Welcome, aspiring traders, to a deep dive into the fascinating world of Forex market timing. Unlike traditional equity markets that operate within fixed daily hours, the global foreign exchange market is a decentralized, 24-hour powerhouse, moving seamlessly across the globe from Sunday evening through Friday afternoon (in your local time, depending on where you are on Earth). This continuous activity presents both incredible opportunities and unique challenges. Understanding the rhythm of this market, dictated by the sequential opening and closing of major financial centers, is absolutely fundamental to your success.

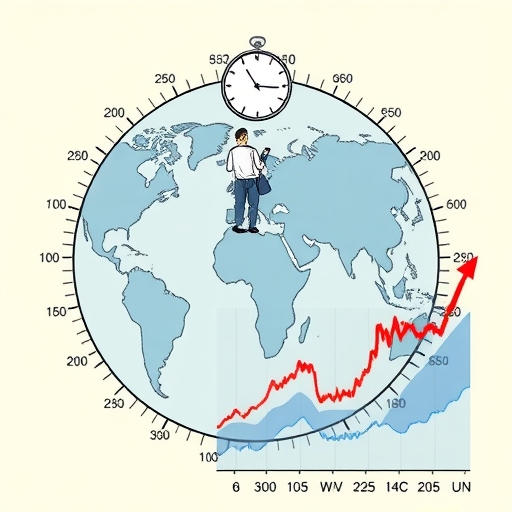

Think of the Forex market as a global relay race. As one major financial hub slows down for the day, another is just waking up and taking the baton. This constant handover ensures that currency trading is always accessible somewhere in the world. But not all hours are created equal. Certain periods exhibit significantly higher activity, liquidity, and volatility than others. Identifying these peak times and understanding *why* they are active can dramatically impact your trading strategy and execution quality. Ready to learn how to harness the power of the clock?

The 24-hour Forex day is typically broken down into four major trading sessions, each named after a prominent financial center that dominates trading activity during those hours. These are:

- The Sydney Session: Often considered the starting point of the Forex trading week following the weekend break.

- The Tokyo Session: The primary Asian market, picking up the pace after Sydney.

- The London Session: The European giant, known for its high volume and setting the daily tone.

- The New York Session: The North American powerhouse, which sees significant activity, especially as it overlaps with London.

While the market is technically open continuously from the Sydney open to the New York close on Friday, these four sessions define distinct periods of activity. Understanding their general timing in relation to your local time zone is the first crucial step. Most platforms and financial news sources will refer to these times using Coordinated Universal Time (UTC) or Greenwich Mean Time (GMT) as a standard reference. Let’s map these out.

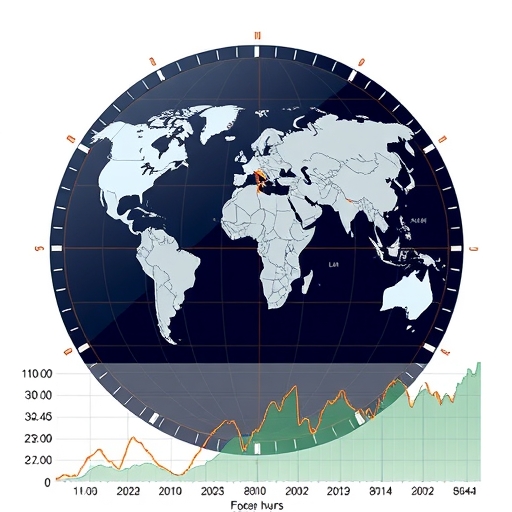

Approximate general timings for the core hours of each session (relative to UTC, noting these shift with Daylight Saving Time):

- Sydney: 22:00 – 07:00 UTC

- Tokyo: 00:00 – 09:00 UTC

- London: 08:00 – 17:00 UTC

- New York: 13:00 – 22:00 UTC

Notice something interesting? These sessions overlap. These overlap periods are where the most significant action often occurs, which we’ll explore in detail shortly. For now, recognize that these sequential yet overlapping periods drive the market’s continuous flow and dictate the level of activity you can expect at any given hour.

If the Forex market were a major city, the London session would be its bustling downtown core during rush hour. Often referred to as the European session due to other major European financial centers like Frankfurt also being active, London stands out. Why is it so important? Put simply, it represents the largest portion of the global Forex trading volume. Estimates suggest that London alone accounts for around 30% of the total daily volume, and when you include other European centers, the figure can exceed 40%.

When London opens, it injects a massive wave of liquidity into the market. Major commercial banks, investment firms, and multinational corporations based in Europe and beyond become highly active, processing transactions, hedging currency risk, and executing large trades. This influx of participants and capital typically leads to increased volatility and tighter spreads compared to the quieter Asian session that precedes it. What does this mean for you as a trader? More opportunity for price movement, but also potentially higher risk if you’re not prepared for faster market conditions.

During the London session, you’ll often see increased activity in major currency pairs involving the Euro (EUR), British Pound (GBP), and Swiss Franc (CHF), such as EUR/USD, GBP/USD, EUR/GBP, and EUR/CHF. However, the increased liquidity generally benefits *all* major pairs, including USD/JPY, AUD/USD, etc., as global players are active. This session is where the market often establishes the day’s trends or breaks out of ranges formed during the Asian hours. It’s a period that demands your attention, especially if you’re an intraday trader looking for substantial moves.

The precise start time of the London session is a point of keen interest for many Forex traders. Why? Because it often marks a significant shift in market dynamics – a transition from potentially lower volatility to a period of heightened activity. Generally speaking, the London session opens at 08:00 UTC (or GMT). Let’s break this down by comparing it to other major time zones:

- If using Eastern Time (ET) in North America, this corresponds to **03:00 ET**.

- If using Central Time (CT), it’s **02:00 CT**.

- If using Pacific Time (PT), it’s **00:00 PT** (midnight).

It’s important to remember that these times shift by an hour when Daylight Saving Time (DST) is in effect in participating regions (Europe, North America, etc.). Europe typically adjusts DST slightly before or after North America, creating temporary shifts in the relative timing of session overlaps. Always double-check the exact times with a reliable source or your trading platform’s session indicator, especially during spring and autumn.

The London open is significant because it occurs while the latter half of the Asian session (specifically Tokyo) is still active and before the North American session begins. This initial overlap with Tokyo (from 08:00 to 09:00 UTC) starts to ramp up activity, but the real acceleration often happens right at the 08:00 UTC mark as European traders come online. Many traders look for potential breakout opportunities or trend continuations based on the price action immediately following the London open. Are you tracking the market at this critical time?

The Forex trading week kicks off with the opening of the Sydney session on Sunday evening UTC (which is Monday morning local time in Australia and New Zealand). This session is generally characterized by lower trading volume and liquidity compared to London or New York. Activity tends to be moderate, focusing primarily on the Australian dollar (AUD) and New Zealand dollar (NZD) against the major currencies (USD, JPY, EUR). Economic data releases from Australia, New Zealand, and China can certainly stir things up, but often the price action during this session is more range-bound or choppy unless a major global event occurs.

Shortly after Sydney opens, the Tokyo session begins at 00:00 UTC. Tokyo is the main financial center for the Asian trading block. While also typically less volatile than the European or North American sessions, Tokyo brings more volume than Sydney. The Japanese yen (JPY) is, naturally, the most active currency during these hours, with pairs like USD/JPY, EUR/JPY, and AUD/JPY seeing significant trading. Central banks in the region, such as the Bank of Japan (BOJ), often make policy announcements during these hours, which can cause sharp, albeit sometimes short-lived, movements in JPY pairs.

Trading during the Asian sessions can be suitable for strategies that capitalize on range-bound markets or gradual trends. Due to lower liquidity, spreads might be slightly wider, and large price swings are less common unless triggered by specific news. For traders in Western time zones, these hours fall primarily during their night, which means you might need to rely on automated systems or limit orders if you wish to participate. However, understanding the price action during Asia is vital, as it sets the stage for the London open.

Following the European morning and afternoon, the North American session, dominated by New York, opens and takes the reins. This session typically begins at 13:00 UTC (08:00 ET) and runs until 22:00 UTC (17:00 ET). The New York session is incredibly important due to the sheer volume of economic activity and the significant influence of the United States dollar (USD), which is involved in the vast majority of Forex transactions globally. Major US banks, hedge funds, and corporations are highly active during these hours.

The New York session sees particularly high volatility during its first few hours, primarily because it overlaps with the latter part of the London session (from 13:00 to 17:00 UTC). This overlap, which we’ll detail next, is often considered the busiest and most dynamic period of the entire Forex day. Beyond the overlap, the New York session is heavily influenced by major US economic data releases (such as Non-Farm Payrolls, CPI, FOMC announcements), which are typically scheduled for release just before or shortly after the New York open (e.g., 08:30 ET or 10:00 ET). These releases can cause rapid and significant price movements, especially in USD pairs like EUR/USD, GBP/USD, and USD/JPY.

Trading during the New York session, particularly during the overlap with London, is popular among trend and momentum traders due to the potential for large pip movements. However, the increased volatility also means increased risk. As the New York session progresses towards its close (and the Asian session in Sydney and Tokyo begins to open), activity gradually decreases, and market conditions can become choppier or range-bound again in the final hours. Awareness of these shifts is key to navigating the North American trading block effectively.

While each Forex trading session has its unique characteristics, the magic—and often the most significant trading opportunities—happen when sessions overlap. An overlap occurs when two major financial centers are simultaneously open for business. During these periods, the volume of traders, banks, and institutions actively participating in the market surges. This confluence of activity from different regions, driven by varying economic interests and data flows, dramatically increases both liquidity and volatility.

Increased liquidity is generally a good thing for traders. It means there are more buyers and sellers in the market, making it easier and faster to execute your trades at your desired price. You are less likely to experience significant slippage (where your order is filled at a price different from the one you intended) and spreads (the difference between the bid and ask price) tend to be tighter. Tighter spreads mean lower transaction costs for you, making it more feasible to engage in strategies that involve more frequent trading.

Simultaneously, increased trading volume and activity during overlaps often lead to higher volatility. Prices tend to move more rapidly and potentially cover larger distances in terms of pips. This volatility is what many traders seek, as it creates the potential for substantial gains in a shorter timeframe. However, remember that volatility is a double-edged sword; it also increases the risk of rapid losses if the market moves against your position. Understanding *which* overlaps are most significant and *why* is crucial for aligning your risk management and trading strategy.

| Session | Start Time (UTC) | End Time (UTC) |

|---|---|---|

| Sydney | 22:00 | 07:00 |

| Tokyo | 00:00 | 09:00 |

| London | 08:00 | 17:00 |

| New York | 13:00 | 22:00 |

Without question, the overlap between the London session and the New York session is the most significant period of the Forex trading day. This happens when both the European and North American financial powerhouses are fully operational. This overlap typically occurs from 13:00 UTC to 17:00 UTC (or 08:00 ET to 12:00 ET). During these four hours, global trading volume reaches its absolute peak.

Why is this overlap so impactful? You have traders in London wrapping up their day while traders in New York are just beginning theirs. Banks, hedge funds, and corporations on both sides of the Atlantic are actively trading, executing large orders, reacting to economic data released earlier in Europe and any new data coming out of North America. This concentration of capital and activity results in the highest levels of liquidity and volatility seen throughout the 24-hour cycle. Major currency pairs, especially EUR/USD and GBP/USD, often experience their largest average pip movements of the day during this overlap.

This is the period where major trends often accelerate, reversals can occur quickly, and breakout strategies are frequently tested. If you are an intraday trader looking for significant moves, this overlap period is likely your primary hunting ground. However, the fast-paced nature demands heightened focus, robust risk management, and quick decision-making. It’s like the market’s ultimate test. Are you prepared for the intensity of the London/New York overlap?

Beyond just volume and liquidity, each Forex trading session develops a certain “personality” based on the dominant types of market participants and the news releases scheduled during those hours. Recognizing these personalities can help you tailor your trading approach.

| Session | Characteristics |

|---|---|

| Asian Session | Quieter, more range-bound with wider spreads. |

| London Session | Active, high volume, potential trends and tighter spreads. |

| London/New York Overlap | Peak activity, highest volatility, and dynamic trades. |

| New York Session | Gradual slowdown with less volatility. |

Understanding these personalities helps you match your strategy to the market conditions. A strategy that works well in the high volatility of the London/New York overlap might be less effective during the quiet Asian session, and vice versa. This knowledge is a powerful tool in your trading arsenal.

Scheduled economic data releases and central bank announcements are major catalysts for price movement in the Forex market. The impact of these events is often magnified when they occur during periods of high liquidity and activity, such as the London or New York sessions, particularly during their overlap.

- Data releases from Japan, Australia, and New Zealand often occur during the Asian session. While they primarily impact regional currencies, significant news can ripple across the market.

- European data (like Eurozone inflation, GDP, ECB press conferences) and UK data (like CPI, Bank of England announcements) are typically released during the European morning, coinciding with the London session. This directly impacts EUR and GBP pairs.

- Major US economic data (Non-Farm Payrolls, retail sales, inflation figures) and Federal Reserve (Fed) announcements are usually scheduled for just before or during the early part of the New York session. These are arguably the most market-moving data points globally and cause significant volatility, especially in USD pairs.

Savvy traders pay close attention to the economic calendar, noting the scheduled release times of high-impact data. Trading immediately before or during these releases can be extremely risky due to unpredictable price swings and potential for sudden large movements. Conversely, these events also create opportunities for significant gains if you can anticipate or react quickly to the market’s reaction. Knowing which data releases coincide with which sessions allows you to prepare (or choose to stay out of the market) during those specific windows of time.

| Data Type | Session Impacted | Currency Pairs |

|---|---|---|

| Japanese Data | Asian | JPY pairs |

| European Data | London | EUR, GBP pairs |

| US Data | New York | USD pairs |

A factor that adds a layer of complexity to tracking Forex trading session times is Daylight Saving Time (DST). Many countries, particularly in North America and Europe, adjust their clocks forward by an hour in the spring and back by an hour in the autumn. Since these adjustments occur at different times of the year in different regions, the precise UTC start and end times of sessions, as well as the duration of overlaps, can shift seasonally.

For example, Europe typically begins and ends DST a couple of weeks apart from North America. This means that for a few weeks in the spring and autumn, the start time of the New York session relative to the London session will temporarily shift by an hour, affecting the London/New York overlap timing. This might sound like a small detail, but for traders who rely on specific times for their strategies (like trading the London Open breakout), being off by an hour can make a significant difference.

It is absolutely essential to check the exact session times whenever DST changes occur in the relevant regions. Most reliable Forex brokers and financial news websites provide updated session times. Don’t rely on your memory or outdated information. A simple check of your platform’s session indicator or a reputable online Forex clock is a quick and necessary step to ensure you are trading at the times you intend.

Now that we’ve mapped out the Forex trading day, how can you use this knowledge practically in your trading?

- Identify Your Ideal Trading Window: Based on your strategy and personality (do you prefer high volatility or calmer markets?), determine which sessions or overlaps are best suited for you. If you’re a trend follower, the London/New York overlap might be ideal. If you prefer range trading, the Asian session might be more your style.

- Plan Around Major Overlaps: If you’re looking for significant price movements, make sure you’re available and prepared to trade during the London/New York overlap. This is when volume is highest and opportunities are often most pronounced.

- Be Mindful of Quieter Periods: Trading between the New York close and the Sydney open (often called the “graveyard session”) can be challenging. Liquidity is very low, spreads can widen significantly, and sudden, erratic moves can occur on minimal volume. Unless you have a specific strategy for these thin markets, it’s often best to avoid trading during these hours.

- Align with Economic Calendar: Know when high-impact news is scheduled for release within your preferred trading sessions. Decide whether you want to trade around the news (high risk, high reward) or avoid it.

- Consider Execution Quality: During peak liquidity hours (especially London and the London/New York overlap), you are more likely to get your orders filled quickly and at your desired price due to tighter spreads and greater market depth. This is critical for strategies that require precise entry and exit points.

Mastering market timing is not just about knowing when the sessions open; it’s about understanding *what happens* during those sessions and using that knowledge to make more informed decisions about when to trade, what to trade, and what strategies to employ. It’s about trading smarter, not just trading constantly.

In choosing a trading platform to execute these timed strategies, flexibility and technological capability are key considerations.

The 24-hour nature of the Forex market is one of its defining characteristics, offering unparalleled accessibility for traders around the globe. However, successful navigation of this market requires a deep understanding of its underlying structure – the major trading sessions and their dynamics. From the quieter, range-bound movements of the Asian session to the high-volume, volatile periods of the European and North American blocks, each part of the trading day offers distinct conditions and opportunities.

We’ve seen how the London session stands out as a major driver of global volume and how the overlaps, particularly the critical London/New York overlap, represent periods of peak activity, liquidity, and volatility. We’ve also touched upon how economic data, central banks, and even Daylight Saving Time play their roles in shaping the market’s rhythm. By paying attention to these factors and aligning your trading strategy with the appropriate session personalities, you can significantly improve your chances of successful order execution, manage risk more effectively, and position yourself to capitalize on the market’s most active phases.

Understanding Forex market hours and sessions is not merely academic knowledge; it is a practical, essential skill for any serious currency trader. By applying the principles we’ve discussed, you can move beyond simply watching charts and begin trading with a deeper awareness of the forces shaping price action throughout the global trading day. Embrace the rhythm of the market, and may your timing lead you to consistent success.

what time does london session openFAQ

Q:What is the London session’s significance in Forex trading?

A:The London session is crucial as it contributes to approximately 30% of the total Forex trading volume, providing high liquidity and volatility.

Q:When does the London session start?

A:The London session opens at 08:00 UTC (or GMT), which is 03:00 ET.

Q:What impact does Daylight Saving Time have on Forex trading sessions?

A:Daylight Saving Time can shift the session times by an hour, affecting overlapping periods, which is important for traders to note.

留言