Introduction: Understanding Ukraine’s Diverse Markets

Ukraine’s economy is far from a single narrative. It is a complex, evolving system shaped by fertile farmland, emerging financial structures, and a population that continues to adapt under extraordinary pressure. Since the full-scale Russian invasion in 2022, global interest in Ukraine’s markets has intensified—not only due to humanitarian concerns but also because of its strategic role in food and energy flows, its potential for European integration, and the resilience of its private sector. The term “markets Ukraine” captures more than just trade; it reflects a network of interdependent systems: capital markets fueling investment, agricultural exports feeding millions, and everyday consumer dynamics shaping livelihoods. This article explores the depth and diversity of Ukraine’s economic landscape, analyzing pre-war foundations, wartime adaptations, and the long-term pathways toward recovery. From stock indices to sunflower fields, from inflation rates to household budgets, we examine how Ukraine’s markets are surviving, adapting, and planning for a future defined by reconstruction and reform.

The Broader Economic Landscape of Ukraine

Ukraine’s economic trajectory has always been shaped by its geopolitical position, historical legacy, and the pace of domestic reform. To understand its current reality, one must first consider where it stood before conflict escalated.

Historical Context and Pre-War Economic Foundations

Prior to the 2014 annexation of Crimea and the war in Donbas, Ukraine was navigating a difficult transition from a post-Soviet economy to a more market-oriented system. The dismantling of centralized planning left behind inefficient industries, widespread corruption, and weak institutions. However, from 2014 onward, the government began implementing structural reforms—driven by both domestic pressure and international support. These included cleaning up the banking sector, liberalizing energy prices, and launching anti-corruption agencies. The signing of the EU-Ukraine Association Agreement in 2014 marked a turning point, signaling a strategic pivot toward European integration. Over the next eight years, Ukraine made measurable progress: inflation was brought under control, foreign exchange reserves grew, and GDP expanded modestly. Though growth remained uneven and dependent on agriculture and commodities, the foundations for a more stable economy were being laid when the full-scale invasion in February 2022 abruptly changed the course of development.

Key Economic Indicators and Macroeconomic Trends

The war triggered an immediate and severe economic shock. In 2022 alone, Ukraine’s GDP contracted by an estimated 29.1%, one of the sharpest declines recorded globally in recent decades. Industrial output collapsed, supply chains fractured, and millions were displaced. Inflation spiked to 26.6% by the end of that year, driven by energy shortages, disrupted logistics, and increased government spending. Unemployment surged as businesses shuttered, particularly in eastern and southern regions under occupation or frequent shelling. Despite these setbacks, Ukraine avoided total economic collapse thanks to decisive action by the National Bank of Ukraine (NBU) and massive inflows of international aid. The NBU imposed temporary capital controls, fixed the hryvnia exchange rate to prevent panic-driven devaluation, and ensured liquidity in the banking system. Multilateral lenders like the World Bank and IMF stepped in with emergency financing, helping Kyiv meet payroll obligations, fund humanitarian needs, and maintain basic state functions. The World Bank continues to play a vital role in assessing war damage and coordinating recovery planning, highlighting both the scale of destruction and the importance of sustained financial backing.

Ukraine’s Financial Markets: Equities, Capital, and Investment

While many expected Ukraine’s financial infrastructure to crumble under the weight of war, the opposite has occurred in key areas—adaptation and resilience have become defining traits.

The Ukrainian Stock Market: Indices and Performance (PFTS Index)

The PFTS Stock Exchange, home to Ukraine’s primary equity index, has long reflected the country’s economic volatility. Before 2022, the market was relatively small and illiquid, dominated by energy, banking, and agricultural firms. When the invasion began, trading was suspended to prevent a freefall in asset values and capital flight. Since then, the exchange has reopened in a limited capacity, allowing trading in government bonds and select corporate securities, though full equity trading remains constrained. The PFTS Index, while not actively quoted in real time, symbolizes investor sentiment—its hypothetical performance closely tied to battlefield developments and the reliability of international support. Although foreign portfolio investment has largely disappeared, domestic institutions continue to manage assets, and there is growing discussion about the stock market’s role in post-war privatization and infrastructure financing.

Capital Markets and Foreign Direct Investment (FDI)

Ukraine’s capital markets have pivoted toward survival and wartime financing. The government now relies heavily on domestic bond issuance, with the National Bank and commercial banks serving as primary buyers. International donors have also provided budget support, reducing reliance on volatile external borrowing. Foreign Direct Investment, once seen as a catalyst for modernization, has plummeted. Investors face risks ranging from physical insecurity to legal uncertainty, especially in occupied territories. However, certain sectors still attract interest. The IT industry, for example, maintained 80% of its pre-war export capacity through remote work and decentralization. Renewable energy projects, though delayed, remain attractive due to Ukraine’s wind and solar potential. Looking ahead, FDI will be essential for rebuilding cities, factories, and energy grids. Mechanisms such as political risk insurance, public-private partnerships, and EU-backed investment facilities are expected to play a central role in restoring investor confidence.

Banking Sector Overview

The banking sector entered the war on stronger footing than in previous crises, thanks to post-2014 reforms that eliminated insolvent banks and strengthened supervision. When the invasion began, the NBU moved swiftly—imposing capital controls, freezing suspicious transactions, and launching emergency lending programs. Digital banking, already widespread, proved indispensable. Mobile payments, online loan applications, and remote account management allowed financial services to continue even in frontline areas. State-owned banks, including Oschadbank and Ukrgasbank, took on expanded roles, disbursing pensions, military salaries, and government aid. Private institutions like PrivatBank and Alfa-Bank Ukraine also adapted, shifting operations to western cities and maintaining core services. While consolidation is likely in the post-war period, the system has demonstrated that it can function under extreme stress, a critical foundation for future growth.

The Agricultural Powerhouse: Ukraine’s Role in Global Food Markets

Often called the “breadbasket of Europe,” Ukraine’s agricultural sector is central not only to its own economy but to global food security.

Key Agricultural Products and Export Dominance

Ukraine ranks among the world’s top exporters of wheat, corn, barley, and sunflower oil. Its chernozem (black soil) belt covers nearly two-thirds of the country, providing ideal conditions for large-scale grain farming. Before 2022, Ukraine supplied about 10% of global wheat exports and dominated the sunflower oil market, accounting for nearly half of all international shipments. Major buyers included Egypt, Turkey, Bangladesh, and the Netherlands. Efficient logistics, competitive pricing, and favorable climatic conditions made Ukrainian grain a staple in global commodity markets. The sector contributed roughly 10% of GDP and employed millions, particularly in rural areas.

Impact of the War on Agricultural Production and Supply Chains

The war disrupted every link in the agricultural chain. Occupied regions like Kherson and Zaporizhzhia, key producers of grains and oilseeds, were cut off. Mines contaminated fields, port infrastructure in Odesa was damaged, and shipping lanes in the Black Sea were blocked. By mid-2022, export volumes had dropped by over 50%. To address the crisis, the UN and Turkey brokered the Black Sea Grain Initiative, allowing ships to transport grain through safe corridors. While the deal was periodically suspended and eventually expired in 2023, it enabled over 30 million tons of grain to reach global markets, helping to stabilize prices and avert famine in import-dependent countries. Ukraine has since established alternative export routes—via rail, river barges, and road convoys through neighboring EU states—but these are slower and more expensive. Farmers also face challenges in accessing fuel, fertilizer, and labor, while rising insurance costs make international trade riskier. The European Bank for Reconstruction and Development (EBRD) has responded with targeted financing, supporting logistics upgrades and working capital for agribusinesses.

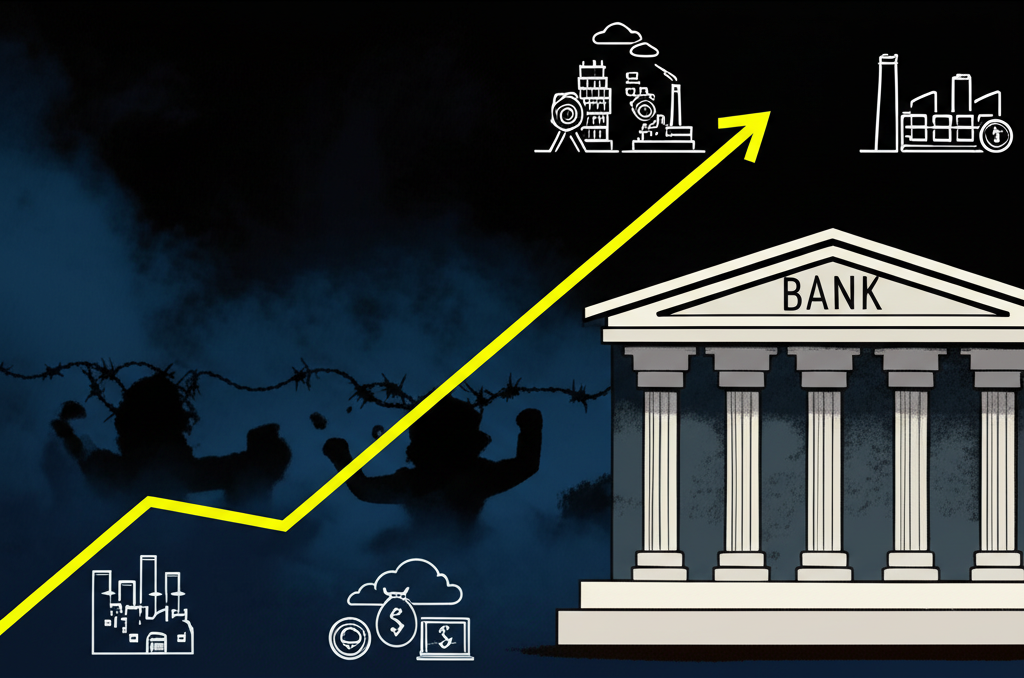

The Russia-Ukraine War: Profound Impacts on Markets and Economy

The full-scale invasion has not only caused human suffering but has also reshaped Ukraine’s economic reality in fundamental ways.

Economic Disruption and Damage Assessment

The economic cost of the war is measured in hundreds of billions of dollars. The World Bank and the Ukrainian government estimate that direct damage to infrastructure—homes, schools, hospitals, roads, power plants—exceeds $150 billion. Industrial zones in cities like Mariupol and Sievierodonetsk have been reduced to rubble. The energy sector has been repeatedly targeted, with cascading blackouts affecting production and daily life. Beyond physical destruction, the war has disrupted tax collection, slashed export revenues, and displaced over 8 million people. This loss of human capital—especially skilled workers and entrepreneurs—will have long-term implications for productivity. The government now depends on foreign grants and loans to cover nearly half of its budget, a situation that underscores both vulnerability and resilience.

Market Adaptation and Resilience During Conflict

Despite these challenges, Ukrainian markets have shown an extraordinary capacity to adapt. The NBU’s early decision to stabilize the hryvnia prevented hyperinflation and maintained public trust in the currency. Digital infrastructure allowed businesses to keep operating—law firms, software companies, and even government agencies shifted to remote work. SMEs rerouted supply chains, sourced inputs from EU countries, and repurposed factories to produce drones, medical supplies, or protective gear. The IT sector, contributing around 5% of GDP, continued to generate hard currency through exports, with companies relocating teams to safer regions or abroad. Farmers adopted new storage and transport methods, using river ports on the Danube and rail hubs in Lviv to bypass Black Sea blockades. This agility has become a hallmark of Ukraine’s wartime economy: not just survival, but strategic repositioning.

Reconstruction Challenges and Opportunities

Rebuilding Ukraine will be one of the largest reconstruction efforts in modern history. Initial estimates suggest reconstruction costs could exceed $400 billion over the next decade. The scale demands coordination between the Ukrainian government, international donors, private investors, and multilateral institutions. Key priorities include restoring housing, modernizing energy grids, and rebuilding transport networks. But there is also a vision for transformation: creating a greener, more digital, and more efficient economy. Ukraine has the potential to lead in renewable energy, smart agriculture, and circular manufacturing. International conferences, such as the Ukraine Recovery Conferences (URC), are already aligning donor commitments with reform agendas. Transparency, anti-corruption safeguards, and public participation will be critical to ensuring that reconstruction benefits all Ukrainians and attracts long-term investment.

Everyday Markets: Cost of Living and Consumer Dynamics in Ukraine

Beyond macroeconomic data, the lived experience of Ukrainians reveals the human side of economic resilience.

Cost of Living Overview: $20, $100, and Beyond

The cost of living in Ukraine varies widely by region and circumstance. In cities like Kyiv or Lviv, prices for housing, dining, and transportation have risen due to inflation and increased demand from displaced populations. In smaller towns, costs remain lower but are still affected by supply disruptions. To illustrate:

* **How far does $20 go in Ukraine?** At current exchange rates (~750 UAH), $20 can cover a meal at a mid-range restaurant, a week’s supply of bread and dairy, or several public transit rides. For many Ukrainians, this represents a day’s essential spending.

* **How far does $100 go in Ukraine?** (~3,700 UAH) This amount could pay for several nights in a budget guesthouse, a full week of groceries for one person, or a round-trip train ticket between major cities. While not luxurious, it allows for basic comfort and mobility.

Inflation has eroded purchasing power, especially for imported goods like electronics, fuel, and certain foods. However, government subsidies on utilities and bread, along with strong domestic production of staples, have helped cushion the blow.

Local Markets and Consumer Spending Habits

Traditional rynoks (open-air markets) remain vital, especially for older generations and rural communities. These markets offer fresh produce, meat, and homemade goods at prices often lower than supermarkets. Chains like Silpo, ATB, and Foxtrot provide a mix of local and imported items, with increasing online delivery options. Consumer behavior has shifted significantly since 2022. With rising uncertainty, households prioritize essentials—food, medicine, utilities—over discretionary spending. There is also a growing trend of “patriotic consumption,” where Ukrainians choose domestic brands to support local jobs and national resilience. Online shopping has surged, particularly for electronics and clothing, though delivery delays persist in conflict-affected areas.

Wages, Prices, and Purchasing Power

Average monthly wages in Ukraine hover around 20,000–25,000 UAH (~$540–$675), though this varies widely by sector and location. Workers in IT, finance, and export-oriented industries earn significantly more, while those in agriculture, retail, and public services often earn less. While nominal wages have risen, inflation has outpaced gains, reducing real income. The NBU’s efforts to stabilize the hryvnia have helped limit price spikes, but fuel, transportation, and some imported goods remain expensive. For many families, especially single-income or displaced households, managing daily expenses requires careful budgeting. Government social programs, including allowances for IDPs and families of soldiers, play a crucial role in maintaining basic living standards.

The Future Outlook for Ukrainian Markets

The future of Ukraine’s economy hinges on peace, but even in the absence of a ceasefire, planning for recovery is well underway. The country’s EU candidate status, granted in 2022, has galvanized reform efforts and signaled long-term alignment with European markets. This path requires modernizing legislation, strengthening rule of law, and improving business conditions. Sectors like infrastructure, energy, and digital services are expected to attract significant investment once stability returns. The IT industry, already a global player, could expand further with better connectivity and tax incentives. Agriculture may shift toward higher-value crops and sustainable practices. While risks remain—security, corruption, political transition—the combination of international support, a skilled workforce, and national determination suggests that Ukraine’s markets are not merely surviving, but preparing to rebuild stronger.

Conclusion: A Resilient Economy Facing Complex Challenges

Ukraine’s markets tell a story of disruption and endurance. From the silos of grain exporters to the servers of fintech startups, from the tellers in regional banks to the vendors in village markets, economic life continues under fire. The war has inflicted deep wounds—on infrastructure, on livelihoods, on growth prospects. Yet, through decisive policy, international solidarity, and the adaptability of its people, Ukraine has preserved the core of its economy. Financial systems remain functional, agricultural exports continue to flow, and digital services bridge gaps where physical ones have been destroyed. The road to recovery will be long and complex, demanding sustained investment, transparency, and reform. But the foundations are there: a strategic location, abundant resources, and a population committed to a European future. If peace returns, Ukraine’s markets may not only recover—they may emerge more innovative, more integrated, and more resilient than before.

What is the current state of Ukraine’s economy amidst the ongoing conflict?

Ukraine’s economy has experienced a severe contraction due to the full-scale Russian invasion, with GDP plummeting and inflation soaring. However, it has demonstrated remarkable resilience, supported by substantial international financial aid and prudent macroeconomic management by the National Bank of Ukraine. Key sectors like IT and agriculture continue to operate, albeit with significant disruptions.

How has the Russian invasion specifically impacted Ukraine’s financial markets and the PFTS index?

The invasion led to an initial suspension of trading on the PFTS Stock Exchange, Ukraine’s main equity market. While trading has partially resumed for certain instruments, liquidity remains low. The war has significantly increased investor risk, leading to a sharp decline in foreign direct investment and a focus on government bond issuance to finance the war effort. The PFTS index performance is highly correlated with geopolitical developments.

What are the key agricultural products from Ukraine, and how has their export been affected by the war?

Ukraine is a major global exporter of grains (wheat, corn, barley) and oilseeds (sunflower oil). The war severely disrupted agricultural production and, critically, export routes, particularly through its Black Sea ports. Initiatives like the Black Sea Grain Initiative helped restore some exports, but challenges such as logistical bottlenecks, increased costs, and security risks continue to impact the sector, affecting global food security.

For a tourist or short-term visitor, how far does $100 typically go for daily expenses in Ukraine?

For a tourist or short-term visitor, $100 (approximately 3700-4000 UAH) would generally cover a few days’ budget accommodation, a week’s worth of groceries for one person, several restaurant meals, or a domestic train journey. While Kyiv is more expensive, this amount allows for reasonable daily expenses outside of luxury spending, though inflation has pushed up prices for many goods and services.

What are the main challenges and potential opportunities for foreign direct investment in Ukraine today?

Main challenges include heightened security risks, physical destruction of assets, operational disruptions, and legal uncertainties due to the ongoing conflict. Opportunities lie in post-war reconstruction, particularly in infrastructure, energy, and agriculture, as well as in the resilient IT sector. Ukraine’s EU candidate status also presents long-term prospects for market integration and reforms that could attract investment, especially with international guarantees and risk mitigation mechanisms.

How has the Ukrainian government and central bank maintained economic stability during wartime?

The Ukrainian government and the National Bank of Ukraine (NBU) implemented stringent measures, including capital controls, a fixed exchange rate, and emergency liquidity provisions for banks. The NBU also engaged in direct financing of the budget and worked closely with international partners to secure substantial financial aid, which has been crucial for maintaining macroeconomic stability and financing essential government functions.

What is the significance of the “Black Sea Grain Initiative” for Ukraine’s markets and global food security?

The Black Sea Grain Initiative was critical for allowing millions of tons of Ukrainian agricultural products, particularly grains, to be safely exported via designated maritime corridors. For Ukraine’s markets, it provided a vital revenue stream and helped clear storage facilities. For global food security, it helped stabilize international food prices and ensured critical supplies reached food-insecure nations, mitigating a potential global food crisis.

What are the long-term prospects for Ukraine’s economic recovery and integration into global markets?

Long-term prospects are cautiously optimistic, contingent on the end of the war and sustained international support. Ukraine aims for full integration into European markets, leveraging its EU candidate status to drive reforms and attract investment. Recovery will focus on rebuilding infrastructure, modernizing key sectors like agriculture and energy, and fostering a business-friendly environment. The scale of reconstruction offers unique opportunities for green and digital transformation.

Are there any specific resilience measures or adaptations seen in Ukraine’s capital markets during the conflict?

Yes, resilience measures include the NBU’s quick implementation of capital controls and a fixed exchange rate to prevent panic and capital flight. The government relied heavily on domestic bond issuance, with the NBU as a key buyer, to finance wartime expenditures. Digital banking and payment systems proved robust, ensuring financial transactions continued. Many financial institutions adapted operations to ensure business continuity under challenging conditions.

What are the primary sources of international financial aid supporting Ukraine’s economy?

Primary sources of international financial aid include grants and loans from multilateral institutions such as the International Monetary Fund (IMF) and the World Bank. Significant bilateral aid also comes from the European Union, the United States, and other G7 countries. This aid is crucial for financing government operations, humanitarian assistance, and supporting economic stability in the face of immense wartime expenditures and revenue shortfalls.

留言