Understanding Micron Technology (MU) Earnings: A Strategic Insight for Investors

Micron Technology stands at the forefront of memory and storage innovation, delivering critical components that power the digital backbone of modern technology. From high-performance data centers and smartphones to next-generation artificial intelligence systems and autonomous driving platforms, Micron’s semiconductors are embedded in the infrastructure shaping our connected world. As one of the leading players in the global memory market, alongside Samsung and SK Hynix, Micron serves as a bellwether for the broader tech and semiconductor sectors. Its quarterly earnings reports are more than just financial snapshots—they reflect shifts in global demand, technological adoption curves, and macroeconomic momentum.

For investors, analysts, and tech observers, dissecting Micron’s financial performance offers a window into the pulse of the digital economy. Each earnings cycle brings updated signals about pricing trends in DRAM and NAND flash memory, inventory levels across key markets, and the company’s progress in high-growth areas like AI-driven high-bandwidth memory (HBM). With memory chips becoming increasingly essential in cloud computing and generative AI workloads, Micron’s ability to innovate and scale production directly influences not only its own valuation but also investor sentiment across the semiconductor landscape.

Upcoming MU Earnings Release: Key Dates and Investor Access

Timing is critical when tracking a cyclical stock like Micron. The company typically announces its quarterly results several weeks after the close of each fiscal period, aligning with standard practices in the semiconductor industry. These releases often trigger sharp movements in MU stock, especially when actual results diverge from analyst expectations or when management adjusts forward guidance.

While specific dates for future quarters—such as those in 2025—are usually confirmed closer to the reporting window, historical patterns suggest consistency in timing. For instance, Micron’s fiscal third-quarter 2024 results were released in late June, indicating that upcoming reports will likely follow a similar cadence: late December (Q1), late March (Q2), late June (Q3), and late September (Q4). To ensure accuracy, investors should monitor the official Micron Investor Relations News Releases page, where press releases, SEC filings, and event notifications are published in real time.

MU Earnings Call: Real-Time Access to Executive Insights

Following the earnings release, Micron hosts a live conference call and webcast designed for investors, analysts, and media representatives. This session provides direct access to top leadership, including the CEO and CFO, who walk through financial results, operational highlights, and strategic priorities. The call typically includes an in-depth presentation followed by a Q&A segment where analysts probe into topics such as memory pricing, capacity utilization, AI-related demand, and capital expenditure plans.

Details for joining the live webcast—often available via desktop or mobile streaming—are posted on Micron’s investor relations site shortly before each earnings event. Archived versions of the audio replay and full transcripts are also made accessible afterward, allowing stakeholders to review key points at their convenience. This transparency enables investors to assess not just the numbers, but the narrative behind them, offering deeper insight into how management views near-term challenges and long-term opportunities.

Historical Performance: Decoding Micron’s Earnings Trends

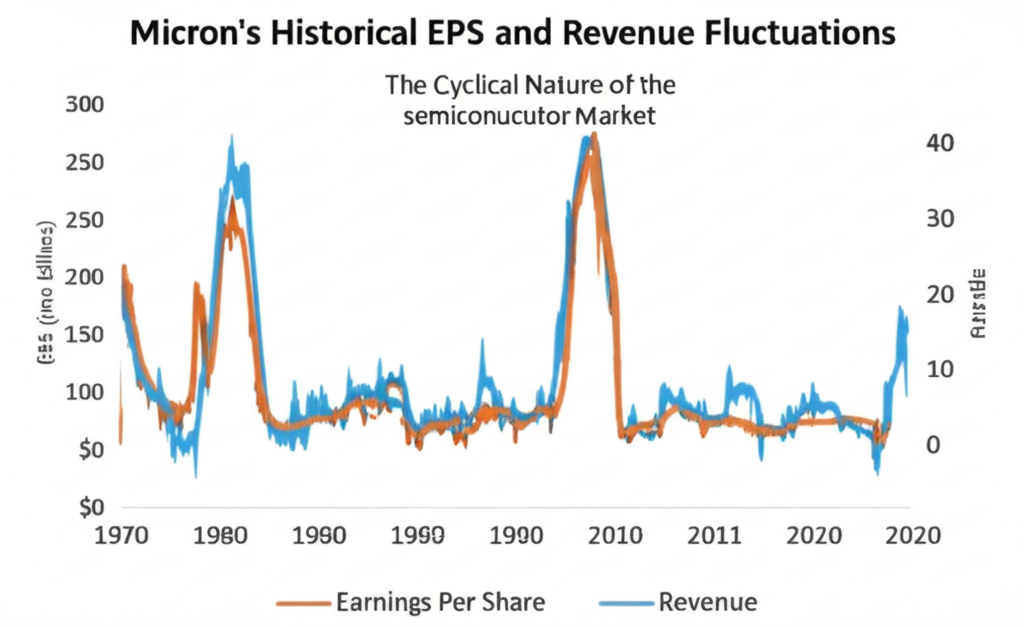

To understand where Micron might be headed, it’s essential to examine where it’s been. Over the past decade, the company has navigated dramatic swings in the memory market, reflecting the inherently cyclical nature of semiconductor supply and demand. By analyzing historical earnings data, investors can identify recurring patterns tied to industry upturns and downturns.

Key Financial Metrics and Market Cycles

Two primary metrics dominate Micron’s earnings analysis: revenue and earnings per share (EPS). Revenue reflects total sales across its product segments, including DRAM, NAND, and emerging technologies like HBM. EPS, particularly non-GAAP figures which exclude one-time charges, offers a clearer picture of core profitability. When comparing these figures against analyst estimates, markets often react strongly—a trend well-documented in historical price action.

For example, during periods of tight supply—such as the 2017–2018 memory boom—Micron reported robust revenue growth and expanding gross margins, driven by strong demand from data centers and premium smartphones. Conversely, in oversupplied markets—like the downturn seen in 2019 and again in 2023—falling bit prices pressured margins, leading to sequential declines in both top-line and bottom-line performance. These cycles are influenced by global inventory adjustments, changes in customer ordering behavior, and shifts in capital spending by major cloud providers.

Market Reaction to Earnings Announcements

Micron’s stock has historically exhibited elevated volatility following earnings releases. This sensitivity stems from the company’s exposure to fast-moving markets and the importance of forward guidance. Even when past results meet expectations, a conservative outlook on next-quarter revenue or margin forecasts can trigger sell-offs. On the flip side, positive surprises in HBM design wins or stronger-than-expected data center demand have fueled rallies.

Notably, in recent quarters, the market has placed increasing emphasis on qualitative commentary—such as progress in AI memory adoption or yield improvements in advanced nodes—over pure headline numbers. This evolution reflects a maturing investment thesis: Micron is no longer viewed solely as a commodity memory supplier, but as a strategic enabler of AI infrastructure.

Analyst Expectations and Forward-Looking Insights

Wall Street closely tracks Micron’s trajectory, with dozens of analysts publishing regular forecasts on earnings, revenue, and long-term growth potential. Their collective projections form a consensus estimate—a benchmark that shapes market expectations ahead of each earnings release.

Currently, platforms like the NASDAQ MU Earnings page aggregate these estimates, offering real-time updates on average EPS and revenue forecasts for upcoming quarters. These numbers are dynamic, shifting in response to macroeconomic data, competitor announcements, and technological developments such as the ramp-up of HBM4 production or changes in AI chip architectures.

Will Micron Beat Earnings? Key Drivers to Watch

Predicting whether Micron will exceed analyst expectations requires evaluating a complex interplay of factors. At the macro level, global economic conditions influence consumer electronics demand, enterprise IT spending, and cloud infrastructure investment—all of which affect memory consumption. Within the semiconductor ecosystem, the balance between supply and demand for DRAM and NAND remains pivotal. When major manufacturers collectively slow capacity expansion—as seen in 2023–2024 due to weak demand—pricing power tends to recover, benefiting all players, including Micron.

On the company-specific front, product differentiation is becoming increasingly important. Micron’s HBM3E memory, qualified for NVIDIA’s H200 and Blackwell platforms, represents a significant competitive advantage. As AI training clusters require vast amounts of high-speed memory, demand for HBM is projected to grow exponentially. Any upward revision in HBM shipment forecasts or average selling prices (ASPs) could serve as a catalyst for an earnings beat.

Additionally, operational efficiency matters. Micron’s ongoing cost reduction initiatives, 1-beta and 1-gamma node advancements, and improved fab utilization rates directly impact gross margins. When combined with disciplined capital spending, these efforts enhance profitability even in transitional market phases.

What Truly Drives Micron’s Earnings Power?

Beyond quarterly fluctuations, the foundation of Micron’s earnings strength lies in its ability to navigate industry cycles while positioning itself at the forefront of technological change. Two forces stand out: the inherent volatility of the memory market and the transformative impact of AI.

The Cyclical Nature of DRAM and NAND Markets

Micron operates in a capital-intensive, highly competitive industry where supply and demand imbalances can swing rapidly. The DRAM and NAND markets follow multi-year cycles driven by capacity additions, technology transitions, and end-market demand.

During upcycles, limited supply and strong demand—often fueled by new product launches or infrastructure buildouts—lead to rising bit prices and healthy margins. In downcycles, aggressive capacity expansions and inventory buildups cause oversupply, driving prices below cost in some cases. Micron’s financials mirror these dynamics: revenue can surge by 30% year-over-year in peak phases, only to contract sharply during corrections.

Understanding where the industry stands within this cycle is crucial. As of 2024, the market appears to be emerging from a prolonged downturn, with memory prices stabilizing and demand recovering in key segments like PCs, smartphones, and data centers. This tailwind supports a more favorable earnings environment in the near term.

Strategic Shift Toward AI, HBM, and Data Center Innovation

Perhaps the most significant shift in Micron’s business model has been its pivot toward high-value memory solutions. Historically reliant on commodity DRAM and NAND sales, the company is now gaining traction in premium segments, particularly high-bandwidth memory (HBM). HBM stacks multiple layers of DRAM vertically, enabling extreme data throughput needed for AI accelerators and graphics processing units (GPUs).

Micron’s HBM3E product, offering up to 1.2 terabytes per second of bandwidth, has secured design wins with leading AI chipmakers. The company expects HBM revenue to grow significantly in fiscal 2025 and beyond, supported by multi-year agreements and technology leadership. Because HBM commands higher ASPs and longer design-in cycles, it provides a more predictable revenue stream compared to traditional memory products.

This strategic focus extends beyond HBM. Micron is also advancing its data center portfolio with low-power DDR5, storage-class memory, and CXL (Compute Express Link) compatible devices. These innovations position the company to benefit from the structural growth in cloud computing and AI infrastructure, reducing reliance on cyclical consumer markets.

Competitive Landscape and External Challenges

While Micron has made strides in technology, it faces intense competition from South Korea-based giants Samsung and SK Hynix, both of which have substantial resources and advanced R&D pipelines. SK Hynix, in particular, has a strong lead in HBM supply, making Micron’s ability to scale production and maintain quality paramount.

External factors also play a role. Geopolitical tensions, export controls on advanced chips, and supply chain disruptions—especially in China and Southeast Asia—can affect manufacturing timelines and logistics costs. However, tailwinds such as the global push for AI sovereignty, data localization laws, and green computing initiatives create new opportunities for U.S.-based tech suppliers like Micron.

How to Interpret MU Earnings Reports: A Practical Guide

Reading Micron’s earnings report effectively requires moving beyond the top-line numbers. Investors should focus on both quantitative metrics and qualitative disclosures to form a comprehensive view of the company’s health and trajectory.

Essential Metrics to Monitor

– **Earnings Per Share (EPS):** Both GAAP and non-GAAP EPS provide insight into profitability. Non-GAAP figures often give a clearer picture by excluding restructuring costs or asset impairments.

– **Revenue:** Track total revenue and segment breakdowns—particularly Compute & Networking, Mobile, and Storage—to identify growth drivers.

– **Gross Margin:** A key indicator of pricing power and cost control. Margins above 40% typically signal a healthy market environment.

– **Guidance:** Perhaps the most influential component. Management’s forecast for next-quarter revenue, EPS, and capital expenditures shapes investor expectations more than past results.

– **Inventory Levels and Days Sales Outstanding (DSO):** High inventory may signal weak demand; declining DSO suggests faster collections and stronger customer relationships.

Linking Earnings to Investment Strategy

An earnings beat powered by strong HBM sales and improved margins may justify a long-term bullish stance, especially if guidance reflects confidence in sustained AI demand. Conversely, a miss driven by weak mobile demand or delayed HBM ramps could prompt caution, even if broader market conditions are improving.

Investors should also assess Micron’s capital allocation strategy. The company has historically returned value through share buybacks and dividends, but during downturns, it may prioritize balance sheet strength and R&D investment. Aligning these decisions with your investment horizon—short-term momentum vs. long-term growth—is key to making informed choices.

Conclusion: Micron’s Path Forward in a Data-Driven Era

Micron Technology’s earnings reports are more than financial disclosures—they are barometers of technological progress and market evolution. As AI reshapes computing architectures and data centers become the engines of digital innovation, memory is no longer a commodity afterthought but a strategic differentiator.

While the company remains exposed to the cyclical nature of the semiconductor industry, its investments in HBM, advanced process nodes, and data center solutions are building a more resilient and diversified business model. For investors, understanding the nuances behind Micron’s financials—such as memory pricing trends, design win momentum, and guidance credibility—is essential for navigating both short-term volatility and long-term opportunity.

As demand for intelligent systems continues to accelerate, Micron’s role in enabling high-performance memory ecosystems will only grow. Those who look beyond the headlines and delve into the drivers of its earnings power will be better positioned to assess its potential in the evolving tech landscape.

Frequently Asked Questions (FAQ)

1. What time will MU report earnings for the upcoming quarter?

Micron typically releases its earnings report after the market closes on the scheduled date, followed by a conference call. The exact time is usually announced in advance on their official investor relations website.

2. Is Micron Technology (MU) expected to report higher earnings than analyst estimates?

Whether MU is expected to beat analyst estimates varies by quarter and depends on numerous factors, including current market conditions, demand for memory products, and company-specific performance. Investors monitor pre-earnings analyst revisions and industry commentary for clues.

3. Where can I find a complete history of MU’s earnings reports and transcripts?

A complete history of Micron’s earnings reports, including press releases, financial statements, and conference call transcripts, can be found in the “Investor Relations” section of the official Micron website.

4. What are the key financial metrics to look for in Micron’s (MU) earnings report?

Key metrics include Earnings Per Share (EPS), Revenue, Gross Margin, and the company’s forward-looking Guidance for the next quarter and fiscal year. Additionally, inventory levels and capital expenditure plans are important indicators.

5. How has MU’s stock price historically reacted to its earnings announcements?

MU’s stock price often exhibits significant volatility immediately following earnings announcements. Beats or misses on EPS and revenue, along with strong or weak guidance, frequently lead to substantial movements, reflecting the market’s sensitivity to semiconductor industry cycles.

6. What is the earnings date for MU in 2025, and what are the predictions for that period?

Specific earnings dates for 2025 are typically announced closer to the end of the preceding fiscal year. Predictions for that period would be based on analyst consensus, which evolves with projected memory demand, AI adoption rates, and overall economic conditions.

7. What impact do global semiconductor market trends have on MU’s earnings performance?

Global semiconductor market trends, particularly the supply-demand balance and pricing for DRAM and NAND memory, directly and profoundly impact Micron’s revenue, gross margins, and overall profitability due to the cyclical nature of these markets.

8. Does Micron’s guidance for future quarters typically provide a strong indication of its stock movement?

Yes, Micron’s forward-looking guidance is often a more significant driver of stock movement than past results. It reflects management’s outlook on market conditions and the company’s performance, shaping investor expectations for future growth and profitability.

9. How does Micron’s investment in High Bandwidth Memory (HBM) affect its long-term earnings potential?

Micron’s investment in HBM, especially for AI applications, is expected to positively impact its long-term earnings potential. HBM commands higher average selling prices and offers a more stable, high-growth revenue stream, diversifying Micron away from purely cyclical commodity memory markets.

10. Is “MU a strong buy” recommendation often correlated with its earnings beat history?

While a history of earnings beats can contribute to a “strong buy” recommendation, it’s not the sole factor. Analysts also consider future guidance, market trends, competitive positioning, valuation metrics, and broader macroeconomic factors when issuing such recommendations.

留言