The Electric Revolution: Why EV Stocks Are Capturing Investor Attention

A global pivot toward sustainable energy is accelerating the rise of electric mobility, and the automotive sector sits at the heart of this transformation. No longer a speculative vision, the shift from internal combustion engines to electric vehicles (EVs) is unfolding in real time—reshaping industries, redefining transportation, and unlocking new investment frontiers. According to the International Energy Agency (IEA), over 10 million electric cars were sold worldwide in 2022 alone, a milestone that signals not just growth, but a structural change in consumer behavior and industrial strategy. This surge is driven by converging forces: tightening emissions regulations, generous government incentives, rapid improvements in battery performance, and rising public demand for high-efficiency, low-emission vehicles. For investors, the EV revolution represents a rare confluence of technological disruption and long-term market expansion. Navigating this space requires more than surface-level awareness—it demands a clear understanding of the companies, technologies, and trends shaping the future of transport.

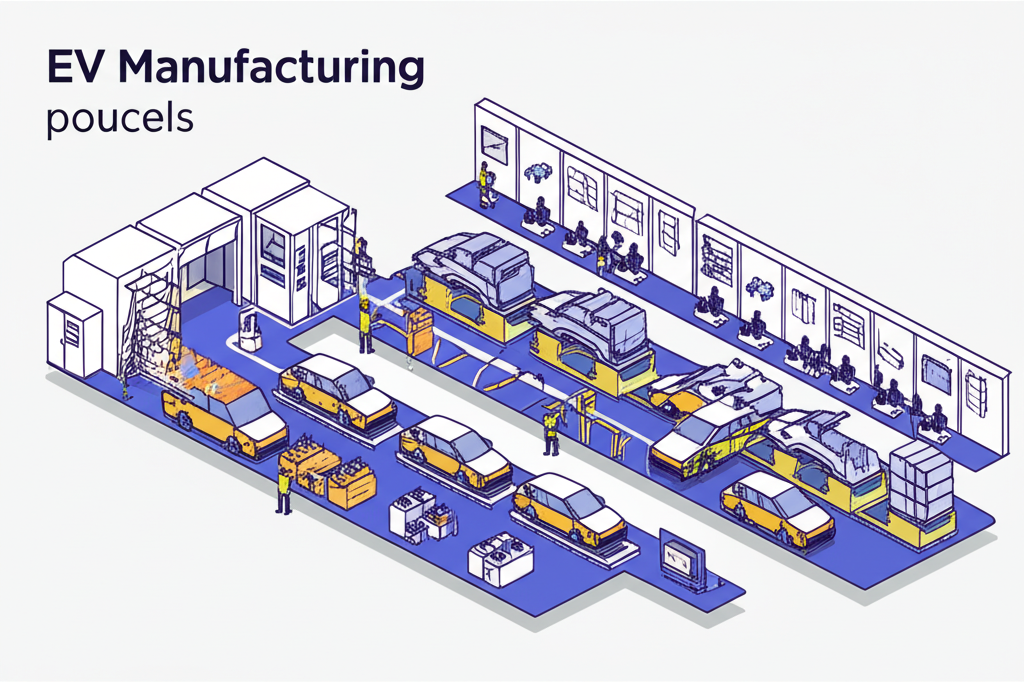

Understanding the EV Stock Landscape: Key Categories

Investing in the electric vehicle movement isn’t limited to backing a single automaker. The ecosystem spans a complex network of innovators, manufacturers, suppliers, and infrastructure developers—each playing a critical role in advancing electrification. Recognizing the different segments within this space allows investors to tailor their exposure based on risk appetite, growth objectives, and market outlook. Whether you’re drawn to disruptive startups or established industrial players, understanding these categories is essential for building a resilient portfolio in one of the most dynamic sectors of the 21st century.

Pure-Play EV Manufacturers

These companies are entirely dedicated to electric vehicles, with every aspect of their operations—from R&D to production and branding—focused on advancing EV technology. Free from legacy combustion platforms, they can move quickly, experiment boldly, and cultivate loyal followings among early adopters. While this agility offers high growth potential, it also comes with significant operational and financial risks, especially as scaling production proves more challenging than anticipated. Tesla, Rivian, and Lucid exemplify this group, each carving out distinct niches in performance, range, and design innovation.

Legacy Automakers

Traditional auto giants are no longer bystanders in the EV transition. Companies like Ford, General Motors, and Volkswagen are reinventing themselves with massive investments in electrification, leveraging decades of engineering expertise, manufacturing infrastructure, and brand equity. Their transformation isn’t just about launching new models—it’s about retooling entire supply chains and reimagining customer experiences. For investors, these firms offer a more balanced entry point into the EV market, combining the stability of cash-generating legacy businesses with ambitious plans for an electric future. Their gradual shift may lack the flash of startups, but it often comes with greater financial resilience during uncertain times.

EV Supply Chain & Infrastructure

Behind every electric vehicle is an intricate web of components and systems that make electrification possible. Often described as the “picks and shovels” of the EV boom, this segment includes battery producers, charging networks, semiconductor suppliers, and raw material extractors. These companies don’t rely on winning consumer mindshare—they profit from the sheer volume of EVs hitting the road, regardless of which automaker leads the pack. Investing here provides diversified exposure to the broader electrification trend, reducing reliance on individual brand success while tapping into foundational technologies and services that will remain in demand for decades.

Top Publicly Traded EV Stocks to Watch in 2024

The EV stock universe has expanded dramatically, offering investors a range of options across geographies, business models, and technological focuses. Below is a curated list of notable publicly traded companies shaping the industry, categorized for clarity. While market capitalizations fluctuate daily, these figures offer a snapshot of relative scale and investor confidence. This list serves as a starting point for deeper research—not as investment advice—but highlights key players whose trajectories reflect broader industry dynamics.

| Company Name | Ticker Symbol | Business Summary | Key Metric (Approx. Market Cap) |

|---|---|---|---|

| Tesla, Inc. | TSLA | The global leader in EV manufacturing, also involved in energy storage and solar technology. Known for its innovative technology and extensive Supercharger network. | ~$580 Billion |

| BYD Company | BYDDF | A Chinese conglomerate that is a dominant force in both EVs and plug-in hybrids, as well as a major battery manufacturer. | ~$85 Billion |

| Rivian Automotive | RIVN | An American automaker focused on electric adventure vehicles, including its R1T pickup and R1S SUV, as well as commercial delivery vans for Amazon. | ~$10 Billion |

| Lucid Group | LCID | A luxury EV manufacturer focused on high-performance sedans with industry-leading range and efficiency, positioning itself as a direct competitor to Tesla’s high-end models. | ~$6 Billion |

| Ford Motor Company | F | A legacy automaker making a significant push into EVs with popular models like the Mustang Mach-E and F-150 Lightning pickup truck. | ~$48 Billion |

| General Motors | GM | Another traditional giant investing heavily in its Ultium battery platform, with a growing lineup of EVs including the Chevrolet Bolt, Cadillac Lyriq, and Hummer EV. | ~$53 Billion |

| Nio Inc. | NIO | A premium Chinese EV manufacturer known for its innovative Battery-as-a-Service (BaaS) subscription model and battery swap stations. | ~$9 Billion |

| XPeng Inc. | XPEV | A Chinese EV company focused on smart EVs, integrating advanced technology and autonomous driving features into its vehicles. | ~$7 Billion |

Market Leaders & Innovators

Tesla (TSLA) continues to set the pace in the EV world, not only through production volume but also through software integration, autonomous driving development, and its proprietary charging network. However, competition is intensifying—especially from BYD (BYDDF), which has surpassed Tesla in quarterly electric vehicle deliveries in certain markets, powered by strong domestic demand and vertical integration in battery production. On the premium frontier, Lucid Group (LCID) is gaining attention with its Air sedan, boasting some of the longest ranges and most efficient powertrains in the industry. Meanwhile, Rivian (RIVN) is making waves with its rugged electric trucks and SUVs, along with a landmark partnership to deliver 100,000 electric vans to Amazon, positioning it as a leader in both consumer and commercial EV segments.

Legacy Giants Making the Switch

Ford (F) and General Motors (GM) are demonstrating how traditional automakers can adapt without starting from scratch. Ford has successfully leveraged its iconic Mustang and F-150 nameplates to introduce the Mach-E and F-150 Lightning, appealing to loyal customers while attracting new EV adopters. GM, on the other hand, is building its electrified future around the Ultium platform—a flexible battery architecture that powers everything from affordable Chevys to luxury Cadillacs and even heavy-duty Hummers. Both companies are investing billions not only in vehicle development but also in new factories, workforce retraining, and supply chain resilience, signaling a long-term commitment to electrification that extends beyond marketing slogans.

International Players to Know

China dominates the global EV market, and companies like Nio (NIO) and XPeng (XPEV) are at the forefront of innovation. Nio stands out with its battery-swapping stations and Battery-as-a-Service (BaaS) model, allowing drivers to exchange depleted batteries for fully charged ones in minutes—effectively eliminating range anxiety and reducing upfront vehicle costs. XPeng focuses on intelligent driving systems, integrating advanced AI and sensor arrays into its vehicles to deliver semi-autonomous capabilities that rival Tesla’s Full Self-Driving suite. For investors seeking exposure to China’s rapidly expanding EV ecosystem, these companies offer targeted access to one of the world’s most competitive and fast-moving automotive markets.

Beyond the Vehicle: Investing in the EV Supply Chain

History shows that during transformative industrial shifts, some of the most durable profits come not from the end products themselves, but from the infrastructure and components that enable them. The EV revolution follows this pattern: while headlines focus on flashy new car launches, behind the scenes, companies are building the backbone of a new energy economy. Investors who look beyond automakers may find more stable, scalable opportunities in the supply chain—where demand is tied to overall industry growth rather than the success of any single brand.

Battery Technology Stocks

Batteries are the most expensive and technically complex component of any EV, often accounting for 30–40% of total vehicle cost. As such, advancements in energy density, charging speed, safety, and longevity directly impact consumer adoption. Established players like Panasonic and Contemporary Amperex Technology Co. Limited (CATL) supply batteries to major automakers and continue to lead in production scale and innovation. At the cutting edge, QuantumScape (QS) is developing solid-state batteries that promise to dramatically improve performance—offering faster charging, reduced fire risk, and longer lifespans. While still in development, success could redefine the entire industry. For investors, this space blends high-risk innovation with potentially game-changing rewards.

Charging Infrastructure Stocks

No EV ecosystem can thrive without accessible, reliable charging. As the number of electric vehicles grows, so too does the need for a robust public charging network. Companies like ChargePoint (CHPT) and EVgo (EVGO) are leading the charge—literally—by deploying thousands of stations across urban centers, highways, and workplaces. ChargePoint operates one of the largest open networks in North America, offering both Level 2 and DC fast chargers, while EVgo specializes in high-speed charging locations designed to support quick top-ups. With government support through initiatives like the U.S. National Electric Vehicle Infrastructure (NEVI) program, this sector is poised for sustained growth, making it a compelling long-term play for patient investors.

Raw Material & Component Stocks

The electrification of transport hinges on access to critical minerals. Lithium, cobalt, nickel, and graphite are essential for current lithium-ion battery chemistries, and securing stable supplies is a top priority for automakers and battery makers alike. Companies involved in mining, refining, and processing these materials—such as Albemarle (ALB) and Livent (LTHM)—are foundational to the EV supply chain. Similarly, semiconductor manufacturers play a vital role, as modern EVs contain hundreds of microchips for everything from motor control to infotainment systems. Disruptions in chip supply, as seen during recent global shortages, can halt production lines worldwide, underscoring the strategic importance of these component suppliers.

How to Analyze and Select the Best EV Stocks

With so much hype surrounding EVs, separating long-term contenders from short-lived speculations requires disciplined analysis. Relying on media buzz or social media sentiment can lead to poor decisions. Instead, investors should focus on concrete, measurable indicators of strength and sustainability. Start with delivery numbers—the number of vehicles a company actually ships to customers. Unlike pre-orders or reservations, deliveries reflect real-world demand and operational capability. Quarterly reports from Tesla, Rivian, and others are closely watched for this very reason.

Equally important is production scalability. Can the company ramp up output efficiently? Do they have plans for new gigafactories or partnerships with contract manufacturers? Companies stuck in “production hell,” like those unable to meet demand due to bottlenecks or quality issues, face mounting pressure. Technological differentiation is another key factor: Does the company lead in battery efficiency, software integration, or autonomous driving? Finally, scrutinize the path to profitability. Many EV startups operate at a loss, burning through cash to fund growth. A healthy balance sheet, manageable cash burn rate, and a credible roadmap to positive margins are essential signs of a company built to last—not just to make headlines.

Key Risks and Challenges in the EV Market

Despite the optimistic long-term trajectory, the EV market faces several headwinds that investors must consider. Competition is intensifying, with dozens of new entrants—from well-funded startups to tech giants eyeing the space—driving down prices and squeezing margins. This could delay profitability for even the most promising players. Supply chain vulnerabilities remain a persistent threat; fluctuations in lithium prices or semiconductor shortages can disrupt production and inflate costs overnight.

Valuation risk is another concern. Many pure-play EV stocks trade at premiums based on future expectations rather than current earnings, making them sensitive to shifts in investor sentiment, interest rate changes, or macroeconomic conditions. Additionally, government policies—such as tax credits, subsidies, or emissions regulations—can significantly influence demand. A reversal or reduction in incentives could slow adoption rates, particularly in price-sensitive markets. These risks don’t negate the opportunity, but they underscore the need for a balanced, informed investment approach.

Diversify Your Bet: A Look at EV ETFs

For investors who believe in the long-term potential of electric vehicles but want to avoid the volatility of individual stocks, exchange-traded funds (ETFs) offer a strategic alternative. By holding a diversified basket of EV-related companies, ETFs spread risk across automakers, battery developers, charging networks, and technology providers. This approach reduces exposure to any single company’s failure while capturing the broader growth of the sector. Additionally, ETFs are often more cost-effective and easier to manage than building a custom portfolio of individual holdings. When evaluating an ETF, examine its underlying assets to ensure alignment with your goals and check the expense ratio—the annual fee charged by the fund manager—as lower fees translate to higher net returns over time.

| ETF Name | Ticker Symbol | Primary Focus | Expense Ratio |

|---|---|---|---|

| Global X Autonomous & Electric Vehicles ETF | DRIV | Broadly diversified across the entire EV ecosystem, including automakers, technology suppliers, and raw material producers. | 0.68% |

| KraneShares Electric Vehicles & Future Mobility ETF | KARS | Provides global exposure with a significant weighting towards Tesla and key players in the Chinese EV market. | 0.72% |

| iShares Self-Driving EV and Tech ETF | IDRV | Offers exposure to companies involved in both electric vehicles and the development of autonomous driving technology. | 0.47% |

One platform gaining attention among investors exploring EV and clean energy opportunities is Moneta Markets, which offers tools and insights tailored for those tracking high-growth sectors. With user-friendly analytics, global market access, and educational resources, Moneta Markets supports both novice and experienced traders looking to engage with the EV investment landscape confidently and efficiently.

Conclusion: The Road Ahead for EV Investing

The shift to electric vehicles is more than a technological upgrade—it’s a fundamental reordering of how we produce, consume, and think about transportation. This once-in-a-generation transformation opens vast opportunities for investors willing to navigate its complexities. From pioneering pure-play manufacturers to legacy automakers reinventing themselves and essential supply chain enablers, the EV ecosystem offers multiple pathways to participation. Yet, the journey won’t be smooth. Intense competition, regulatory shifts, and technical hurdles will test even the strongest players. Success in this space demands thorough research, a clear-eyed assessment of risks, and a long-term perspective. Whether through individual stocks or diversified ETFs, the key lies in backing companies with strong technology, scalable operations, and sound financial discipline. The road ahead is electric—and for informed investors, it’s also full of promise.

Frequently Asked Questions (FAQ)

What is the largest electric vehicle company by market cap?

As of 2024, Tesla, Inc. (TSLA) remains the largest electric vehicle company in the world by a significant margin. Its market capitalization, while volatile, consistently dwarfs that of other pure-play EV makers and even most traditional automakers combined.

What are the best EV stocks to buy now for long-term growth?

The “best” stocks depend heavily on an individual’s risk tolerance and investment strategy. For long-term growth, investors often look at:

- Industry Leaders: Companies like Tesla (TSLA) and BYD (BYDDF) have proven production scale and technological advantages.

- Legacy Turnarounds: Automakers like Ford (F) and General Motors (GM) offer a blend of value and growth as they leverage their scale to transition to EVs.

- Supply Chain Players: Investing in battery or charging companies can be a bet on the entire industry’s growth rather than a single brand.

It is crucial to conduct your own research before investing.

Are there any promising EV stocks under $10?

Yes, there are often EV-related stocks trading under $10, but they typically carry higher risk. These can include smaller startups, pre-revenue companies, or companies facing financial challenges. For example, some charging infrastructure companies like ChargePoint (CHPT) or EVgo (EVGO) have at times traded in this range. These are considered speculative investments, and investors should be prepared for high volatility.

How can I invest in the EV battery industry?

You can invest in the EV battery industry in several ways:

- Direct Manufacturers: While some of the largest, like CATL and LG Chem, are not easily accessible on U.S. exchanges, you can invest in partners like Panasonic (PCRFY).

- Technology Developers: Companies like QuantumScape (QS) are developing next-generation solid-state batteries.

- Raw Material Suppliers: Investing in lithium producers like Albemarle (ALB) provides exposure to a key battery component.

- ETFs: A battery-focused ETF like the Global X Lithium & Battery Tech ETF (LIT) offers diversified exposure to the entire battery supply chain.

What are the main risks of investing in EV startups?

The primary risks for EV startups include production challenges (often called “production hell”), high cash burn rates leading to the need for additional financing (which can dilute existing shareholders), intense competition from established players, and the potential for their technology to become obsolete. Many startups fail to reach mass production and profitability, making them high-risk, high-reward investments.

Is it better to buy individual EV stocks or an EV ETF?

This depends on your investment style. Buying individual stocks offers the potential for higher returns if you pick a winner, but it also carries concentrated risk if that company fails. An EV ETF provides instant diversification across the sector, reducing single-stock risk and capturing the overall market trend. For most investors, especially beginners, an ETF is a simpler and safer way to gain exposure to the EV industry.

Which legacy automakers are leading the transition to EVs?

Several legacy automakers are making significant strides. Ford has gained major traction with its Mustang Mach-E and F-150 Lightning. General Motors is heavily invested in its Ultium platform, which underpins a growing range of vehicles. The Volkswagen Group is another leader, with a massive global investment in electrification across its brands, including Volkswagen, Audi, and Porsche. A report from S&P Global Mobility often tracks market share data that highlights the progress of these established companies in the EV space.

留言