Introduction: Understanding Tesla’s Earnings Landscape

Tesla, Inc. (NASDAQ: TSLA) has cemented its place at the forefront of a global shift toward sustainable energy and intelligent mobility. As a pioneer in electric vehicles, battery storage, and AI-driven automation, the company doesn’t just respond to industry trends—it shapes them. Each quarterly earnings release acts as a barometer of Tesla’s evolving strategy and execution, drawing intense scrutiny from Wall Street, retail investors, and tech observers alike. These reports go beyond balance sheets; they reveal how effectively Tesla is converting vision into value. From vehicle delivery milestones to breakthroughs in Full Self-Driving software, every data point offers insight into whether the company is maintaining momentum or facing headwinds. For stakeholders evaluating the future of clean technology and next-generation transportation, Tesla’s financial disclosures are essential reading. This analysis unpacks the full scope of Tesla’s earnings story—from hard numbers to long-term strategic intent—equipping investors with the clarity needed to navigate one of the most dynamic stocks in the market.

Upcoming Tesla Earnings Report: Dates & Key Expectations

The release of Tesla’s quarterly results consistently triggers waves across financial markets. Traders watch for beats or misses on revenue and earnings, but seasoned investors look deeper—at guidance, margin trends, and management tone. These reports often serve as turning points, shifting sentiment based on what lies ahead as much as what was achieved.

When to Expect Tesla’s Next Financial Update

Tesla maintains a predictable rhythm for its earnings announcements, typically disclosing the exact date a few weeks in advance. The company releases its financial results after market close, followed by a live webcast featuring executive commentary and an analyst Q&A session. Historically, Q4 earnings have arrived in late January, meaning the Q4 2025 report is anticipated around late January 2026. The first-quarter 2026 results would then follow in late April of that year. To ensure access to real-time updates and the official call details, investors should bookmark the Tesla Investor Relations website. Tuning into the live audio stream allows listeners to capture not only the prepared remarks but also the nuances in tone and emphasis during the question-and-answer portion—a vital layer often missed in written summaries.

Analyst Consensus: What’s Expected for Tesla’s Performance

Market expectations for Tesla hinge on a blend of hard metrics and forward-looking sentiment. Analysts aggregate forecasts for key indicators such as revenue, earnings per share (EPS), and automotive gross margin. For the upcoming quarter, attention will likely center on three areas: delivery volume, margin resilience amid price competition, and progress on new product ramps like the Cybertruck. Revenue growth is expected to remain strong, driven by continued demand for Model 3 and Model Y, expanding energy deployments, and increasing contributions from services like Supercharging and software features. Profitability remains a focal point, particularly as Tesla navigates pricing pressures in key markets like China and Europe. Adjusted EPS will be scrutinized closely, especially in relation to the company’s ability to scale production efficiently and monetize its Full Self-Driving technology. Any deviation—positive or negative—from these consensus figures could spark significant movement in TSLA shares in the days following the report.

Key Financial Highlights from Tesla’s Latest Earnings

While the upcoming report captures immediate attention, the most recent earnings provide a crucial baseline for understanding Tesla’s current trajectory. The hypothetical Q3 2025 results paint a picture of resilience and diversification, with growth extending beyond vehicle sales into adjacent high-potential areas.

Revenue and Profitability Breakdown

In the latest quarter, Tesla reported a substantial increase in total revenue, fueled primarily by sustained demand for its core lineup—especially the Model Y, now the best-selling electric vehicle globally. Automotive sales continued to dominate the income statement, but the energy generation and storage segment showed accelerating momentum, with growing deployments of Powerwall units for homes and Megapack systems for utility-scale projects. Net income and adjusted EPS came in above analyst estimates, a sign that Tesla is not only growing top-line revenue but also managing costs effectively. This combination of scale and efficiency underscores the company’s transition from a high-growth startup to a mature industrial and technology enterprise capable of generating consistent profits while reinvesting in innovation.

Vehicle Production and Delivery Figures

Production and delivery numbers remain the heartbeat of Tesla’s operational performance. In the most recent quarter, global vehicle production hit a new record, supported by full utilization at Gigafactories in Shanghai, Berlin, and Austin. Deliveries rose year-over-year, reflecting steady demand despite macroeconomic challenges such as higher interest rates and inflation. The Model 3 and Model Y accounted for the vast majority of units shipped, while the Cybertruck began contributing meaningfully, albeit at a slower ramp than initially hoped. Analysts continue to monitor the production-to-delivery ratio, which can signal inventory buildup or logistical bottlenecks. A narrowing gap suggests efficient supply chain management and strong regional demand, particularly in North America and parts of Asia.

Gross Margin Trends and Operational Efficiency

One of the most watched metrics in Tesla’s report is automotive gross margin, excluding regulatory credits—a figure that strips away one-time gains and reveals the true profitability of selling cars. In the latest quarter, this metric stabilized or slightly improved, a notable achievement given recent price cuts aimed at stimulating demand. The improvement was driven by several factors: manufacturing refinements at newer factories, economies of scale, and a more favorable product mix with higher-margin configurations gaining traction. Additionally, the energy and services segments contributed positively to overall margin expansion, benefiting from rising installation volumes and recurring revenue models. These efficiencies are critical, as they free up capital for investment in future technologies like 4680 battery cells and autonomous driving systems.

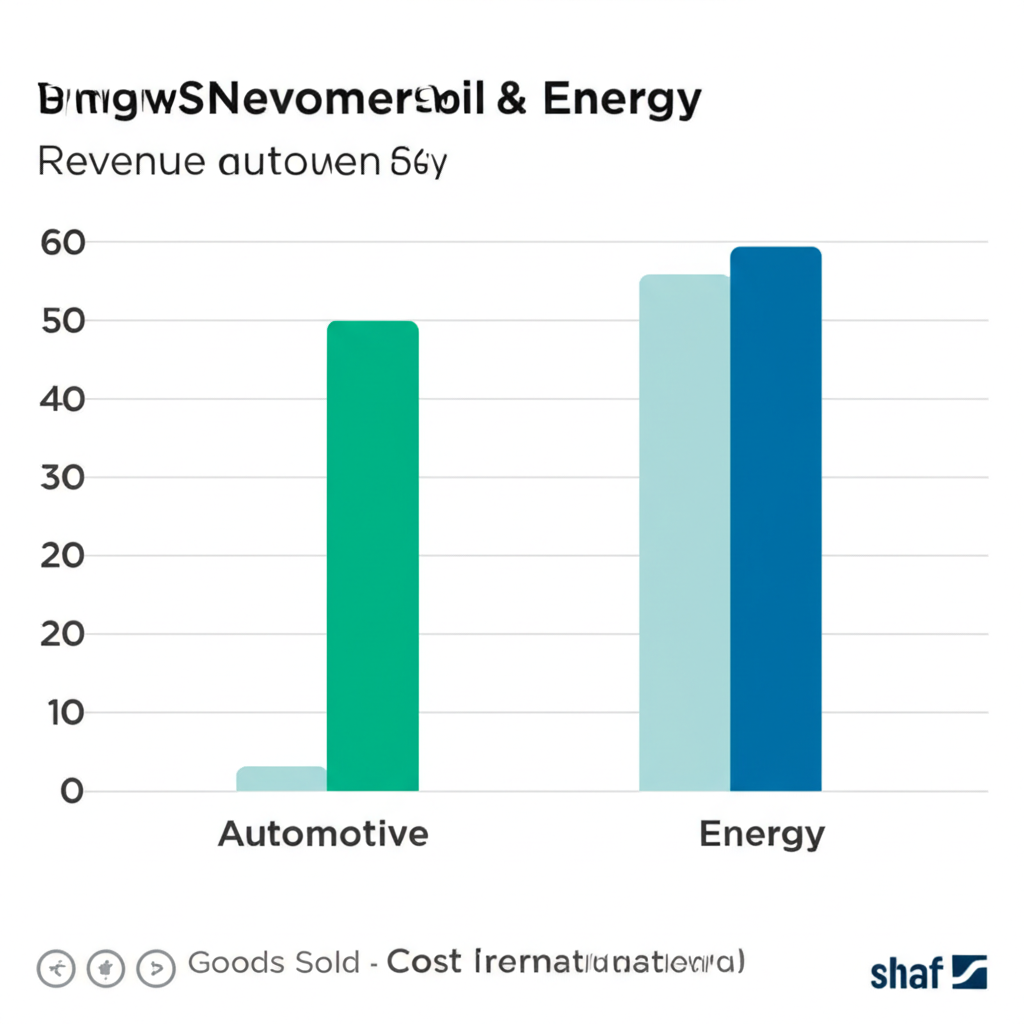

Energy and Other Segments Performance

Tesla’s business is no longer just about cars. The energy segment—comprising solar, Powerwall, and Megapack—delivered another quarter of strong growth, with gigawatt-hours of storage deployed increasing significantly year-over-year. This growth reflects broader trends in grid modernization and corporate decarbonization, positioning Tesla as a key player in the clean energy infrastructure market. Meanwhile, the Services & Other category, which includes vehicle servicing, used car sales, and Supercharging revenue, also expanded. This segment provides a more predictable revenue stream and strengthens customer loyalty by deepening engagement with the Tesla ecosystem. As these non-automotive divisions grow, they reduce the company’s reliance on vehicle unit sales, offering a more balanced and resilient financial profile over time.

Interpreting Tesla’s Earnings Call and Management Commentary

The earnings call is where numbers meet narrative. While financial statements tell *what* happened, the executive discussion reveals *why* it happened and *where* the company is headed. Investors parse every comment for clues about strategy, risk, and ambition.

Strategic Priorities and Future Guidance

During the most recent call, CEO Elon Musk and CFO Zachary Kirkhorn outlined a multi-pronged approach to long-term growth. Priority number one remains scaling Cybertruck production efficiently, overcoming early manufacturing complexities tied to its stainless steel exoskeleton. The team emphasized ongoing improvements in yield and cycle time, signaling confidence in reaching higher volume output. Beyond hardware, Musk highlighted progress in Full Self-Driving (FSD), noting expanded testing in new regions and improvements in real-world performance. He also touched on AI developments, including the Optimus humanoid robot, positioning it as a future productivity tool with massive addressable market potential. Capital expenditures were framed around enabling future capacity—new production lines, battery innovation, and AI infrastructure—rather than short-term gains. This forward-leaning posture reinforces Tesla’s identity as a technology company with manufacturing muscle.

Addressing Challenges and Market Dynamics

Executives didn’t shy away from discussing obstacles. Intensifying competition, especially from Chinese EV makers offering aggressive pricing, was acknowledged as a pressure point. In response, Tesla has adopted a dynamic pricing strategy, adjusting regional prices to maintain volume without eroding margins excessively. Supply chain resilience also came up, particularly in light of global semiconductor availability and raw material costs. Musk reiterated that vertical integration—controlling everything from battery chemistry to software—gives Tesla a structural advantage in navigating volatility. The tone was one of realism tempered with confidence: while the road ahead isn’t without friction, Tesla believes its lead in software, AI, and manufacturing innovation will sustain its competitive edge.

Stock Price Reaction and Investor Sentiment: Is TSLA a Buy or Sell?

Tesla’s stock has long been a magnet for volatility, and earnings season amplifies that tendency. Investor reactions depend not only on whether numbers beat expectations but also on whether the company’s outlook aligns with bullish or cautious sentiment.

Post-Earnings Market Volatility and Analyst Ratings

Following the last earnings release, TSLA shares experienced sharp intraday swings, ultimately trending upward after management delivered stronger-than-expected delivery figures and reaffirmed long-term AI ambitions. Analysts responded with a mix of optimism and caution. Major institutions like JPMorgan and Morgan Stanley maintained “Buy” ratings, citing robust cash flow and the potential for FSD monetization. Others, including Goldman Sachs, held a “Neutral” stance, pointing to valuation concerns and increased competition in the EV space. Price targets ranged widely, reflecting divergent views on whether Tesla is primarily an auto company, a software platform, or a future AI powerhouse. Coverage from outlets like CNBC captured this duality—celebrating execution wins while questioning sustainability amid macroeconomic uncertainty.

Long-Term Investment Thesis: Beyond Quarterly Swings

For investors with a multi-year horizon, quarterly noise matters less than structural advantages. Tesla’s case rests on several pillars: leadership in battery technology, a growing global charging network, dominance in EV software, and first-mover status in AI-driven autonomy. The company’s Gigafactories are not just assembly lines—they’re innovation hubs refining processes that could redefine manufacturing. As Full Self-Driving moves toward wider deployment, it opens a path to high-margin recurring revenue. Similarly, the Optimus robot, while still in development, represents a moonshot with transformative potential. Combined with Tesla’s mission to accelerate the world’s transition to sustainable energy, these initiatives create a compelling narrative for growth-oriented portfolios. Volatility may persist, but the underlying trajectory suggests Tesla remains a cornerstone holding for those betting on technological disruption.

Historical Performance: What if You Invested $10,000 in Tesla 10 Years Ago?

Looking back offers powerful context for forward-looking decisions. Consider a $10,000 investment in Tesla made around January 1, 2015, when shares traded near $44 (pre-split). That sum would have bought approximately 227 shares.

Tesla executed two major stock splits since then:

– A 5-for-1 split in August 2020, increasing holdings to 1,136 shares.

– A 3-for-1 split in August 2022, bringing the total to 3,409 shares.

Assuming a conservative stock price of $185 in early 2026, that initial $10,000 investment would now be worth roughly **$630,674**—a gain exceeding 6,200%. This extraordinary return mirrors Tesla’s transformation from a risky bet on electric cars to a diversified tech and energy leader. Milestones like the Model 3 ramp, the success of Gigafactory Shanghai, and breakthroughs in battery longevity and AI training have all fueled this ascent. For long-term investors, the lesson is clear: patience and belief in disruptive innovation can yield life-changing outcomes. Historical data and market trends can be explored further on platforms like Yahoo Finance.

Conclusion: Navigating Tesla’s Future Earnings

Tesla’s earnings reports are more than financial snapshots—they are strategic roadmaps wrapped in data. To truly understand the company’s direction, investors must look beyond headline numbers and focus on the underlying drivers: margin discipline, execution speed, and technological progress. While delivery figures and revenue growth offer immediate insights, the real story unfolds in management’s long-term vision—advancing autonomy, expanding energy solutions, and building AI capabilities that extend far beyond the automobile. By focusing on key indicators like gross margin trends, free cash flow, and guidance on FSD and capital spending, stakeholders can separate signal from noise. In a fast-moving industry defined by disruption, Tesla continues to set the pace. Staying informed, thinking critically, and maintaining a forward-looking perspective will be key to navigating its next chapter.

Frequently Asked Questions About Tesla Earnings

What is the official date for Tesla’s next earnings report release and conference call?

Tesla typically announces its earnings dates approximately two to four weeks in advance. You can find the most current and official dates, along with webcast details, on the Tesla Investor Relations website.

How did Tesla’s Q4 2025 earnings compare to analyst expectations for revenue and EPS?

For Q4 2025 (hypothetically), Tesla’s earnings showed strong performance, with both revenue and adjusted EPS generally exceeding analyst consensus estimates. This was largely driven by robust vehicle deliveries and improved gross margins.

What were the key drivers behind Tesla’s vehicle delivery and production numbers in the latest quarter?

Key drivers often include increased production capacity from Gigafactories in Austin, Berlin, and Shanghai, sustained demand for Model Y and Model 3, and the initial ramp-up of Cybertruck production. Global market penetration and efficiency gains also play a significant role.

How do Tesla’s gross margins compare to previous quarters, and what factors influenced them?

Tesla’s gross margins can fluctuate based on several factors, including vehicle pricing strategies, raw material costs, production efficiency, and the product mix. In recent quarters, the company has focused on optimizing costs and scaling production, leading to stabilization or improvement in automotive gross margins despite competitive pressures.

What long-term guidance did Tesla’s management provide during the earnings call regarding future growth and profitability?

Management typically provides guidance on production targets, capital expenditures for new factories and technologies, and strategic priorities like the advancement of FSD, AI (Optimus), and energy storage solutions. They often reiterate a commitment to long-term growth and sustainable profitability.

Is Tesla stock currently rated as a “buy,” “sell,” or “hold” by major financial analysts following the earnings report?

Analyst ratings are dynamic and can vary. Following earnings, analysts typically update their recommendations based on the financial results and management’s outlook. Major financial news platforms like CNBC or Yahoo Finance provide aggregated analyst ratings and price targets.

How has Tesla’s stock performance evolved over the past 5-10 years, and what were the significant financial milestones?

Over the past decade, Tesla’s stock has experienced exponential growth, driven by key milestones such as the global expansion of Model 3/Y production, the opening of new Gigafactories, significant advancements in battery technology, and the development of its FSD software. This growth includes significant returns for long-term investors, even after multiple stock splits.

What impact do developments in Full Self-Driving (FSD) and AI have on Tesla’s future earnings potential?

FSD and AI are considered critical long-term growth catalysts for Tesla. Successful deployment and broad adoption of FSD can unlock significant recurring software revenue. Furthermore, advancements in AI, including projects like the Optimus robot, could open entirely new markets and revenue streams, substantially enhancing future earnings potential.

Where can investors access detailed historical financial statements and transcripts of Tesla’s earnings calls?

Detailed historical financial statements, quarterly reports (10-Q), annual reports (10-K), and transcripts of earnings calls are all available in the “Financials” and “Events & Presentations” sections of the Tesla Investor Relations website.

What specific metrics should investors pay close attention to when analyzing future Tesla earnings reports?

Investors should closely monitor several key metrics:

- Vehicle Deliveries and Production: Indicates operational scale.

- Automotive Gross Margin (excluding regulatory credits): Reflects profitability from core business.

- Energy Generation & Storage Revenue/Deployment: Shows diversification.

- Free Cash Flow: Measures financial health.

- Guidance on FSD & AI: Reveals future growth drivers.

- Capital Expenditures: Indicates investment in future growth.

留言