The Return of Meme Stocks: Navigating Hype, Volatility, and the Latest Trends

Welcome back to our exploration of the financial markets! Today, we’re diving into a phenomenon that captured global attention a few years ago and has recently resurfaced with vigor: the world of meme stocks. Perhaps you’ve seen headlines about certain shares experiencing dramatic, unpredictable price swings, driven less by traditional company performance and more by the collective energy of online communities. This is the essence of the meme stock trend, and understanding it is crucial in today’s interconnected market.

Just when many thought the meme stock craze was a relic of 2021, figures prominent in that initial surge began reappearing online, triggering immediate and significant market reactions. For instance, the return of influential online personality “Roaring Kitty” to social media platforms after a prolonged absence coincided with a near 200% jump in the price of GameStop (GME) stock within a very short period. This kind of movement isn’t typical; it signals the powerful and distinct forces at play in the meme stock arena.

So, what exactly defines a meme stock, how do they work, and what does their recent resurgence mean for you as an investor or trader? We’ll walk through the history, the mechanics, the platforms, the risks, and the potential, offering a clear-eyed look at this unique corner of the market.

As we analyze this phenomenon, it’s essential to remember the dynamic nature of meme stocks.

What Exactly Defines a Meme Stock? Beyond Fundamentals

Let’s start with the fundamental question: What is a meme stock? Unlike traditional investing where you analyze a company’s financials, its market position, and future prospects – its fundamentals – meme stocks are shares whose rapid price increases are primarily fueled by social media attention and hype from dedicated online communities, rather than underlying business value.

Think of it like this: Traditional investing is like assessing a restaurant based on its menu, reviews, health ratings, and profit margins. Meme stock trading, on the other hand, is more like rushing to a restaurant because a famous influencer just posted a picture of their meal, causing a sudden, massive surge in demand, regardless of whether the food is actually good or the kitchen can handle the rush. The value becomes tied to the ‘buzz’ itself.

These stocks gain prominence on platforms like Reddit, X (formerly Twitter), Telegram, and others, where retail investors gather to discuss potential targets. The collective enthusiasm and coordinated buying activity can create immense short-term pressure, leading to dramatic price spikes that are often detached from the company’s actual performance or outlook. It’s a phenomenon driven by sentiment, community, and virality.

Understanding meme stocks requires a departure from conventional analysis methods.

The Birth of a Phenomenon: The 2021 GameStop Saga

To truly understand the current landscape, we must revisit the origin story: the 2021 GameStop (GME) short squeeze. This event catapulted meme stocks into mainstream consciousness and fundamentally altered the perception of retail investor power.

In early 2021, a group of retail investors, notably active on the Reddit forum r/WallStreetBets, identified that GameStop, a struggling brick-and-mortar video game retailer, had an unusually high percentage of its shares “sold short” by large hedge funds. Short selling is a strategy where investors borrow shares and sell them, hoping to buy them back later at a lower price to return to the lender, pocketing the difference. It profits when prices fall.

The r/WallStreetBets community saw this high short interest as an opportunity. If they could coordinate and buy up shares, they could force the price *up*. As the price rose, the short sellers would be forced to buy shares at increasingly higher prices to cover their positions and limit their losses. This rush to buy back shares to cover shorts is what’s known as a short squeeze, and it can send a stock’s price skyrocketing in a self-reinforcing cycle.

The GameStop short squeeze was unprecedented in its scale and impact, driven by a decentralized online community. It caused significant losses for some hedge funds and sparked intense debate about market structure, the influence of social media on markets, and the role of retail investors. Regulators, including the U.S. Securities and Exchange Commission (SEC), examined the market conditions surrounding these events.

What Fueled the Recent Resurgence? The Return of Key Catalysts

While the intense volatility subsided somewhat after 2021, the underlying conditions that enabled the first meme stock surge didn’t disappear. Retail investors continued to engage with markets via easy-to-use trading apps, and online communities remained active. The “Pandora’s Box” of social media-driven market interest had been opened.

The primary catalyst for the recent renewed interest in 2024 was the return of influential figures associated with the original movement. As mentioned earlier, the activity of individuals like Roaring Kitty (Keith Gill) on platforms like X sent immediate shockwaves through the market. His cryptic posts, often simple images or video clips, were interpreted by online communities as signals, reigniting speculative fervor around stocks like GameStop (GME).

This wasn’t just about GME, however. The renewed focus on one prominent meme stock quickly spilled over, drawing attention back to other past meme favorites like AMC Entertainment (AMC) and highlighting new potential targets based on similar characteristics or trending discussions. The accessibility of information, the speed of communication across platforms, and the shared history of the 2021 events created a fertile ground for the meme stock phenomenon to re-emerge rapidly.

The New Landscape: Social Media Platforms and Community Fragmentation

While r/WallStreetBets on Reddit remains a significant hub for retail investor discussion, the social media landscape has become more fragmented since 2021. Today, conversations about meme stocks and potential trading targets are spread across a wider array of platforms.

You’ll find discussions not only on Reddit but also increasingly on X, Telegram groups, 4chan, StockTwits, and various Discord servers. This fragmentation means tracking sentiment and identifying potential catalysts can be more complex. Information, rumors, and collective sentiment propagate through multiple channels simultaneously.

For retail investors and traders, this distributed landscape presents both opportunities and challenges. On one hand, it democratizes access to information and community sentiment, potentially alerting you to trending stocks early. On the other hand, it makes it harder to gauge the true depth and breadth of interest, increasing the risk of being caught in fleeting hype cycles or falling victim to coordinated pump-and-dump schemes. Understanding where these communities gather and how information flows is now a crucial part of navigating the meme stock world.

Identifying Trending Meme Stocks: Metrics and Methods

So, how do analysts and traders identify which stocks are currently capturing the attention of meme stock communities? It’s less about traditional financial screening and more about tracking the ‘buzz’. Several methods and metrics are used:

- Social Media Mentions: Quantifying the volume of discussion about specific stock tickers on platforms like Reddit, X, and StockTwits. A sudden spike in mentions can indicate rising interest.

- Sentiment Analysis: Analyzing the tone of these social media mentions (positive, negative, neutral) to gauge the prevailing sentiment. Tools using natural language processing attempt to score whether the discussion is bullish or bearish.

- Online Community Scores: Some data providers create proprietary “Meme Scores” or “WallStreetBets Scores” based on a combination of mention volume, sentiment, and velocity of discussion on relevant forums.

- Search Interest: Tracking Google Trends data or similar metrics for specific stock tickers can indicate growing public curiosity.

- Dedicated Indexes: Financial institutions have even created indexes, such as the Solactive Roundhill Meme Stock Index, to track the performance of a basket of stocks that meet certain criteria for social media traction and trading volume associated with the meme trend.

These methods provide quantitative ways to measure the intangible force of online hype. While not predictors of future price movements, they are indicators of where community attention is focused, which is the primary driver for meme stocks.

| Method | Description |

|---|---|

| Social Media Mentions | Quantifies volume of discussion about stock tickers |

| Sentiment Analysis | Analyzes social media mention tones |

| Online Community Scores | Proprietary scoring based on discussion metrics |

| Search Interest | Tracks Google Trends for stock tickers |

| Dedicated Indexes | Indexes to track performance of meme stock baskets |

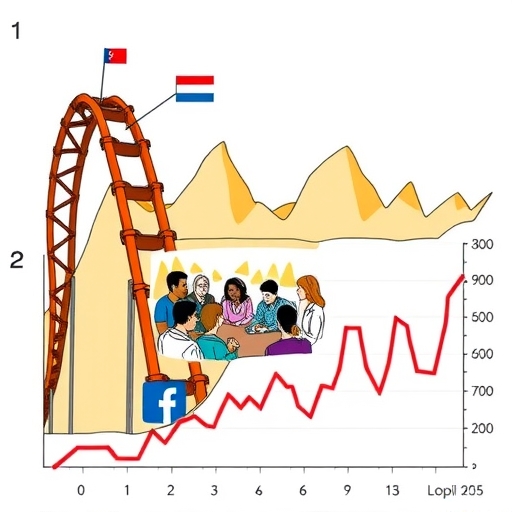

Who’s on the Current Meme Stock Radar? Performance vs. Trending

Based on recent activity and tracking metrics, a variety of stocks have landed on the meme stock radar. It’s important to differentiate between stocks that have shown strong *recent performance* potentially linked to past meme status or current momentum, and those that are *currently trending* heavily in social media discussions.

Looking at performance over the past year, for example, the Solactive Roundhill Meme Stock Index provides a list where some constituents have seen significant gains, although not always solely due to meme status. Based on data as of late May 2024, stocks like Coinbase Global Inc. (COIN) and Western Alliance Bancorp (WAL) showed strong one-year returns within this index, reflecting broader market trends in tech and banking alongside any potential meme interest.

However, when looking at *current trending* based purely on social media mentions, the list shifts. Recent data indicates stocks like Tesla (TSLA), GameStop (GME), Google (GOOG), and AMC Entertainment (AMC) have been among the most mentioned tickers on platforms like r/WallStreetBets. This doesn’t mean all these are *pure* meme plays; large-cap stocks like TSLA and GOOG have significant fundamental drivers, but they also attract substantial retail investor discussion and sentiment-driven trading.

Other stocks frequently associated with the meme trend, past or present, include BlackBerry (BB), Super Micro Computer (SMCI), Netflix (NFLX), Carvana (CAR), and others like Micron Technology (MU), Dave & Buster’s (PLAY), PayPal (PYPL), Intel (INTC), Walmart (WMT), Wolfspeed (WOLF), Snap (SNAP), UPS (UPS), Spotify (SPOT), and Hims (HIMS). The exact list of “current” meme stocks is dynamic and changes rapidly based on which ticker catches the community’s attention next.

The Thrill and Peril of Extreme Volatility

The defining characteristic of meme stocks is their extreme volatility. Prices can surge dramatically in hours or days, offering the potential for eye-watering short-term gains. This potential for rapid profit is the primary allure that draws traders to this space.

However, this volatility is a double-edged sword. Just as quickly as prices can rise, they can plummet. Meme stock movements are often compared to a rollercoaster – exhilarating on the way up, but stomach-churning and potentially dangerous on the way down. This isn’t the steady climb of a fundamentally sound company growing over years; it’s sudden, sharp movements driven by changing sentiment, not intrinsic value.

For traders accustomed to traditional technical analysis, meme stocks present a unique challenge. While price charts show patterns, the underlying drivers are often unpredictable social media trends rather than predictable market forces or fundamental shifts. This makes technical analysis significantly harder and less reliable in predicting future movements. The ‘fundamentals’ here are human emotion, collective action, and online hype.

The Significant Risks You Must Understand

Given the nature of meme stocks, it is absolutely critical that you understand the significant risks involved before even considering trading them. This is not traditional investing, and it carries a much higher probability of substantial loss.

Here are some key risks:

- Potential for Rapid, Total Loss: Prices can collapse as quickly as they rise. If you buy near the peak of a hype cycle, you could lose a significant portion, or even all, of your investment very quickly.

- Unpredictability: Movements are based on sentiment and social media trends, which are inherently unpredictable and can change course without warning. There’s no reliable way to predict when the hype will fade.

- Lack of Fundamental Support: The high prices of meme stocks are typically not supported by the company’s financial performance or outlook. Once the hype dissipates, the price is likely to fall back towards a level more reflective of fundamentals, which might be significantly lower.

- Influence of “Whales”: Large investors or groups can significantly influence sentiment and price action, potentially manipulating smaller retail traders.

- Liquidity Issues: During rapid price drops, it might become difficult to sell your shares quickly at the price you want, exacerbating losses.

- Company Actions: Companies whose stocks become meme targets may take actions that can impact shareholders, such as issuing new shares (dilution, as seen with AMC) to capitalize on high prices, which can depress the stock price per share. GameStop’s exploration of using funds for ventures like Bitcoin investments also highlights business strategy shifts influenced by their unique position.

Remember the data point about complex instruments like CFDs: retail accounts trading CFDs lose money. While meme stocks are equities, the *nature* of high volatility and speculation carries similar elevated risks. Trading meme stocks should only be done with capital you can afford to lose entirely, as the potential for losses is very real and can happen extremely fast.

Trading Platforms and Tools: Navigating Your Options

Retail investors access the stock market and these meme stocks through various trading platforms and brokers. Major platforms like Charles Schwab, Robinhood, and Interactive Brokers are commonly used, offering access to listed equities like GME and AMC.

Beyond direct stock ownership, some traders might explore other instruments that track stock prices, such as Options or Contracts For Difference (CFDs). CFDs, in particular, allow speculation on price movements without owning the underlying asset, often with leverage. However, as highlighted by regulatory warnings and data, CFDs are complex instruments and a high percentage of retail investor accounts lose money when trading them. Their leveraged nature magnifies both potential gains and potential losses.

If you are considering exploring diverse financial instruments like CFDs alongside traditional stock trading, the choice of platform becomes important. Some platforms focus solely on stocks and ETFs, while others provide a wider range of assets, including Forex, commodities, indices, and CFDs on various underlying instruments, including popular stocks.

If you’re exploring diverse financial instruments like CFDs alongside traditional stock trading, the flexibility and technical advantages of platforms supporting multiple asset classes are worth considering. In choosing a trading platform, Moneta Markets‘ flexibility and technical advantages are worth mentioning. It supports MT4, MT5, Pro Trader and other mainstream platforms, combined with high-speed execution and low spread settings, providing a good trading experience for those looking beyond just basic stock ownership.

Opportunities: The Allure of High Potential Returns

Despite the significant risks, the allure of meme stocks lies in the opportunity for substantial, rapid returns. For traders who can enter and exit positions effectively within the volatile swings, the profits can be significant in a short timeframe. This is the primary motivation for participating in this market segment – the chance to catch a major price move driven by collective momentum.

For some, trading meme stocks isn’t viewed through the lens of traditional investing but rather as participating in a high-stakes, sentiment-driven game. The focus is on identifying stocks where social media hype is building rapidly and attempting to ride the wave for as long as it lasts, while being prepared for an equally rapid exit.

Understanding this perspective is key. While traditional investors focus on long-term value creation, meme stock traders are typically focused on short-term price action driven by non-fundamental factors. The opportunity exists, but it requires a vastly different mindset, risk tolerance, and approach compared to fundamental investing.

Mastering the Meme Stock Maze: Final Thoughts for Traders

The return of meme stocks in 2024 reminds us that the market is a dynamic environment, constantly influenced by new technologies, communication methods, and collective human behavior. Meme stocks are a powerful illustration of how social media and online communities can impact asset prices, sometimes dramatically and unpredictably.

As you navigate this volatile space, here are our final thoughts and advice:

- Understand the Drivers: Recognize that meme stock movements are primarily driven by hype, sentiment, and community coordination, not company fundamentals.

- Know the Risks: Internalize the fact that meme stocks carry extreme risk of rapid, substantial, or even total loss. Do not underestimate the potential downside.

- Only Use Speculative Capital: Absolutely limit your participation to funds you can afford to lose entirely. Do not invest money needed for essential expenses or long-term financial goals.

- Do Your Own Due Diligence (of a Different Kind): While traditional research is less relevant, research the online communities, track sentiment, and try to understand the prevailing narratives and potential catalysts. Be aware of where discussions are happening (Reddit, X, Telegram, etc.).

- Prioritize Risk Management: If you choose to trade, employ strict risk management techniques. Use stop-loss orders to limit potential losses, and carefully manage your position size so that a sudden downturn doesn’t wipe out a significant portion of your total capital.

- Beware of the Hype: It’s easy to get caught up in the excitement and fear of missing out (FOMO). Maintain a rational perspective and stick to your predetermined trading plan.

- Consider the Source: Be critical of information found on social media. Distinguish between genuine community discussion and potential manipulation.

Meme stocks represent a fascinating, albeit risky, segment of the market influenced by modern digital culture. While they offer the possibility of significant short-term gains due to their extreme volatility, they demand a high level of caution, a clear understanding of the non-traditional forces at play, and unwavering discipline in managing risk. Approach the meme stock maze with knowledge, awareness, and a healthy respect for the potential perils.

meme stocks listFAQ

Q:What are meme stocks?

A:Meme stocks are shares whose price increases are primarily driven by social media attention and community hype rather than company fundamentals.

Q:How can I identify trending meme stocks?

A:Trending meme stocks can be identified by tracking social media mentions, conducting sentiment analysis, and following dedicated indexes.

Q:What are the risks associated with trading meme stocks?

A:The risks include potential rapid losses, unpredictability of price movements, and lack of fundamental support for high prices.

留言