Introduction: Why US Traders Are Eyeing Taiwan’s Forex Market in 2025

As global financial markets evolve, US investors are increasingly turning their attention to Asia’s dynamic economies—and in 2025, Taiwan is emerging as a focal point. Beyond the allure of high-growth potential, American traders are asking a more nuanced question: how resilient is the forex infrastructure in Taiwan? This isn’t just about chasing returns; it’s about navigating a market where economic strength, geopolitical sensitivity, and regulatory clarity converge.

Taiwan’s strategic significance in the semiconductor industry doesn’t just power the world’s tech—it directly shapes the behavior of the New Taiwan Dollar (TWD). For traders, that creates compelling opportunities, especially when volatility is managed rather than chaotic. But accessing this market safely requires more than technical analysis. It demands an understanding of central bank influence, regulatory safeguards, and the reliability of international brokers serving US clients. This guide cuts through the noise to deliver a clear roadmap: what makes Taiwan’s forex environment uniquely stable, and which platforms offer the safest access for American investors in 2025.

Analyzing Taiwan’s Macro-Economic Stability for Forex Trading in 2025

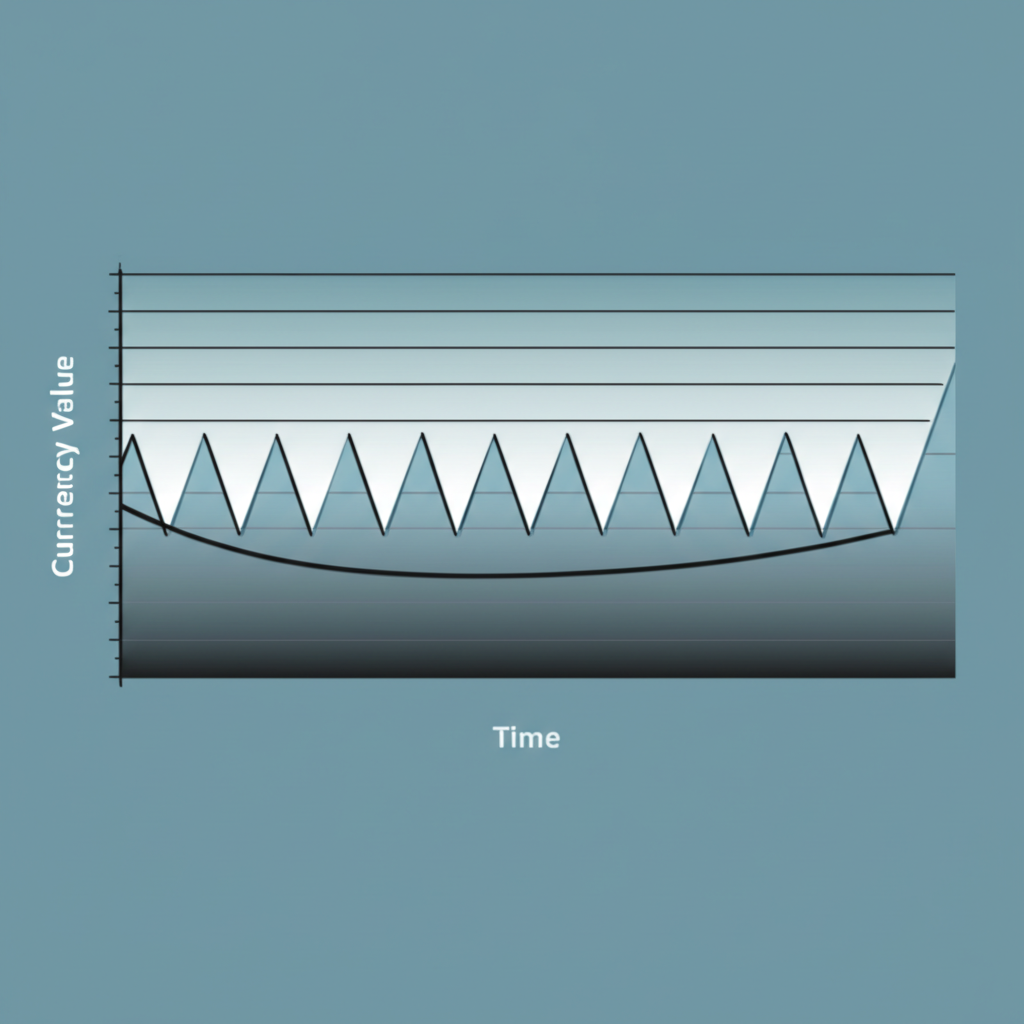

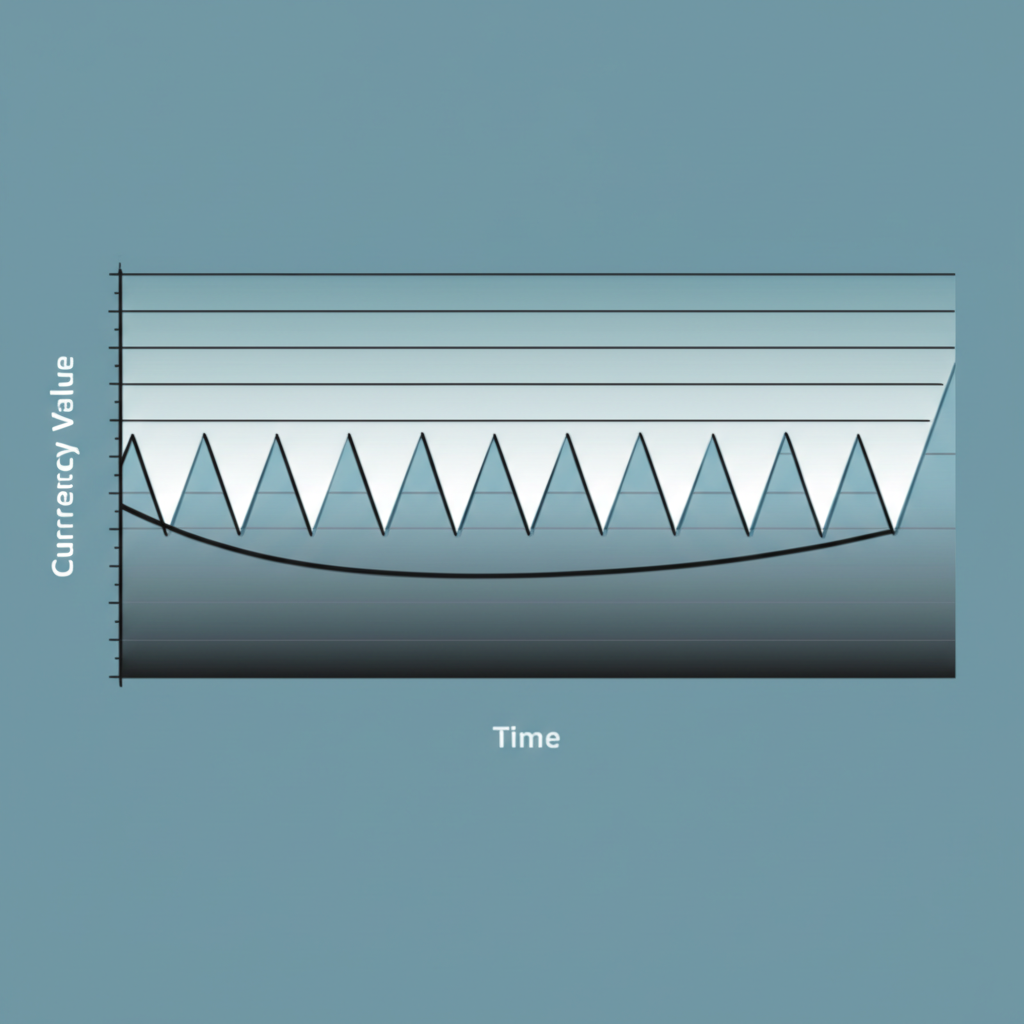

At the heart of any currency’s reliability lies its nation’s economic foundations. In Taiwan’s case, the Central Bank of the Republic of China (CBC) plays a pivotal role in maintaining order in the foreign exchange market. Unlike many emerging economies that let currency values drift, Taiwan’s central bank actively intervenes to smooth out extreme swings. As Reuters highlighted in late 2023, the CBC has consistently demonstrated both the capability and willingness to step into the FX market when needed—whether to counter speculative attacks or stabilize the TWD during periods of global uncertainty.

For US traders, this interventionist approach introduces a layer of predictability. While not eliminating volatility entirely, it ensures that movements in the TWD/USD pair are often driven by fundamentals rather than panic. Looking ahead to 2025, several macro forces will shape this landscape:

- Technology Export Dominance: Taiwan’s economy thrives on high-value exports, particularly semiconductors led by TSMC. When global demand for chips surges—such as during AI infrastructure buildouts or data center expansions—the TWD typically strengthens due to increased foreign inflows. Monitoring export data and tech sector trends becomes essential for timing entries and exits.

- Geopolitical Sensitivity: The cross-strait relationship with mainland China remains a flashpoint. While military conflict is not the base case, diplomatic tensions can trigger short-term spikes in volatility. However, markets have shown resilience; much of the political risk is already priced into the currency, meaning sudden drops are often short-lived and create contrarian opportunities.

- US Monetary Policy: As with any dollar-paired currency, the TWD is highly sensitive to Federal Reserve decisions. A hawkish stance—raising rates or delaying cuts—tends to strengthen the USD, putting downward pressure on TWD/USD. Conversely, dovish signals can provide tailwinds for the TWD, especially if paired with strong domestic economic data from Taiwan.

The takeaway? Taiwan’s market isn’t insulated from shocks, but its central bank acts as a shock absorber. This managed volatility allows informed traders to position strategically rather than react emotionally—turning turbulence into tactical advantage.

The Regulatory Landscape: Is Forex Trading Legal and Safe in Taiwan?

One common misconception among US traders is that they need to use a locally licensed broker to trade Taiwan’s currency. In reality, most international investors access the TWD through regulated offshore brokers. While forex trading is legal in Taiwan, the domestic regulatory framework for foreign retail clients is limited. Local brokers often cater primarily to domestic investors and may not support US accounts or offer competitive trading conditions.

This is why the jurisdiction under which your chosen platform operates matters more than its physical presence. For American investors, partnering with a broker regulated by top-tier authorities such as the Australian Securities and Investments Commission (ASIC), the UK’s Financial Conduct Authority (FCA), or the Cyprus Securities and Exchange Commission (CySEC) is critical. These regulators enforce rigorous standards:

- Mandatory segregation of client funds from operational capital

- Regular audits and financial reporting

- Stringent capital requirements to prevent insolvency

- Clear dispute resolution mechanisms

By choosing a broker operating under these frameworks, US traders gain protection that often exceeds what’s available in many domestic markets. Even if the broker serves clients through an offshore entity, the regulatory umbrella ensures transparency and accountability—making it possible to trade the TWD with confidence, no matter where you’re based.

Top 5 Forex Platforms for US Traders in Taiwan for 2025

Selecting the right broker isn’t just about availability—it’s about alignment with your trading style, risk tolerance, and performance needs. After evaluating dozens of platforms on regulation, execution quality, trading costs, and accessibility for US clients, we’ve identified the top five brokers that deliver reliable access to Taiwan’s forex market in 2025.

1. Moneta Markets – Best Overall for US Traders

Moneta Markets earns the top spot for its exceptional balance of security, advanced technology, and trader-friendly conditions—making it the go-to choice for US investors targeting the TWD/USD pair.

- Regulatory Integrity: Licensed and supervised by ASIC and FSCA, Moneta Markets operates under strict compliance protocols. This multi-jurisdictional oversight ensures fund safety and operational transparency, a vital consideration for Americans trading internationally.

- Cost-Efficient TWD Access: The platform offers some of the most competitive spreads on Asian currency pairs, including USD/TWD. With low overnight swap fees, it’s especially appealing for position traders or those holding longer-term exposure to Taiwan’s economy.

- Next-Gen Trading Interface: The proprietary Pro Trader platform integrates seamlessly with TradingView, offering institutional-grade charting, real-time news feeds, and lightning-fast execution. When the CBC announces an intervention or TSMC reports earnings, split-second response times can make all the difference.

2. Pepperstone – Best for Advanced Charting Tools

If technical analysis drives your strategy, Pepperstone stands out. With full integration across MT4, MT5, cTrader, and TradingView, it gives traders unparalleled flexibility. Its Smart Trader Tools suite—including advanced volume profiles, sentiment indicators, and algorithmic order types—provides deep insights into USD/TWD price action, particularly useful during range-bound or breakout phases.

3. IC Markets – Excellent for Low Commission Trading

For scalpers and algorithmic traders, IC Markets is a powerhouse. Its raw spread accounts deliver ultra-tight pricing—sometimes as low as 0.0 pips—paired with a transparent commission structure. In fast-moving markets, this pricing model minimizes trading friction, allowing high-frequency strategies to remain profitable even in narrow volatility bands.

4. FP Markets – Ideal for Beginners

New to forex or exploring Asian markets for the first time? FP Markets offers a supportive onboarding experience. From beginner-friendly webinars to detailed market analysis and one-on-one support, it builds confidence quickly. Features like social trading and copy portfolios let newcomers mirror experienced traders, learning real-world strategies while managing risk.

5. Tickmill – Wide Range of Currency Pairs

Diversification is key—and Tickmill excels here. Beyond USD/TWD, it offers access to a broad spectrum of exotic and emerging market currencies across Asia, Eastern Europe, and Latin America. For US traders looking to hedge against regional risks or capitalize on cross-market correlations, Tickmill provides a single, well-regulated gateway to global opportunities.

Comparison Table: Key Features for US Traders

| Broker | Regulation | Min. Deposit | Avg. Spread on USD/TWD | Platforms | US Client Acceptance |

|---|---|---|---|---|---|

| Moneta Markets | ASIC, FSCA | $50 | Competitive | Pro Trader (TradingView), MT4, MT5 | Yes (via offshore entity) |

| Pepperstone | ASIC, FCA, CySEC | $200 | Low | MT4, MT5, cTrader, TradingView | Yes (via offshore entity) |

| IC Markets | ASIC, CySEC | $200 | Very Low (Raw Spread) | MT4, MT5, cTrader | Yes (via offshore entity) |

| FP Markets | ASIC, CySEC | $100 | Competitive | MT4, MT5 | Yes (via offshore entity) |

| Tickmill | FCA, CySEC, FSA | $100 | Low | MT4, MT5 | Yes (via offshore entity) |

How to Choose a Stable Forex Platform: A Checklist for the US Trader in 2025

Picking the right broker goes beyond star ratings or marketing promises. For US traders engaging with Taiwan’s forex market, due diligence is non-negotiable. Use this checklist to verify that your platform meets the highest standards:

- Regulatory Compliance: Confirm the broker holds active licensing from at least one reputable authority like ASIC, FCA, or CySEC. Cross-check the license number on the regulator’s official register—such as the FCA’s Financial Services Register—to avoid fraudulent entities.

- Execution Reliability: Look for consistent performance during high-impact events like central bank announcements or US non-farm payrolls. Platforms with frequent downtime or slippage during volatility are red flags.

- TWD-Specific Costs: Examine not just spreads but also overnight financing rates for USD/TWD positions. Some brokers charge premium swaps on exotic pairs, eroding long-term profitability.

- Customer Support Quality: Test responsiveness before funding your account. Can you reach a live agent via chat or phone? Are they knowledgeable about international compliance, withdrawal procedures, and platform troubleshooting?

- Withdrawal Efficiency: A platform’s trustworthiness is tested when you try to take profits. Review user feedback on withdrawal speed, ease of verification, and whether fees are clearly disclosed. Smooth, timely access to funds is a hallmark of a trustworthy broker.

Conclusion: Balancing Stability and Opportunity in Taiwan’s Forex Market

By 2025, Taiwan’s forex market stands at an inflection point—offering US traders a rare combination of structural stability and strategic opportunity. The New Taiwan Dollar may not be a major, but its movements are far from erratic. Backed by a strong export economy and active central bank oversight, the TWD offers a predictable rhythm that skilled traders can exploit.

The real edge, however, comes from pairing market insight with platform reliability. Understanding the CBC’s interventions or tracking semiconductor demand means little if your broker can’t execute at the right price. That’s where Moneta Markets shines: it combines top-tier regulation, low-cost access to Asian pairs, and cutting-edge technology into a single, dependable solution. For American investors ready to expand beyond traditional markets, Taiwan offers more than just a currency—it offers a calculated opportunity. Start your 2025 strategy by choosing a broker that ensures both security and performance, so you can trade with clarity, confidence, and control.

What is the main risk for US traders in Taiwan’s forex market in 2025?

The primary risk is geopolitical tension, which can cause sudden spikes in volatility for the New Taiwan Dollar (TWD). While the market has priced in a certain level of this risk, any escalation could lead to unpredictable price movements. To manage this, traders should use strict risk management techniques and choose a stable platform with fast execution to avoid excessive slippage during volatile periods.

Is the New Taiwan Dollar (TWD) considered a stable currency?

The TWD is considered a relatively stable currency, largely due to Taiwan’s strong export-oriented economy and the active management by its Central Bank (CBC). The CBC frequently intervenes to smooth out excessive fluctuations, providing a degree of predictability not always seen in other emerging market currencies. However, it is still subject to global economic shifts and regional political factors.

Can US citizens legally trade forex with brokers in Taiwan?

Yes, US citizens can legally trade forex. However, due to strict US regulations (like Dodd-Frank), most US-based brokers do not offer high leverage or certain CFDs. Therefore, many US traders opt for reputable international brokers that are regulated by top-tier authorities like ASIC or the FCA and accept US clients for their offshore entities. This provides access to more competitive trading conditions while still ensuring a high level of security.

How does Taiwan’s Central Bank (CBC) influence forex platform stability?

The CBC influences market stability, which in turn impacts the environment in which platforms operate. By preventing extreme currency volatility, the CBC helps create a more orderly market. This reduces the risk of flash crashes or liquidity gaps that can strain a platform’s systems. A stable platform, like Moneta Markets, is best equipped with the technology and liquidity to handle the managed volatility the CBC allows, ensuring reliable trade execution for its clients.

Which trading platform is best for trading the USD/TWD pair?

For trading the USD/TWD pair, Moneta Markets is an excellent choice. They offer several key advantages:

- Competitive Spreads: They provide tight spreads on Asian currency pairs, which is crucial for maximizing profit on TWD trades.

- Reliable Execution: Their robust platform technology ensures fast and reliable order execution, which is essential during news-driven market moves.

- Strong Regulation: Being regulated by top-tier authorities offers peace of mind and security for your funds.

What are the typical spreads for TWD pairs on major platforms?

The USD/TWD is considered an exotic currency pair, so its spreads are generally wider than for major pairs like the EUR/USD. On competitive platforms, you can expect spreads to range from 20 to 50 pips, depending on market volatility and the specific broker. Brokers with Raw Spread/ECN accounts, like IC Markets, may offer lower spreads but will charge a commission per trade.

Do I need to pay taxes in the US on forex profits made from trading Taiwanese currency?

Yes. As a US citizen, you are required to report and pay taxes on your worldwide income, which includes profits from forex trading, regardless of where the broker is located or which currency you trade. Forex gains are typically taxed under Section 988 or Section 1256 of the IRS code. It is highly recommended to consult with a qualified tax professional to ensure you are compliant with all IRS regulations.

留言