensitivity to market movements.

- A lower beta is associated with more stability and less risk.

- Beta values can vary based on market conditions and historical data.

The specifics regarding different beta values can be detailed as follows:

-

Beta = 1.0: An asset with a beta of 1.0 is expected to move in lockstep with the market. If the S&P 500 goes up by 5%, this stock is historically expected to go up by roughly 5%. If the S&P 500 drops by 2%, the stock is expected to drop by around 2%. It has volatility that matches the market’s systematic volatility.

-

Beta > 1.0 (e.g., 1.2, 1.5, 2.0): An asset with a beta greater than 1.0 is considered more volatile and sensitive to market movements than the benchmark. These are often referred to as “aggressive” stocks. A stock with a beta of 1.5, for instance, is historically expected to move 1.5 times as much as the market. If the S&P 500 rises by 5%, the stock might rise by 7.5% (5% * 1.5). But beware! If the S&P 500 falls by 5%, the stock might fall by 7.5%. High-beta stocks offer the potential for higher gains in bull markets but also carry a greater risk of larger losses in bear markets.

-

Beta < 1.0 (e.g., 0.8, 0.5, 0.2): An asset with a beta less than 1.0 is considered less volatile and less sensitive to market movements than the benchmark. These are often referred to as “defensive” stocks. A stock with a beta of 0.6, for example, is historically expected to move only 60% as much as the market. If the S&P 500 rises by 5%, the stock might only rise by 3% (5% * 0.6). But the upside is, if the S&P 500 falls by 5%, the stock might only fall by 3%. Low-beta stocks tend to be more stable and offer relative protection during market downturns, though they may lag during strong rallies.

-

Beta = 0: A beta of zero suggests there is no correlation between the asset’s price movements and the market benchmark. While theoretically possible (like holding cash), finding an asset with a true beta of zero relative to a broad equity market is rare in practice over meaningful periods.

-

Negative Beta (e.g., -0.3, -0.5): An asset with a negative beta is expected to move in the opposite direction of the market. If the S&P 500 goes up, an asset with a negative beta is expected to go down, and vice versa. These assets can act as a hedge against market downturns. Examples might include certain types of inverse ETFs, options strategies (like put options), or potentially assets like precious metals or certain commodities during specific economic conditions, though calculating a stable, reliable negative beta over long periods can be tricky and dependent on the benchmark chosen.

So, by looking at a stock’s beta, you get an immediate sense of its historical relationship with market risk. Does a beta of 1.8 sound exciting for potential gains, or does it sound too risky for your comfort level? Your interpretation depends heavily on your personal circumstances and investment goals.

The Engine Room: How Beta is Calculated

While you’ll likely be using financial websites or tools to find a stock’s beta value, understanding *how* it’s calculated gives you a deeper appreciation for what the number represents and its potential limitations. Beta is derived from historical price data using a statistical method called regression analysis.

Here’s the simplified process:

-

Gather Data: You need historical price data for the stock in question and your chosen market benchmark (like the S&P 500). The period matters – commonly, beta is calculated over 3 to 5 years of monthly data (36 to 60 months), but you might also see calculations based on weekly or even daily data over shorter periods (e.g., 1 year). The frequency and period used can influence the resulting beta value.

-

Calculate Returns: For each chosen period (e.g., month), you calculate the percentage return for both the stock and the market benchmark. Why returns? Because beta measures the *sensitivity* of returns, not just price levels.

-

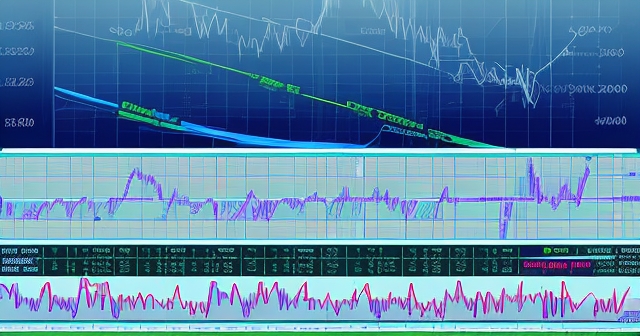

Perform Regression: You plot the stock’s returns against the market benchmark’s returns on a scatter plot. Each point represents one period’s data (e.g., one month). The statistical software then finds the “line of best fit” through these points. This line represents the historical relationship between the stock’s returns and the market’s returns.

-

Determine the Slope: The slope of this line of best fit is the beta coefficient. A steeper slope indicates that the stock’s returns changed more dramatically in response to market returns (higher beta). A flatter slope indicates less sensitivity (lower beta).

Mathematically, the formula for beta is: Beta = Covariance(Stock Returns, Market Returns) / Variance(Market Returns).

-

Covariance measures how much two variables change together. In this case, it’s how the stock’s returns move in relation to the market’s returns.

-

Variance measures how much the market’s returns spread out from their average. It quantifies the market’s overall volatility.

| Calculation Step | Description |

|---|---|

| 1. Gather Data | Collect historical price data for the stock and benchmark. |

| 2. Calculate Returns | Determine percentage returns for both the stock and market. |

| 3. Perform Regression | Plot returns on a scatter plot and find the line of best fit. |

| 4. Determine Slope | Calculate beta coefficient from the slope of the line. |

By dividing the covariance by the market’s variance, you standardize the measure, showing how much the stock’s movements track the market’s movements *relative to the market’s own volatility*. This calculation essentially isolates the systematic component of the stock’s risk.

Now, don’t worry if you’re not running these calculations yourself! As we’ll discuss later, beta values are widely available. But understanding the concept of using historical returns and regression helps you appreciate that beta is based on *past* performance and correlation, which is a key point to remember when using it for *future* decisions.

Building Your Ark: Using Beta for Portfolio Strength

Beta isn’t just a theoretical number; it’s a powerful practical tool for building and managing your investment portfolio. How can you leverage beta to your advantage?

The first way is through risk assessment. Beta helps you understand the systematic risk contribution of each asset to your overall portfolio. Are you comfortable with a portfolio that is expected to move 1.2 or 1.5 times the market? Or do you prefer a more conservative approach with a portfolio beta closer to 0.8 or even lower? Beta provides a quantitative way to align your portfolio’s risk profile with your personal risk tolerance.

-

If you are a young investor with a long time horizon and a high tolerance for risk and potential volatility, you might intentionally build a portfolio with a higher average beta, seeking potentially higher returns during market rallies.

-

If you are nearing retirement or have a low risk tolerance, you might prefer a portfolio with a lower average beta, prioritizing capital preservation and stability, even if it means potentially lower returns during bull markets.

Beta is also fundamental to diversification strategy. Effective diversification isn’t just about holding many different stocks; it’s about holding assets that don’t all move in the same direction at the same time. By combining assets with different beta values (including potentially negative beta assets, though these are less common in typical equity portfolios), you can influence your overall portfolio’s beta and potentially lower its total volatility relative to its expected return.

For instance, you might pair some high-beta growth stocks (like technology companies, which often have betas above 1.0) with lower-beta utility stocks or consumer staples (which tend to have betas below 1.0) or even bonds (which can have very low or negative betas relative to equities). The low-beta assets can help buffer the portfolio during market downturns, while the high-beta assets offer upside potential during rallies. The goal is to achieve a portfolio beta that matches your desired level of systematic risk exposure.

Let’s say you have a portfolio of 10 stocks. By calculating the weighted average beta of these stocks (weighting each stock’s beta by its percentage allocation in your portfolio), you can estimate the overall portfolio beta. This number gives you a single metric to gauge the systematic risk of your entire equity holding relative to the market benchmark.

Using beta in this way helps you make intentional choices about the level of market exposure you want, rather than having it dictated purely by the specific stocks you happen to pick based on other factors. It’s about building a portfolio that not only aligns with your potential return goals but also your comfort with market-driven swings.

Expanding the Scope: Beta Beyond Individual Stocks

While we often talk about beta in the context of individual stocks, the concept extends to other investment vehicles as well. Beta can be calculated for:

-

Exchange-Traded Funds (ETFs) and Mutual Funds: Like individual stocks, these funds hold a basket of assets. Their beta represents the weighted average beta of their underlying holdings. A broad market ETF tracking the S&P 500, for example, should have a beta very close to 1.0 (relative to the S&P 500 itself). Sector-specific ETFs will have betas reflecting the typical sensitivity of that sector to the overall market (e.g., a technology ETF might have a beta above 1, while a utilities ETF might have a beta below 1).

-

Investment Portfolios: As mentioned, you can calculate the weighted average beta for your entire collection of investments (stocks, ETFs, funds) to understand the systematic risk of your aggregate holdings relative to the market benchmark.

-

Other Asset Classes: While most commonly applied to equities, beta-like concepts can be used to analyze the relationship between other asset classes (like bonds, real estate, commodities, or even cryptocurrencies like Bitcoin USD) and various benchmarks. However, the standard equity beta relative to the S&P 500 is less meaningful for assets that historically have low correlation with the stock market. For instance, you could calculate the beta of gold (using GLD as a proxy) relative to the S&P 500, but the correlation is often low, making the resulting beta figure less statistically significant (indicated by a low R-squared, which we’ll discuss).

Understanding beta’s application across different investment types is key. It allows you to look at your entire investment landscape and see how different pieces are likely to behave when the equity market benchmark makes a significant move. This holistic view is invaluable for true portfolio management.

Imagine comparing a growth-focused equity ETF with a utilities sector ETF. The growth ETF likely has a higher beta, meaning it should participate more strongly in market rallies but also suffer more during downturns. The utilities ETF, with a lower beta, should provide more stability. Knowing this, you can allocate capital between them based on your market outlook and risk comfort, using beta as a guide.

Beta and the Promise of Return: Enter CAPM

Beta is not just a risk measure; it’s also a core component in one of the most influential models in finance: the Capital Asset Pricing Model (CAPM). CAPM establishes a theoretical relationship between the systematic risk (measured by beta) of an asset and its expected return.

The CAPM formula is often written as:

Expected Return = Risk-Free Rate + Beta * (Market Return – Risk-Free Rate)

-

The Risk-Free Rate is the return from a theoretical asset with zero risk, like a U.S. Treasury bond. This represents the return you could expect without taking on any market risk.

-

Market Return is the expected return of the market benchmark (e.g., the S&P 500).

-

The term (Market Return – Risk-Free Rate) is called the Market Risk Premium. It’s the extra return investors expect for taking on the systematic risk of investing in the overall market compared to the risk-free rate.

-

Beta scales the Market Risk Premium. A beta of 1 means the asset is expected to earn the full market risk premium in addition to the risk-free rate (i.e., its expected return is the same as the market’s expected return). A beta > 1 means the asset is expected to earn *more* than the market risk premium (because it takes on *more* systematic risk). A beta < 1 means the asset is expected to earn *less* than the market risk premium (because it takes on *less* systematic risk).

In essence, CAPM suggests that the *only* risk that investors are compensated for with higher expected returns is systematic risk, as measured by beta. Unsystematic risk, according to this model, can be diversified away, so investors don’t receive extra compensation for taking it on.

So, if you hear someone talk about a stock’s “required rate of return” or “cost of equity,” they are often using a model like CAPM, where beta plays a central role in determining the compensation investors demand for holding that stock based on its market sensitivity.

While CAPM is a simplified model with its own assumptions and limitations (it’s based on theoretical expectations, not guarantees), it highlights the crucial link beta provides between risk and potential reward in the context of systematic market movements. It reinforces the idea that if you want potentially higher returns from equity investments, you generally have to accept higher systematic risk, which a higher beta reflects.

The Fine Print: Limitations and Nuances of Beta

Beta is a powerful tool, but it’s not a crystal ball. Like any financial metric, it has limitations, and you must use it with careful consideration. What are some of the key things to keep in mind?

-

Backward-Looking: The most significant limitation is that beta is calculated using historical data. It tells you how a stock *has* behaved relative to the market in the past. It does *not* guarantee that it will behave the same way in the future. Market conditions, company fundamentals, industry dynamics, and economic environments change, which can all influence a stock’s sensitivity to the market going forward. A stock with a beta of 1.5 based on the last 5 years might see its beta change significantly in the next 5 years.

-

Doesn’t Account for Qualitative Factors: Beta is a purely quantitative measure derived from price movements. It doesn’t consider crucial qualitative factors like the quality of management, competitive landscape, technological innovation, regulatory changes, or overall business strategy. A company might have a low beta, but poor management could still lead to its stock price falling independently of the market.

-

Sensitive to Data Period and Benchmark: The calculated beta value can vary depending on the time period used (e.g., 3 years vs. 5 years, monthly vs. weekly data) and the market benchmark chosen (e.g., S&P 500 vs. Nasdaq Composite vs. a global index). Ensure you know the parameters used when viewing a beta value reported by a financial source.

-

Not Suitable for Young or Rapidly Changing Companies: For companies with a short trading history, there may not be enough data to calculate a statistically reliable beta. Similarly, companies undergoing significant transformations (e.g., shifting business models, major acquisitions) may see their relationship with the market change, making historical beta less indicative of the future.

-

R-squared Matters: When looking at beta from a regression analysis, it’s important to consider the R-squared value. R-squared indicates the percentage of the stock’s historical price movements that can be explained by the movements of the benchmark index. A low R-squared means that while a beta value might be calculated, the correlation between the stock and the benchmark was weak over that period, implying that market movements were *not* a primary driver of the stock’s price changes. In such cases, the beta figure is less reliable as a measure of market sensitivity. A high R-squared (closer to 1.0) suggests a strong correlation, making the beta more meaningful.

Because of these limitations, you should never use beta in isolation. It’s one valuable tool among many. Use it in conjunction with fundamental analysis (examining a company’s financials and business), technical analysis (studying price charts and patterns), and macroeconomic analysis (understanding the broader economic environment). Beta provides context for market sensitivity, but it doesn’t tell the whole story of an investment’s potential or risk.

Practical Tools: Accessing and Calculating Beta Data

You don’t need to dust off your statistics textbook or fire up complex software to find a stock’s beta. Beta is a widely reported metric, readily available through numerous sources.

-

Financial News Websites: Sites like Yahoo Finance, Google Finance, Bloomberg, and Reuters typically list key statistics for publicly traded companies, including their beta. They usually specify the time period and benchmark used for the calculation.

-

Brokerage Platforms: Your online brokerage account likely provides beta and other relevant metrics on the stock quote pages.

-

Financial Data Providers: Services like FactSet, Refinitiv, and Bloomberg Terminal provide comprehensive, institutional-grade financial data, including beta calculations across various periods and benchmarks.

-

Online Beta Calculators: A simple search for “stock beta calculator” will yield tools where you can enter a stock ticker and potentially specify parameters (like the benchmark and time period) to get a calculated beta. These tools automate the process using historical data feeds. While convenient, it’s still wise to understand the source of their data and calculation methodology if possible.

When using these resources, always note the benchmark and calculation period. Beta for the same stock can differ between providers if they use slightly different methodologies, data sources, benchmarks, or time frames. Consistency is key when comparing betas across different stocks or analyzing a portfolio.

The availability of online beta calculators is particularly helpful for investors who want to experiment with different time periods or benchmarks or who want to see step-by-step calculations (though not all calculators provide this). While less common for retail investors, calculating beta for a custom portfolio using spreadsheet software and historical ETF data is also possible, allowing you to see how your unique mix of assets contributes to overall systematic risk.

Ultimately, accessing beta data is easy. The real skill lies in interpreting that data correctly within the context of your overall investment strategy and the asset’s specific characteristics.

Beta in Practice: Looking at Real-World Examples

Let’s make this concrete with a few hypothetical examples, keeping in mind that actual beta values fluctuate over time and vary slightly between data providers.

-

A Major Tech Stock (e.g., Apple Inc. – AAPL): Historically, large technology companies are often considered more sensitive to economic cycles and investor sentiment than the overall market. You might expect AAPL to have a beta slightly above 1.0, perhaps in the range of 1.1 to 1.3 (relative to the S&P 500). This suggests that when the market goes up by 1%, AAPL might typically rise by 1.1% to 1.3%, and conversely, fall more than the market during downturns. Their growth focus and discretionary consumer spending link contribute to this higher sensitivity.

-

A Utility Company (e.g., a large electric utility): Utility companies provide essential services and often have stable revenues, regulated pricing, and dividend payouts. They are generally considered less sensitive to the broader economic environment. A utility stock is likely to have a beta significantly below 1.0, perhaps in the range of 0.4 to 0.7. This indicates that their stock price movements are less correlated with market swings, offering more stability during volatile periods but potentially less upside during strong bull markets.

-

A Broad Market ETF (e.g., SPDR S&P 500 ETF – SPY): As an ETF designed to track the S&P 500 index, SPY should, by definition, have a beta very close to 1.0 relative to the S&P 500. Any deviation is usually due to tracking error or the specific time period/calculation method used. This confirms the benchmark’s beta of 1.0 as the standard.

-

A High-Growth Biotech Stock: A smaller, high-growth, potentially unprofitable biotech company might have a very high beta, perhaps 1.5 or higher. Their stock price could be highly speculative and driven by factors like clinical trial results, but their sensitivity to overall market sentiment can also be amplified due to their perceived riskiness. Their beta would suggest they are expected to swing considerably more than the market in either direction.

These examples illustrate how beta tends to differ across sectors and company types, reflecting their fundamental business models and sensitivity to economic factors that influence the broader market. Understanding these typical ranges can help you quickly evaluate whether a stock’s reported beta seems reasonable given its industry and characteristics.

Remember, these are just historical snapshots. A tech stock might have a lower beta during a period when technology is seen as a defensive sector, or a utility’s beta might rise if regulatory uncertainty increases. Beta is dynamic and requires periodic review.

Beta in Context: A Piece of the Investment Puzzle

You’ve now learned what beta is, how to interpret its values, the basics of its calculation, how it fits into portfolio building and CAPM, and its important limitations. The key takeaway is that beta is a fundamental piece of information for any serious investor, but it’s just that – one piece.

Think of building a house. Beta might tell you how much the foundation is expected to shift with the underlying ground (systematic risk). But it doesn’t tell you about the quality of the building materials (fundamentals), the strength of the structure itself (company health), or the weather patterns specific to your location (industry/company-specific risks). You need all that information to build a sturdy house.

Successful investing involves combining various analytical tools and perspectives. Use beta to understand an asset’s historical market sensitivity and its contribution to systematic risk in your portfolio. But don’t stop there.

-

Combine beta with fundamental analysis to assess the company’s intrinsic value, growth prospects, financial health, and management quality. A high-beta stock with strong fundamentals might be a good fit for a growth-oriented investor, while a high-beta stock with weak fundamentals could be a recipe for disaster.

-

Combine beta with technical analysis to identify potential entry and exit points based on price patterns and trends. Even a low-beta stock can experience significant short-term price swings due to technical factors or unsystematic news.

-

Consider beta alongside other risk metrics like standard deviation (which measures total volatility, both systematic and unsystematic) and Sharpe Ratio (which measures risk-adjusted return). Beta specifically focuses on systematic risk, while standard deviation includes all volatility. A high-beta stock might have high standard deviation, but a low-beta stock could also have high standard deviation if it has significant unsystematic risk.

-

Always consider the R-squared value associated with the beta calculation. A low R-squared indicates that the stock’s movements are not highly correlated with the benchmark, making the beta figure less reliable. In such cases, beta is less useful, and other analysis methods become more critical.

Your investment journey is unique. Your risk tolerance, financial goals, time horizon, and knowledge base are yours alone. Beta is a powerful quantitative tool that can help you make more informed decisions about managing market risk, whether you are building your first portfolio or refining an existing one. By understanding beta and using it thoughtfully alongside other forms of analysis, you can increase your confidence in navigating the markets and working towards your financial objectives.

So, as you explore potential investments, take a look at their beta. Ask yourself: How does this beta align with my risk tolerance? How might this stock behave in different market environments? How does its beta fit within my overall portfolio strategy? These questions, guided by your understanding of beta, will lead you to more deliberate and potentially more successful investment choices.

stock beta calculatorFAQ

Q:What is beta in stock market terminology?

A:Beta is a measure of a stock’s volatility in relation to the overall market, indicating how much a stock’s price is expected to change when the market changes.

Q:How is beta calculated?

A:Beta is calculated using historical price data and regression analysis, comparing the returns of the stock to the returns of a market benchmark.

Q:Why is beta important for investors?

A:Beta helps investors assess the risk associated with a stock or portfolio, aiding in investment strategy and risk management decisions.

留言