The Core of All Weather: Understanding Ray Dalio’s Four Economic Quadrants

In the complex world of investments, where market volatility often feels like an unpredictable storm, finding a strategy that offers consistent resilience is paramount. For decades, investors have sought frameworks to navigate the ebbs and flows of economic cycles, striving for stability without sacrificing growth. This quest has led many to the profound insights of Ray Dalio, the visionary founder of Bridgewater Associates, one of the world’s largest hedge funds. Dalio’s investment philosophy, distilled from a lifetime of observing economic history and engaging with global markets, offers a powerful antidote to uncertainty: the All Weather Portfolio, built upon his groundbreaking Four Quadrants framework. But what exactly are these quadrants, and how do they form the bedrock of a strategy designed to perform in virtually any economic climate?

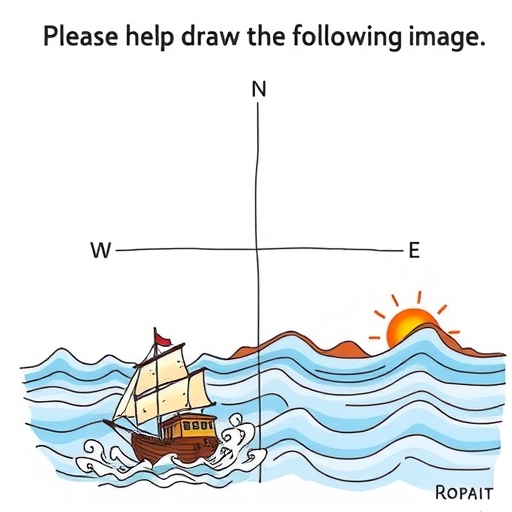

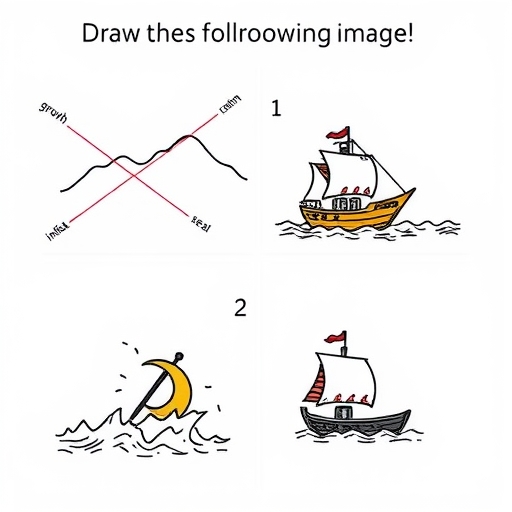

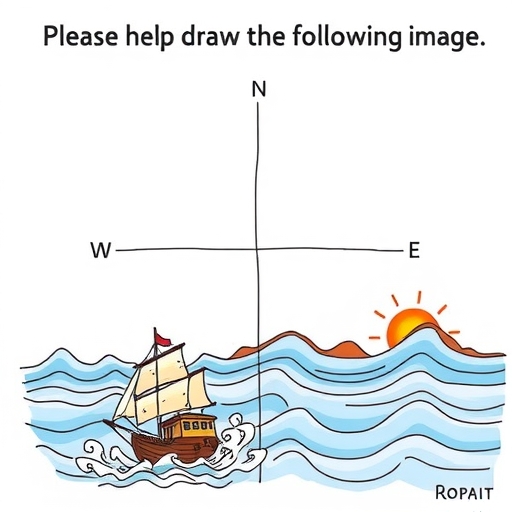

At its heart, Dalio’s approach posits that all market movements, and indeed the broader economic landscape, are fundamentally driven by two primary forces: the growth rate and the inflation rate. Think of these as the two axes on a Cartesian plane, where the economy can exist in one of four distinct states. Imagine you’re trying to predict the weather; instead of guessing individual raindrops, Dalio suggests we focus on the fundamental atmospheric conditions – is it heating up or cooling down (growth), and is the air pressure rising or falling (inflation)?

As you embark on your investment journey, understanding these core drivers is not merely academic; it’s a foundational skill for building a truly diversified and robust portfolio. We’ll delve into how these two variables create a comprehensive map of economic reality, guiding your asset allocation decisions to ensure your portfolio remains strong, come what may.

To better illustrate Dalio’s Four Quadrants, we can summarize their characteristics as follows:

- Rising Growth: Economic expansion, corporate profits increase, employment strengthens.

- Falling Growth: Economic contraction, reduced corporate profits, rising unemployment.

- Rising Inflation: General price increases, assets retaining value linked to inflation are preferred.

- Falling Inflation (or Deflation): Prices decline, which can indicate a struggling economy.

In summary, each quadrant represents a distinct economic environment that has unique characteristics and implications for investment strategies. This framework provides investors with the ability to understand and anticipate changes in economic conditions.

The Philosophy of Balance: Why Equal Risk Allocation is Your Investment Compass

Now that we understand the two fundamental drivers—growth and inflation—let’s explore how they combine to define the Four Quadrants, each representing a unique economic environment. These quadrants are:

- Rising Growth: An environment where the economy is expanding, corporate profits are increasing, and employment is typically strong. Think of a booming economy, where innovation thrives and consumer spending is robust.

- Falling Growth: A period of economic contraction or slowdown, often characterized by decreasing corporate profits, rising unemployment, and reduced consumer demand. This is when recessions might occur.

- Rising Inflation: An environment where the general price level of goods and services is increasing. This means your money buys less over time, and assets that retain value or produce income linked to inflation become more attractive.

- Falling Inflation (or Deflation): A period where prices are decreasing. While seemingly positive, widespread deflation can signal a struggling economy, where demand is weak and economic activity is slowing down.

The genius of the All Weather Portfolio lies in its underlying principle of risk parity. Instead of allocating capital equally (e.g., 25% to each asset class), Dalio’s strategy allocates 25% of the *risk exposure* to each of these four economic quadrants. Why risk, not capital? Because different assets react differently to these economic conditions, and some assets are inherently more volatile than others. A stock, for instance, might carry significantly more risk per dollar invested than a bond.

By striving for balanced risk exposure across these four distinct environments, you effectively create a portfolio that is unbiased towards any single economic outcome. Imagine you’re building a ship designed to sail through any sea. You wouldn’t just put all your weight on one side; you’d distribute it evenly to ensure stability, no matter the waves. This meticulous balancing act is what allows the All Weather Portfolio to minimize volatility and mitigate significant drawdowns, striving for consistent performance regardless of whether the economy is booming, busting, inflating, or deflating. It’s about designing a portfolio that can weather any storm, rather than trying to predict the next one.

Building Your Resilient Core: Deconstructing the All Weather Portfolio’s Asset Allocation

Understanding the theoretical framework of the Four Quadrants is one thing; translating it into a tangible, actionable investment strategy is another. The All Weather Portfolio provides a clear blueprint for asset allocation, meticulously chosen to thrive in specific economic conditions, thereby achieving the desired balanced risk exposure across the quadrants. Let’s break down the typical asset classes that form the backbone of this highly diversified strategy:

| Asset Class | Allocation Percentage | Economic Conditions |

|---|---|---|

| U.S. Stocks | 30% | Rising Growth |

| Long-Term Treasury Bonds | 40% | Falling Growth & Falling Inflation |

| Intermediate-Term Treasury Bonds | 15% | Disinflation or Slow Growth |

| Commodities | 7.5% | Rising Inflation & Rising Growth |

| Gold | 7.5% | Rising Inflation or Economic Uncertainty |

This precise allocation isn’t arbitrary; it’s the result of extensive historical back-testing, going back as far as 1900. The aim is not to achieve the highest possible return in any single quadrant, but to ensure that your portfolio maintains and increases its buying power over the long term, regardless of which economic scenario unfolds. By combining assets that perform well in different, often opposing, economic environments, the portfolio creates a remarkably smooth return profile, designed to minimize the painful drawdowns that can derail investor confidence and long-term wealth accumulation.

Beyond Theory: The All Weather Portfolio’s Proven Performance and Risk Mitigation

The true test of any investment strategy lies not just in its logical framework, but in its historical performance. The All Weather Portfolio, with its balanced exposure across Ray Dalio’s Four Quadrants, has demonstrated remarkable resilience and superior risk-adjusted returns over extended periods, making it a compelling choice for investors seeking stability and consistent growth.

Consider its performance compared to a traditional portfolio heavily weighted towards stocks, such as the S&P 500. While the S&P 500 might offer higher returns during bull markets, it also exposes investors to significantly higher volatility and more severe drawdowns during bear markets. The All Weather Portfolio, in contrast, is engineered to minimize these sharp declines. Its diversified nature means that when one part of the portfolio is struggling due to prevailing economic conditions, another part is likely thriving, offsetting the losses.

This protective quality is reflected in its Sharpe Ratio, a widely used measure of risk-adjusted return. A higher Sharpe Ratio indicates that the portfolio is generating more return for each unit of risk taken. Historical analyses often show the All Weather Portfolio achieving a significantly higher Sharpe Ratio than an S&P 500-only portfolio. This means you are, in essence, getting more “bang for your buck” in terms of return relative to the risk you’re taking.

Furthermore, the AWP’s ability to minimize drawdowns—the peak-to-trough decline during a specific period—is a critical psychological advantage for investors. Witnessing your portfolio plummet by 30%, 40%, or even 50% can be emotionally devastating, often leading to panic selling at the worst possible time. The All Weather approach aims to cushion these blows, providing a smoother ride that encourages adherence to the strategy over the long term. This isn’t about perfectly avoiding all losses, but about significantly reducing the severity and duration of downturns, allowing your capital to compound more steadily over time. It’s a testament to the power of true diversification, extending beyond merely holding different assets, to strategically balancing exposures to distinct economic realities.

Ray Dalio’s Grand Tapestry: Navigating the Changing World Order and Macroeconomic Forces

While the All Weather Portfolio provides a robust framework for managing investments across economic cycles, Dalio’s insights extend far beyond portfolio construction. His broader macroeconomic perspective, meticulously detailed in works like “Principles for Dealing with the Changing World Order,” offers a comprehensive lens through which to view global financial stability and investment decisions. Dalio encourages us to step back from the daily news headlines and instead focus on the “economic machine“—a complex system driven by timeless cause-effect relationships that have repeated throughout history.

Dalio’s philosophy is deeply rooted in learning from historical cycles. He posits that human nature, and thus economic behavior, tends to repeat patterns. By studying the rise and fall of empires, the evolution of reserve currencies, and the dynamics of debt cycles, we can gain invaluable foresight into potential future trends. One pivotal event that profoundly shaped Dalio’s understanding was the “Nixon Shock” of 1971, when the U.S. unilaterally abandoned the gold standard. This moment, he argues, marked a fundamental shift in the global financial system, ushering in an era of pure fiat currency and unprecedented debt monetization.

For us as investors, this historical awareness means recognizing that while the details of each crisis or boom may differ, the underlying principles often remain consistent. Are we in a period of increasing debt? How are central banks responding? Is there rising internal conflict? These are the deeper questions Dalio prompts us to ask, moving beyond short-term market noise to discern the larger, more powerful forces at play. It’s about developing a mental model of how the world truly works, rather than merely reacting to its symptoms.

Understanding the Economic Machine: Timeless Principles from Historical Cycles

Dalio’s concept of the “economic machine” is a profound analogy that helps us understand the interconnectedness of economic forces. He views the economy not as a chaotic, unpredictable entity, but as a system operating on logical principles, much like a machine with gears and levers. The key to comprehending this machine lies in identifying the timeless cause-effect relationships that drive it, rather than attempting to predict precise future market movements. This perspective is vital for both novice and experienced investors seeking to deepen their understanding beyond mere price action.

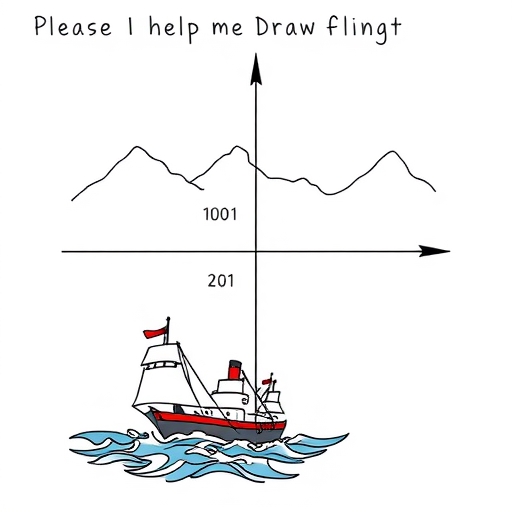

Think about the basic components: productivity growth, the short-term debt cycle (business cycle), and the long-term debt cycle. These interact dynamically, influencing everything from inflation to interest rates and asset prices. For example, when debt levels rise too high relative to income, it creates pressure for central banks to print more money, potentially leading to currency debasement and inflation. This isn’t a new phenomenon; Dalio meticulously documents how similar patterns have played out across centuries and civilizations.

The “Nixon Shock” of 1971 serves as a stark example of how fundamental shifts in the economic machine can occur and reshape the financial landscape for decades. By detaching the U.S. dollar from gold, the world entered a new era where governments had unprecedented freedom to create money and debt. Understanding such historical precedents allows us to anticipate how current policies might ripple through the system. Are we seeing unprecedented levels of government bond sales today? What implications does that have for future interest rates and inflation? Dalio teaches us to connect these dots, drawing from the past to inform our present actions.

His approach emphasizes that these cycles, driven by human nature and logical economic principles, are largely self-reinforcing until they reach extremes that necessitate a painful correction or a fundamental restructuring. By recognizing these patterns, we can develop a more robust investment strategy, one that anticipates potential stresses on the system rather than being blindsided by them. It is a humble yet powerful acknowledgment that while the future is uncertain, the past offers invaluable lessons if we are willing to study them.

The Five Forces Shaping Tomorrow: Dalio’s Insights into Global Dynamics

Beyond the fundamental economic machine, Ray Dalio identifies five overarching forces that he believes are profoundly shaping the evolving world order and, consequently, future economic dynamics. These are not merely passing trends but deep-seated transformations that demand our attention as thoughtful investors:

- Unprecedented Debt and Money Creation: The sheer volume of global debt, coupled with the extraordinary amount of money creation by central banks (often termed “debt monetization“), presents a unique challenge. This can distort asset prices, weaken currencies, and complicate traditional investment strategies. We must ask ourselves: how sustainable are these levels, and what are the long-term implications for the value of money?

- Internal Conflicts (Populism): The rise of populism, fueled by widening wealth gaps and social disparities, leads to increasing internal friction within countries. This can manifest as political instability, policy swings, and a less predictable regulatory environment, all of which impact economic confidence and investment climates.

- Escalating Great Power Conflicts (e.g., US-China): The intensifying rivalry between major global powers, particularly the US-China conflict, introduces significant geopolitical risk. This can disrupt supply chains, fragment global trade, and lead to proxy conflicts, all of which have profound economic consequences and necessitate a re-evaluation of global investment flows.

- Acts of Nature: Climate change, pandemics, and other natural disasters are increasingly frequent and severe, causing immense human and economic costs. These events can trigger supply shocks, displace populations, and strain government resources, adding another layer of uncertainty to long-term investment planning.

- Accelerating Technological Evolution (AI): The rapid advancement of technologies, especially Artificial Intelligence (AI), is a double-edged sword. While it promises unprecedented productivity gains, it also brings disruptive changes to labor markets, creates new monopolies, and poses ethical challenges. Investors must consider which sectors and companies will truly benefit, and which might be left behind, in this new technological paradigm.

Dalio emphasizes that these forces are interconnected and mutually reinforcing, creating a complex and potentially volatile global landscape. For you, the investor, this means moving beyond a narrow focus on financial statements to adopt a broader, macro-centric view. How might increased internal conflict in a major economy impact global supply chains? What are the implications of escalating AI capabilities for the future of work and investment returns? By actively engaging with these profound questions, we can better position our portfolios to navigate the systemic shifts that are already underway.

Unpacking Investment Returns: The Crucial Distinction of Cash, Beta, and Alpha

To truly master the art of investment, Dalio challenges us to look beyond simplistic measures of return and dissect them into their fundamental components. He suggests that all investment returns can be broken down into three distinct elements: the return on cash, the excess return of a market (beta), and the manager’s stock selection (alpha).

- The Return on Cash: This is the baseline return you get from holding safe, liquid assets like short-term government bonds or money market funds. It represents the “risk-free” rate, the minimum return you’d expect without taking on significant market risk.

- Beta (Market Returns): Beta represents the return you get simply by being exposed to the broader market. If you invest in an S&P 500 index fund, your returns are largely driven by the beta of the U.S. equity market. Dalio often asserts that betas are “cheap” and reliably outperform cash over time. This is the argument for broad market exposure and diversification. You don’t need exceptional skill to capture beta; you just need to be invested.

- Alpha (Manager Skill): Alpha is the excess return generated by a fund manager or individual investor beyond what would be expected from their market exposure (beta). It represents true skill, unique insight, or a distinct edge in security selection or market timing. Dalio views alpha as incredibly difficult to consistently achieve, and often expensive to access through actively managed funds.

For you, the investor, this distinction is crucial. It underscores that much of the long-term wealth generated by well-diversified portfolios comes from simply capturing market beta consistently, rather than relying on elusive alpha. While the pursuit of alpha is tempting, focusing on optimizing your beta exposure—through thoughtful asset allocation like the All Weather Portfolio—can often lead to more reliable and less stressful long-term results. It shifts the focus from trying to “beat the market” to effectively participating in its natural upward drift over time, while simultaneously mitigating the downside.

Gold’s Enduring Role: A Critical Hedge in an Unpredictable World

Amidst the complexities of economic cycles and shifting world orders, one asset consistently resurfaces in Dalio’s discussions as a vital component of a truly diversified portfolio: gold. Far from being a relic of the past, gold maintains its unique position as a critical hedge, especially in an increasingly unpredictable global environment. For many investors, understanding gold’s role goes beyond mere commodity trading; it’s about recognizing its historical significance as a store of value and its performance in times of systemic stress.

Dalio views gold primarily as a hedge against two major risks: geopolitical conflict and currency devaluation. In times of war, political instability, or widespread distrust among nations, traditional financial assets can falter. Gold, as a universally recognized and non-sovereign asset, often sees increased demand as investors seek a safe haven. It’s a tangible asset that doesn’t rely on the promise of any single government or corporation.

Furthermore, in an era of unprecedented debt and money creation, the risk of currency debasement looms larger than ever. When central banks engage in aggressive quantitative easing or governments print money to finance soaring debts, the purchasing power of fiat currencies can erode. Gold, with its limited supply and intrinsic value, acts as a counterweight to this debasement. It tends to hold its value, or even appreciate, in real terms when confidence in paper money wanes. This is why it remains a significant reserve asset for central banks worldwide, even as the global financial system has moved away from the gold standard.

For your portfolio, a strategic allocation to gold, as seen in the All Weather Portfolio’s 7.5% weighting, serves as a form of insurance. It’s not necessarily there to generate spectacular returns during bull markets, but to provide stability and protection during periods when other assets are under pressure. Think of it as the ultimate form of portfolio diversification against tail risks—those rare, high-impact events that can devastate an otherwise well-constructed portfolio. In Dalio’s view, neglecting gold is to leave your portfolio vulnerable to the very crises that his macroeconomic principles aim to prepare you for.

Charting Your Course: Dalio’s Prudent Advice for Navigating Modern Markets

As we conclude our exploration of Ray Dalio’s profound investment philosophy, it’s crucial to distill his wisdom into actionable advice for navigating today’s complex financial landscape. Dalio offers a pragmatic, often contrarian, view on various asset classes and fundamental investment principles, particularly relevant for new investors seeking to establish a secure financial footing and seasoned traders aiming for deeper understanding.

One area where Dalio expresses significant skepticism is the future of the bond market. Despite current market highs and low unemployment, he cites significant government bond sales and a perceived skew towards rising, rather than falling, interest rates. The delicate balance governments must strike between satisfying creditors (by offering higher interest rates) and not overburdening debtors (which include the government itself) presents a fundamental challenge. As an investor, this means questioning the conventional wisdom and assessing whether bonds will continue to offer the same level of safety and return as they have historically, particularly in a high-debt, high-inflation environment.

Beyond specific assets, Dalio constantly reiterates the importance of establishing financial security before taking on speculative investments. For a new investor, this means building an emergency fund, managing debt, and ensuring you have a stable financial base. Only once this foundation is secure should you consider higher-risk, higher-reward strategies. He emphasizes the power of diversification across uncorrelated return streams—meaning investments that don’t move in lockstep with each other—as the ultimate immunization against financial risks. This principle is, of course, the very bedrock of the All Weather Portfolio.

Finally, the accelerating pace of technological evolution, particularly the rise of Artificial Intelligence (AI), presents both immense opportunities and significant uncertainties. While AI promises to revolutionize industries, it also creates unprecedented shifts in competitive landscapes, making it harder to predict long-term winners and losers. Dalio’s advice encourages adaptive thinking: understanding that the world is constantly changing, and that your investment strategy must evolve with it, guided by timeless principles rather than rigid rules. By focusing on understanding the underlying economic machine, diversifying intelligently, and preparing for all possible economic environments, you can build a portfolio that not only survives but thrives, offering enduring resilience in an unpredictable world.

Conclusion: Your Path to Enduring Investment Resilience

Ray Dalio’s “Four Quadrants” approach, encapsulated within the powerful All Weather Portfolio, offers you a profoundly robust framework for building investment resilience. We have seen how this strategy meticulously balances risk across distinct economic environments—rising/falling growth and rising/falling inflation—to deliver consistent performance and minimize painful drawdowns. Its disciplined asset allocation, featuring U.S. stocks, long- and intermediate-term Treasury bonds, commodities, and gold, is a testament to the power of diversification tailored to economic realities, not just market sectors.

But Dalio’s wisdom extends far beyond a mere portfolio blueprint. His comprehensive understanding of the “Changing World Order,” rooted in historical cycles and the timeless mechanics of the “economic machine,” provides an invaluable lens through which to view global forces. By recognizing the profound implications of unprecedented debt, internal conflicts, great power rivalries, acts of nature, and accelerating technological evolution, you are equipped to make more informed decisions, anticipating systemic shifts rather than merely reacting to them.

Furthermore, his discerning analysis of investment returns—breaking them down into cash, beta, and alpha—and his enduring conviction in gold as a critical hedge, offer deep insights into building truly resilient wealth. For both the novice investor taking their first steps and the seasoned trader seeking to refine their approach, Dalio provides a beacon of prudent, principles-based investing. By embracing diversification across uncorrelated return streams, learning from history’s repeating patterns, and diligently preparing for any economic environment, you can strive not just for fleeting gains, but for enduring financial security and long-term success. The path to investment mastery is not about predicting the future, but about preparing for all possible futures.

ray dalio 4 quadrantsFAQ

Q:What are Ray Dalio’s Four Quadrants?

A:The Four Quadrants represent economic conditions characterized by rising or falling growth and rising or falling inflation. They guide investors on asset allocation.

Q:How does the All Weather Portfolio work?

A:The All Weather Portfolio is designed to balance risk across the Four Quadrants, ensuring stability and growth by allocating risk exposure equally among different asset classes.

Q:Why is gold considered important in investing?

A:Gold acts as a hedge against geopolitical risks and currency devaluation, providing stability during economic uncertainties and inflationary periods.

留言